Market Overview

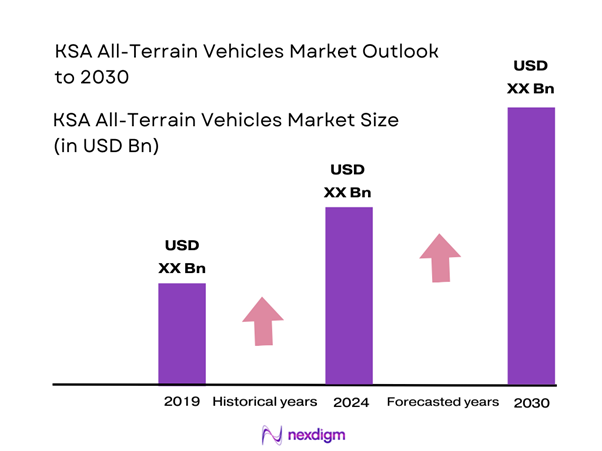

The KSA All-Terrain Vehicles market is valued at USD 1.2 billion in 2024 with an approximated compound annual growth rate (CAGR) of 4.7% from 2025-2030, supported by a rapid increase in demand for recreational off-road vehicles and an expanding agricultural sector that utilizes these vehicles for a variety of applications. Factors such as rising disposable incomes and shifting lifestyles toward outdoor recreational activities fuel this growth, leading to increased purchases of ATVs and UTVs among consumers.

Cities such as Riyadh, Jeddah, and Dammam hold significant influence in the market due to their high population density and increased participation in outdoor activities. These urban centers have seen a growing trend toward recreational sports, including off-roading and adventure tourism, which further drives the demand for all-terrain vehicles. The strategic location of Jeddah as a gateway to numerous recreational destinations also supports the market, making it a vital hub for ATV and UTV sales.

Saudi Arabia’s commitment to reducing environmental impact drives the establishment of stringent emission standards for all vehicles, including all-terrain variants. In 2022, the government revised its emissions regulations to align with international benchmarks, aiming for a notable reduction in pollutants from newly sold vehicles by 20% by end of 2025. This push is part of a broader environmental initiative to combat climate change and improve public health.

Market Segmentation

By Vehicle Type

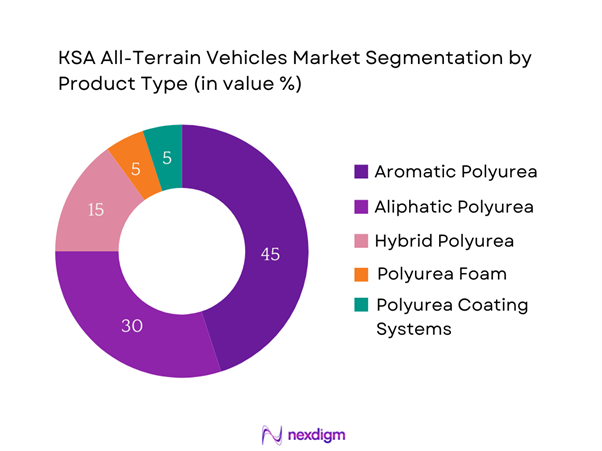

The KSA All-Terrain Vehicles market is segmented by vehicle type into Quad Bikes, UTVs (Utility Task Vehicles), ATVs (All-Terrain Vehicles), Side-by-Side Vehicles, and Electric All-Terrain Vehicles. The UTV segment commands a dominant market share due to its versatility and utility, appealing to both recreational and commercial users. UTVs accommodate larger passenger capacities and provide enhanced off-road performance, which caters to the growing demand in sectors such as agriculture, construction, and leisure activities. Moreover, the ability to customize UTVs for specific tasks has established a loyal consumer base that prioritizes functionality alongside leisure.

By Application

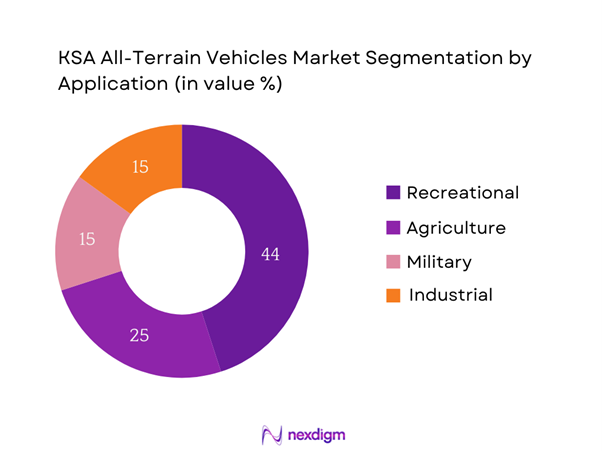

In terms of application, the market is segmented into Recreational, Agriculture, Military, and Industrial uses. The Recreational segment demonstrates the largest market share owing to the increase in outdoor activities, adventure sports, and recreational parks in the Kingdom. As more individuals seek leisure activities that incorporate off-roading, recreational use of all-terrain vehicles has surged. Additionally, support from tourism initiatives aimed at promoting adventure sports further energizes this segment’s growth, appealing particularly to younger demographics who value experiential purchases.

Competitive Landscape

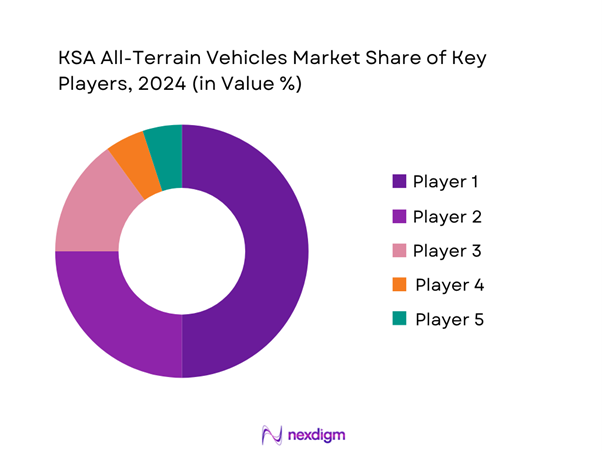

The KSA All-Terrain Vehicles market is dominated by a few major players, each contributing significantly to the overall landscape. Key companies include Polaris Industries, Yamaha Motor Co., Honda Motor Co., Can-Am (BRP), and Arctic Cat. This consolidation highlights the significant influence of these brands, many of which boast a strong global presence and brand loyalty within the Kingdom.

| Company | Year Established | Headquarters | Market Share (%) | Key Products | Distribution Channels | Regional Presence |

| Polaris Industries | 1954 | Minnesota, USA | – | – | – | – |

| Yamaha Motor Co. | 1953 | Japan | – | – | – | – |

| Honda Motor Co. | 1948 | Japan | – | – | – | – |

| Can-Am (BRP) | 2003 | Quebec, Canada | – | – | – | – |

| Arctic Cat | 1960 | Minnesota, USA | – | – | – | – |

KSA All-Terrain Vehicles Market Analysis

Growth Drivers

Increasing Outdoor Recreation Activities

The rise in outdoor recreation activities in Saudi Arabia is supported by increasing participation rates. In 2022, the Saudi government reported that around 41% of the population engaged in outdoor activities, a significant increase from previous years. Events like the Adventure Tour and various off-road racing events have seen participation growing by 30% year-on-year, appealing especially to younger demographics. The government’s Vision 2030 initiative emphasizes promoting sports and recreational activities, which in turn creates a thriving environment for all-terrain vehicle use. This increase indicates a robust market potential for recreational all-terrain vehicles which cater to these activities.

Growing Agricultural Sector

Saudi Arabia’s agricultural sector is experiencing transformation and growth as part of its diversification strategy post-oil reliance. In 2022, the sector contributed approximately USD 15 billion to the national GDP, indicating growth driven by increased local production initiatives. Technologies such as modern farming equipment, including all-terrain vehicles, are becoming essential for operational efficiency. The government has mandated a 25% increase in agricultural productivity by end of 2025 as it aims for food security, further driving the demand for utility vehicles in farming. All-terrain vehicles provide enhanced performance necessary for hill farming and rugged terrains.

Market Challenges

Regulatory Constraints

The KSA All-Terrain Vehicles market faces various regulatory constraints that can hinder growth. In recent evaluations, the Saudi government established stringent safety and operational regulations that local manufacturers and dealers must adhere to. These regulations, while crucial for safety, can complicate market entry and may deter potential investors, thereby limiting market expansion. The necessity for compliance is growing due to increasing concern about safety and environmental impact.

High Maintenance Costs

High maintenance costs associated with all-terrain vehicles can be a significant barrier for consumers and businesses. According to insights from industry reports, annual maintenance expenses can reach upwards of USD 1,500 for premium models, inclusive of parts and labor, which deters budget-conscious consumers. Additionally, vehicles used in demanding environments tend to require more frequent maintenance, raising operational costs for agricultural businesses and recreational users alike. The cumulative effect of these high costs risks limiting broader acceptance and purchasing in a sensitive economic landscape.

Opportunities

Innovations in Electric Vehicles

Current advancements in electric all-terrain vehicles present a prime opportunity for market growth within the KSA landscape. As of 2023, the Kingdom aims to have 30% of all vehicles be electric by 2030, and innovative manufacturers are already introducing electric all-terrain vehicles that meet this objective. Recent data indicates a growing demand for sustainable transport solutions, with electric vehicle registrations increasing by 50% in urban areas, driven by government incentives. This push toward electrification aligns with global trends toward sustainability and can significantly influence future market trajectories.

Expanding Off-Roading Culture

The off-roading culture in Saudi Arabia is quickly expanding, fueled by local community events and increased media coverage. In 2022, it was reported that off-roading events attracted over 50,000 participants across various regions, demonstrating a burgeoning interest that supports the market. With around 80% of the country’s terrain being desert, there are abundant opportunities for adventure tourism that many are beginning to explore. As such, the continued rise of off-roading clubs and weekend adventure events establishes a robust context for all-terrain vehicle sales growth and supporting services.

Future Outlook

Over the next several years, the KSA All-Terrain Vehicles market is expected to exhibit significant growth driven by ongoing innovations in vehicle technology, coupled with supportive government initiatives that promote outdoor recreational activities. As the government envisions a robust leisure industry, investments in tourism and infrastructure enhancements are likely to further expand market opportunities. Consumer preferences for electric and environmentally friendly vehicles are also anticipated to guide new product offerings, resulting in a diversified market landscape.

Major Players in the Market

- Polaris Industries

- Yamaha Motor Co.

- Honda Motor Co.

- Can-Am (BRP)

- Arctic Cat

- Kawasaki Motors

- John Deere

- Kubota Corporation

- CFMoto

- Hisun Motors

- Kymco

- Textron Off Road

- Massimo Motor

- ATVTEC

- SSR Motorsports

Key Target Audience

- Investors and Venture Capitalist Firms

- Government and Regulatory Bodies (Saudi Ministry of Transport, Saudi Commission for Tourism and National Heritage)

- Automotive Manufacturers and Suppliers

- Agricultural Enterprises

- Military Procurement Departments

- Recreational Vehicle Dealerships

- Outdoor and Adventure Sports Organizations

- Event Organizers in Adventure Sports

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the KSA All-Terrain Vehicles Market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we will compile and analyze historical data pertaining to the KSA All-Terrain Vehicles Market. This includes assessing market penetration, the ratio of marketplaces to service providers, and the resultant revenue generation. Furthermore, an evaluation of service quality statistics will be conducted to ensure the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be developed and subsequently validated through computer-assisted telephone interviews (CATIs) with industry experts representing a diverse array of companies. These consultations will provide valuable operational and financial insights directly from industry practitioners, which will be instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple all-terrain vehicle manufacturers to acquire detailed insights into product segments, sales performance, consumer preferences, and other pertinent factors. This interaction will serve to verify and complement the statistics derived from the bottom-up approach, thereby ensuring a comprehensive, accurate, and validated analysis of the KSA All-Terrain Vehicles Market.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Market Genesis

- Timeline of Major Players

- Business Cycle

- Supply Chain and Value Chain Analysis

- Growth Drivers

Increasing Outdoor Recreation Activities

Growing Agricultural Sector - Market Challenges

Regulatory Constraints

High Maintenance Costs - Opportunities

Innovations in Electric Vehicles

Expanding Off-Roading Culture - Trends

Increasing Customization Options

Enhanced Safety Features - Government Regulations

Emission Standards

Licensing and Registration Requirements - SWOT Analysis

- Stakeholder Ecosystem

- Porter’s Five Forces

- By Value, 2019-2024

- By Volume, 2019-2024

- By Average Price, 2019-2024

- By Vehicle Type (In Value %)

Quad Bikes

– Standard Quad Bikes

– Sport Quad Bikes

– Youth Quad Bikes

UTVs (Utility Task Vehicles)

– 2-Seater UTVs

– 4-Seater UTVs

– Crew UTVs (6+ seaters)

ATVs (All-Terrain Vehicles)

– Entry-Level ATVs

– Mid-Size ATVs

– Full-Size ATVs

Side-by-Side Vehicles (SxS)

– Utility SxS

– Sport SxS

– Multi-Purpose SxS

Electric All-Terrain Vehicles

– Electric Quad Bikes

– Electric UTVs

– Electric SxS - By Application (In Value %)

Recreational

– Off-Road Adventure Parks

– Desert Safari/Tourism

– Personal Leisure

Agriculture

– Farm Utility Transport

– Livestock Management

– Crop Monitoring

Military

– Border Patrol Vehicles

– Tactical Reconnaissance

– Troop/Cargo Transport

Industrial

– Oil & Gas Field Mobility

– Construction Sites

– Mining Operations - By Engine Capacity (In Value %)

Below 400cc

– Recreational/Youth ATVs

– Entry-level Work Utility ATVs

400cc to 800cc

– Mid-range Utility ATVs

– SxS for Dual Use (Recreational + Industrial)

Above 800cc

– Heavy-Duty Utility and Sport ATVs

– High-performance SxS Vehicles - By Distribution Channel (In Value %)

Direct Sales

– Manufacturer-Owned Showrooms

– B2B Bulk Purchases (military, industrial)

Online Retail

– Manufacturer E-commerce Platforms

– Third-Party E-commerce Sites (Amazon, Noon, etc.)

Dealerships

– Authorized Multi-brand Dealerships

– Brand-Exclusive Dealerships - By Region (In Value %)

Riyadh

Al Kharj

Dammam

Al Khobar

Dhahran

Jeddah

Mecca

Medina

Abha

Jizan

Najran

- Market Share of Major Players on the Basis of Value/Volume, 2024

Market Share of Major Players by Type of All-Terrain Vehicles, 2024 - Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strength, Weakness, Organizational Structure, Revenues, Pricing Strategy, Customer Satisfaction, After-Sales Support, Sustainability Practices, Number of Touchpoints, Distribution Channels, Number of Dealers and Distributors, Margins, Production Plant, Unique Value offering and others)

- SWOT Analysis of Major Players

- Pricing Analysis Basis SKUs for Major Players

- Detailed Profiles of Major Companies

Polaris Industries

Yamaha Motor Co.

Honda Motor Co.

Can-Am (BRP)

Arctic Cat

Kawasaki Motors

Suzuki Motor Corporation

John Deere

Kubota Corporation

CFMOTO

Hisun Motors

Kymco

Textron Off Road

Massimo Motor

CF Moto

- Market Demand and Utilization

- Purchasing Behavior and Budget Allocations

- Regulatory and Compliance Considerations

- Needs, Desires, and Pain Points Analysis

- Decision-Making Process

By Value, 2025-2030

By Volume, 2025-2030

By Average Price, 205-2030