Market Overview

The KSA armored vehicles navigation systems market is valued at USD ~ billion, driven by the increasing demand for enhanced precision and reliability in military vehicles. The market growth is attributed to technological advancements in GPS, inertial navigation systems, and sensor fusion technologies, allowing for more efficient navigation in challenging terrains. Moreover, government initiatives and defense spending in the region further propel the market’s expansion, with substantial investments in upgrading military infrastructure and enhancing defense capabilities.

Key players are heavily concentrated in Saudi Arabia, where the defense sector receives significant government support. The country’s strategic geographical location and the rising security concerns within the region contribute to the growing demand for advanced navigation systems in military vehicles. The presence of major defense contractors and local manufacturers in the region also plays a crucial role in the dominance of this market segment. This, combined with robust infrastructure development, positions Saudi Arabia as a leader in the market.

Market Segmentation

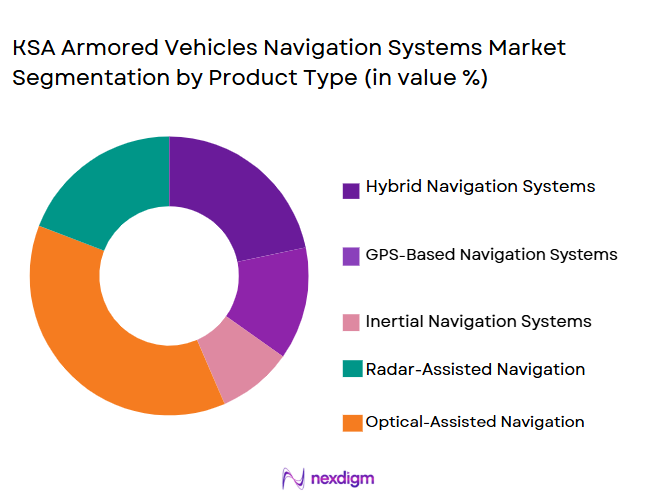

By Product Type

KSA armored vehicles navigation systems market is segmented by product type into GPS-based systems, inertial navigation systems, and sensor fusion systems. Recently, GPS-based navigation systems have a dominant market share due to their wide adoption in military operations, offering precise positioning in remote areas. The strong infrastructure, high demand from military forces for real-time navigation, and the preference for reliable and scalable systems have further cemented the dominance of this segment.

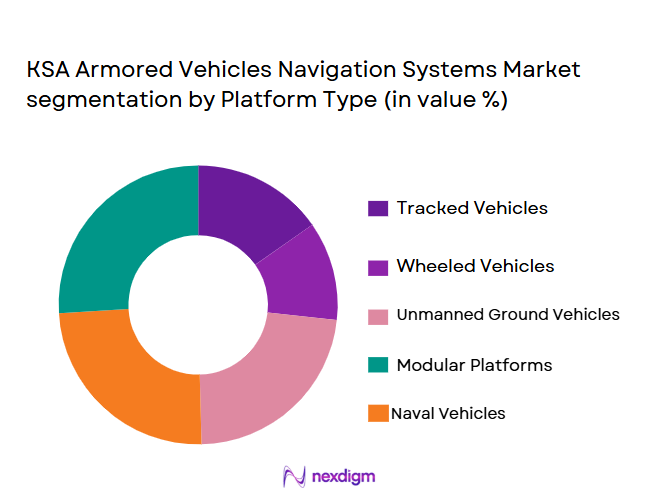

By Platform Type

KSA armored vehicles navigation systems market is segmented by platform type into wheeled armored vehicles, tracked armored vehicles, and hybrid vehicles. The demand for wheeled armored vehicles has surged in recent years, driven by their versatility, enhanced mobility, and ease of integration with advanced navigation systems. Their increased deployment in various military operations, coupled with the growing need for faster response times, positions this platform type as the dominant sub-segment in the market.

Competitive Landscape

The KSA armored vehicles navigation systems market is highly competitive, with consolidation driven by major defense contractors who leverage their technological expertise and strong government ties. These companies dominate the market by offering advanced, customized solutions that meet military specifications. The dominance of large-scale defense players in the region ensures a steady supply of innovative systems, while local manufacturers benefit from government contracts and defense modernization initiatives.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue (USD Billion) | Government Contract Share |

| Lockheed Martin | 1912 | Bethesda, USA | ~ | ~ | ~ | ~ | ~ |

| Thales Group | 2000 | Paris, France | ~ | ~ | ~ | ~ | ~ |

| General Dynamics | 1952 | Falls Church, USA | ~ | ~ | ~ | ~ | ~ |

| BAE Systems | 1999 | London, UK | ~ | ~ | ~ | ~ | ~ |

| Raytheon Technologies | 1922 | Waltham, USA | ~ | ~ | ~ | ~ | ~ |

KSA Armored Vehicles Navigation System Market Analysis

Growth Drivers

Technological Advancements in Navigation Systems

The increasing demand for advanced navigation systems in KSA’s armored vehicles is driven by continuous technological innovations. This growth driver has led to the development of more precise, reliable, and efficient navigation solutions that cater to the evolving needs of the defense sector. Innovations like multi-sensor fusion and AI-driven navigation systems are becoming standard, offering enhanced precision in harsh environments. The integration of GPS, inertial sensors, and real-time data processing is improving the accuracy of navigation in military operations. These advancements also provide a competitive advantage to manufacturers that focus on innovative navigation solutions, thus driving the growth of the market. With KSA’s increasing defense budget and investments in upgrading its military infrastructure, the demand for technologically advanced navigation systems is expected to rise significantly.

Government Defense Spending and Modernization

Another critical growth driver is the increase in defense spending by the KSA government. As part of its Vision 2030 initiative, KSA is heavily investing in the modernization of its military fleet, which includes armored vehicles. This commitment to defense modernization has fueled the demand for high-tech navigation systems capable of enhancing the operational efficiency and tactical advantage of these vehicles. The government’s focus on upgrading and enhancing defense systems ensures a steady flow of investments into the defense sector, particularly in the area of navigation technology for armored vehicles. This financial support is crucial for the continued development and adoption of advanced navigation systems in KSA’s military vehicles, making this driver a key contributor to market growth.

Market Challenges

High Cost of Advanced Navigation Systems

One of the major challenges in the KSA armored vehicles navigation systems market is the high cost of advanced systems. The integration of cutting-edge technologies such as multi-sensor fusion and inertial navigation systems requires significant investment in research and development, as well as high-quality materials. For military forces operating within a set defense budget, the cost of upgrading or procuring advanced navigation systems can be prohibitive. Furthermore, the complexities of maintaining and repairing such sophisticated systems add to the long-term costs. These financial constraints can limit the speed at which new technologies are adopted, presenting a challenge for defense contractors and local governments in meeting the growing demand for advanced navigation solutions in armored vehicles.

Limited Interoperability with Legacy Systems

Another challenge is the issue of interoperability between new navigation systems and legacy military vehicles. Many of the armored vehicles currently in use were not designed to support the latest navigation technologies, leading to compatibility issues. This lack of seamless integration results in a higher cost of retrofitting existing vehicles with new navigation systems. Furthermore, these compatibility challenges also complicate the training and maintenance processes for military personnel, as they must be proficient in operating both legacy and new navigation technologies. This challenge highlights the importance of developing modular and adaptable systems that can be integrated into a wide range of military platforms.

Opportunities

Integration of Autonomous Systems

The rising interest in autonomous vehicles in the defense sector presents a significant opportunity for the KSA armored vehicles navigation systems market. The integration of autonomous systems into military vehicles requires advanced navigation technologies, such as GPS, inertial navigation, and sensor fusion. These systems enable the vehicle to navigate independently, reducing the need for manual control and enhancing operational efficiency. The adoption of autonomous systems in military applications is gaining traction globally, and KSA’s strong defense sector is well-positioned to capitalize on this opportunity. As the government continues its defense modernization efforts, the demand for autonomous navigation systems in armored vehicles is expected to grow, providing a lucrative opportunity for technology providers in the market.

Growing Demand for Customizable Navigation Systems

The KSA armored vehicles navigation systems market is also presented with an opportunity due to the increasing demand for customized navigation solutions tailored to specific operational needs. Different military operations require unique navigation capabilities, whether for urban warfare, desert terrains, or mountainous regions. Providing adaptable and customizable systems that meet the specific needs of various military units is a growing trend in the defense sector. This opportunity allows manufacturers to design navigation systems that can be integrated into a variety of platforms, ensuring that KSA’s armed forces have the necessary tools for different operational scenarios. Customizable navigation systems can address both tactical and strategic requirements, making this a highly attractive opportunity for technology providers in the market.

Future Outlook

The KSA armored vehicles navigation systems market is expected to witness significant growth over the next five years, driven by advancements in technology and increased defense investments. The government’s Vision 2030 initiative will further accelerate the modernization of military infrastructure, including the integration of advanced navigation systems. The growing emphasis on autonomous military vehicles, along with innovations in multi-sensor fusion, GPS, and AI-driven technologies, will play a key role in shaping the future of this market. The increasing demand for customizable and resilient navigation solutions in challenging terrains will continue to be a major growth driver.

Major Players

- Lockheed Martin

- Thales Group

- General Dynamics

- BAE Systems

- Raytheon Technologies

- Northrop Grumman

- L3 Technologies

- Honeywell Aerospace

- Rheinmetall AG

- ST Engineering

- Elbit Systems

- Israel Aerospace Industries

- Kongsberg Gruppen

- Tacticos

- Oshkosh Defense

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Defense contractors and OEMs

- Military forces and defense ministries

- Research institutions specializing in defense technology

- Armored vehicle manufacturers

- Military vehicle system integrators

- Defense system procurement agencies

Research Methodology

Step 1: Identification of Key Variables

The first step in the research process is to identify the key variables that influence the KSA armored vehicles navigation systems market, including technological trends, market drivers, and government regulations. This involves extensive secondary research and expert consultation to define the scope of the study.

Step 2: Market Analysis and Construction

The next step involves gathering quantitative data from credible sources, including industry reports, market surveys, and government publications. This data is used to build a comprehensive market model and provide insights into market trends, growth drivers, and regional dynamics.

Step 3: Hypothesis Validation and Expert Consultation

To ensure accuracy and reliability, the hypothesis developed in the earlier steps is validated through expert interviews and consultations with industry leaders. Feedback from these experts helps refine market projections and provides real-world insights into current and future market dynamics.

Step 4: Research Synthesis and Final Output

The final step involves synthesizing all collected data, validating assumptions, and constructing a comprehensive report that covers market sizing, segmentation, competitive landscape, and growth forecasts. This report is then reviewed and finalized for publication.

- Executive Summary

- KSA Armored Vehicles Navigation Systems Research Methodology

(Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increased military spending

Modernization of armored vehicle fleets

Adoption of advanced navigation systems for tactical superiority - Market Challenges

High costs of advanced navigation technologies

Limited interoperability with legacy systems

Security concerns over GPS and satellite-based systems - Market Opportunities

Growing demand for autonomous military vehicles

Emerging demand for multi-functional navigation systems

Development of resilient systems against jamming and cyber threats - Trends

Integration of AI and machine learning in navigation

Rise of hybrid and electric armored vehicle platforms

Enhanced demand for precise and secure navigation in adverse environments - Government Regulations & Defense Policy

Strict defense procurement regulations

Adoption of cybersecurity measures in defense systems

Government incentives for technological upgrades in defense - SWOT Analysis (Capability Strengths, Cost Vulnerabilities, Competitive Pressures)

- Porter’s Five Forces (Procurement Power, Supplier Concentration, Substitutes, Barriers to Entry)

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Land-based Navigation Systems

GPS-based Navigation Systems

Inertial Navigation Systems

Multi-sensor Fusion Systems

Advanced Driver Assistance Systems - By Platform Type (In Value%)

Wheeled Armored Vehicles

Tracked Armored Vehicles

Hybrid Armored Vehicles

Light Tactical Vehicles

Heavy Duty Armored Vehicles - By Fitment Type (In Value%)

OEM Fitment

Retrofit Fitment

Integrated Systems

Modular Fitment

Custom Fitment - By EndUser Segment (In Value%)

Military Forces

Defense Contractors

Government Agencies

OEMs

Law Enforcement Agencies - By Procurement Channel (In Value%)

Direct Procurement

Government Tenders

Defense Expos & Bids

Private Contractors

Aftermarket & Retrofit Sales

- Market Share Analysis

- Cross Comparison Parameters

(Technology, Platform Compatibility, Market Reach, Production Capacity, Customer Support) - SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

Lockheed Martin

Thales Group

General Dynamics

BAE Systems

Raytheon Technologies

Northrop Grumman

L3 Technologies

Honeywell Aerospace

Rheinmetall AG

ST Engineering

Elbit Systems

Israel Aerospace Industries

Kongsberg Gruppen

Tacticos

Oshkosh Defense

- Shift towards autonomous military vehicle fleets

- Integration of navigation with vehicle performance management

- Demand for real-time operational data sharing

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035