Market Overview

The KSA APAC ballistic missile market is valued at approximately USD ~billion based on a recent historical assessment, driven by increasing defense budgets, ongoing technological advancements in missile defense systems, and a surge in regional security concerns. Rising investments in defense by regional governments and collaborations in missile technology are critical factors pushing market growth. Further, advancements in hypersonic missile development and missile interception technologies continue to fuel the demand for new systems and upgrades in existing platforms.

The market is dominated by countries in the Middle East and Asia Pacific, with the Kingdom of Saudi Arabia at the forefront due to its substantial defense budget and strategic geopolitical positioning. Other key players include nations such as the United Arab Emirates and India, which have also significantly ramped up defense spending, particularly in the missile defense and ballistic systems sectors. These countries benefit from both national initiatives and international collaborations that drive technological innovation and infrastructure growth.

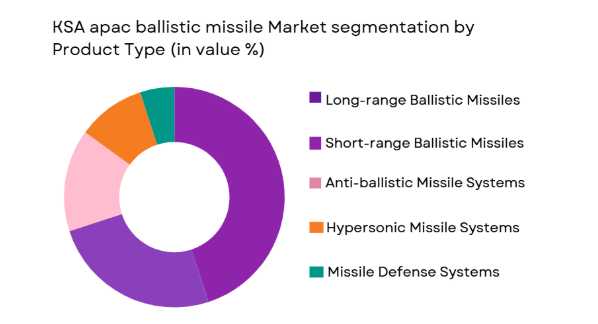

Market Segmentation

By Product Type

The KSA APAC ballistic missile market is segmented by product type into long-range ballistic missiles, short-range ballistic missiles, anti-ballistic missile systems, hypersonic missile systems, and missile defense systems. The long-range ballistic missile segment has dominated the market share due to growing regional defense needs and the expanding range of military strategies aimed at deterring potential threats. The development of increasingly sophisticated systems for long-range strikes and the military’s focus on strategic defense capabilities have made this sub-segment a key focus for both governmental and defense contractors. The demand for these systems has been driven by the need for powerful deterrence measures and strategic force projection.

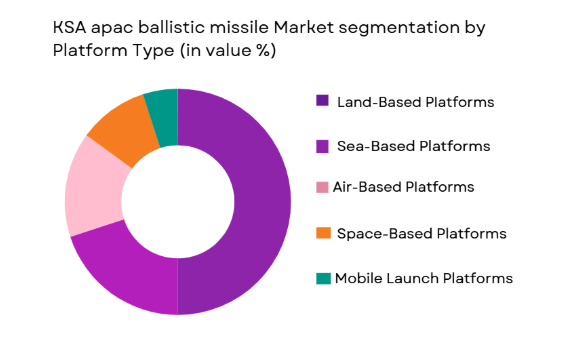

By Platform Type

The platform types in the KSA APAC ballistic missile market include land-based platforms, sea-based platforms, air-based platforms, space-based platforms, and mobile launch platforms. The land-based platforms dominate the market due to their strategic relevance in regional defense frameworks, particularly in KSA. These platforms are deployed in both static defense systems and mobile launch configurations, offering rapid reaction capabilities for both offensive and defensive operations. Furthermore, land-based platforms are integral to the defense architecture of the Kingdom of Saudi Arabia, which continues to prioritize missile defense infrastructure along its borders.

Competitive Landscape

The competitive landscape of the KSA APAC ballistic missile market is marked by consolidation among several key players. Major defense contractors, such as Lockheed Martin, Northrop Grumman, and Raytheon Technologies, dominate the market, often in collaboration with regional governments and military contractors. These players influence the market through strategic partnerships, technology sharing, and government contracts, fostering long-term relationships that are vital to maintaining a competitive edge in the missile defense space.

| Company Name | Establishment Year | Headquart-ers | Technology Focus | Market Reach | Key Products | Revenue | Market

Specific Parameter |

| Lockheed Martin | 1912 | USA | ~ | ~ | ~ | ~ | ~ |

| Northrop Grumma | 1939 | USA | ~ | ~ | ~ | ~ | ~ |

| Raytheon Technolo | 1922 | USA | ~ | ~ | ~ | ~ | ~ |

| BAE Systems | 1999 | UK | ~ | ~ | ~ | ~ | ~ |

| MBDA | 2001 | France/UK | ~ | ~ | ~ | ~ | ~ |

KSA apac Ballistic Missile Market Analysis

Growth Drivers

Defense spending growth

As regional security concerns intensify, defense spending, particularly in KSA and other Gulf nations, is projected to rise significantly. A focus on technological advancements, including hypersonic missiles and missile defense systems, is pivotal in driving market growth. This surge in funding has created a competitive environment, prompting significant investments in research and development, technological upgrades, and procurement of state-of-the-art defense systems. Additionally, as missile defense becomes a priority to safeguard borders and national interests, defense budgets are being allocated more efficiently to enhance defense capabilities. Strategic partnerships between regional governments and global missile manufacturers further bolster growth, providing access to the latest technologies and reinforcing military readiness.

Technological advancements in missile defense

The continuous improvement in missile interception technologies has a considerable impact on the ballistic missile market. With nations like KSA and India emphasizing the development of integrated missile defense systems, the demand for advanced interceptors and defense systems has surged. Innovations such as laser systems, AI-guided missile defense systems, and hypersonic technology are reshaping the competitive landscape. Furthermore, the advancement in satellite technology and data analytics plays a key role in improving the precision and effectiveness of defense systems. As these technological strides continue, the market is expected to see enhanced systems with better accuracy, faster response times, and expanded range, ultimately driving growth.

Market Challenges

High cost of missile defense systems

The major challenge faced by countries in the KSA APAC ballistic missile market is the high cost associated with acquiring and maintaining advanced missile defense systems. The cost of research, development, and deployment of these systems can be prohibitively expensive, particularly for smaller economies within the region. In addition to the financial burden, countries must also invest heavily in personnel training, logistical support, and infrastructure development, all of which add to the overall cost. These challenges are further compounded by the need for regular upgrades and maintenance to keep systems at peak performance levels, which also require significant financial outlay.

Geopolitical tensions and instability

The political climate in the Middle East and APAC regions is another factor that limits the growth of the missile defense market. Ongoing geopolitical tensions, particularly in areas like the Gulf and South Asia, influence government priorities and affect military procurement decisions. Countries may face diplomatic challenges in procuring advanced missile systems due to arms control regulations or trade restrictions imposed by global powers. This can disrupt the timely acquisition of necessary defense technologies, delay the deployment of advanced systems, and hamper the effectiveness of defense strategies.

Opportunities

Integration of AI in missile defense systems

One of the most significant opportunities for growth in the KSA APAC ballistic missile market lies in the integration of artificial intelligence (AI) into missile defense systems. AI enables the rapid processing of vast amounts of data, improving missile tracking, targeting, and interception capabilities. The ability to detect and neutralize threats in real-time is transforming the defense industry, particularly with the advent of hypersonic missile technology. As AI continues to evolve, it will further enhance the efficiency and effectiveness of missile defense systems, making it a critical opportunity for market growth. Governments and defense contractors are increasingly focusing on incorporating AI to reduce human error, improve decision-making processes, and optimize defense systems’ operational performance.

Expansion of regional defense collaborations

Another opportunity in the KSA APAC ballistic missile market is the expanding network of regional defense collaborations and joint military exercises. With growing security concerns, particularly regarding missile threats from adversarial states, countries in the region are strengthening their defense alliances. Joint missile defense programs, such as those seen with KSA and its allies, are enhancing interoperability between nations and streamlining defense capabilities. These collaborations foster the sharing of technology, reduce costs through bulk procurement, and improve collective security strategies. As alliances between countries grow stronger, the market for integrated missile defense systems and related technologies will continue to expand.

Future Outlook

The KSA APAC ballistic missile market is expected to continue its growth trajectory over the next five years. Advancements in missile defense technologies, such as hypersonic interception systems and AI-driven capabilities, are set to play a crucial role in the market’s future. The expansion of defense budgets in key countries, coupled with growing geopolitical instability, will drive demand for advanced missile systems. Additionally, collaborative efforts between nations will provide new opportunities for technological innovation and cost-sharing, further enhancing the market’s growth prospects.

Major Players

- Lockheed Martin

- Northrop Grumman

- Raytheon Technologies

- BAE Systems

- MBDA

- Saab Group

- Leonardo S.p.A.

- Elbit Systems

- Thales Group

- General Dynamics

- Hanwha Aerospace

- Kongsberg Defence & Aerospace

- L3Harris Technologies

- Rafael Advanced Defense Systems

- Boeing

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Military contractors

- Defense technology developers

- Aerospace and defense manufacturers

- International defense agencies

- Regional military forces

- Defense policy influencers

Research Methodology

Step 1: Identification of Key Variables

The first step in the research methodology involves identifying the key variables that influence the KSA APAC ballistic missile market. These include geopolitical factors, technological advancements, and military procurement patterns.

Step 2: Market Analysis and Construction

Market trends are analyzed, and historical data is collected to construct the market model, which includes segmentation, market size, and growth forecasts. Key drivers, challenges, and opportunities are identified during this stage.

Step 3: Hypothesis Validation and Expert Consultation

The market model is then validated through consultations with industry experts, government representatives, and defense contractors to ensure accuracy and relevance.

Step 4: Research Synthesis and Final Output

Finally, the findings from all stages are synthesized into a comprehensive report that includes actionable insights, market projections, and strategic recommendations for stakeholders in the KSA APAC ballistic missile market.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Government defense spending

Technological advancements in missile defense

Strategic partnerships in the region

Increasing regional security concerns

Advancements in hypersonic missile technologies - Market Challenges

High capital expenditure for defense systems

Political instability in neighboring regions

Technological obsolescence and constant upgrades

Geopolitical tensions and arms control regulations

Export control restrictions - Market Opportunities

Growth in defense collaborations across APAC

Technological advancements driving system cost reduction

Emerging defense partnerships with global powers - Trends

Increased adoption of AI in missile guidance systems

Shift toward integrated defense systems

Rise in demand for autonomous missile defense platforms

Integration of hypersonic weapons in national defense

Increased focus on mobile missile systems - Government Regulations & Defense Policy

National defense policies shaping missile procurement

Regulation of ballistic missile technology transfers

International arms control treaties affecting missile development - SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Ballistic Missile Defense Systems

Anti-Ballistic Missile Systems

Long-Range Ballistic Missiles

Short-Range Ballistic Missiles

Hypersonic Missiles - By Platform Type (In Value%)

Land-Based Platforms

Sea-Based Platforms

Air-Based Platforms

Space-Based Platforms

Mobile Launch Platforms - By Fitment Type (In Value%)

Retrofit Systems

New Systems

Dual-Use Systems

Stand-Alone Systems

Integrated Systems - By EndUser Segment (In Value%)

Government & Defense

Military Contractors

International Organizations

Private Contractors

Research & Development Institutions - By Procurement Channel (In Value%)

Direct Sales

Government Procurement Programs

Private Procurement

International Collaboration Agreements

Defense Alliances - By Material / Technology (in Value%)

Advanced Propulsion Systems

Composite Materials

Electronic Warfare Systems

AI-Integrated Guidance Systems

Stealth Technology

- Market structure and competitive positioning

Market share snapshot of major players - Cross Comparison Parameters (Technology Innovation, Production Capacity, Geopolitical Reach, Market Penetration, R&D Investment)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

Lockheed Martin

Northrop Grumman

Raytheon Technologies

Boeing

Thales Group

MBDA

Saab Group

BAE Systems

L3Harris Technologies

Rafael Advanced Defense Systems

General Dynamics

Kongsberg Defence & Aerospace

Elbit Systems

Leonardo S.p.A.

Hanwha Aerospace

- Government defense agencies and their missile procurement strategies

- Impact of military alliances on procurement decisions

- Role of private contractors in missile defense technology development

- Research institutions driving technological advancements in missile systems

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035