Market Overview

The ammunition storage market is valued at USD ~, driven by increased defense spending and the expansion of military infrastructure. Technological advancements in secure storage solutions, especially those designed for enhanced safety and climate control, contribute significantly to the growth. Governments are prioritizing investments in modernizing ammunition storage facilities to meet the rising security demands. As global geopolitical tensions increase, the necessity for secure, long-term ammunition storage has accelerated, ensuring that this market remains robust.

Countries with high defense budgets, such as the United States, China, and Russia, dominate the ammunition storage market. These nations invest heavily in upgrading their military infrastructure, including ammunition storage systems. The rising defense expenditures, coupled with an emphasis on ensuring operational readiness, are key factors driving this dominance. Additionally, regions with active military engagements require state-of-the-art storage solutions to secure large quantities of ammunition, further contributing to the strong demand.

Market Segmentation

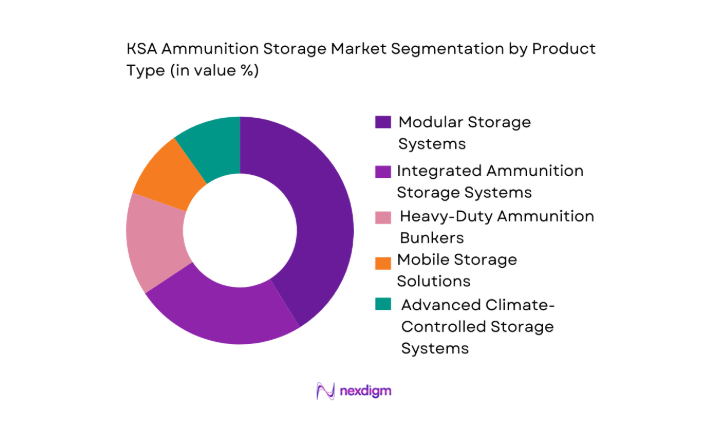

By Product Type:

The ammunition storage market is segmented by product type into modular storage systems, integrated ammunition storage systems, heavy-duty ammunition bunkers, mobile storage solutions, and advanced climate-controlled storage systems. Recently, modular storage systems have dominated the market share due to factors such as their flexibility, cost-effectiveness, and ease of integration into existing infrastructures. Their demand has surged as defense sectors seek scalable and secure solutions for ammunition storage, making them a preferred choice in both military and private sectors. The versatility of modular systems enables efficient storage and rapid deployment, solidifying their dominance in the market.

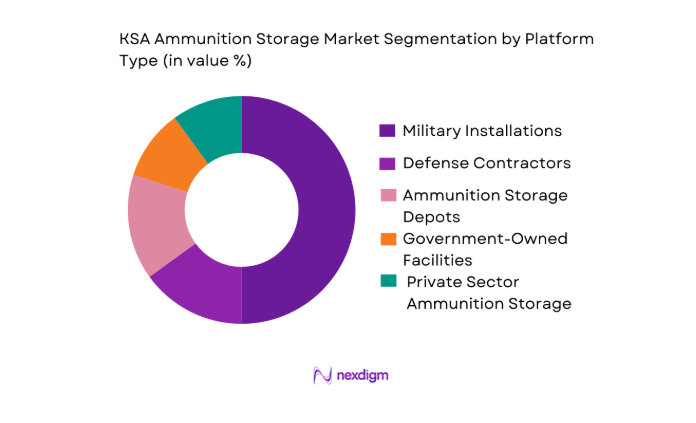

By Platform Type:

The ammunition storage market is segmented by platform type into military base installations, storage for defense contractors, ammunition storage depots, government-owned facilities, and private sector ammunition storage. Military base installations currently hold the largest market share due to the large-scale requirements for secure, high-capacity storage solutions. As defense budgets rise globally, especially in regions with heightened security concerns, military bases demand more advanced storage solutions for both tactical and strategic readiness. These installations require robust, long-term storage facilities to meet military needs in volatile geopolitical climates.

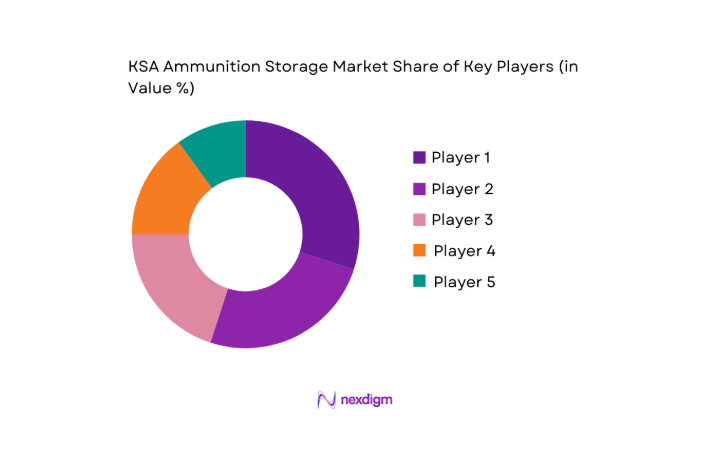

Competitive Landscape

The ammunition storage market is highly competitive, with a few dominant players consolidating the industry. Major companies are focusing on technological innovations, particularly modular and secure storage solutions, to stay ahead of the competition. Consolidation has been observed as leading defense companies acquire smaller firms to expand their portfolios and enhance product offerings. The market is also influenced by the increasing demand for sustainable and climate-controlled storage solutions, with companies adapting to these new trends to gain competitive advantages.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue (USD) | Additional Parameter |

| General Dynamics | 1952 | United States | ~ | ~ | ~ | ~ | ~ |

| Rheinmetall | 1889 | Germany | ~ | ~ | ~ | ~ | ~ |

| BAE Systems | 1999 | United Kingdom | ~ | ~ | ~ | ~ | ~ |

| Lockheed Martin | 1912 | United States | ~ | ~ | ~ | ~ | ~ |

| Thales Group | 2000 | France | ~ | ~ | ~ | ~ | ~ |

KSA Ammunition Storage Market Analysis

Growth Drivers

Increase in defense spending

Defense spending has significantly increased across many countries, especially in regions experiencing geopolitical tensions. This surge in defense budgets is primarily allocated toward enhancing military infrastructure, including ammunition storage systems. With an emphasis on ensuring operational readiness and safety, nations are upgrading existing storage facilities or building new ones. As a result, the demand for secure, efficient, and technologically advanced storage solutions is at an all-time high. Furthermore, as defense expenditures continue to rise globally, both developed and developing nations are focusing on modernizing their military facilities, contributing to the growth of the ammunition storage market. This trend is expected to continue as military readiness and safety become paramount.

Technological advancements in ammunition storage systems

Technological advancements play a crucial role in the growth of the ammunition storage market. As the need for more secure and sustainable solutions increases, manufacturers are incorporating advanced features such as climate control, automated inventory management, and modular designs. These innovations ensure greater efficiency in storage management while providing enhanced safety features. The integration of digital technologies, such as sensors and real-time monitoring systems, has led to smarter storage solutions that meet strict regulatory requirements. This has driven the market as military forces seek to optimize storage capacity while maintaining high standards of safety and efficiency.

Market Challenges

High capital investment and operational costs

The high cost of installing advanced ammunition storage systems is one of the major challenges in the market. Developing and implementing secure, high-capacity storage solutions requires significant capital investment, particularly in terms of infrastructure development and system integration. Additionally, maintaining these systems comes with operational costs, including regular inspections, repairs, and upgrades to meet evolving safety standards. This financial burden can be particularly challenging for smaller defense contractors or countries with limited defense budgets, hindering widespread adoption of state-of-the-art storage systems. As defense spending increases, however, governments are expected to prioritize these investments, helping mitigate some of these costs.

Regulatory compliance and certification complexities

The ammunition storage market is heavily regulated, with stringent safety and compliance standards imposed by governments and international organizations. Adhering to these regulations requires ammunition storage solutions to meet high safety, security, and environmental standards. Companies in the market face challenges in ensuring their products comply with these complex regulations, which vary across different regions. The process of obtaining necessary certifications can be time-consuming and costly, further delaying product deployment. As regulations become more stringent, manufacturers must continuously innovate to meet these demands while ensuring that their storage solutions remain efficient and cost-effective.

Opportunities

Growing demand for climate-controlled storage

One of the significant opportunities in the ammunition storage market is the growing demand for climate-controlled storage solutions. These systems are crucial for ensuring the longevity and stability of stored ammunition, particularly in regions with extreme weather conditions. Climate-controlled storage helps mitigate the risk of deterioration due to temperature fluctuations, humidity, or exposure to adverse environmental conditions. As military forces increasingly recognize the importance of these systems, the market for climate-controlled ammunition storage solutions is expected to expand. This trend is further supported by rising global temperatures and the growing need for secure, long-term storage options in military depots.

Adoption of modular storage systems

Modular ammunition storage systems present a significant growth opportunity within the market. These systems provide flexibility, scalability, and cost-efficiency, which are crucial factors for defense organizations looking to expand their storage capabilities without large upfront investments. The demand for modular systems is driven by the ability to customize storage configurations to meet specific needs, such as accommodating various ammunition types and sizes. Modular systems are also easier to integrate with existing infrastructure, making them a preferred choice for military bases and defense contractors. As the demand for flexible and adaptable storage solutions increases, modular storage systems are expected to play a pivotal role in the market’s future growth.

Future Outlook

The ammunition storage market is expected to experience steady growth over the next five years. With increased defense spending, technological advancements, and the growing importance of safety and security, the demand for modern ammunition storage solutions is anticipated to rise. Innovations in modular and climate-controlled storage systems are set to drive the market forward, offering efficient, cost-effective, and secure options. Additionally, stricter regulations and rising geopolitical tensions are likely to further propel the adoption of high-quality storage solutions across military and government sectors.

Major Players

- General Dynamics

- Rheinmetall

- BAE Systems

- Lockheed Martin

- Thales Group

- L3Harris Technologies

- Northrop Grumman

- Leonardo S.p.A

- Raytheon Technologies

- Saab Group

- Textron Systems

- Leonardo DRS

- Elbit Systems

- AeroVironment

- Oshkosh Defense

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Military contractors

- Defense equipment suppliers

- Armed forces and defense ministries

- Logistics and infrastructure development companies

- Security and defense technology providers

- Manufacturers of storage systems

Research Methodology

Step 1: Identification of Key Variables

Key variables, including defense spending trends, technological advancements, and market demand drivers, are identified to guide the research process.

Step 2: Market Analysis and Construction

Comprehensive data analysis and market modeling are conducted to construct an accurate market framework and trends.

Step 3: Hypothesis Validation and Expert Consultation

Expert consultations are performed to validate hypotheses and ensure accurate forecasting, incorporating industry insights.

Step 4: Research Synthesis and Final Output

The final output is synthesized from gathered data and expert feedback to provide actionable market insights.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increasing defense budget allocations

Rising regional geopolitical tensions

Technological advancements in storage solutions - Market Challenges

High infrastructure and maintenance costs

Regulatory and certification complexities

Limited availability of advanced storage technology - Market Opportunities

Expansion of military base installations

Growing demand for secure and climate-controlled storage

Rising need for modernizing legacy systems - Trends

Integration of automation in storage systems

Adoption of eco-friendly storage solutions

Rise in demand for modular and scalable systems - Government Regulations

- SWOT Analysis

- Porter’s Five Forces

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Modular Storage Systems

Integrated Ammunition Storage Systems

Heavy-Duty Ammunition Bunkers

Mobile Storage Solutions

Advanced Climate-Controlled Storage Systems - By Platform Type (In Value%)

Military Base Installations

Storage for Defense Contractors

Ammunition Storage Depots

Government-Owned Facilities

Private Sector Ammunition Storage - By Fitment Type (In Value%)

OEM Fitment

Retrofit Fitment

Aftermarket Fitment

Custom Fitment

Modular Fitment - By EndUser Segment (In Value%)

Defense Ministries

Private Defense Contractors

Military Suppliers

Government Procurement Agencies

Ammunition Storage Service Providers - By Procurement Channel (In Value%)

Direct Procurement

Third-Party Distributors

Government Contracts

- Market Share Analysis

- Cross Comparison Parameters (Storage Capacity, Technology Adoption, Compliance Standards, System Complexity, End-User Requirements)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

Saudi Arabian Military Industries

General Dynamics Ordnance and Tactical Systems

Rheinmetall

BAE Systems

Lockheed Martin

Raytheon Technologies

Northrop Grumman

Leonardo S.p.A

Thales Group

L3Harris Technologies

Meggitt

AeroVironment

Harris Corporation

Elbit Systems

Oshkosh Defense

- Defense Ministries’ Role

- Private Defense Contractors’ Requirements

- Government Procurement Agencies’ Needs

- Storage Service Providers’ Demand

Forecast Market Value, 2026-2035

Forecast Installed Units, 2026-2035

Price Forecast by System Tier, 2026-2035

Future Demand by Platform, 2026-2035