Market Overview

The KSA anti-inflammatory topical creams market is anchored in the wider topical drugs space, valued at around USD ~ billion, up from roughly USD ~ billion in the immediately preceding period, based on a multi-year, country-level assessment of topical formulations. Rising cases of dermatological conditions (acne, eczema, psoriasis, contact dermatitis) and musculoskeletal pain, coupled with a young, urban population and harsh desert climate, are expanding demand for localized, non-systemic therapies. Strong OTC culture, SFDA-regulated switching of selected molecules, and growing self-care habits further pull anti-inflammatory creams into everyday treatment regimens. The market is highly concentrated in Riyadh and Makkah regions, led by Riyadh city, which hosts the largest population base, purchasing power, and healthcare infrastructure in KSA. Official statistics indicate 499 hospitals nationwide, with Riyadh region accounting for 109 and Makkah for 95, underscoring their dominance in prescription and pharmacy traffic.

Market Segmentation

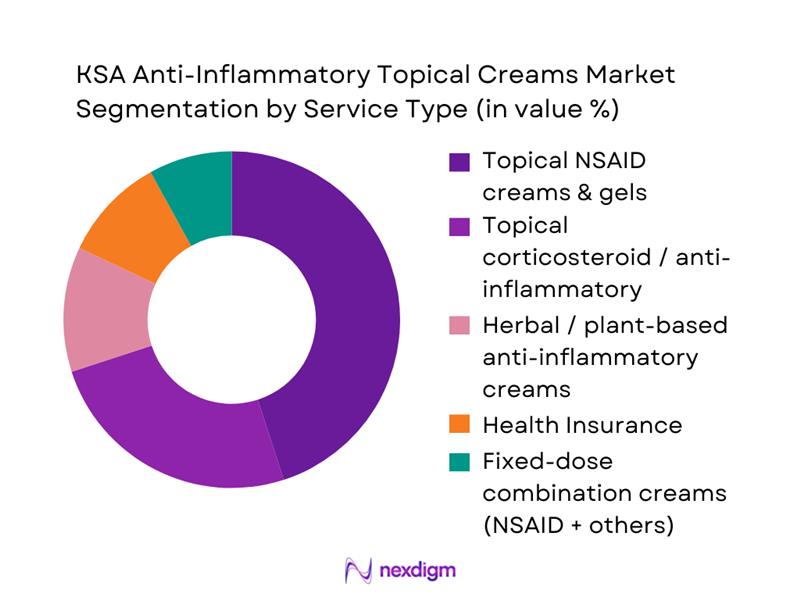

By Drug Class

The KSA anti-inflammatory topical creams market is segmented by drug class into topical NSAID creams and gels, topical corticosteroid/anti-inflammatory combinations, counter-irritant balms and rubefacients, herbal/plant-based anti-inflammatory creams, and fixed-dose combination products with muscle relaxants or local anesthetics. By Drug Class: The KSA anti-inflammatory topical creams market is segmented by drug class into topical NSAID creams and gels, topical corticosteroid combinations, counter-irritant balms and rubefacients, herbal/plant-based anti-inflammatory creams, and fixed-dose combination products.

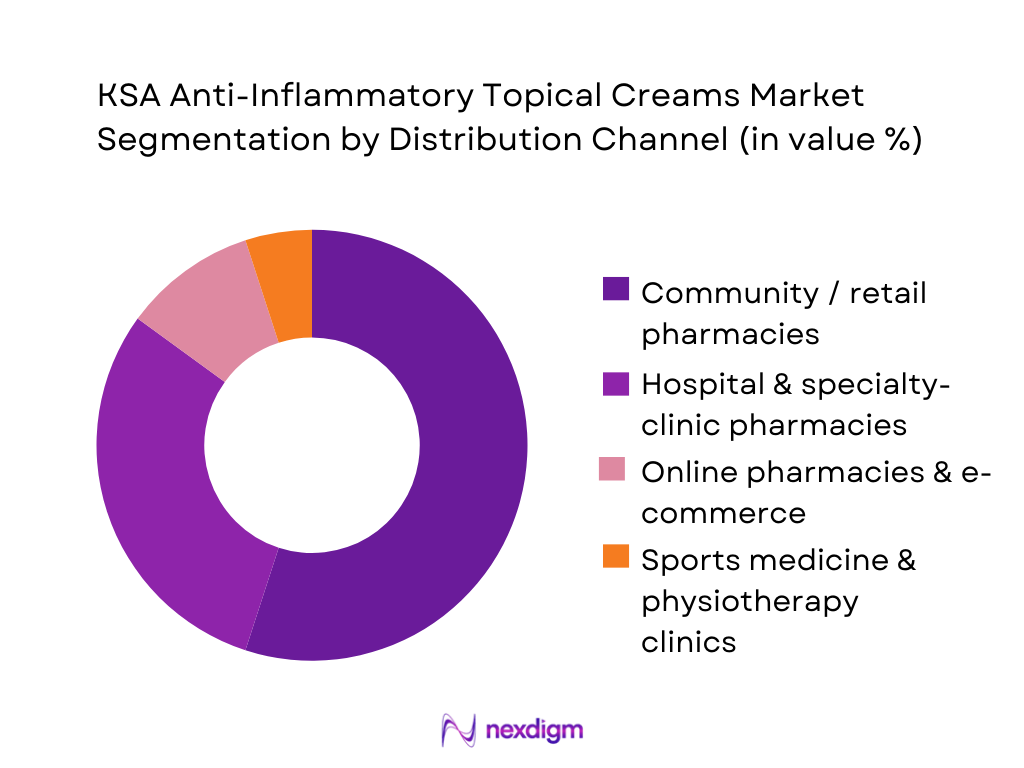

By Distribution Channel

The KSA anti-inflammatory topical creams market is segmented by distribution channel into hospital and specialty clinic pharmacies, community/retail pharmacies, online pharmacies & e-commerce platforms, and sports medicine & physiotherapy clinics. Community and retail pharmacies dominate the market share as they sit at the intersection of physician prescriptions and OTC self-medication. Large chains such as Nahdi and Al-Dawaa operate extensive networks across urban and semi-urban regions, combining wide SKU depth in pain-relief and dermatology topicals with pharmacist-led recommendation. Their presence in malls, residential clusters, and near primary care centers makes them the first point of contact for chronic musculoskeletal pain, sports injuries and minor dermatologic inflammation, while strong relationships with both local manufacturers and multinational OTC brands ensure high availability and frequent promotional activity.

Competitive Landscape

The KSA anti-inflammatory topical creams market is characterized by a hybrid competitive structure: strong local branded generics players (Jamjoom Pharma, SPIMACO ADDWAEIH, Tabuk Pharmaceuticals) co-exist with global consumer healthcare and pharma multinationals (Haleon, Bayer, GSK, Sanofi) that leverage iconic pain-relief brands and robust marketing. Competition is driven by dermatologist and orthopedist prescription preferences, SFDA registration timelines, hospital tender performance, pharmacy-level merchandising, and the ability to differentiate via formulation technology (fast absorption gels, patches, odorless creams, herbal-hybrid products).

| Company | Establishment Year | Headquarters (Core Region) | Key Anti-inflammatory / Topical Focus | Primary Segment Focus in KSA | Distribution Strength in KSA | Local Manufacturing / Localization Focus | Notable Strategic Direction in KSA Topicals |

| Jamjoom Pharma | 1994 | Jeddah, Saudi Arabia | ~ | ~ | ~ | ~ | ~ |

| SPIMACO ADDWAEIH | 1986 | Riyadh, Saudi Arabia | ~ | ~ | ~ | ~ | ~ |

| Tabuk Pharmaceuticals | 1994 | Riyadh, Saudi Arabia | ~ | ~ | ~ | ~ | ~ |

| Haleon (Panadol, Advil) | 2022 | Weybridge, UK | ~ | ~ | ~ | ~ | ~ |

| Bayer Middle East (Bayer) | 1863 (group) | Leverkusen, Germany | ~ | ~ | ~ | ~ | ~ |

KSA Anti-Inflammatory Topical Creams Market Analysis

Growth Drivers

Rising Musculoskeletal Disorders & Occupational Stress Load

Saudi Arabia’s working-age population is large and highly exposed to physical and occupational strain, supporting sustained demand for anti-inflammatory topical creams. The Kingdom’s population stands at around 35.3 million people with roughly three-quarters in the 15+ age group, a cohort most exposed to musculoskeletal (MSK) stress in construction, logistics, and industrial jobs.World Bank – Population, Saudi Arabia. National health statistics show 94.8% of adults and 96.1% of children have basic healthcare coverage, with adults averaging 1.9 visits to healthcare providers annually, indicating frequent contact points where topical analgesics are recommended.

Increased Sports & Fitness Participation

Rapid growth in organized fitness, amateur sports, and recreational activity is creating a structurally higher baseline of acute sprains, strains, and delayed onset muscle soreness, directly benefiting anti-inflammatory topical creams. The Physical Activity Statistics 2025 show 59.1% of adults (18+ years) in Saudi Arabia achieve 150 minutes or more of physical activity per week, with participation peaking at 71.2% in the 18–29 age group.GASTAT – Physical Activity Statistics 2025. Among children and adolescents (5–17 years), 19.0% reach at least 60 minutes of daily activity, reflecting ongoing penetration of school sports and youth fitness programs.

Market Challenges

High Competition from Low-Cost Generics

The Saudi medicines market has undergone a deliberate policy shift to favor generics, intensifying price pressure on branded anti-inflammatory topical creams. A 2025 analysis of National Unified Procurement Company (NUPCO) data across eleven therapeutic classes found that generic medicines’ share of total volumes rose from 70% to 76% between late 2022 and mid-2023, while their share of total spending climbed from 38% to 44%.ScienceDirect – Generic Medicines Utilization in Saudi Arabia. Within this mix, local generics accounted for 45% of dispensed volume, imported generics for 30%, and originator brands just 25%, generating realized savings of SAR 334.79 million and potential additional savings of SAR 228.21 million if generic substitution were fully optimized.

Stringent SFDA Guidelines for Steroid Potency Compliance

Topical corticosteroid (TCS)–containing anti-inflammatory and dermatology creams in Saudi Arabia are subject to closely monitored potency and safety standards, raising development and compliance costs. National clinical guidelines for atopic dermatitis classify TCS products into distinct potency categories and emphasize limited-duration use, rotation strategies, and close monitoring of adverse effects, reflecting SFDA’s strict stance on cutaneous steroid exposure and systemic absorption risk.Saudi Ministry of Health – Atopic Dermatitis Guidelines. The Saudi Food and Drug Authority’s Product-Specific Bioequivalence Guidance (2022) also requires robust in-vitro and in-vivo evidence—including reference product–based bioequivalence studies—for many topical formulations, tightening the approval pathway compared with oral generics.

Market Opportunities

Halal-Certified Anti-Inflammatory Topicals

Saudi Arabia’s combination of religious alignment, rising income, and growing ethical-consumption trends makes Halal-certified topical anti-inflammatory creams a compelling long-run opportunity. Pew demographic work indicates that over 97% of Saudi Arabia’s 35+ million residents are Muslim, making Halal compliance a baseline expectation for many consumers in personal care and therapeutics.Pew – Muslim Population by Country. The 2023 Household Income and Expenditure Survey shows median household monthly disposable income at SAR 7,362 overall and SAR 13,655 for Saudi households, with median per-capita income at SAR 2,220, of which 66.1% comes from employment.

Growth in Sports Rehabilitation & Orthopedic Clinics

The same physical activity boom that is elevating soft-tissue injury incidence is also catalyzing specialized sports-medicine and orthopedic services, creating targeted institutional demand for topical anti-inflammatory therapies. Physical activity data reveal that 59.1% of adults engage in at least 150 minutes per week, and 71.2% of people aged 18–29 are regularly active, while 19.0% of children and adolescents meet the daily 60-minute activity guideline. Meanwhile, adults average 1.9 healthcare visits per year, with children averaging 2 visits, and the Ministry of Health’s budget exceeds SAR 86 billion, supporting expansion of orthopedic, rehabilitation, and sports clinics in major cities.

Future Outlook

Over the next several years, the KSA anti-inflammatory topical creams market is expected to expand steadily, in line with the overall topical drugs market CAGR of about 4.75% through the forecast horizon. Growth will be driven by rising lifestyle-related musculoskeletal pain, greater dermatology awareness, and wider insurance and e-health coverage under Vision 2030 healthcare reforms. Technology upgrades in formulations (nanoemulsions, enhanced skin penetration, cooling gels), the rise of sports and fitness culture among younger Saudis, and increased localization of pharmaceutical manufacturing will further support value growth and portfolio premiumization. Players that combine evidence-backed efficacy with patient-friendly textures, Halal compliance, and strong pharmacy education programs are likely to outperform.

Major Players

- Jamjoom Pharma

- SPIMACO ADDWAEIH

- Tabuk Pharmaceuticals

- Bayer Middle East FZE

- Glaxo Saudi Arabia Limited (GSK)

- Johnson & Johnson Medical Saudi Arabia Limited / Kenvue

- Novartis AG

- Hisamitsu Pharmaceutical Co. Inc.

- Glenmark Pharmaceuticals Ltd

- Merck

- Cipla (dermatology & respiratory, with topical presence)

- Riyadh Pharma (The Medical Union Pharmaceuticals)

- AJA Pharma (local manufacturer aligned with Vision 2030)

- Local private-label pharmacy brands (major chains’ in-house topical creams)

- Regional derma-focused brands supplying anti-inflammatory and combination topicals into KSA

Key Target Audience

- Local branded generics and multinational pharmaceutical companies

- Public and private hospital groups and specialty clinics (e.g., Ministry of Health hospital network, Dr. Sulaiman Al Habib Medical Group, Saudi German Health) procuring anti-inflammatory creams for orthopedic, rheumatology, sports medicine and dermatology units.

- National retail pharmacy chains and independent pharmacies (e.g., Nahdi, Al-Dawaa and regional chains) focusing on OTC pain-relief and dermatology categories.

- Sports medicine, physiotherapy centers and rehabilitation clinics requiring topical anti-inflammatory creams for injury management and post-operative recovery.

- Health insurance companies and third-party administrators (TPAs) designing formularies, reimbursement plans and pain-management protocols.

- E-pharmacy, quick-commerce and digital health platforms offering registered anti-inflammatory topical products via online channels.

- Investments and venture capitalist firms (healthcare-focused PE/VC funds and family offices) evaluating local manufacturing, derma-specialty and OTC pain-relief opportunities in KSA.

- Government and regulatory bodies (Saudi Food and Drug Authority – SFDA, Ministry of Health, Vision 2030 health clusters) overseeing drug registration, pricing, localization incentives and OTC/ Rx policy.

Research Methodology

Step 1: Ecosystem Mapping and Variable Identification

We begin by mapping the full ecosystem of the KSA anti-inflammatory topical creams market – covering manufacturers, importers, distributors, hospital and retail pharmacy networks, online pharmacies, regulators (SFDA, MoH), and end users. Desk research leverages syndicated reports on Saudi topical drugs, NSAIDs and pain-management markets, SFDA databases, GASTAT statistics, and hospital-market analyses to identify key variables such as molecule mix, route of administration, end-user segments, distribution split, pricing tiers and local versus imported share.

Step 2: Market Construction and Sizing

Using the Saudi Arabia topical drugs market value of USD ~ billion and its forecast to USD ~ billion, we construct a top-down market model and isolate the anti-inflammatory topical creams segment using therapy-area splits, dermatology and musculoskeletal prescription data, and OTC category structures. This is cross-checked against pain-management and NSAID market values, hospital procurement patterns by region, and major brand revenue insights where available. Semi-solid topical formulations and Northern & Central region dominance are explicitly incorporated into the base model.

Step 3: Hypothesis Testing with Industry Experts

We validate hypotheses on segment shares (drug class, distribution channel, region), brand positioning, and pricing ladders through structured interviews and CATIs with KSA-based product managers, brand managers, hospital pharmacists, orthopedic and dermatology specialists, and large retail pharmacy category heads. These interactions refine assumptions on topical versus systemic usage, Rx-to-OTC switching dynamics, and sports medicine / physiotherapy uptake, feeding back into our quantitative estimates and qualitative trend assessment.

Step 4: Synthesis, Benchmarking and Final Output

Finally, we synthesize secondary data and expert insights into a coherent, validated narrative, benchmarking the KSA anti-inflammatory topical creams market against broader topical drugs, dermatology, and pain-relief markets in KSA and GCC. Scenario analysis (base, optimistic, conservative) and sensitivity checks around localization policies, reimbursement, and OTC regulations are applied to ensure robustness. The output includes market size and CAGR, detailed segmentation, competitive profiling, and actionable recommendations for manufacturers, investors and healthcare providers.

- Executive Summary

- Research Methodology (Market Definitions & Assumptions, Pharmacological Classifications, Therapeutic Pathways Considered, Abbreviations, Data Triangulation, Market Sizing Logic, Epidemiology-Backed Demand Modelling, Primary–Secondary Consolidation, SME–Clinician Interviews, Limitations & Future Assumptions)

- Definition & Therapeutic Scope

- Disease Genesis & Epidemiological Load

- Evolution of Topical Formulations in KSA

- Treatment Flow & Patient Journey

- Supply Chain & Value Chain Assessment (API Imports, Local Manufacturing, Retail Distribution, Hospital Outbound Pharmacy Flow)

- Growth Drivers

Rising Musculoskeletal Disorders & Occupational Stress Load

Increased Sports & Fitness Participation

Growing Incidence of Arthritis & Chronic Inflammation

Strong Preference for Localized, Non-Systemic Pain Relief

Expansion of Physiotherapy & Orthopedic Care Infrastructure - Market Challenges

High Competition from Low-Cost Generics

Stringent SFDA Guidelines for Steroid Potency Compliance

Variability in Herbal/Traditional Product Quality

Incomplete Patient Awareness of Correct Usage

Supply Chain Disruptions & API Import Dependence - Opportunities

Halal-Certified Anti-Inflammatory Topicals

Growth in Sports Rehabilitation & Orthopedic Clinics

Innovation in Ayurvedic/Herbal Anti-Inflammatory Products

Advanced Dermatology-Integrated Anti-Inflammatory Solutions

Local Manufacturing Expansion with API Backward Integration - Trends

Shift Toward Gel-Based & Fast-Absorption Topicals

Introduction of Sensor-Integrated Roll-Ons

Preference for Non-Steroidal Anti-Inflammatory Products

Expansion of Dermatology-Sports Medicine Overlap Products - Government Regulation

SFDA Approval Pathways for Topical NSAIDs

Labeling, Steroid Potency & Contraindication Guidelines

Import & Tender Policies for Hospital Purchases - SWOT Analysis

- Stakeholder Ecosystem

- Porter’s Five Forces

- Competitive Landscape Ecosystem

- By Value, 2019-2024

- By Volume, 2019-2024

- By Average Price Analysis Across Formulations, 2019-2024

- By Drug Class (In Value %)

Topical NSAIDs (Diclofenac, Ibuprofen, Ketoprofen)

Topical Corticosteroids (Low, Mid, High Potency)

Counter-Irritants (Menthol, Camphor, Methyl Salicylate)

Herbal/AYUSH-Equivalent Anti-Inflammatory Creams

Combination Therapy Formulations (Steroid + Antibiotic, NSAID + Muscle Relaxant) - By Indication (In Value %)

Musculoskeletal Pain (Sports Injuries, Sprains, Strains)

Arthritis & Joint Degeneration

Dermatological Inflammation (Eczema, Dermatitis)

Post-Operative/Orthopedic Rehabilitation

Chronic Pain Management - By Formulation Type (In Value %)

Creams

Gels

Ointments

Sprays

Roll-Ons - By Distribution Channel (In Value %)

Hospital Pharmacies

Retail/Community Pharmacies

Online Pharmacies & E-Commerce

Clinics & Sports Rehabilitation Centers

General Stores - By Region (In Value %)

Central Region

Western Region

Eastern Region

Southern Region

Northern Region

- Market Share by Drug Class

Market Share by Formulation Type - Cross-Comparison Parameters (Product Portfolio Breadth (NSAID/Steroid/Herbal/Combination), Number of SFDA-Approved SKUs, Retail Pharmacy Penetration Score, Hospital Tender Participation Index, Import Dependence Level, R&D/Innovation Intensity, Distribution Network Density, Brand Recall Strength in OTC Segment)

- SWOT Analysis of Key Players

- Pricing Analysis (By SKU, By Formulation, By Drug Class)

- Detailed Company Profiles

Jamjoom Pharmaceuticals

Tabuk Pharmaceuticals

SPIMACO

Saudi Pharmaceutical Industries (SIPHCO)

Glenmark Pharmaceuticals

Novartis Consumer Health

GSK Consumer Healthcare

Sanofi

Bayer Consumer Health

Reckitt Benckiser

Himani

Himalaya Wellness

Mentholatum

Emami Limited

Al-Esra Medical

- End-User Consumption Behaviour

- Treatment Compliance Drivers

- Pain Points & Unmet Medical Needs

- Purchasing Power Mapping (Urban, Semi-Urban, Labor Market)

- Decision-Making Journey (Doctor Prescription vs Self-Selection)

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average Price Analysis Across Formulations, 2025-2030