Market Overview

The KSA armored vehicle fire suppression systems market is valued at approximately USD ~ billion, driven by Saudi Arabia’s substantial defense spending and the increasing demand for advanced protection systems for military and security vehicles. The market is expanding due to the country’s commitment to modernizing its defense infrastructure and fleet of armored vehicles. The growing need for enhanced safety features in combat and military operations is further contributing to the demand for reliable fire suppression systems in armored vehicles, ensuring optimal protection against fire hazards in critical operations.

Saudi Arabia dominates the market due to its position as one of the largest defense spenders globally, with a significant focus on strengthening its military capabilities. The country’s strategic investments in armored vehicle fleets, coupled with ongoing defense modernization programs, play a crucial role in driving the demand for advanced fire suppression systems. Saudi Arabia’s geopolitical concerns in the Middle East and its increasing focus on military safety further solidify its dominance in the market, making it the key player in the region for such technologies.

Market Segmentation

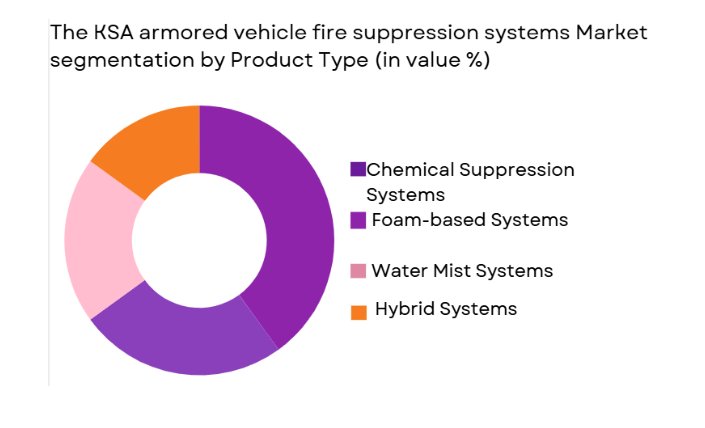

By Product Type

The KSA armored vehicle fire suppression systems market is segmented by product type into chemical suppression systems, foam-based systems, water mist systems, and hybrid systems. Recently, chemical suppression systems have a dominant market share due to factors such as their high effectiveness in rapidly extinguishing fires in military vehicles, their established reliability in combat environments, and their compatibility with a wide range of armored vehicles. Chemical systems are particularly favored in high-risk military applications where quick action is critical to safeguarding both personnel and vehicle integrity.

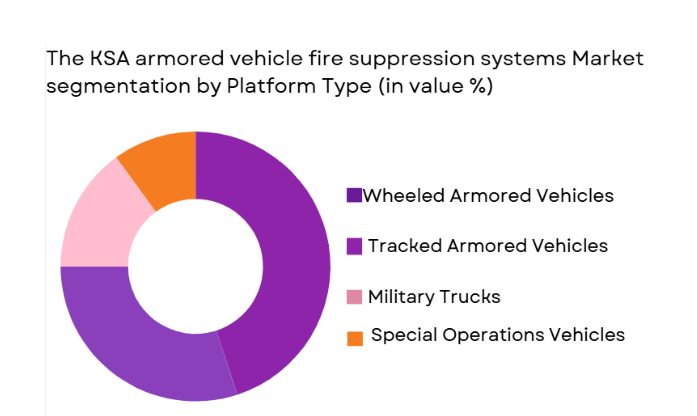

By Platform Type

The market is segmented by platform type into wheeled armored vehicles, tracked armored vehicles, military trucks, special operations vehicles, and others. Wheeled armored vehicles dominate the market share due to their growing adoption in modern military operations, offering superior mobility and tactical versatility. These vehicles, which are favored for their quick deployment and ease of maintenance, require fire suppression systems to ensure safety in diverse operational environments, driving the high demand for such systems in this segment.

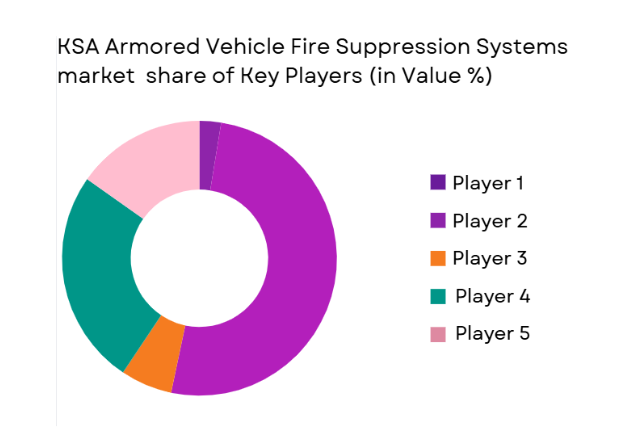

Competitive Landscape

The competitive landscape of the KSA armored vehicle fire suppression systems market is shaped by major defense contractors and suppliers of advanced fire suppression technologies. Consolidation in the market is evident as key players leverage partnerships with both government agencies and military contractors to strengthen their positions. The market is primarily influenced by global companies with technological expertise and established relationships in defense procurement, offering tailored solutions for armored vehicles and military clients.

| Company Name | Establishment Year | Headquar-ters | Techno-logy Focus | Market Reach | Key Produ-cts | Reve-nue | Market-Specific Paramet-er |

| Firetrace Internat-ional | 1999 | USA | ~ | ~ | ~ | ~ | ~ |

| Rosenbauer | 1866 | Austria | ~ | ~ | ~ | ~ | ~ |

| Dafo Vehicle Fire Protection | 1992 | Sweden | ~ | ~ | ~ | ~ | ~ |

| Kidde-Fenwal | 1917 | USA | ~ | ~ | ~ | ~ | ~ |

| Minimax Viking | 1903 | Germany | ~ | ~ | ~ | ~ | ~ |

KSA Armored Vehicle Fire Suppression Systems Market Analysis

Growth Drivers

Increased Defense Spending

One of the primary growth drivers in the KSA armored vehicle fire suppression systems market is the substantial defense expenditure by Saudi Arabia. As one of the largest defense spenders in the world, the country allocates significant portions of its budget to enhance its military capabilities, including the modernization of armored vehicles. This growing investment in defense infrastructure naturally drives the demand for advanced fire suppression systems to ensure the protection of military personnel and equipment. Furthermore, with increasing security threats and regional instability, Saudi Arabia’s government has made significant efforts to bolster its military assets, prioritizing both the enhancement of its defense technologies and the protection of its forces. These efforts result in consistent demand for state-of-the-art safety solutions in armored vehicles. As a result, the KSA armored vehicle fire suppression systems market is poised to benefit from ongoing and future defense procurement programs, driving market growth.

Technological Advancements in Fire Suppression Systems

Another key driver of growth in the market is the continuous technological advancements in fire suppression systems. Innovations in fire detection and suppression technology have made these systems more efficient, effective, and environmentally friendly, driving their adoption across both military and commercial sectors. The development of automated systems, which can detect and suppress fires in real-time, is one example of how technological advancements are enhancing the effectiveness of fire suppression solutions. Moreover, innovations in suppression agents, such as eco-friendly and less toxic chemicals, are gaining traction in the market as governments and organizations push for more sustainable solutions. As the KSA defense sector continues to modernize, demand for these technologically advanced fire suppression systems is expected to increase, providing growth opportunities for companies that can deliver cutting-edge products. This technological shift not only improves the reliability of fire suppression systems but also aligns with global trends toward greater environmental sustainability in defense technologies, positioning the market for long-term expansion.

Market Challenges

High Installation and Maintenance Costs

One of the most significant challenges in the KSA armored vehicle fire suppression systems market is the high installation and maintenance costs associated with these systems. The deployment of advanced fire suppression solutions requires substantial upfront investment in both hardware and labor. The cost of installing these systems in armored vehicles can be prohibitively high, especially when retrofitting older vehicle models. Additionally, these systems require regular maintenance to ensure they are functioning properly, which adds ongoing operational costs. For government entities and private sector buyers, this presents a financial hurdle, especially when balancing the need for advanced fire protection with the budgetary constraints of military procurement. Furthermore, the specialized nature of these systems means that only a limited number of suppliers can provide them, often driving up prices and creating barriers to broader adoption across all vehicle types.

Complex Integration with Armored Vehicles

Another challenge faced by the KSA armored vehicle fire suppression systems market is the complexity involved in integrating fire suppression technologies with existing armored vehicles. Armored vehicles come in a wide variety of designs and configurations, and each may require a customized solution to effectively integrate a fire suppression system. This lack of standardization in the design of armored vehicles poses challenges for manufacturers seeking to deliver universal fire suppression solutions. Additionally, integrating these systems with other vehicle components, such as vehicle management and safety systems, can be a complex and time-consuming process. These integration challenges can lead to delays in deployment and increase the cost of system adoption. Furthermore, retrofitting existing armored vehicles with modern fire suppression systems requires careful planning and testing to ensure that the integration does not affect the overall vehicle performance, further adding to the challenge.

Opportunities

Growth in Defense Contracts

A key opportunity in the KSA armored vehicle fire suppression systems market is the expansion of defense contracts. With the Saudi Arabian government focusing heavily on modernizing its military assets and increasing defense spending, there is a growing demand for advanced fire suppression systems in armored vehicles. This trend is expected to continue as the government strengthens its defense infrastructure in response to regional security concerns. The ongoing and future defense procurement contracts will offer significant opportunities for fire suppression system manufacturers to secure long-term contracts with the government and military contractors. As Saudi Arabia continues to prioritize the safety of its personnel and military vehicles, the demand for cutting-edge fire suppression systems will increase, providing ample growth opportunities for market participants.

Private Sector Fleet Modernization

Another significant opportunity lies in the increasing modernization of private sector armored vehicle fleets. Private security firms, commercial transport companies, and high-risk industries are increasingly investing in armored vehicles to protect assets and personnel. As these companies expand their operations in volatile regions, the demand for advanced fire suppression systems in armored vehicles is expected to rise. These industries are becoming more aware of the risks associated with fire hazards in armored vehicles and are prioritizing the integration of fire safety systems. This trend creates an untapped market for fire suppression system providers, offering a new avenue for growth. As the private sector continues to grow and expand its fleet, the demand for advanced fire suppression solutions will also increase, providing a significant opportunity for market players.

Future Outlook

The future outlook for the KSA armored vehicle fire suppression systems market appears positive, with sustained growth driven by continued defense sector expansion and technological innovations. The Saudi Arabian government’s ongoing investments in military modernization, coupled with a growing emphasis on vehicle safety, are expected to propel demand for fire suppression systems. Technological advancements in suppression agents and fire detection systems will likely enhance the effectiveness and affordability of these solutions, making them more accessible to a broader range of customers. Additionally, increasing demand for armored vehicles in the private security and commercial sectors will further boost market growth, creating new opportunities for system providers. As the geopolitical landscape in the region evolves, the demand for armored vehicle fire suppression systems is expected to rise, positioning the market for steady growth.

Major Players

- Firetrace International

- Rosenbauer

- Dafo Vehicle Fire Protection

- Kidde-Fenwal

- Minimax Viking

- Tyco Fire Protection

- ANSUL

- Viking Group

- SFFECO Global

- Dafo

- Ultra Fire Protection

- UTC Aerospace Systems

- Halma

- Wormald

- Fike Corporation

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Defense contractors

- Armored vehicle manufacturers

- Military procurement departments

- Private security companies

- Commercial fleet operators

- Military defense equipment suppliers

Research Methodology

Step 1: Identification of Key Variables

We begin by identifying key market variables such as technological advancements, consumer demand, and regional dynamics affecting market growth.

Step 2: Market Analysis and Construction

The next step involves secondary research, data collection, and analysis to construct market size estimates and forecasts.

Step 3: Hypothesis Validation and Expert Consultation

We validate our research findings through expert consultations and discussions with industry leaders to refine our models and hypotheses.

Step 4: Research Synthesis and Final Output

Finally, the data and insights are synthesized into a comprehensive report, offering actionable market insights and recommendations.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increasing military expenditure

Focus on armored vehicle protection

Demand for advanced fire suppression systems in high-risk environments

Technological advancements in fire suppression technologies

Growing demand for OEM and retrofit fitment - Market Challenges

High installation and maintenance costs

Complexity in retrofitting existing platforms

Integration challenges with existing vehicle systems

Regulatory compliance and certification hurdles

Limited awareness in certain defense sectors - Market Opportunities

Expansion in defense sectors in the Middle East

Technological innovation in fire suppression systems

Collaborations with global defense contractors - Trends

Rising interest in multi-functional fire suppression systems

Development of eco-friendly suppression agents

Adoption of AI-driven fire detection technologies

Increased focus on safety standards for armored vehicles

Integration with vehicle-specific monitoring systems - Government Regulations & Defense Policy

Increased government regulations on fire safety

Standards for fire suppression systems in military vehicles

Defense policy initiatives promoting technology adoption - SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Automatic Fire Suppression Systems

Manual Fire Suppression Systems

Hybrid Fire Suppression Systems

Water-Based Fire Suppression Systems

Foam-Based Fire Suppression Systems - By Platform Type (In Value%)

Wheeled Armored Vehicles

Tracked Armored Vehicles

Light Armored Vehicles

Heavy Armored Vehicles

Specialized Military Vehicles - By Fitment Type (In Value%)

OEM (Original Equipment Manufacturer) Fitment

Aftermarket Fitment

Retrofit Fitment

On-Site Installation

Pre-Installation Testing - By EndUser Segment (In Value%)

Military Defense

Homeland Security

Law Enforcement

Private Security Contractors

Civilian Armored Vehicle Manufacturers - By Procurement Channel (In Value%)

Direct Sales to Governments

Procurement through Defense Contractors

Retail and Distribution Networks

OEM Partnerships

Government Tenders and Contracts - By Material / Technology (In Value%)

Carbon Dioxide-Based Systems

Chemical Fire Suppression Systems

Water Mist Technology

Aerosol Fire Suppression Systems

Foam-Based Fire Suppression Systems

- Market structure and competitive positioning

Market share snapshot of major players - Cross Comparison Parameters (Market Value, Market Size, Technological Innovations, OEM Partnerships, Competitive Positioning)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

Kidde Fire Systems

Firetrace International

Williams Fire & Hazard Control

Blazecut

Tyco Fire Protection Products

ANSUL (Johnson Controls)

Chemguard

FirePro Systems

SFFECO Global

Nobel Fire Systems

Fire Protection Technologies, Inc.

Dacon Systems

A.C. Fire Pump Company

Gielle Group

Fike Corporation

- Military vehicles increasingly demanding advanced fire protection systems

- Private security contractors seeking more reliable suppression solutions

- OEM manufacturers requiring integration with new vehicle models

- Homeland security agencies focusing on fire safety in tactical operations

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035