Market Overview

The KSA ammunition market is currently valued in the ~ of USD, driven primarily by significant government investments in defense and security. A strong defense posture, increasing security threats in the region, and rising military budgets fuel demand for both conventional and advanced ammunition types. With modernization efforts for the armed forces and defense contracts, the market sees steady demand from government agencies and defense contractors. Increasing military expenditures, along with a growing focus on strengthening national defense capabilities, continue to expand the market.

The dominance of Saudi Arabia in the regional market is underpinned by its robust military infrastructure, strong alliances, and strategic location in the Middle East. The country’s defense sector benefits from substantial government spending, including substantial arms and ammunition procurements, both domestically and from international sources. Riyadh’s emphasis on self-reliance and upgrading defense systems further bolsters its leadership role. The Kingdom also serves as a regional hub for defense technology transfers and military operations, making it a central player in the Middle East’s security landscape.

Market Segmentation

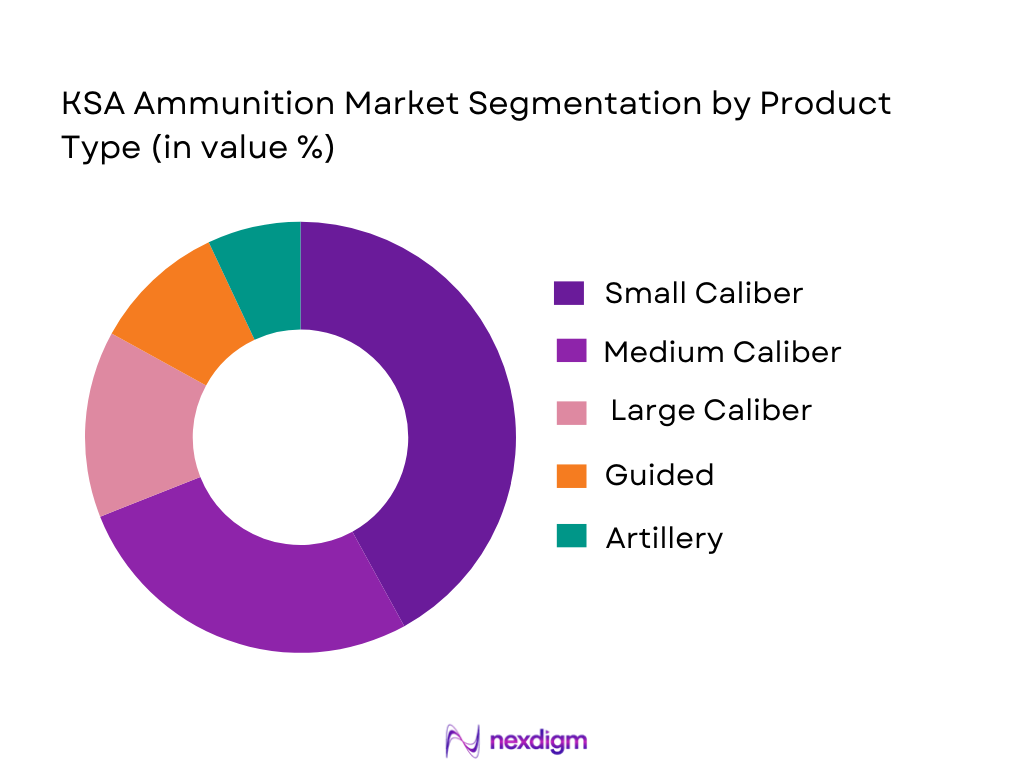

By Product Type

The KSA ammunition market is segmented by product type into small caliber, medium caliber, large caliber, guided ammunition, and artillery ammunition. Among these, small caliber ammunition dominates the market share due to high demand from military forces, law enforcement agencies, and civilian users. Factors such as the continued use of firearms, increasing law enforcement budgets, and military requirements for personal and vehicle-mounted weapons contribute to the dominance of small caliber ammunition. Furthermore, small caliber ammunition is versatile and cost-effective, which leads to its widespread adoption for both combat and training purposes.

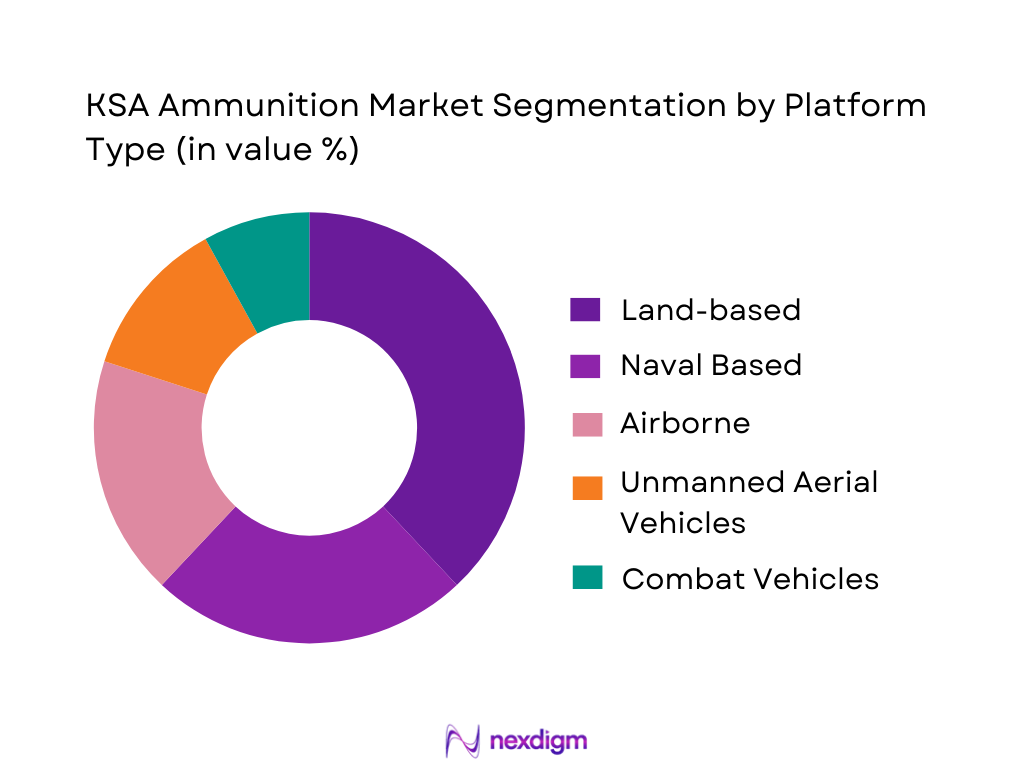

By Platform Type

The KSA ammunition market is also segmented by platform type into land-based platforms, naval platforms, airborne platforms, unmanned aerial vehicles (UAVs), and combat vehicles. Land-based platforms hold the largest market share owing to the extensive use of infantry and artillery weapons in Saudi Arabia’s defense strategy. The continuous investment in land-based military vehicles, tanks, and support systems enhances the demand for compatible ammunition. Additionally, land-based platforms are favored due to their role in domestic defense and border security operations.

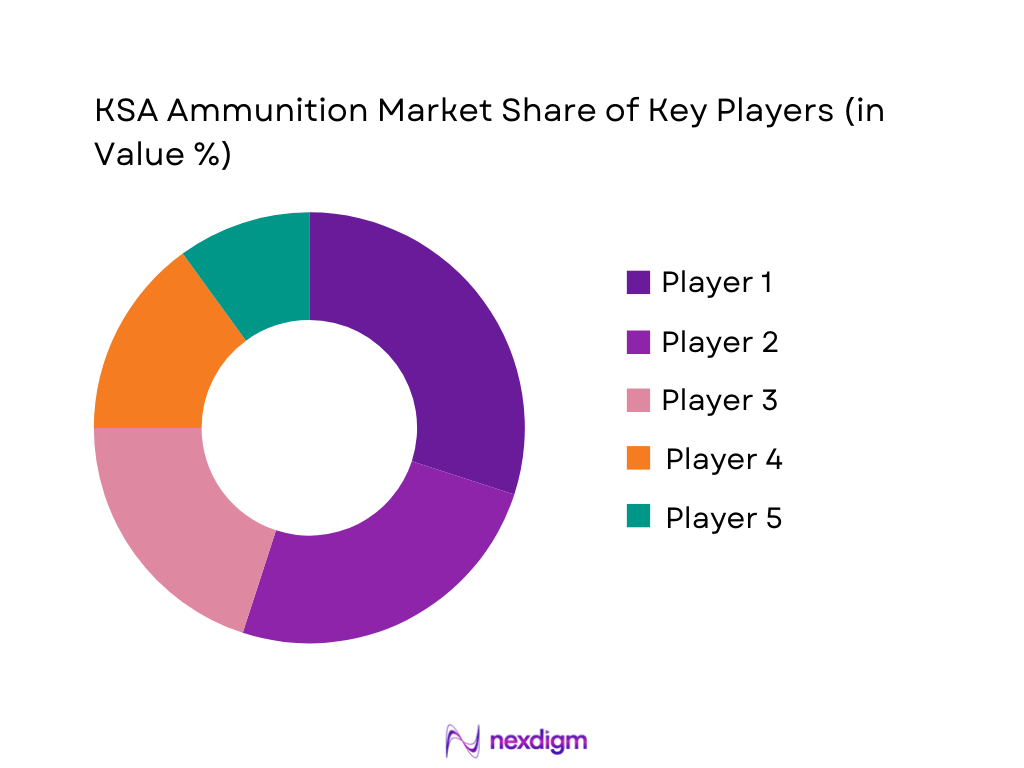

Competitive Landscape

The KSA ammunition market is highly competitive, with several key global players establishing their presence in the region. The market is influenced by major defense contractors and international suppliers who have long term defense contracts and partnerships with the Saudi government. Market consolidation has been witnessed as smaller companies merge with larger corporations to meet the increasing demand for advanced ammunition technologies. Major players hold a significant share of the market due to their technological innovations, production capabilities, and strong government ties.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue (USD) | Additional Parameter |

| General Dynamics Ordnance | 1948 | USA | ~ | ~ | ~ | ~ | ~ |

| BAE Systems | 1999 | UK | ~ | ~ | ~ | ~ | ~ |

| Lockheed Martin | 1912 | USA | ~ | ~ | ~ | ~ | ~ |

| Rheinmetall | 1889 | Germany | ~ | ~ | ~ | ~ | ~ |

| Elbit Systems | 1966 | Israel | ~ | ~ | ~ | ~ | ~ |

KSA Ammunition Market Analysis

Growth Drivers

Increasing defense budgets

The growing global security concerns, coupled with regional instability, have resulted in countries like Saudi Arabia increasing their defense budgets. This boost in military spending directly impacts the demand for advanced ammunition. With a consistent focus on enhancing defense capabilities, Saudi Arabia has bolstered its military expenditures to improve its combat readiness, modernize armed forces, and procure new weapons systems. Increasing defense contracts and military drills push the demand for various types of ammunition, making it a key driver of market growth.

Modernization of armed forces

Saudi Arabia is undergoing a major transformation of its military infrastructure, focusing on the integration of modern technology. The emphasis on high-tech, advanced weaponry, and ammunition systems such as smart ammunition and guided projectiles drives the demand for sophisticated munitions. These developments have positioned the market for continued growth in defense procurement. Additionally, the Kingdom’s shift towards autonomous systems and UAVs further drives demand for specialized ammunition, presenting new opportunities for ammunition manufacturers.

Market Challenges

High production and maintenance costs

One of the primary challenges in the KSA ammunition market is the high production and maintenance costs. The development of advanced, high-tech ammunition systems requires substantial investments in research, development, and manufacturing. Additionally, the costs involved in maintaining the equipment and ensuring the supply chain for critical ammunition are high. These financial burdens can limit the adoption of cutting-edge technology and increase the overall cost of military operations. Manufacturers are also facing the challenge of providing quality ammunition at competitive prices amidst economic fluctuations.

Regulatory complexities and international trade barriers

Saudi Arabia faces various regulatory complexities when it comes to the procurement and distribution of ammunition. Strict international trade agreements, arms control regulations, and export restrictions imposed by other countries often create barriers to acquiring ammunition from international suppliers. These regulations also affect the smooth distribution of ammunition to domestic and regional defense sectors. Furthermore, compliance with international security standards and agreements adds additional layers of complexity, increasing the time and cost associated with ammunition procurement.

Opportunities

Technological advancements in ammunition

The growing interest in smart ammunition and precision-guided munitions presents a significant opportunity for the market. Technological advancements, such as improved guidance systems, smaller, more efficient projectiles, and eco-friendly ammunition, are changing the landscape of modern warfare. Saudi Arabia’s emphasis on upgrading its military systems opens the door for new ammunition types that offer enhanced accuracy, range, and efficiency. These advancements are expected to grow the ammunition market, attracting both local and international suppliers with innovative solutions.

Expansion in defense exports

Saudi Arabia is looking to increase its defense exports, which presents a key opportunity for ammunition manufacturers. The Kingdom has strong ties with other countries in the Middle East and North Africa (MENA) region, which enhances its position as a regional exporter of defense technology. By developing advanced ammunition types suited for various military requirements, Saudi Arabia is poised to expand its reach and export ammunition systems to its allies and partners globally. This opportunity opens the market to new buyers and helps position Saudi Arabia as a key player in the international arms trade.

Future Outlook

The future of the KSA ammunition market is shaped by continuous technological innovation, strategic government investments, and the region’s increasing need for advanced defense systems. Over the next five years, it is expected that Saudi Arabia will focus heavily on modernizing its military infrastructure, including adopting cutting-edge ammunition types, especially in the realm of guided and smart munitions. Advancements in automation, UAV systems, and precision weapons are expected to drive further growth. Additionally, favorable government regulations and regional security concerns will continue to foster a positive growth environment.

Major Players

- General Dynamics Ordnance and Tactical Systems

- BAE Systems

- Lockheed Martin

- Rheinmetall

- Elbit Systems

- Textron Systems

- Leonardo S.p.A.

- Thales Group

- Northrop Grumman

- Kongsberg Gruppen

- FN Herstal

- Diehl Defence

- L3 Technologies

- MBDA

- Raytheon Technologies

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Armed forces and military contractors

- Aerospace and defense manufacturers

- Civilian security agencies

- Private security firms

- International defense buyers

- Military technology developers

Research Methodology

Step 1: Identification of Key Variables

This step involves identifying the core variables that impact the ammunition market, including economic, technological, and regulatory factors. A detailed literature review, alongside expert opinions, helps define the scope and relevance of these variables.

Step 2: Market Analysis and Construction

The collected data is analyzed, segmented by relevant categories such as product types and platform types, to understand market trends. Using both primary and secondary data, a market model is constructed to determine overall size, demand, and growth.

Step 3: Hypothesis Validation and Expert Consultation

The initial market assumptions and hypotheses are validated through expert consultations. Key industry players, including manufacturers, suppliers, and government officials, provide insights that guide further refinement of the market analysis.

Step 4: Research Synthesis and Final Output

The final market report is synthesized based on all collected data and expert feedback. The market outlook, trends, and forecasts are finalized, providing actionable insights and recommendations for stakeholders.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increasing defense budget allocation

Rise in regional military conflicts

Technological advancements in ammunition systems - Market Challenges

High manufacturing costs

Logistical challenges in distribution

Stringent regulatory compliance - Market Opportunities

Expansion in defense exports

Modernization of armed forces

Growth in defense-related technologies - Trends

Adoption of smart ammunition systems

Shift towards eco-friendly ammunition

Growth in private security services - Government Regulations

- SWOT Analysis

- Porter’s Five Forces

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Small Caliber Ammunition

Medium Caliber Ammunition

Large Caliber Ammunition

Guided Ammunition

Artillery Ammunition - By Platform Type (In Value%)

Land-based Platforms

Naval Platforms

Airborne Platforms

Unmanned Aerial Vehicles (UAVs)

Combat Vehicles - By Fitment Type (In Value%)

OEM Fitment

Retrofit Fitment

Aftermarket Fitment

Custom Fitment - By EndUser Segment (In Value%)

Military

Law Enforcement

Private Security Contractors

Civilian Users

Defense Contractors - By Procurement Channel (In Value%)

Direct Procurement

Government Bidding

Third-Party Intermediaries

- Market Share Analysis

- Cross Comparison Parameters (System Type, Platform Type, Procurement Channel, End User Segment, Region)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

General Dynamics Ordnance and Tactical Systems

BAE Systems

Lockheed Martin

Rheinmetall

Nexter Systems

Raytheon Technologies

Elbit Systems

Textron Systems

Saab AB

Leonardo S.p.A.

Thales Group

Northrop Grumman

Kongsberg Gruppen

FN Herstal

Diehl Defence

- Military Demand

- Law Enforcement Demand

- Private Security Contractors

- Civilian Demand

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035