Market Overview

The KSA artillery ammunition casing market is expected to experience robust growth, driven by increasing defense budgets and the region’s geopolitical dynamics. As of recent assessments, the market size stands at USD ~ billion, with demand largely fueled by KSA’s focus on defense modernization, infrastructure development, and military preparedness. The market is also supported by ongoing investments in technology, including smart munitions, and the country’s strategic defense policies aimed at strengthening its military capabilities.

Saudi Arabia, along with neighboring countries such as the UAE and Qatar, dominates the artillery ammunition casing market due to substantial defense spending and a commitment to enhancing military infrastructure. The region benefits from strategic partnerships with international defense contractors, fostering the production of advanced ammunition systems. This dominance is also attributed to the demand for high-performance artillery systems for both domestic defense and regional security, driven by the ongoing focus on modernization and military expansion.

Market Segmentation

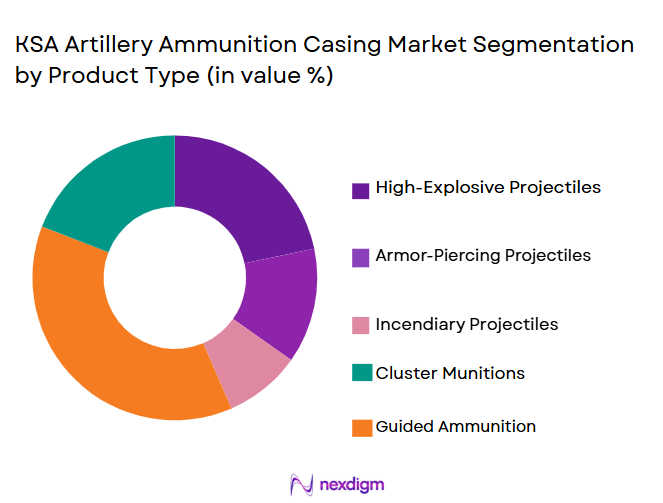

By Product Type

The KSA artillery ammunition casing market is segmented by product type into high-velocity projectiles, armor-piercing shells, explosive rounds, training rounds, and rocket-assisted projectiles. Recently, the high-velocity projectiles segment has dominated the market due to the increased need for long-range, precise, and efficient ammunition for modern artillery systems. These projectiles offer improved accuracy, enhanced penetration power, and are increasingly demanded in military operations. As artillery forces modernize, the importance of high-velocity projectiles grows, ensuring their dominance in the market. This is further bolstered by the defense sector’s focus on precision-guided munitions and their contribution to the effectiveness of artillery systems in combat situations.

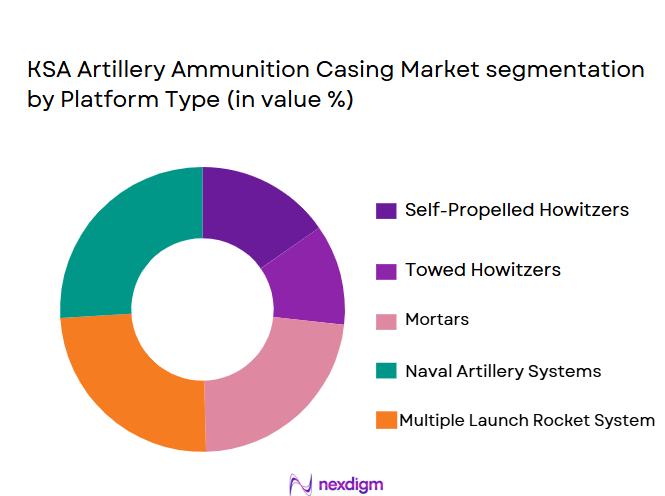

By Platform Type

The market is segmented by platform type into land-based artillery, naval artillery systems, mobile artillery systems, self-propelled guns, and heavy artillery. The land-based artillery segment holds the largest market share due to its widespread usage in both strategic and tactical defense operations. These systems are favored for their ability to cover large areas with high firepower, and the growing military needs in the region have led to an increased demand for these systems. Furthermore, their role in various defense operations, including border security and combat, ensures that land-based artillery remains the most prominent platform for artillery ammunition casing products.

Competitive Landscape

The KSA artillery ammunition casing market is highly competitive, with several major global defense players and regional manufacturers contributing to the market landscape. These companies focus on technological advancements, cost efficiency, and robust supply chains to maintain a competitive edge. Mergers and acquisitions are common as firms seek to strengthen their position in the market and expand their product offerings. The influence of key players, such as BAE Systems and Rheinmetall, continues to drive consolidation in the market, contributing to the ongoing innovation and competition.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue (USD) | Military Engagement Support |

| BAE Systems | 1999 | United Kingdom | ~ | ~ | ~ | ~ | ~ |

| Rheinmetall AG | 1889 | Germany | ~ | ~ | ~ | ~ | ~ |

| General Dynamics | 1952 | USA | ~ | ~ | ~ | ~ | ~ |

| Lockheed Martin | 1995 | USA | ~ | ~ | ~ | ~ | ~ |

| Nexter Systems | 1999 | France | ~ | ~ | ~ | ~ | ~ |

KSA artillery ammunition casing Market Analysis

Growth Drivers

Defense Modernization Programs

The ongoing defense modernization efforts in KSA are a primary growth driver for the artillery ammunition casing market. With a strategic focus on bolstering military capabilities and enhancing national defense systems, KSA’s investment in advanced artillery technologies has seen a significant increase in demand for high-performance ammunition casings. The country’s military is actively updating its arsenal, seeking modern solutions that offer greater precision, enhanced range, and superior performance in various combat situations. This demand is expected to continue as Saudi Arabia continues to fortify its defense structure amidst the evolving geopolitical situation in the Middle East. The increasing focus on military readiness, enhanced by these modernization programs, will continue to propel the market forward, ensuring that advanced ammunition solutions remain a top priority for KSA’s armed forces.

Geopolitical Tensions in the Middle East

Another crucial growth driver for the artillery ammunition casing market is the rising geopolitical tensions in the Middle East. The region has been marked by a volatile political landscape, with ongoing conflicts and territorial disputes necessitating stronger military responses. KSA, being one of the most influential nations in the region, has been at the forefront of these defense requirements. With the increased need to protect national borders and maintain military presence, Saudi Arabia has expanded its defense capabilities, which in turn stimulates the demand for artillery munitions. As KSA continues to enhance its military readiness to tackle potential threats, the demand for specialized and reliable artillery ammunition casings is expected to grow, further driving the market in the years ahead.

Market Challenges

Technological Complexities in Ammunition Manufacturing

The technological complexity involved in the manufacturing of artillery ammunition casings presents a significant challenge in the market. The development of advanced, precision-guided munitions requires sophisticated manufacturing capabilities, which are costly and require continuous innovation. For KSA, keeping pace with global defense technologies and ensuring compatibility with modern artillery systems can be a daunting task. Moreover, maintaining a robust supply chain for such specialized products while managing costs and timelines remains a significant hurdle. The need for high-quality materials, advanced production techniques, and strict adherence to international standards makes the manufacturing process both challenging and resource-intensive, impacting the market’s growth potential.

High Production Costs

The production of advanced artillery ammunition casings involves high costs, particularly in terms of materials, labor, and technology investments. These costs can hinder market growth, particularly for smaller manufacturers who may not have the economies of scale to compete effectively. In KSA, while defense spending is high, the need for efficient use of resources in military procurement remains crucial. As a result, producers are under pressure to maintain profitability while offering competitive prices. The rising costs associated with research and development, as well as the expense of sourcing high-quality raw materials, create a significant challenge for the market. Overcoming these challenges will require innovations in manufacturing and supply chain management to reduce production costs without compromising quality.

Opportunities

Expansion of Domestic Defense Manufacturing

One of the key opportunities for growth in the artillery ammunition casing market lies in the expansion of domestic defense manufacturing capabilities. As part of Saudi Arabia’s Vision 2030 initiative, the country is increasingly focusing on reducing its dependence on foreign defense suppliers by enhancing its domestic defense industry. This focus provides a unique opportunity for local manufacturers to increase their presence in the market, particularly in the production of artillery ammunition casings. With increasing demand for high-quality, locally produced military equipment, Saudi Arabia aims to become a hub for defense manufacturing in the region. This opportunity is expected to contribute significantly to the growth of the artillery ammunition casing market as local players ramp up production to meet domestic and regional demands.

Strategic Partnerships with Global Defense Firms

Another significant opportunity for the KSA artillery ammunition casing market lies in the strategic partnerships with global defense firms. These collaborations offer an opportunity for knowledge transfer, technology sharing, and co-development of advanced artillery solutions. As KSA continues to modernize its defense forces, partnerships with leading international players can help meet the growing demand for high-performance ammunition. By leveraging the technological expertise of global defense companies, Saudi Arabia can enhance its own defense manufacturing capabilities, ensuring that it remains competitive in the artillery sector. These partnerships will also support the local economy by creating jobs and enhancing technical skills within the defense industry, contributing to long-term market growth.

Future Outlook

The KSA artillery ammunition casing market is poised for continued growth driven by technological advancements and increasing defense spending. The ongoing military modernization programs, coupled with the country’s focus on reducing reliance on foreign defense suppliers, are expected to lead to a surge in demand for locally manufactured ammunition solutions. Technological advancements in precision-guided munitions and sustainable production processes will play a critical role in shaping the future of the market, with strong government support and regulatory frameworks aiding market expansion. Over the next few years, the KSA market is expected to witness robust growth as the defense sector continues to evolve and adapt to new challenges in the Middle East.

Major Players

• Rheinmetall AG

• General Dynamics

• Lockheed Martin

• Nexter Systems

• Thales Group

• Leonardo DRS

• Saab

• Denel Land Systems

• Elbit Systems

• Hanwha Defense

• Northrop Grumman

• Raytheon Technologies

• KADDB

• IMI Systems

Key Target Audience

• Government and regulatory bodies

• Defense contractors

• Military procurement departments

• Security forces

• Defense consultants

• International defense trade bodies

• Military logistics companies

Research Methodology

Step 1: Identification of Key Variables

The first step involves identifying the key variables influencing the artillery ammunition casing market, such as technological advancements, defense spending, and regional geopolitical factors.

Step 2: Market Analysis and Construction

This step involves constructing a detailed market model using historical data, trends, and insights from primary and secondary research sources to build a comprehensive market analysis.

Step 3: Hypothesis Validation and Expert Consultation

During this phase, hypotheses regarding market trends and growth drivers are validated through expert consultations with industry leaders, defense analysts, and manufacturers.

Step 4: Research Synthesis and Final Output

The final step synthesizes the findings into a comprehensive report, offering actionable insights and forecasts for stakeholders in the artillery ammunition casing market.

- Executive Summary

- KSA Artillery Ammunition Casing Research Methodology

(Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increased defense spending by the KSA government

Ongoing military modernization programs

Growing geopolitical tensions in the Middle East - Market Challenges

Technological complexity in ammunition manufacturing

Supply chain disruptions in the defense sector

High cost of advanced artillery casings - Market Opportunities

Expansion of KSA defense exports

Collaborations with international defense companies

Emerging demand for advanced smart munitions - Trends

Shift towards lightweight and modular artillery systems

Integration of AI and smart technology in ammunition

Growing adoption of automated artillery systems - Government Regulations & Defense Policy

Implementation of stricter ammunition production standards

Regulation on foreign defense contracts

Strategic defense policy fostering local manufacturing - SWOT Analysis (Capability Strengths, Cost Vulnerabilities, Competitive Pressures)

- Porter’s Five Forces (Procurement Power, Supplier Concentration, Substitutes, Barriers to Entry)

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

High-velocity projectiles

Armor-piercing shells

Explosive rounds

Training rounds

Rocket-assisted projectiles - By Platform Type (In Value%)

Land-based artillery

Naval artillery systems

Mobile artillery systems

Self-propelled guns

Heavy artillery - By Fitment Type (In Value%)

Custom-fit casings

Standard-fit casings

Modular-fit casings

Field-compatible casings

Multi-caliber casings - By EndUser Segment (In Value%)

Military forces

Defense contractors

Government defense agencies

Private defense manufacturers

Military logistics companies - By Procurement Channel (In Value%)

Direct government procurement

Defense contractor procurement

Third-party intermediaries

International defense partnerships

Government auctions

- Market Share Analysis

- Cross Comparison Parameters

(Manufacturing capacity, Supply chain reliability, Technological innovation, Production cost, Product durability) - SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

General Dynamics

BAE Systems

Thales Group

Lockheed Martin

Rheinmetall AG

Northrop Grumman

Leonardo DRS

BAE Systems Bofors

Denel Land Systems

Saab

Roketsan

Elbit Systems

KADDB

Nexter Systems

Iveco Defence Vehicles

- Military forces’ increasing demand for high-performance munitions

- Demand for cost-effective artillery casings in defense operations

- Growing collaboration between defense forces and contractors

- Shift towards sustainable and recyclable materials

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035