Market Overview

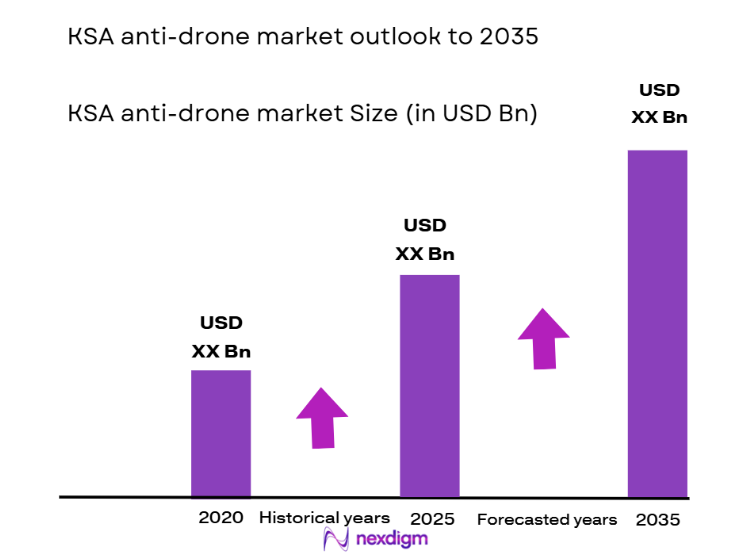

The KSA anti-drone market is poised for significant growth, driven by the increasing use of drones in both military and commercial applications, with a market size estimated at approximately USD ~ billion. The rising need for anti-drone systems to mitigate security threats, including surveillance, smuggling, and potential terrorist activities, is a key factor propelling this market’s growth. Government initiatives focused on national security and military modernization are further driving investments in counter-drone technologies. The market is supported by advancements in technologies like drone detection, jamming, and interception, which are becoming more integrated into defense infrastructure.

The dominance of Saudi Arabia in the anti-drone market can be attributed to the country’s strong defense sector, coupled with rising concerns over border security and national defense. The kingdom’s strategic geographic location, coupled with a robust military presence, demands the development and procurement of sophisticated anti-drone systems. Urban centers such as Riyadh and Jeddah are key hubs for defense innovations and procurement, with government agencies and military institutions driving demand for advanced countermeasures to address the increasing drone activity in the region.

Market Segmentation

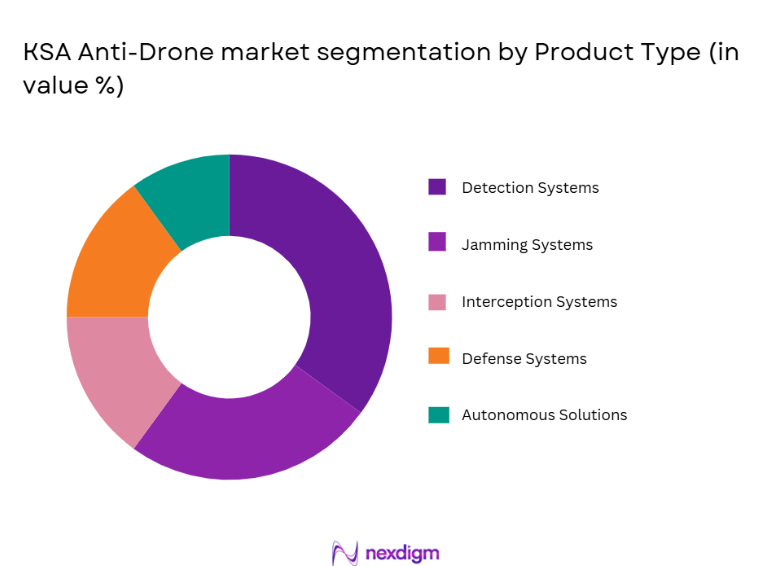

By Product Type

KSA anti-drone market is segmented by product type into detection systems, jamming systems, interception systems, defense systems, and autonomous solutions. Recently, drone detection systems have dominated the market share due to their ability to provide early warnings and prevent potential threats before they escalate. This sub-segment is witnessing strong growth as the need for proactive security measures increases across the defense and government sectors. The ability of detection systems to integrate with existing surveillance and defense infrastructure further bolsters their market presence. Their cost-effectiveness, scalability, and non-intrusive nature make them a preferred choice for both military and civil applications.

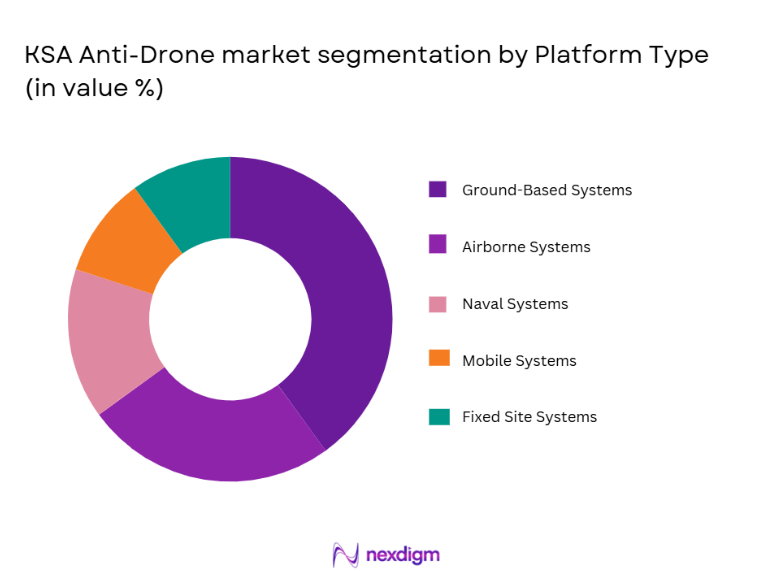

By Platform Type

KSA anti-drone market is segmented by platform type into ground-based systems, airborne systems, naval systems, mobile systems, and fixed site systems. Ground-based systems are currently leading the market share due to their versatility, ease of deployment, and cost-efficiency. These systems are highly favored by military forces and security agencies for both urban and rural settings. Ground-based platforms provide a reliable and scalable solution for perimeter defense, especially for high-risk locations like airports and military bases. The development of portable and modular ground-based systems, coupled with improved detection capabilities, further drives their dominance in the market.

Competitive Landscape

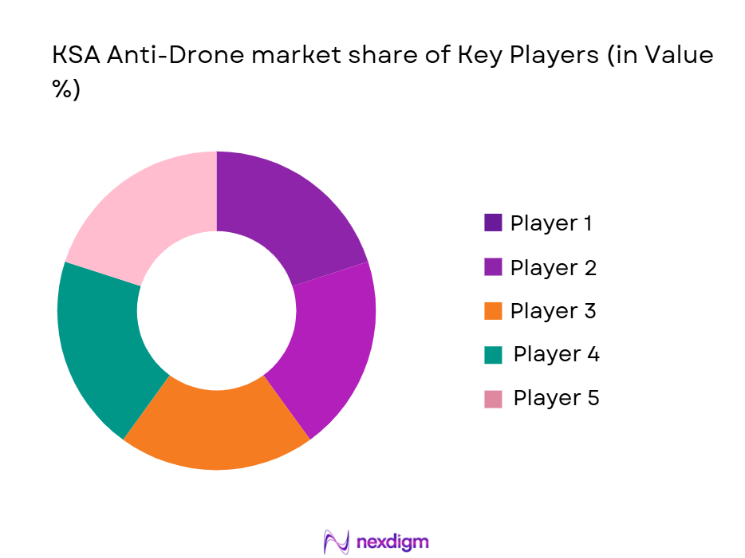

The competitive landscape in the KSA anti-drone market is characterized by significant consolidation, with several large defense contractors and technology firms dominating the space. The increasing demand for advanced anti-drone systems has led to strategic partnerships and acquisitions among market players, strengthening their capabilities in providing end-to-end counter-drone solutions. Major players in this market are increasingly focusing on technological advancements, including AI-based drone detection and autonomous counter-drone systems.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue (USD) | Additional Parameter |

| Lockheed Martin | 1912 | USA | ~ | ~ | ~ | ~ | ~ |

| Raytheon Technologies | 1922 | USA | ~ | ~ | ~ | ~ | ~ |

| Israel Aerospace Industries | 1953 | Israel | ~ | ~ | ~ | ~ | ~ |

| Thales Group | 2000 | France | ~ | ~ | ~ | ~ | ~ |

| Northrop Grumman | 1939 | USA | ~ | ~ | ~ | ~ | ~ |

KSA Anti Drone Market Analysis

Growth Drivers

Government Investment in Defense

Government investment in defense, particularly in the realm of national security and border control, is a critical driver of the anti-drone market. Saudi Arabia’s military modernization plans, supported by Vision 2030, are a key influence on the growing demand for advanced countermeasures against drone-based threats. The government’s push for technological advancements in defense, coupled with increased budget allocations to modernize military capabilities, has spurred procurement of anti-drone systems. With a rising focus on sovereignty and territorial security, the demand for reliable, scalable, and cost-efficient counter-drone systems has never been higher. These initiatives are not only driven by external threats but also by the need to secure critical infrastructure, airports, and oil facilities, which makes anti-drone systems integral to the national defense strategy. Moreover, partnerships with global defense contractors ensure the acquisition of the latest technological solutions.

Technological Advancements in Countermeasures

Another major growth driver is the continual advancement in counter-drone technology. Saudi Arabia has made substantial investments in research and development to enhance the effectiveness of anti-drone systems, integrating artificial intelligence (AI), machine learning (ML), and deep learning to improve the detection and neutralization of drones. As drone technology evolves, so does the capability of anti-drone systems to target a wider range of threats. AI-driven detection systems are highly effective in distinguishing between friendly and hostile drones, even in congested airspace. This technology enables faster response times and greater accuracy, which is crucial for mitigating the growing threat posed by drones. The development of automated interception systems, such as drone-catching nets and jamming devices, is also driving the growth of the market. As these technologies become more advanced, the affordability and accessibility of such systems for military and civilian use will further fuel demand.

Market Challenges

Regulatory and Compliance Issues

One of the main challenges hindering the growth of the KSA anti-drone market is the complex and evolving regulatory landscape surrounding the use of counter-drone systems. Governments worldwide, including in Saudi Arabia, are still in the process of establishing clear frameworks for the safe deployment of anti-drone technology. Issues such as the legality of jamming signals, the potential for civilian interference, and international aviation laws pose significant challenges. Regulatory bodies must find a balance between ensuring national security and allowing for innovation in drone defense technology. In addition, coordination among government agencies, defense contractors, and local authorities is required to ensure that counter-drone systems are integrated into national defense strategies while adhering to laws and international agreements. Delays in the formalization of regulations could hinder the broader adoption of anti-drone technologies in both military and civilian sectors.

High Operational and Maintenance Costs

Another significant challenge facing the market is the high operational and maintenance costs associated with advanced anti-drone systems. The initial investment in these technologies can be substantial, and while they provide long-term security benefits, they also require ongoing maintenance and periodic upgrades to remain effective against evolving drone threats. The high cost of deploying, maintaining, and operating counter-drone systems can be a deterrent for some potential customers, especially smaller government agencies and private sector entities. The complexity of operating these systems, coupled with the specialized training required for personnel, adds to the overall expense. Furthermore, the need for frequent software updates and hardware improvements to combat emerging threats exacerbates the financial burden.

Opportunities

Increased Adoption of Autonomous Anti-Drone Solutions

One significant opportunity in the KSA anti-drone market lies in the growing demand for autonomous counter-drone systems. With the continuous advancement of artificial intelligence (AI) and machine learning (ML), the development of autonomous solutions capable of detecting, tracking, and neutralizing drones without human intervention is gaining traction. These systems offer several advantages, including reduced personnel requirements, faster response times, and the ability to operate 24/7 in high-risk environments. Autonomous counter-drone systems can be deployed in critical infrastructure, urban areas, and border control points, making them highly versatile. The demand for these systems is expected to rise as governments and defense organizations seek to improve operational efficiency and reduce reliance on human resources. The integration of AI and robotic systems into the counter-drone ecosystem represents a major opportunity for both developers and end-users.

Emerging Commercial Use of Anti-Drone Systems

The commercial sector also presents a valuable growth opportunity for anti-drone systems. With the increasing prevalence of drones for surveillance, delivery, and entertainment, the need to secure private property, corporate assets, and public events is growing. Anti-drone systems can be utilized in a variety of settings, such as protecting high-profile events, securing sensitive infrastructure like airports, and preventing illegal drone activities in restricted zones. The rise in drone-related incidents, including smuggling, espionage, and accidents, is driving the demand for effective countermeasures in the commercial space. As regulatory frameworks evolve, commercial applications of anti-drone technology will become more mainstream, creating new avenues for market expansion.

Future Outlook

The KSA anti-drone market is expected to experience continued growth driven by technological advancements and increased government focus on national security. Over the next five years, the adoption of AI-powered detection systems and autonomous countermeasures will likely dominate, with a significant rise in the use of mobile and airborne platforms. Furthermore, ongoing regulatory developments will support market growth as governments establish clearer frameworks for drone defense technologies. The commercial sector is also expected to see higher demand for anti-drone systems, particularly in areas related to infrastructure protection and event security.

Major Players

- Lockheed Martin

- Raytheon Technologies

- Israel Aerospace Industries

- Thales Group

- Northrop Grumman

- BAE Systems

- Leonardo

- Saab AB

- Elbit Systems

- Rheinmetall

- General Dynamics

- Textron Systems

- DRS Technologies

- SRC, Inc.

- L3 Technologies

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Defense contractors

- Military agencies

- Critical infrastructure companies

- Airport authorities

- Private security firms

- Technology developers

Research Methodology

Step 1: Identification of Key Variables

Identify the primary market drivers, challenges, and trends shaping the anti-drone market.

Step 2: Market Analysis and Construction

Analyze historical market data, trends, and segmentation to build a comprehensive model of the current market landscape.

Step 3: Hypothesis Validation and Expert Consultation

Consult industry experts and stakeholders to validate key assumptions and hypotheses regarding market dynamics.

Step 4: Research Synthesis and Final Output

Compile and synthesize all findings into a comprehensive report, focusing on actionable insights and market forecasts.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increasing Security Threats from Unmanned Aerial Vehicles

Government Initiatives to Enhance National Security

Rising Demand for Anti-Drone Technologies in Defense and Civil Sectors - Market Challenges

High Development and Operational Costs of Anti-Drone Systems

Lack of Standardized Regulations for Drone Defense Technologies

Integration Challenges with Existing Security Infrastructure - Market Opportunities

Rising Adoption of Autonomous Counter-Drone Solutions

Growing Demand for Drone Detection Systems in Civil Applications

Government Investments in National Defense and Cybersecurity - Trends

Advancements in AI and Machine Learning for Drone Detection

Emerging Applications in Critical Infrastructure Protection

Integration of Anti-Drone Systems with Smart Cities - Government Regulations

Regulations for Drone Usage and Countermeasures

Compliance with International Drone Defense Standards

Government Funding and Policies for Anti-Drone Technologies

- By Market Value 2020-2025

- By Installed Units 2020-2025

- By Average System Price 2020-2025

- By System Complexity Tier 2020-2025

- By System Type (In Value%)

Drone Detection Systems

Drone Jamming Systems

Drone Interception Systems

Drone Defense Systems

Autonomous Counter-Drone Systems - By Platform Type (In Value%)

Ground-Based Systems

Airborne Systems

Naval Systems

Mobile Systems

Fixed Site Systems - By Fitment Type (In Value%)

OEM Fitment

Retrofit Fitment

Aftermarket Fitment

Custom Fitment

Upgrade Fitment - By EndUser Segment (In Value%)

Military

Government & Law Enforcement

Commercial & Industrial

Critical Infrastructure

Defense Contractors - By Procurement Channel (In Value%)

Direct Procurement

Distributor Procurement

Government Procurement

Third-Party Procurement

Online Procurement

- Market Share Analysis

- CrossComparison Parameters (Drone Detection, Jamming Systems, Interception, Autonomous Solutions, Military Applications)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Porter’s Five Forces

- Key Players

Lockheed Martin

Raytheon Technologies

Israel Aerospace Industries

Northrop Grumman

Leonardo S.p.A

Thales Group

BAE Systems

Saab AB

DRS Technologies

SRC, Inc.

Elbit Systems

Rheinmetall

Textron Systems

L3 Technologies

General Dynamics

- Military Applications and Defense

- Government Use in Law Enforcement

- Industrial Use for Asset Protection

- Commercial Use in Aviation and Airports

- Forecast Market Value 2026-2035

- Forecast Installed Units 2026-2035

- Price Forecast by System Tier 2026-2035

- Future Demand by Platform 2026-2035