Market Overview

The market for armored fighting vehicles is valued at approximately USD~ billion, with significant demand driven by the military and defense sector. This market is primarily driven by increasing defense budgets in various countries and the growing need for advanced military equipment to counter evolving threats. In addition to the modernized defense forces, procurement activities from governments and military contractors further fuel the market growth. The market sees significant investments in research and development of new technologies, such as armored protection, mobility enhancements, and weapon systems integration, all contributing to market expansion.

Countries like the United States, Russia, China, and India are significant players in the armored fighting vehicles market, with robust defense spending and ongoing modernization programs. These regions dominate the market due to their advanced military infrastructure, substantial defense budgets, and continuous upgrades of armored vehicle fleets to meet emerging battlefield needs. Additionally, regional conflicts and geopolitical tensions continue to boost the demand for cutting-edge armored fighting vehicles, as governments seek to enhance military capabilities for national security and global influence.

Market Segmentation

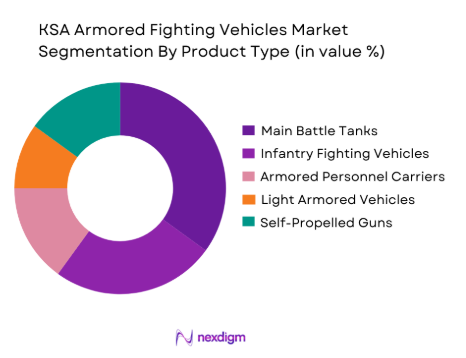

By Product Type

The armored fighting vehicles market is segmented by product type into main battle tanks, infantry fighting vehicles, armored personnel carriers, light armored vehicles, and self-propelled guns. Recently, main battle tanks have dominated the market share due to factors such as their versatility on the battlefield, widespread adoption by military forces, and continued technological advancements in armor and weaponry. As a result, many defense budgets are allocated to upgrading and maintaining existing fleets of these vehicles, ensuring they remain relevant in modern combat scenarios.

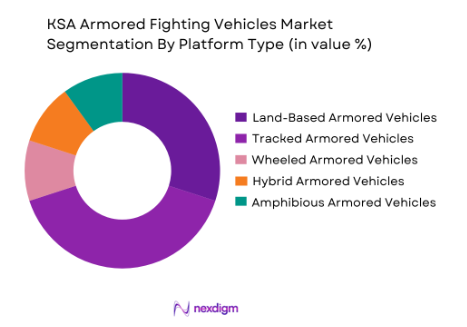

By Platform Type

The market is segmented by platform type into land-based armored vehicles, tracked armored vehicles, wheeled armored vehicles, hybrid armored vehicles, and amphibious armored vehicles. Recently, tracked armored vehicles have garnered the largest market share due to their superior off-road mobility, which is crucial for combat scenarios in difficult terrains. Their ability to operate in various environmental conditions, coupled with continued advancements in engine power and suspension systems, solidifies their dominance in the market, particularly in regions with rough terrain and challenging operational environments.

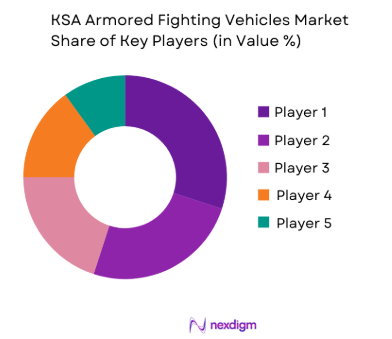

Competitive Landscape

The armored fighting vehicles market is characterized by consolidation, with major global defense companies leading the market share. The competition in this market is primarily driven by technological innovations, pricing, and contracts with governments. Companies are focusing on enhancing vehicle survivability, mobility, and weapon systems, while also exploring hybrid propulsion systems and advanced armor materials. Key players in the market are leveraging strategic partnerships, joint ventures, and collaborations to expand their market presence and product portfolios.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue | Military Contracts |

| Lockheed Martin | 1912 | Bethesda, MD | Advanced Armor Systems | ~ | ~ | ~ | ~ |

| General Dynamics | 1952 | Falls Church, VA | Armored Mobility | ~ | ~ | ~ | ~ |

| BAE Systems | 1999 | London, UK | Amphibious and Tracked Vehicles | ~ | ~ | ~ | ~ |

| Rheinmetall | 1889 | Düsseldorf, Germany | Advanced Armored Protection | ~ | ~ | ~ | ~ |

| Oshkosh Defense | 1917 | Oshkosh, WI | Tactical Vehicles | ~ | ~ | ~ | ~ |

KSA Armored Fighting Vehicles Market Analysis

Growth Drivers

Increased Military Spending

Global military spending has been increasing steadily, with many countries committing to upgrading and expanding their armored fighting vehicle fleets. The rise in defense budgets across various regions has directly fueled the demand for advanced armored vehicles, as countries invest heavily in enhancing their military capabilities. The need for military readiness, particularly in regions with geopolitical instability, has led to significant investments in modern armored fighting vehicles. These vehicles are viewed as vital assets for national defense and security, supporting the growing demand for the market. As more nations allocate funds to military modernization, particularly with the expansion of military fleets, the armored fighting vehicles market is set to benefit from sustained growth.

Technological Advancements

The armored fighting vehicle market has witnessed continuous technological innovations, particularly in the areas of vehicle mobility, armor protection, and weapon systems integration. Advancements in artificial intelligence (AI) and automation are expected to enhance vehicle capabilities, making them more efficient, reliable, and cost-effective. The growing demand for vehicles with improved mobility and survivability on the battlefield has led to the development of lighter, more flexible, and advanced armored vehicles, boosting their adoption. These technological developments not only improve vehicle performance but also enable manufacturers to cater to the changing needs of modern military forces, ensuring the continued growth of the market.

Market Challenges

High Production Costs

One of the primary challenges faced by manufacturers in the armored fighting vehicles market is the high production cost of advanced systems. The integration of cutting-edge technologies such as hybrid propulsion, advanced armor, and autonomous systems significantly increases manufacturing costs. In many cases, the costs of research, development, and testing required for the production of advanced vehicles are also substantial. These high costs may deter some countries, particularly those with limited defense budgets, from acquiring the latest armored vehicle systems, slowing down market growth. As manufacturers are forced to maintain high production standards, these cost barriers will remain a significant challenge in the coming years.

Supply Chain Disruptions

The global supply chain for raw materials used in armored vehicle production, such as specialized steel, composites, and electronics, has been disrupted in recent years due to global trade tensions and logistical challenges. These disruptions have led to delays in production schedules, increased material costs, and challenges in meeting demand. Additionally, geopolitical tensions and regional conflicts have further strained supply chains, affecting the timely delivery of key components. This challenge could hinder the expansion of the armored fighting vehicles market, as manufacturers must navigate the complexities of the global supply chain to meet customer demands.

Opportunities

Growing Demand for Modernization of Defense Forces

Many countries are focusing on modernizing their defense forces to counter evolving security threats. This modernization process includes the replacement of outdated armored vehicles with more advanced and capable systems. The increasing focus on technological enhancements such as AI, hybrid propulsion, and enhanced armor opens up opportunities for manufacturers to innovate and provide next-generation armored fighting vehicles. As governments and military contractors continue to invest in advanced systems, the demand for modernized armored vehicles is expected to rise, creating new growth avenues for market players.

Emerging Markets and Regional Alliances

Several emerging economies and regional alliances are focusing on strengthening their military capabilities, particularly in Asia, Africa, and the Middle East. The expansion of these defense budgets, often coupled with increasing security concerns, presents opportunities for armored vehicle manufacturers to penetrate these growing markets. Countries involved in regional defense collaborations are also looking to enhance their collective security, which will further drive demand for armored fighting vehicles. Additionally, the rise of private defense contractors in these regions further fuels the market demand, presenting substantial growth opportunities for manufacturers targeting these expanding markets.

Future Outlook

Over the next five years, the armored fighting vehicles market is expected to experience steady growth, driven by advancements in military technology and a rising focus on defense modernization. New technologies, such as artificial intelligence, hybrid propulsion systems, and advanced armor, will become more prominent in vehicles, providing higher performance and operational efficiency. Governments will continue to prioritize defense spending, particularly in regions facing security threats. Additionally, strategic defense alliances and regional procurement initiatives will further support market expansion.

Major Players

- Lockheed Martin

- General Dynamics

- BAE Systems

- Rheinmetall

- Oshkosh Defense

- Thales Group

- Elbit Systems

- Northrop Grumman

- L3 Technologies

- KMW

- CNH Industrial

- SAMI (Saudi Arabian Military Industries)

- UAE International Defense

- Iveco Defense Vehicles

- Rosoboronexport

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Military contractors and defense suppliers

- Defense consultants

- Armored vehicle manufacturers

- Research and development firms

- Military forces

- Aerospace and defense investment firms

Research Methodology

Step 1: Identification of Key Variables

The first step involves identifying the key variables that drive the armored fighting vehicle market, such as market size, growth drivers, challenges, and key technologies.

Step 2: Market Analysis and Construction

Market analysis is conducted using primary and secondary data sources to assess market size, segmentation, and trends.

Step 3: Hypothesis Validation and Expert Consultation

Expert consultation is undertaken to validate market hypotheses, ensuring the accuracy and relevance of findings.

Step 4: Research Synthesis and Final Output

The final output synthesizes research findings, presenting a comprehensive market analysis and future outlook based on data and expert insights.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Inf

- Growth Drivers

Increased military expenditure in the region

Rising defense modernization initiatives

Escalating demand for advanced security solutions - Market Challenges

High cost of advanced technology integration

Supply chain disruptions for key components

Regulatory challenges in armored vehicle production - Market Opportunities

Growth in joint defense ventures

Emerging demand for specialized armored vehicles

Technological innovations in armor materials - Trends

Increased automation in armored vehicle operations

Shift towards hybrid propulsion systems

Focus on developing lightweight yet durable armor

- By Market Value 2020-2025

- By Installed Units 2020-2025

- By Average System Price 2020-2025

- By System Complexity Tier 2020-2025

- By System Type (In Value%)

Main Battle Tanks

Infantry Fighting Vehicles

Armored Personnel Carriers

Light Armored Vehicles

Self-Propelled Guns - By Platform Type (In Value%)

Land-Based Armored Vehicles

Tracked Armored Vehicles

Wheeled Armored Vehicles

Hybrid Armored Vehicles

Amphibious Armored Vehicles - By Fitment Type (In Value%)

OEM Fitment

Retrofit Fitment

Aftermarket Fitment

Custom Fitment

Upgraded Systems - By End User Segment (In Value%)

Military

Government and Law Enforcement Agencies

Private Security Firms

Defense Contractors

Research and Development Institutes - By Procurement Channel (In Value%)

Direct Procurement

Government Tenders

Private Sector Procurement

Military Alliances

International Procurement

- Market Share Analysis

- Cross Comparison Parameters (Technology integration, system reliability, cost-effectiveness, defense contracts, market adoption)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Porter’s Five Forces

- Key Players

Lockheed Martin

General Dynamics

BAE Systems

Rheinmetall

Oshkosh Defense

Thales Group

Elbit Systems

Northrop Grumman

L3 Technologies

KMW

CNH Industrial

SAMI (Saudi Arabian Military Industries)

UAE International Defense

Iveco Defense Vehicles

Rosoboronexport

- Military forces prioritizing advanced defense capabilities

- Government agencies investing in border security

- Private security firms demanding specialized vehicles

- Research and development initiatives for future armored systems

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035