Market Overview

The KSA Ammunition Handling Systems market is valued at approximately USD ~million, with steady growth driven by increased defense budgets and military modernization programs. The market’s expansion is fueled by the rising demand for advanced ammunition handling systems to enhance operational efficiency and safety. The ongoing technological advancements in automation and robotics are further accelerating the market’s growth, positioning it as a critical segment in the defense and security sectors.The dominance of the KSA Ammunition Handling Systems market is primarily observed in the Kingdom of Saudi Arabia, driven by its strategic military alliances and government investment in defense infrastructure. The country’s robust defense spending, alongside an expanding portfolio of defense contracts, solidifies its position as a key player in the Middle East. This trend is further supported by KSA’s focus on upgrading military capabilities and increasing its reliance on advanced technological solutions for its armed forces.

Market Segmentation

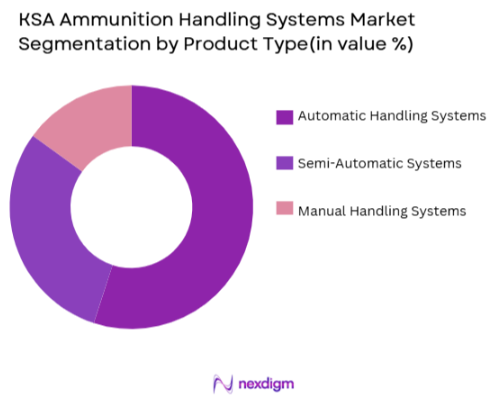

By Product Type

KSA Ammunition Handling Systems market is segmented by product type into automatic, semi-automatic, and manual handling systems. Recently, the automatic handling systems have dominated the market share, driven by factors such as their high operational efficiency, improved safety measures, and the growing preference for automated solutions in modern military operations. These systems are favored due to their ability to reduce manual labor, increase speed, and enhance precision during ammunition handling, thus making them a preferred choice in defense and military applications.

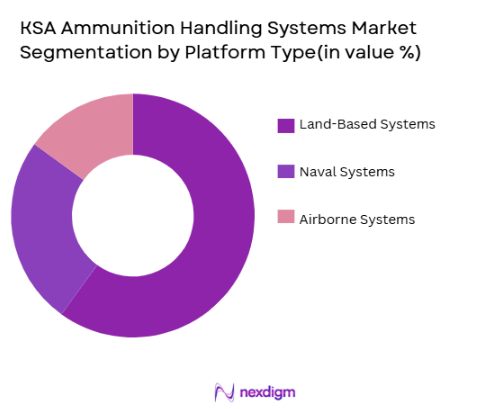

By Platform Type

KSA Ammunition Handling Systems market is segmented by platform type into land, naval, and airborne platforms. Among these, land-based systems currently lead the market, owing to the large-scale deployment of such systems for ground operations. These systems are integral to military logistics and operational efficiency in various defense scenarios, including troop and equipment transportation. Land-based systems’ dominance is also attributed to their extensive use in securing borders and the robust infrastructure supporting their deployment.

Market Analysis

Competitive Landscape

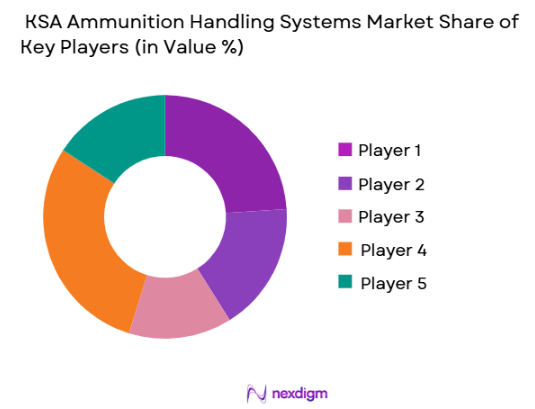

The KSA Ammunition Handling Systems market is highly competitive, with a mix of well-established global defense companies and local players. Consolidation is evident as major players continue to expand their technological capabilities and geographic reach, ensuring they stay competitive. Strategic partnerships and joint ventures are common as companies seek to strengthen their position in the Middle East defense sector. Innovation, along with government support and military contracts, plays a key role in shaping the market dynamics.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue (USD) |

| Lockheed Martin | 1912 | Bethesda, USA | ~ | ~ | ~ | ~ |

| BAE Systems | 1999 | London, UK | ~ | ~ | ~ | ~ |

| Rheinmetall Defence | 1889 | Düsseldorf, Germany | ~ | ~ | ~ | ~ |

| Saab Group | 1937 | Stockholm, Sweden | ~ | ~ | ~ | ~ |

| Thales Group | 2000 | Paris, France | ~ | ~ | ~ | ~ |

KSA Ammunition Handling Systems Market Analysis

Growth Drivers

Technological Advancements in Ammunition Handling Systems

The rapid advancement of technology in ammunition handling systems is a key driver of market growth. Innovations such as automated handling, robotics, and artificial intelligence have revolutionized the defense sector, enhancing operational efficiency and safety. Automation reduces human error, increases speed, and minimizes the risk associated with handling hazardous materials. Moreover, the integration of Internet of Things (IoT) for real-time system monitoring and predictive maintenance is improving system reliability. These advancements not only improve the operational capabilities of military and defense organizations but also lower long-term operational costs. The increasing reliance on high-tech solutions, coupled with government investments in military modernization, continues to push demand for advanced handling systems. As military forces worldwide prioritize automation and efficiency, the demand for sophisticated ammunition handling systems is expected to rise substantially. This trend is expected to continue as nations look to reduce manpower requirements and enhance defense infrastructure. The need for precision and high-level performance in ammunition handling further fuels the adoption of these technologies across various platforms. These technological shifts have been instrumental in transforming the market, making it more innovative and capable of meeting modern defense needs.

Military Modernization and Increased Defense Budgets

Rising military expenditure, driven by the need for modernization, is a significant growth driver for the ammunition handling systems market. Governments around the world, especially in defense-focused regions like the Middle East, are heavily investing in upgrading military infrastructure. These efforts include enhancing logistics and munitions handling capabilities. As nations seek to upgrade their forces to meet contemporary security challenges, there is an increased demand for advanced, automated ammunition handling systems. Such systems enable military forces to enhance operational readiness while ensuring safety and efficiency in handling ammunitions. With a focus on streamlining logistics, countries are incorporating more automated and reliable systems into their military operations. Additionally, the strategic importance of military modernization has led to large defense contracts for leading defense manufacturers. This growing emphasis on improving military logistics has driven the need for better, more reliable systems capable of ensuring a smooth supply chain and ammunition handling process. As governments continue to prioritize defense spending, the market for these systems will experience steady expansion, with new technologies and solutions being deployed to meet the demands of modern warfare.

Market Challenges

High Initial Costs of Ammunition Handling Systems

One of the main challenges facing the ammunition handling systems market is the high initial cost associated with acquiring advanced systems. The adoption of automated systems and technologies such as robotics, AI, and IoT integration involves significant upfront investment. These costs often deter smaller or less-funded military and defense organizations from upgrading their infrastructure. In many regions, particularly in emerging markets, the high capital expenditure required for cutting-edge systems limits the widespread adoption of these technologies. Even in developed markets, defense budgets are often stretched thin, and allocating a large portion of funds to sophisticated handling systems may not always be a priority. Furthermore, the maintenance and operational costs of these systems can also be substantial, making the long-term cost-benefit analysis less attractive for some military bodies. The need for specialized training to operate and maintain these advanced systems further adds to the expense. Despite the long-term operational efficiencies and cost savings, the significant capital investment required is a major barrier to market growth. This challenge is especially pronounced in defense forces that do not have the financial flexibility to invest in expensive technologies. Therefore, the high initial costs remain a critical challenge for the market, particularly in cost-sensitive regions.

Complexity of System Integration and Maintenance

Another challenge that hampers the growth of the ammunition handling systems market is the complexity involved in integrating these systems into existing military infrastructure. Many armed forces operate with legacy systems that are not always compatible with the latest advancements in ammunition handling. Integrating new automated or AI-driven systems into older platforms often requires significant modifications, which can be costly and time-consuming. Additionally, the maintenance of these complex systems requires specialized knowledge and expertise, further complicating the operational landscape. The availability of trained personnel to operate, maintain, and troubleshoot these advanced systems is a critical issue. In regions where skilled labor is scarce, maintaining operational readiness can become a significant challenge. These factors make it difficult for military organizations to seamlessly integrate and maintain these systems, thereby limiting their widespread adoption. As defense forces seek to modernize, overcoming these integration and maintenance barriers will be crucial to realizing the full potential of advanced ammunition handling technologies. Without overcoming these challenges, many defense organizations may continue to rely on older, less efficient systems, delaying the adoption of advanced solutions.

Opportunities

Integration of Ammunition Handling Systems with Smart Defense Technologies

The growing trend of integrating ammunition handling systems with smart defense technologies presents a significant opportunity for market expansion. The incorporation of artificial intelligence, IoT, and advanced sensors into handling systems can provide real-time monitoring and predictive maintenance capabilities. These features can significantly enhance the efficiency and reliability of ammunition handling, reducing human error and improving operational performance. As defense organizations increasingly adopt smart technologies across various systems, integrating them with ammunition handling processes will improve logistical operations and contribute to enhanced defense capabilities. Furthermore, the use of AI in managing ammunition inventories, ensuring safety protocols, and predicting system failures can drastically reduce operational downtime and improve overall system efficiency. This integration also offers the opportunity to create more sophisticated and versatile handling systems capable of adapting to a wide range of military operations. As the defense sector continues to evolve, incorporating smart technologies into ammunition handling systems will become a key differentiator for manufacturers, driving growth in the market. This presents an exciting opportunity for companies to innovate and develop advanced systems that can provide a competitive edge in the defense sector.

Expansion into Emerging Markets

Another opportunity for growth in the ammunition handling systems market lies in the expansion into emerging markets. Many developing nations are increasingly focusing on strengthening their military capabilities, driven by regional security concerns and the need for modernized defense infrastructure. As these countries seek to modernize their armed forces, they will require advanced ammunition handling systems to improve operational efficiency and reduce human risk. Emerging markets such as those in Southeast Asia, Latin America, and parts of Africa are expected to see growing defense budgets, driven by both internal and external security concerns. As a result, these regions present an opportunity for ammunition handling systems manufacturers to expand their market reach. Governments in these regions are looking for cost-effective solutions that balance performance and cost, and as the market for defense systems expands, the demand for advanced ammunition handling systems will grow. Manufacturers who can offer flexible and scalable solutions tailored to the needs of these markets will be well-positioned to tap into this emerging demand. With a significant increase in defense spending and military modernization efforts, the expansion into emerging markets offers substantial growth potential for the ammunition handling systems industry.

Future Outlook

The ammunition handling systems market is expected to see continued growth over the next five years, driven by technological advancements, increasing military budgets, and rising demand for automation in defense operations. Innovations in automation, AI, and IoT integration will be key drivers, as these technologies enhance the efficiency and safety of ammunition handling. Regulatory support for modernization and defense spending will further accelerate growth in the sector, while increased defense spending across various regions will continue to support market demand. As global defense priorities shift toward automation and operational efficiency, ammunition handling systems will play a central role in military infrastructure upgrades.

Major Players

- Lockheed Martin

- BAE Systems

- Rheinmetall Defence

- Saab Group

- Thales Group

- General Dynamics

- Northrop Grumman

- L3Harris Technologies

- Kongsberg Gruppen

- Leonardo S.p.A

- Elbit Systems

- Textron Systems

- Raytheon Technologies

- Hanwha Defense

- STM

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Military organizations

- Defense contractors

- Defense equipment manufacturers

- Security agencies

- Private military contractors

- Aerospace and defense industry stakeholders

Research Methodology

Step 1: Identification of Key Variables

Key market drivers, challenges, and opportunities are identified based on industry trends and historical data.

Step 2: Market Analysis and Construction

Quantitative and qualitative analysis is conducted to understand the market size, segmentation, and trends.

Step 3: Hypothesis Validation and Expert Consultation

Theoretical models are validated by consulting industry experts and key stakeholders.

Step 4: Research Synthesis and Final Output

Results are synthesized into a comprehensive report, ensuring that market trends, forecasts, and strategic insights are clearly presented.

- Executive Summary

- Research Methodology(Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Technological Advancements in Ammunition Handling Systems

Rising Military Expenditure in KSA

Increased Demand for Defense Modernization Programs - Market Challenges

High Initial Cost of Ammunition Handling Systems

Lack of Skilled Workforce in Handling Complex Systems

Maintenance and Operational Challenges - Market Opportunities

Integration with Smart Defense Technologies

Expansion of Military Alliances and Contracts

Government Funding for Modernizing Armed Forces - Trends

Adoption of Automation and Robotics in Ammunition Handling

Increased Use of IoT for Real-Time System Monitoring

Shift Toward Modular and Flexible Ammunition Handling Solutions - Government Regulations

KSA Defense Procurement Policies

Environmental Regulations in Ammunition Handling Systems

Defense Export Control Regulations

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Porter’s Five Force

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Automatic Ammunition Handling Systems

Manual Ammunition Handling Systems

Semi-Automatic Ammunition Handling Systems

Modular Ammunition Handling Systems

Integrated Ammunition Handling Systems - By Platform Type (In Value%)

Land-Based Ammunition Handling Systems

Naval Ammunition Handling Systems

Airborne Ammunition Handling Systems

Hybrid Ammunition Handling Systems

Integrated Ammunition Handling Systems - By Fitment Type (In Value%)

Original Equipment Manufacturing (OEM)

Aftermarket Fitment

Upgraded Systems

Customized Systems

Pre-installed Systems - By EndUser Segment (In Value%)

Military Forces

Law Enforcement Agencies

Ammunition Manufacturers

Defense Contractors

Private Security Firms - By Procurement Channel (In Value%)

Direct Procurement

Government Tenders

Third-Party Suppliers

OEM Partnerships

Online Platforms

- Market Share Analysis

- CrossComparison Parameters(Market Value, Installed Units, System Price, Platform Type, End-User Segment)

- Key Players

Lockheed Martin

BAE Systems

Rheinmetall Defence

Saab Group

Thales Group

Raytheon Technologies

Northrop Grumman

Leonardo S.p.A

L3Harris Technologies

Kongsberg Gruppen

Textron Systems

Elbit Systems

Hanwha Defense

STM

- Military Forces

- Law Enforcement Agencies

- Ammunition Manufacturers

- Private Security Firms

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035