Market Overview

The KSA armored vehicle procurement and upgrade market is valued at approximately USD ~ billion in 2024, driven by substantial military investments from the Saudi Arabian government. The market has seen consistent growth due to the strategic importance of modernizing the defense infrastructure and enhancing security measures within the region. Additionally, geopolitical tensions in the Middle East and the increasing need for advanced defense systems have pushed the demand for armored vehicles and upgrades. Furthermore, the rising government spending under Vision 2030 and military modernization programs is expected to significantly contribute to the market expansion in the coming years.

Key regions dominating the armored vehicle procurement and upgrade market include major urban centers such as Riyadh and Jeddah, where defense and military activities are concentrated. These cities serve as hubs for military procurements, owing to their proximity to military bases and defense contractors. Additionally, the Saudi Arabian government’s centralization of defense operations in these areas, alongside strategic defense initiatives, strengthens their dominance. High investment in infrastructure and partnerships with international defense companies further boosts the concentration of demand in these regions, supporting the market’s growth trajectory.

Market Segmentation

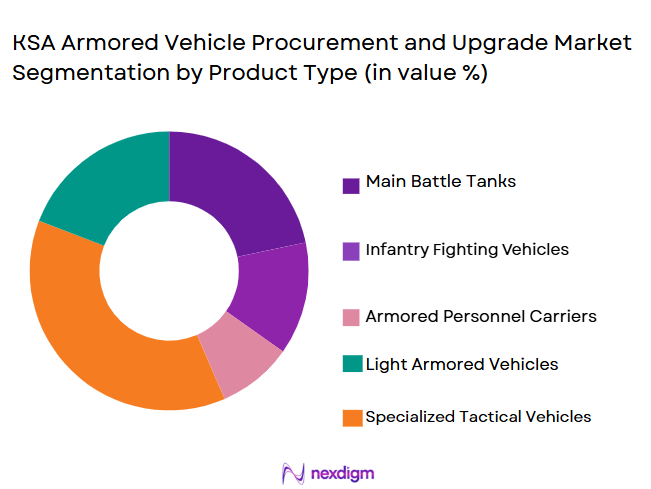

By Product Type

The KSA armored vehicle procurement and upgrade market is segmented by product type into mine-resistant ambush-protected vehicles (MRAPs), light armored vehicles (LAVs), heavy armored vehicles (HAVs), armored personnel carriers (APCs), and combat reconnaissance vehicles (CRVs). The MRAP segment currently leads the market, mainly driven by the demand for enhanced troop protection in conflict zones and areas prone to roadside bombings. MRAPs are favored by the Saudi Arabian military for their ability to withstand various explosive threats, making them ideal for both urban and desert warfare. The continued investment in MRAPs is further amplified by their proven operational effectiveness, reliability, and demand within the region. As such, MRAPs continue to maintain the dominant market share in the armored vehicle procurement and upgrade space.

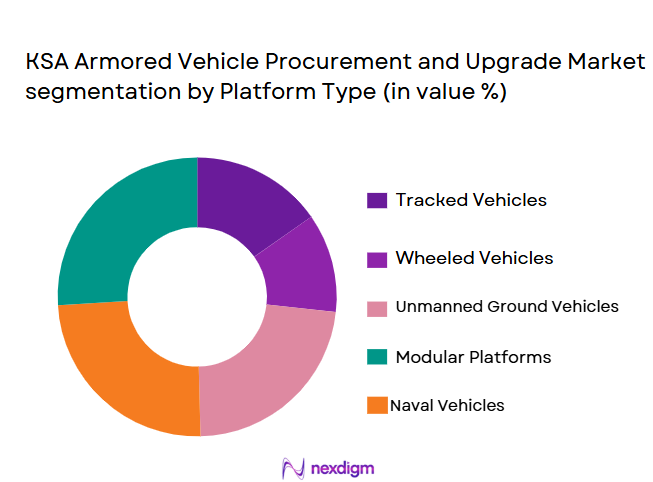

By Platform Type

The KSA armored vehicle procurement and upgrade market is segmented by platform type into tracked platforms, wheeled platforms, hybrid platforms, unmanned ground vehicles (UGVs), and multi-role armored platforms. Wheeled platforms dominate the market, owing to their superior mobility, cost-effectiveness, and flexibility in various operational environments, particularly in urban and desert terrains. The demand for wheeled armored vehicles is primarily driven by their versatility in transporting troops, weapons, and equipment, making them suitable for both combat and peacekeeping missions. These vehicles offer lower operational costs and ease of maintenance compared to tracked platforms, thus solidifying their leading position in the market.

Competitive Landscape

The competitive landscape of the KSA armored vehicle procurement and upgrade market is characterized by the presence of both local and international defense contractors, with consolidation occurring through joint ventures and long-term defense contracts. The Saudi Arabian government plays a pivotal role in determining the market’s direction by selecting preferred suppliers and fostering collaboration with global defense giants. Companies like BAE Systems, General Dynamics, and Rheinmetall, which offer advanced armored vehicle technologies, are central to this competitive ecosystem. Local manufacturers also play a crucial role, catering to the demand for upgrades and retrofitting services.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue | Additional Parameter |

| BAE Systems | 1999 | London, UK | ~ | ~ | ~ | ~ | ~ |

| General Dynamics | 1948 | Falls Church, USA | ~ | ~ | ~ | ~ | ~ |

| Rheinmetall | 1889 | Düsseldorf, Germany | ~ | ~ | ~ | ~ | ~ |

| Oshkosh Defense | 1917 | Oshkosh, USA | ~ | ~ | ~ | ~ | ~ |

| Lockheed Martin | 1912 | Bethesda, USA | ~ | ~ | ~ | ~ | ~ |

KSA Armored Vehicle Procurement and Upgrade Market Analysis

Growth Drivers

Government Modernization Programs

The expansion of the KSA armored vehicle procurement and upgrade market is largely attributed to the Saudi Arabian government’s modernization initiatives. These programs focus on enhancing the capabilities of the Saudi military, particularly in the area of land defense. The government’s emphasis on upgrading the army’s armored vehicle fleet aligns with Saudi Vision 2030, which seeks to diversify the economy and increase defense capabilities. As part of this vision, Saudi Arabia has made significant investments in defense technology and infrastructure, encouraging both local and foreign defense contractors to contribute to the modernization of the military. This includes a growing need for advanced armored vehicles capable of handling contemporary threats, such as improvised explosive devices (IEDs) and sophisticated anti-tank missiles. The government’s substantial budget allocation for defense, along with the demand for technologically advanced platforms, is a key driver fueling the market’s growth.

Geopolitical Tensions

The ongoing geopolitical instability in the Middle East has been another major driver for the KSA armored vehicle procurement and upgrade market. Saudi Arabia’s military priorities are heavily influenced by the region’s security dynamics, particularly in light of rising threats from neighboring countries and non-state actors. The kingdom’s engagement in regional conflicts and its involvement in peacekeeping missions necessitate the continued development of advanced defense solutions. As a result, the Saudi Arabian military is actively seeking to enhance its armored vehicle fleet with state-of-the-art technologies to ensure superior protection, mobility, and operational readiness. This growing focus on military preparedness in response to regional instability is expected to further drive demand for new procurements and upgrades of armored vehicles.

Market Challenges

High Costs of Modernization

One of the significant challenges faced by the KSA armored vehicle procurement and upgrade market is the high cost associated with modernizing the military fleet. While the Saudi government has allocated substantial funds for defense spending, the procurement of advanced armored vehicles, as well as the upgrading of existing units, remains an expensive endeavor. This includes the costs for specialized equipment, research and development, and ongoing maintenance of high-tech defense systems. Furthermore, inflationary pressures and supply chain disruptions can also increase the overall expenditure required to maintain the fleet, making it difficult for the military to balance cost-effective solutions with the need for cutting-edge technology. The financial burden of modernization programs may limit the pace at which Saudi Arabia can enhance its military capabilities, especially in light of economic fluctuations.

Dependence on Foreign Suppliers

Another key challenge for the KSA armored vehicle procurement and upgrade market is the heavy reliance on foreign suppliers for the acquisition of advanced military vehicles. Despite efforts to localize defense manufacturing through joint ventures, Saudi Arabia continues to depend on international defense contractors for high-tech armored vehicle systems and related components. This reliance on foreign suppliers creates vulnerabilities in terms of geopolitical risks, supply chain disruptions, and the potential for changes in defense policy by key supplier countries. Furthermore, the complexity of integrating foreign technology into the Saudi military’s existing infrastructure can pose challenges in terms of interoperability, maintenance, and training. These factors may impact the overall efficiency and effectiveness of the procurement and upgrade process.

Opportunities

Localization of Production

One of the key opportunities for the KSA armored vehicle procurement and upgrade market is the increased emphasis on localizing defense production. Saudi Arabia has been actively pursuing initiatives to boost its domestic defense industry, in line with its Vision 2030 objectives. This includes partnerships with international defense companies to establish local production facilities for armored vehicles and related components. By localizing production, Saudi Arabia can reduce its dependence on foreign suppliers and create a more self-sufficient defense ecosystem. The establishment of local manufacturing plants for armored vehicles can also stimulate job creation, technology transfer, and the development of a skilled workforce. This opportunity presents significant growth potential for both domestic manufacturers and foreign firms seeking to tap into the Saudi market.

Technological Advancements in Armored Vehicles

The rapid evolution of defense technologies presents an opportunity for the KSA armored vehicle procurement and upgrade market to benefit from innovations in armored vehicle design and functionality. Advances in areas such as autonomous vehicle systems, advanced armor materials, energy-efficient propulsion systems, and improved battlefield communications are expected to shape the future of armored vehicle procurement. Saudi Arabia’s military modernization efforts can leverage these innovations to develop more capable, cost-efficient, and versatile armored vehicles. By adopting cutting-edge technologies, Saudi Arabia can enhance its defense capabilities, improve operational effectiveness, and stay ahead of emerging security threats. This ongoing technological evolution in armored vehicles presents a significant opportunity for growth in the market.

Future Outlook

The KSA armored vehicle procurement and upgrade market is expected to experience robust growth over the next five years, fueled by Saudi Arabia’s defense modernization initiatives and the increasing focus on technological advancements in military equipment. Enhanced defense budgets, strategic alliances with international defense firms, and localized production are expected to drive the demand for both new armored vehicles and upgrades to existing fleets. As geopolitical tensions continue to influence the region, the demand for advanced armored vehicles, capable of withstanding modern-day threats, will remain high. Regulatory support for defense industry development and growing investment in R&D will further contribute to the market’s expansion.

Major Players

• BAE Systems

• General Dynamics

• Rheinmetall

• Oshkosh Defense

• Lockheed Martin

• Thales Group

• Elbit Systems

• MBDA

• SAAB AB

• KMW (Krauss-Maffei Wegmann)

• STREIT Group

• Armored Group

• Navistar Defense

• Leonardo S.p.A

• Polaris Government and Defense

Key Target Audience

• Investments and venture capitalist firms

• Government and regulatory bodies

• Military contractors

• Defense equipment manufacturers

• Saudi Arabian Ministry of Defense

• Regional military forces

• Defense policy advisors

• International defense agencies

Research Methodology

Step 1: Identification of Key Variables

The key variables influencing the market were identified, including military spending, government regulations, and technology trends.

Step 2: Market Analysis and Construction

A comprehensive analysis was performed, utilizing historical data, industry reports, and expert insights to construct the market landscape.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses were validated through discussions with industry experts, defense contractors, and government officials involved in military procurement.

Step 4: Research Synthesis and Final Output

The final output synthesized all collected data, providing a comprehensive report on the KSA armored vehicle procurement and upgrade market.

- Executive Summary

- KSA Armored Vehicle Procurement and Upgrade Research Methodology

(Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increased Military Budget Allocations

Heightened Geopolitical Tensions in the Middle East

Need for Modernization and Increased Combat Readiness - Market Challenges

High Maintenance and Operational Costs

Complexity in Integrating New Technologies

Supply Chain and Logistics Constraints - Market Opportunities

Collaboration with International Defense Partners

Emerging Defense Technology Solutions

Growth in Regional Military Alliances - Trends

Focus on Autonomous and Remote-Controlled Systems

Shift Towards Multi-role Platforms

Increase in Counter-Mine and Protection Systems - Government Regulations & Defense Policy

Saudi Vision 2030 and Its Impact on Military Modernization

International Arms Trade Regulations and Compliance

Increased Focus on Domestic Defense Manufacturing - SWOT Analysis (Capability Strengths, Cost Vulnerabilities, Competitive Pressures)

Porter’s Five Forces (Procurement Power, Supplier Concentration, Substitutes, Barriers to Entry)

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Mine-Resistant Ambush Protected (MRAP) Vehicles

Light Armored Vehicles (LAV)

Heavy Armored Vehicles (HAV)

Combat Reconnaissance Vehicles (CRV)

Armored Personnel Carriers (APC) - By Platform Type (In Value%)

Tracked Platforms

Wheeled Platforms

Hybrid Platforms

Unmanned Ground Vehicles (UGVs)

Multi-role Armored Platforms - By Fitment Type (In Value%)

New Procurement

Upgrades and Modernization

System Replacement

Retrofits

Spare Parts & Components - By EndUser Segment (In Value%)

Saudi Arabian National Guard

Saudi Arabian Army

Royal Saudi Air Defense

Private Security Contractors

Regional Military Forces - By Procurement Channel (In Value%)

Direct Purchases from OEMs

Defense Contractors and Integrators

Government-to-Government Contracts

Local Manufacturers

Third-Party Distributors

- Market Share Analysis

- Cross Comparison Parameters

(Technology Integration, Platform Versatility, Operational Cost Efficiency, Global Partnership Reach, Local Manufacturing Capability, System Adaptability, Aftermarket Support, Product Quality, Regulatory Compliance) - SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

Saudi Arabian Military Industries

Oshkosh Defense

General Dynamics Land Systems

BAE Systems

Rheinmetall

Navistar Defense

Lockheed Martin

Thales Group

L3Harris Technologies

Elbit Systems

Armoured Group

Polaris Government and Defense

KMW (Krauss-Maffei Wegmann)

Jankel Armoring

STREIT Group

- Demand for Advanced Protection Systems

- Integration of Next-Gen Armored Platforms

- Upgrading Legacy Systems for Operational Efficiency

- Cost-Effective Solutions for Expanding Regional Defense

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035