Market Overview

The KSA artillery ammunition market is projected to reach a significant size based on recent assessments, driven by factors such as increasing defense budgets and heightened security concerns in the region. The market value is estimated in the billions ~ USD, as the Kingdom continues to prioritize military modernization and the enhancement of its defense infrastructure. This demand is largely supported by substantial investments from both the government and private defense contractors, along with an increasing focus on improving the capabilities of artillery systems to meet evolving defense requirements.

The market is primarily driven by major cities and regions with strategic defense importance, particularly the capital Riyadh and military hubs across the Kingdom. The dominance of these areas stems from robust infrastructure, proximity to key military bases, and their central role in national defense strategies. Additionally, the Kingdom’s geopolitical significance, along with ongoing conflicts and the need for enhanced artillery defense, further drives demand in these regions. Investment in defense manufacturing and procurement channels from global suppliers plays a key role in the market’s growth.

Market Segmentation

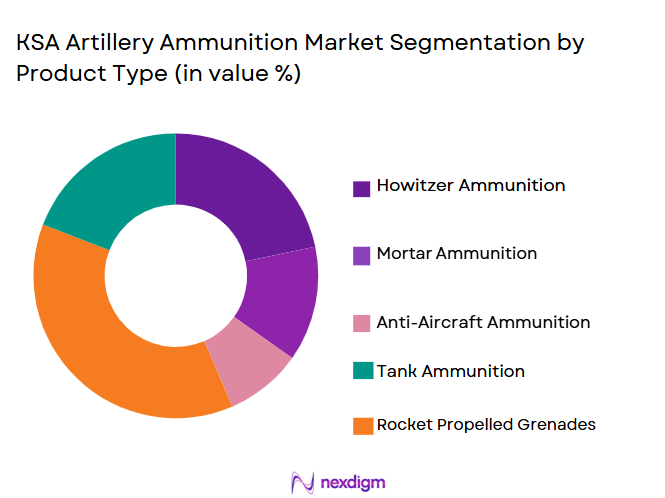

By Product Type

KSA artillery ammunition market is segmented by product type into high explosive, guided, smoke, training, and precision-guided munitions. Recently, high explosive ammunition has a dominant market share due to its broad applicability in various military operations, such as suppression, fire support, and destruction of enemy targets. This sub-segment is heavily driven by its versatility, availability, and the extensive use of high explosive rounds in artillery units across the Kingdom. High explosive ammunition continues to be favored for its operational efficiency and effectiveness in achieving strategic objectives, particularly in counter-insurgency and conventional warfare scenarios.

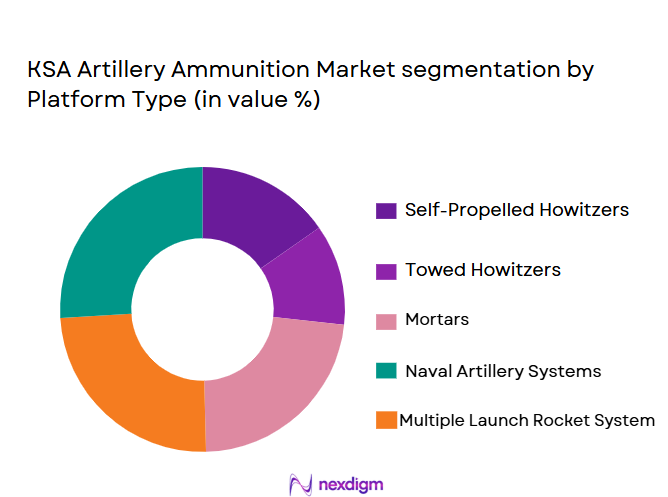

By Platform Type

The KSA artillery ammunition market is segmented by platform type into towed artillery systems, self-propelled artillery systems, field guns, howitzers, and mortars. Self-propelled artillery systems dominate the market share due to their mobility, firepower, and advanced targeting systems that enhance the effectiveness of artillery units. These systems are essential for rapid deployment and flexibility in the field, which is crucial in modern warfare and in addressing the evolving defense needs of the Kingdom. The preference for self-propelled artillery stems from the need for enhanced maneuverability and survivability in a highly dynamic combat environment.

Competitive Landscape

The KSA artillery ammunition market is highly competitive, characterized by consolidation and significant involvement of both local and international defense companies. Major players in the market influence technological innovation, supply chain strategies, and long-term defense contracts. As the Kingdom continues to modernize its defense capabilities, these players collaborate with government entities, shaping the landscape and contributing to market growth. Leading defense contractors focus on enhancing their product portfolios and expanding their technological edge to meet the Kingdom’s ever-growing defense demands.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue |

| Lockheed Martin | 1912 | USA | ~ | ~ | ~ | ~ |

| BAE Systems | 1999 | UK | ~ | ~ | ~ | ~ |

| Rheinmetall AG | 1889 | Germany | ~ | ~ | ~ | ~ |

| Northrop Grumman | 1939 | USA | ~ | ~ | ~ | ~ |

| Thales Group | 2000 | France | ~ | ~ | ~ | ~ |

KSA artillery ammunition Market Analysis

Growth Drivers

Increasing Defense Budgets

The Kingdom of Saudi Arabia has significantly increased its defense budget in recent years to modernize its military capabilities, with a focus on enhancing artillery systems and ammunition. This budget expansion enables the purchase of advanced artillery ammunition and systems, driving demand for products that can be deployed in a variety of military operations. The substantial investments also facilitate R&D efforts to improve ammunition technology, ensuring that the Kingdom remains capable of responding to both conventional and asymmetric threats. Furthermore, the geopolitical situation in the Middle East necessitates a strong military presence, prompting the Saudi government to prioritize defense procurement. These factors collectively make increasing defense budgets a major growth driver for the artillery ammunition market in Saudi Arabia.

Geopolitical Tensions in the Region

The volatile geopolitical climate in the Middle East, particularly with neighboring countries and regional conflicts, further accelerates the demand for artillery ammunition. Saudi Arabia’s role in various regional security initiatives, including those in Yemen and its involvement in the Gulf Cooperation Council, has necessitated the continuous development and procurement of artillery systems. The need for quick-response artillery units to ensure national and regional security contributes to the growth of the market. Artillery ammunition, such as high explosive and precision-guided munitions, plays a critical role in enhancing the Kingdom’s defense posture in such environments. These factors make geopolitical tensions a key growth driver for the Saudi artillery ammunition market.

Market Challenges

High Manufacturing Costs

The cost of manufacturing artillery ammunition is a significant challenge in the Saudi market, as it involves advanced technology and specialized materials. The high cost of raw materials such as explosives, metals, and advanced components for guidance systems increases the overall production expenses. Additionally, the complexity of manufacturing precision-guided munitions and other advanced ammunition types further escalates costs. While the demand for these products remains high, the rising production costs may limit the ability of local manufacturers to scale operations or pass on savings to the defense ministry. This challenge is compounded by global supply chain disruptions, which affect the timely delivery of key materials and components. Manufacturers must address these cost pressures while maintaining product quality and meeting the Kingdom’s defense needs.

Regulatory Barriers and Export Restrictions

Regulatory barriers and export restrictions in the global defense market can pose challenges to the Saudi artillery ammunition market. International arms control agreements and compliance with United Nations regulations may restrict the ability of manufacturers to source materials or export ammunition to certain countries. These regulations can limit market access for foreign defense contractors seeking to expand in the Saudi market. Moreover, the complex and evolving nature of international arms trade agreements adds to the difficulty of navigating the regulatory environment, making it a challenge for companies seeking to enter or grow in the region. The influence of these regulatory hurdles on market dynamics cannot be understated as they complicate the procurement and distribution processes for artillery ammunition.

Opportunities

Emerging Demand for Precision-Guided Munitions

As military operations become more complex and the need for precision targeting increases, the demand for precision-guided munitions (PGMs) is expected to rise. These munitions, which provide greater accuracy and effectiveness on the battlefield, are seen as a critical asset for modern armies. Saudi Arabia’s emphasis on upgrading its defense capabilities, including artillery systems, provides an opportunity for manufacturers to expand their offerings in the PGM segment. The Kingdom’s increasing focus on advanced weaponry, combined with its strategic alliances with international defense contractors, creates a significant opportunity for companies involved in the production of PGMs. The use of PGMs can enhance operational efficiency, reduce collateral damage, and support more targeted military strategies.

Investment in Domestic Defense Manufacturing

Saudi Arabia’s Vision 2030 initiative aims to strengthen the local defense manufacturing sector, offering opportunities for domestic and international companies to collaborate in the production of artillery ammunition. By focusing on local production capabilities, the Kingdom seeks to reduce its reliance on foreign suppliers and foster greater self-sufficiency in its defense sector. This shift presents a significant opportunity for companies involved in defense manufacturing, as they can partner with the government to establish local production facilities and participate in joint ventures. The push for local manufacturing also includes investments in technology transfer and capacity building, which can further boost the growth of the artillery ammunition market in the Kingdom.

Future Outlook

The future outlook for the KSA artillery ammunition market is positive, with steady growth anticipated over the next five years. Key factors include continued government investment in defense and modernization, technological advancements in artillery systems and ammunition, and a focus on improving operational efficiency. Additionally, regulatory support and the Kingdom’s ongoing efforts to strengthen its defense partnerships with international allies will contribute to the market’s expansion. As defense budgets continue to rise and the demand for advanced artillery systems increases, the market is poised for sustained growth.

Major Players

- Lockheed Martin

- BAE Systems

- Rheinmetall AG

- Northrop Grumman

- Thales Group

- General Dynamics

- L3 Technologies

- Boeing Defense

- Hanwha Defense

- Saab AB

- FN Herstal

- Leonardo

- Kongsberg Gruppen

- Nammo AS

- Raytheon Technologies

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Defense contractors

- Military procurement agencies

- Arms manufacturers

- Defense technology companies

- Aerospace and defense ministries

- Defense research organizations

Research Methodology

Step 1: Identification of Key Variables

Key variables such as market trends, government spending, and geopolitical factors are identified to understand market dynamics and growth drivers.

Step 2: Market Analysis and Construction

Data from primary and secondary sources is analyzed to construct the market size, segmentation, and forecast.

Step 3: Hypothesis Validation and Expert Consultation

Insights from industry experts, consultants, and government officials are integrated to validate hypotheses and refine the analysis.

Step 4: Research Synthesis and Final Output

The findings are synthesized into a comprehensive market report, outlining key insights, forecasts, and strategic recommendations.

- Executive Summary

- KSA Artillery Ammunition Research Methodology

(Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increasing Defense Budgets

Technological Advancements in Ammunition

Strategic Geopolitical Importance of the Region - Market Challenges

High Manufacturing Costs

Import-Export Regulatory Barriers

Shortage of Skilled Workforce - Market Opportunities

Emerging Demand from Neighboring Countries

Rising Investments in Military R&D

Collaborations Between Local and Global Defense Entities - Trends

Adoption of Smart and Guided Ammunition

Shift Towards Modular Ammunition Systems

Growing Use of Simulation and Training Ammunition - Government Regulations & Defense Policy

Impact of Regional Security Dynamics

Government Investment in Domestic Production

International Arms Control Regulations - SWOT Analysis (Capability Strengths, Cost Vulnerabilities, Competitive Pressures)

- Porter’s Five Forces (Procurement Power, Supplier Concentration, Substitutes, Barriers to Entry)

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

High Explosive Ammunition

Guided Ammunition

Smoke and Obscurant Ammunition

Training Ammunition

Precision-Guided Munitions - By Platform Type (In Value%)

Towed Artillery Systems

Self-Propelled Artillery Systems

Field Guns

Howitzers

Mortars - By Fitment Type (In Value%)

Standard Fitment

Aftermarket Fitment

OEM Fitment

Custom Fitment

Retrofit Fitment - By EndUser Segment (In Value%)

Armed Forces

Defense Contractors

Governmental Agencies

Private Security Companies

Foreign Military Sales - By Procurement Channel (In Value%)

Direct Purchase from Manufacturers

Government Tenders

Third-Party Distributors

B2B Marketplaces

International Defense Auctions

- Market Share Analysis

- Cross Comparison Parameters

(Market Value, Growth Rate, Product Portfolio, Market Penetration, R&D Investment) - SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

Lockheed Martin

BAE Systems

Rheinmetall AG

Elbit Systems

Northrop Grumman

Thales Group

General Dynamics

L3 Technologies

Boeing Defense

Hanwha Defense

Saab AB

FN Herstal

Leonardo

Kongsberg Gruppen

Nammo AS

- Strategic Military Investments by Government

- Focus on Enhancing Artillery Precision

- Increased Collaboration with International Defense Forces

- Growing Domestic Defense Manufacturing Capabilities

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035