Market Overview

The KSA AR and VR in defense market is expected to grow significantly, with the total market size projected to reach USD ~ billion. This growth is driven by increasing government investment in advanced defense technologies, particularly augmented and virtual reality solutions, to enhance military training, simulations, and operational efficiency. The market is propelled by rising demand for high-tech systems in defense and security, with the government prioritizing modernizing military capabilities, leveraging AR and VR to improve combat readiness and situational awareness.

The Kingdom of Saudi Arabia remains a dominant player in the AR and VR defense sector in the Middle East. The government’s vision to diversify its economy through Vision 2030 has prioritized military advancements, creating a conducive environment for AR and VR technologies. This is evident from the growing adoption of AR and VR for defense training, which is rapidly expanding in key defense hubs like Riyadh and Dhahran. The country’s strategic location, alongside substantial investments in defense infrastructure, bolsters its dominance in the market, making it a hub for defense technology development in the region.

Market Segmentation

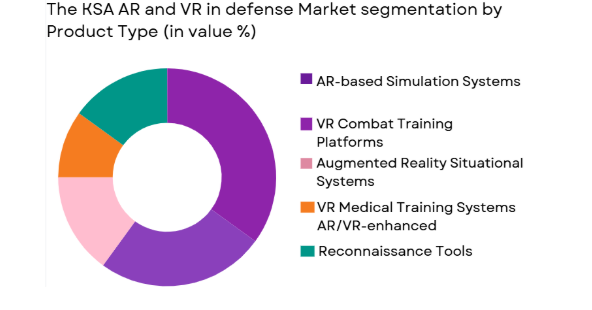

By Product Type

The KSA AR and VR in defense market is segmented by product type into several categories, including AR-based simulation systems, VR combat training platforms, augmented reality situational awareness systems, VR medical training systems, and AR/VR-enhanced reconnaissance tools. Recently, AR-based simulation systems have dominated the market share. This is largely due to their versatility in creating realistic, immersive training environments for military personnel without the need for costly physical infrastructure. With growing demand for cost-effective, scalable training solutions, AR simulation systems offer a highly effective tool for enhancing combat training and operational planning, especially in real-time military scenarios.

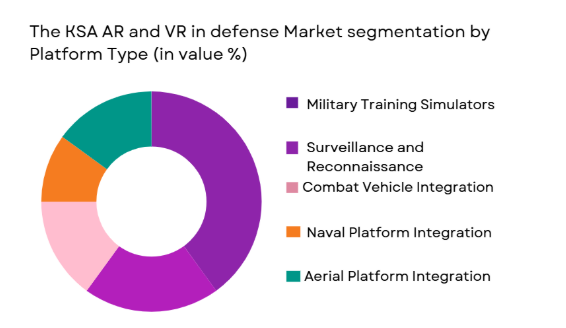

By Platform Type

The market is further segmented by platform type into military training simulators, surveillance and reconnaissance platforms, combat vehicle integration, naval platform integration, and aerial platform integration. Military training simulators have the largest market share due to their pivotal role in providing realistic training environments for soldiers. The increased demand for simulation-based training, which reduces risk and costs, has made military training simulators the most adopted platform in the defense sector. Their ability to integrate with AR and VR technologies to create immersive, battle-ready simulations drives their widespread use.

Competitive Landscape

The KSA AR and VR in defense market is marked by a high degree of competition, with both established defense contractors and new technology firms vying for dominance. Major players are focusing on mergers, partnerships, and technological innovations to strengthen their market positions. The influence of large defense contractors, who have a strong foothold in military technology, is considerable, and they are increasingly integrating AR and VR technologies into their portfolios to enhance their offerings in training and simulation.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue (USD) | Additional Parameter |

| BAE Systems | 1999 | London, UK | ~ | ~ | ~ | ~ | ~ |

| Lockheed Martin | 1912 | Bethesda, USA | ~ | ~ | ~ | ~ | ~ |

| Thales Group | 2000 | Paris, France | ~ | ~ | ~ | ~ | ~ |

| Raytheon Technologies | 1997 | Waltham, USA | ~ | ~ | ~ | ~ | ~ |

| Northrop Grumman | 1939 | Falls Church, USA | ~ | ~ | ~ | ~ | ~ |

The KSA AR and VR Market Analysis

Growth Drivers

Government Investment in Defense Modernization

The significant increase in government funding for defense modernization, as part of Saudi Arabia’s Vision 2030, has fueled the adoption of AR and VR technologies. As part of its goal to build a diversified economy, the government is prioritizing military innovations, including advanced simulation and training solutions, as key tools for enhancing defense capabilities. This investment in high-tech defense systems has created a rapidly expanding market for AR and VR technologies, facilitating their integration into military training systems, which are critical for enhancing operational effectiveness. Moreover, such investments have driven local companies to collaborate with international defense technology firms to enhance the country’s military capabilities, further propelling demand for AR and VR solutions. This driver is crucial in ensuring the rapid growth of the AR and VR market, fostering both local and international partnerships to deliver cutting-edge solutions. Furthermore, the continuous modernization of military operations, combined with the need for cost-effective training methods, positions AR and VR technologies as integral components in the defense sector. The surge in defense budget allocations to advanced technology sectors strengthens the prospects for sustained growth in the AR and VR defense market, making this a critical growth driver for the industry.

Advancement in Simulation Technology

The development of more sophisticated AR and VR systems has been a major catalyst for growth in the defense sector. Innovations in hardware, such as the development of lighter, more durable headsets and the improvement of graphics processing, have made AR and VR solutions more viable for defense applications. These advancements allow for the creation of highly immersive environments, enabling military personnel to experience realistic combat scenarios without the need for physical training grounds. In addition, the integration of AI and machine learning into AR and VR platforms has made it possible to develop adaptive training environments that can replicate a wide range of military situations, enhancing the readiness of defense forces. The technological progress in AR and VR systems has also led to a reduction in costs, making these technologies more accessible to defense agencies across the globe. This trend is further supported by the increasing demand for virtual exercises that allow military personnel to train without the logistical and financial constraints of traditional training methods. The continuing evolution of AR and VR technologies is expected to foster significant growth in the market, as both defense contractors and military organizations prioritize innovative solutions to enhance training, readiness, and operational capabilities.

Market Challenges

High Initial Cost of Deployment

One of the major challenges facing the KSA AR and VR in defense market is the high initial investment required to deploy these systems. While the long-term benefits of AR and VR technologies, such as reduced training costs and improved efficiency, are clear, the upfront costs associated with purchasing hardware, developing software, and integrating these systems into existing defense infrastructures are significant. This is particularly challenging for smaller military organizations or those with limited budgets, as it may delay or prevent the widespread adoption of AR and VR solutions. Additionally, the cost of maintaining and updating these systems can be prohibitive, requiring continuous investment to keep the technology current with evolving defense needs. Despite the potential for cost savings over time, the high upfront costs remain a significant barrier to market growth, limiting the adoption of AR and VR technologies, particularly in countries or regions with constrained defense budgets. The challenge of balancing initial capital expenditures with long-term financial sustainability continues to present a hurdle for many defense agencies looking to invest in these technologies.

Integration with Legacy Systems

Another significant challenge for the AR and VR in defense market is the complexity of integrating these advanced technologies with existing defense systems. Many military organizations still rely on older, legacy systems for training and operational purposes. Incorporating AR and VR technologies into these existing systems can be complex and costly, requiring substantial modifications to both hardware and software to ensure compatibility. The lack of standardized platforms for AR and VR solutions further complicates this issue, as defense organizations may need to develop bespoke solutions to integrate these new technologies with their existing infrastructure. This challenge is particularly acute in countries where defense budgets are stretched, as it may divert resources from other critical areas, such as personnel training or equipment maintenance. Despite the clear advantages of AR and VR, the challenge of effectively integrating these technologies into a broader defense ecosystem remains a major hurdle to widespread adoption, slowing the growth of the market in certain regions.

Opportunities

Military Training System Upgrades

As part of their modernization efforts, many defense agencies are focusing on upgrading their military training systems to incorporate cutting-edge AR and VR technologies. This presents a significant opportunity for market players to capitalize on the increasing demand for immersive training solutions that provide realistic, real-world scenarios. The need to enhance combat readiness and operational efficiency has made AR and VR technologies a key priority for military organizations worldwide. With a growing emphasis on training that simulates complex environments and diverse battle conditions, AR and VR are uniquely positioned to provide valuable solutions that improve the quality and accessibility of training for defense personnel. This opportunity is especially pronounced in the KSA, where the government is heavily investing in modernizing its defense forces under Vision 2030. As the demand for advanced military training solutions rises, AR and VR technology developers have an excellent opportunity to expand their offerings and capture a significant share of the defense training market. Furthermore, the ability of AR and VR systems to simulate high-risk scenarios without putting personnel in danger further solidifies their value proposition, making this a highly lucrative opportunity for businesses in the AR and VR defense sector.

Expansion into Unmanned Systems

Another opportunity lies in the growing application of AR and VR technologies in unmanned systems, such as drones and autonomous vehicles. These systems require advanced training environments for operators, and AR and VR solutions provide the ideal platform for simulating various scenarios, including navigation in hostile or GPS-denied environments. As the military sector increasingly adopts unmanned systems for surveillance, reconnaissance, and combat, the need for AR and VR technologies to train operators and enhance system control will grow. The ability to create realistic virtual environments for drone operation training, for example, offers a significant advantage in ensuring that operators are fully prepared for real-world missions. This trend is already gaining momentum, as unmanned systems become more integrated into military operations globally. The KSA, with its ongoing investments in unmanned technologies, presents a prime market for the expansion of AR and VR solutions in this space. With demand expected to rise for training solutions that cater to the needs of unmanned system operators, this represents a key opportunity for AR and VR companies to enhance their market presence and capitalize on the increasing importance of unmanned technology in modern warfare.

Future Outlook

The future outlook for the KSA AR and VR in defense market is promising, with steady growth expected over the next several years. Technological advancements, such as the development of more immersive AR and VR systems, will continue to drive demand for these solutions in the military sector. Additionally, increasing government investments in defense modernization, coupled with the growing adoption of unmanned systems and advanced military training tools, will further fuel market expansion. As the demand for cost-effective, scalable training solutions grows, AR and VR technologies are poised to play a central role in shaping the future of military operations in Saudi Arabia and beyond.

Major Players

- BAE Systems

- Lockheed Martin

- Thales Group

- Raytheon Technologies

- Northrop Grumman

- L3 Technologies

- Elbit Systems

- Leonardo S.p.A

- General Dynamics

- Rockwell Collins

- Harris Corporation

- Saab Group

- Veeva Systems

- Xilinx

- Cisco Systems

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Military organizations

- Defense contractors

- Aerospace companies

- Simulation and training companies

- Unmanned system developers

- Virtual and augmented reality technology firms

Research Methodology

Step 1: Identification of Key Variables

We identify key variables such as market size, technology trends, growth drivers, and challenges through extensive data collection and expert consultations.

Step 2: Market Analysis and Construction

We use market data and analysis models to segment the market and understand its dynamics, considering factors like government investments and technological advancements.

Step 3: Hypothesis Validation and Expert Consultation

We validate hypotheses through discussions with industry experts, manufacturers, and government bodies, ensuring that the findings are realistic and credible.

Step 4: Research Synthesis and Final Output

The final research output is synthesized from gathered data, offering a comprehensive analysis of the KSA AR and VR defense market, focusing on current trends, opportunities, and forecasts.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Advancement in AR/VR technologies for defense applications

Increased government defense spending

Enhanced demand for realistic military training solutions

Integration of AI and machine learning in AR/VR systems

Demand for immersive simulation-based training tools - Market Challenges

High initial investment costs

Complexity in system integration with existing defense platforms

Limited availability of skilled personnel for AR/VR system management

Security concerns related to virtual environments

High dependency on technological infrastructure and updates - Market Opportunities

Expansion of AR/VR use in unmanned vehicle systems

Collaboration between defense contractors and tech firms

Growth in demand for virtual military exercises - Trends

Increased adoption of AR for reconnaissance and situational awareness

Advancement of VR technologies for combat training

Integration of AR/VR in military medical applications

Usage of AR in enhanced navigation systems

Adoption of multi-sensory AR/VR experiences in tactical training - Government Regulations & Defense Policy

Government incentives for AR/VR defense technology integration

Policy focus on improving military readiness through advanced simulations

Regulatory frameworks for secure defense technology deployment - SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Head-mounted displays

AR-enabled simulation systems

VR combat training platforms

Augmented reality-based reconnaissance tools

AR/VR-based battlefield visualization systems - By Platform Type (In Value%)

Military training simulators

Surveillance and reconnaissance platforms

Combat vehicle integration

Naval platform integration

Aerial platform integration - By Fitment Type (In Value%)

Portable systems

Integrated systems

Mounted systems

Wearable systems

Mobile AR/VR applications - By EndUser Segment (In Value%)

Military forces

Defense contractors

Government agencies

Private defense technology developers

Research and academic institutions - By Procurement Channel (In Value%)

Direct sales from manufacturers

Government procurement

Online platforms

Distributors and resellers

Specialized defense sector channels - By Material / Technology (In Value%)

Optical and photonic materials

AI-powered AR/VR systems

Tactile feedback technologies

Real-time motion tracking technologies

Immersive 3D modeling software

- Market structure and competitive positioning

Market share snapshot of major players - Cross Comparison Parameters (Technology Leadership, Market Penetration, Pricing Strategy, R&D Investment, Regulatory Compliance)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

BAE Systems

Lockheed Martin

Thales Group

Raytheon Technologies

Northrop Grumman

Elbit Systems

Leonardo S.p.A

General Dynamics

Rockwell Collins

L3 Technologies

Saab Group

Harris Corporation

Veeva Systems

Xilinx

Cisco Systems

- Military training simulation requirements

- Increased interest from defense contractors for AR/VR tech integration

- Government agencies investing in augmented and virtual defense solutions

- Growth of research institutions and universities in AR/VR defense technologies

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035