Market Overview

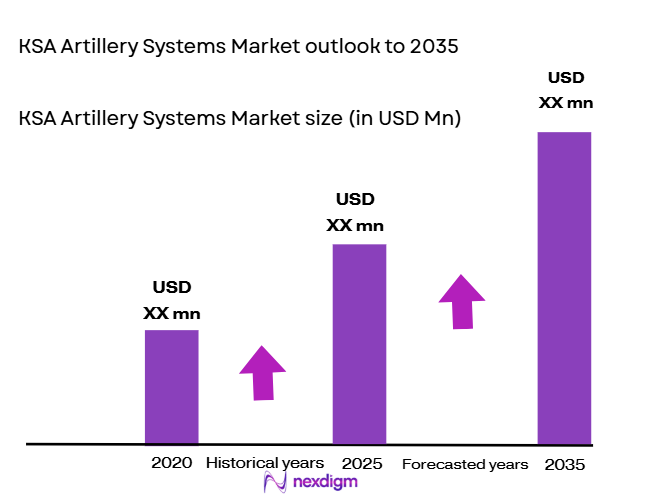

The KSA artillery systems market is projected to experience steady growth, driven by the increasing defense budgets and the country’s strategic focus on enhancing military capabilities. Based on a recent historical assessment, the market size is valued at USD ~ billion, fueled by the modernization of defense systems and the demand for advanced artillery technologies. Government initiatives and collaborations with international suppliers contribute to market expansion, with a rising need for self-propelled artillery systems and advanced ammunition technologies.

Dominance in the KSA artillery systems market is largely attributed to the government’s substantial investments in defense infrastructure and procurement. Key regions such as Riyadh, Jeddah, and Dammam, with their strategic locations, remain central to defense operations. Moreover, these regions benefit from a well-established military presence and continued investments in defense modernization. Regional security concerns and geopolitical positioning further solidify the market’s strength in the country, with the defense sector playing a critical role in national security strategies.

Market Segmentation

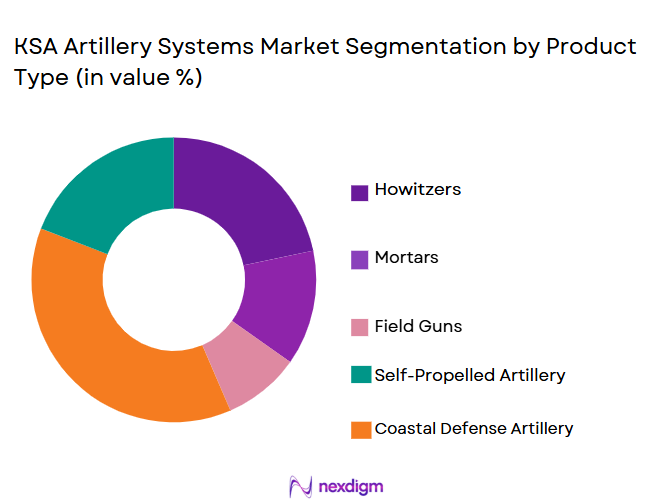

By Product Type

KSA artillery systems market is segmented by product type into self-propelled howitzers, towed howitzers, rocket artillery systems, gun and mortar systems, and advanced ammunition technologies. Recently, self-propelled howitzers have a dominant market share due to factors such as increased mobility, enhanced firepower, and superior tactical advantage, which are crucial in modern warfare. Additionally, the integration of automation and precision targeting technology in self-propelled systems further boosts their demand in the Saudi Arabian defense sector. The product’s versatility in varied combat situations and ongoing procurement by the Saudi Arabian military plays a key role in their market dominance.

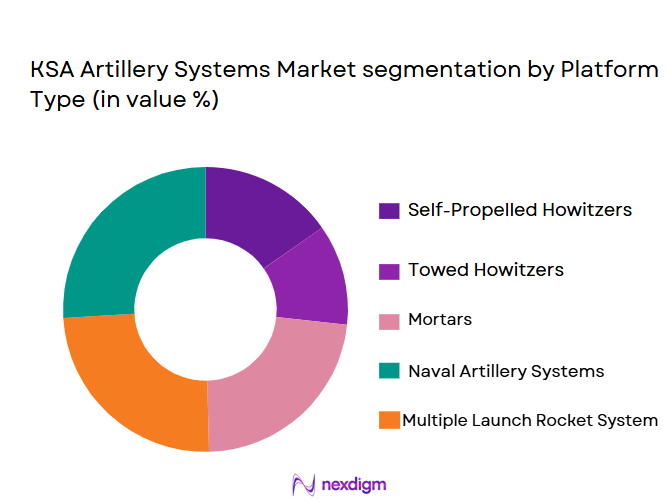

By Platform Type

The KSA artillery systems market is segmented by platform type into land platforms, naval platforms, aerial platforms, integrated defense platforms, and mobile systems. Among these, land platforms hold a significant market share, driven by the country’s focus on ground-based defense strategies. The need for ground mobility, ease of deployment, and compatibility with other land-based military technologies are contributing factors to this dominance. Additionally, the high demand for artillery systems that provide both offensive and defensive capabilities in land-based combat scenarios further strengthens the position of land platforms in the market.

Competitive Landscape

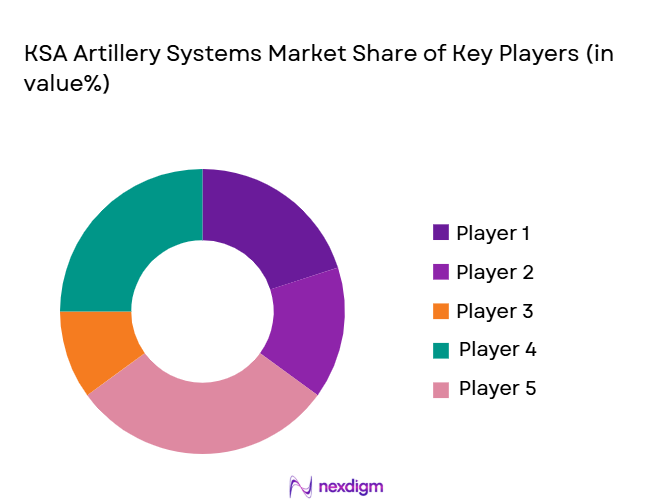

The KSA artillery systems market features a competitive landscape dominated by international players and a few domestic suppliers. Consolidation has been observed as larger defense corporations collaborate with the Saudi government to meet defense demands. With a high emphasis on technological advancements, companies are focusing on providing highly mobile, precision-driven artillery systems. Major players influence the market through cutting-edge technology, strategic partnerships, and long-term defense contracts with the government.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue (USD) | R&D Investment |

| General Dynamics | 1952 | USA | ~ | ~ | ~ | ~ | ~ |

| BAE Systems | 1999 | UK | ~ | ~ | ~ | ~ | ~ |

| Lockheed Martin | 1912 | USA | ~ | ~ | ~ | ~ | ~ |

| Thales Group | 2000 | France | ~ | ~ | ~ | ~ | ~ |

| Rheinmetall | 1889 | Germany | ~ | ~ | ~ | ~ | ~ |

KSA artillery systems Market Analysis

Growth Drivers

Increased Defense Budget Allocation

The growing defense budget allocation by the Saudi government plays a crucial role in driving the KSA artillery systems market. With ongoing security concerns in the Middle East, the Kingdom has been enhancing its defense capabilities to ensure national security. This surge in defense spending is being channeled into the acquisition and modernization of artillery systems. These systems are crucial for border defense, counterinsurgency, and maintaining a military advantage in potential regional conflicts. As part of the Vision 2030 initiative, the Saudi government is focusing on reducing dependence on foreign military systems and bolstering local production capacities. As a result, domestic defense companies have expanded their R&D initiatives to develop advanced artillery technologies tailored to the Kingdom’s needs. Furthermore, the government’s strategic focus on military independence ensures sustained investments in the defense sector, directly benefiting the artillery market.

Technological Advancements and Precision Targeting

Technological advancements, particularly in precision-guided artillery systems, are revolutionizing the KSA artillery systems market. The integration of automated targeting and fire control systems has enabled artillery units to strike more accurately at greater distances, significantly improving the effectiveness of artillery in combat situations. Additionally, the trend of incorporating AI and machine learning into artillery systems has led to better data analytics, situational awareness, and tactical decision-making in real-time operations. The demand for highly advanced, self-propelled artillery units that can be deployed quickly on the ground is also driving this growth. These innovations in technology not only improve the overall capability of the Saudi military but also ensure that the Kingdom’s artillery systems remain competitive and capable of responding to modern warfare dynamics. The rapid advancements in these areas have positioned KSA as a leader in artillery technology within the region, further accelerating market growth.

Market Challenges

High Operational Costs of Artillery Systems

A significant challenge faced by the KSA artillery systems market is the high operational costs associated with advanced artillery systems. The initial procurement cost of artillery units is substantial, and the ongoing maintenance and repair costs add an additional financial burden. The complexity of advanced systems, such as self-propelled artillery and rocket artillery, often requires specialized personnel for operation and maintenance, further raising costs. Despite the Kingdom’s large defense budget, these costs can strain the resources available for other military needs. Moreover, the high cost of procuring spare parts, ammunition, and the need for frequent upgrades to keep pace with technological advancements contribute to the challenge. As KSA continues to modernize its defense infrastructure, ensuring that operational costs are manageable remains a critical issue for the defense sector.

Dependency on Foreign Suppliers

Another challenge facing the KSA artillery systems market is the dependency on foreign suppliers for advanced artillery technologies. Despite efforts to localize production through partnerships with international manufacturers, the Kingdom’s reliance on foreign technologies remains high. This dependency creates vulnerabilities in the supply chain, especially in times of geopolitical tensions or trade restrictions. Additionally, the limited domestic manufacturing capabilities for certain advanced artillery systems and components hinder the ability to fully capitalize on indigenous defense production. To mitigate this, the Saudi government has been working on enhancing local production capabilities, but the pace of progress has been slow. This challenge is compounded by the complexity of modern artillery systems, which require cutting-edge research and development, something that cannot be easily replicated locally in a short period.

Opportunities

Emerging Regional Demand for Advanced Artillery Systems

An opportunity for growth in the KSA artillery systems market lies in the increasing demand for advanced artillery systems across the Middle East and North Africa (MENA) region. Several countries in the region are investing heavily in defense infrastructure, following similar modernization strategies as Saudi Arabia. As regional security threats escalate, these nations require sophisticated artillery systems to ensure their military readiness. This growing demand for advanced artillery presents a significant opportunity for both domestic and international suppliers to tap into the MENA market. Saudi Arabia, with its established defense sector and strategic alliances, is poised to benefit from this opportunity by exporting its locally manufactured artillery systems to neighboring countries. This regional expansion not only boosts the Saudi defense sector but also enhances its influence in the global defense market.

Technological Integration in Smart Defense Systems

The integration of smart technologies in artillery systems offers a unique opportunity for the KSA market. By incorporating artificial intelligence, machine learning, and sensor technologies, Saudi Arabia’s defense forces can enhance their artillery systems’ precision and operational effectiveness. This integration will allow for more efficient targeting, better battlefield awareness, and improved decision-making in real-time combat situations. Additionally, these smart systems enable a higher degree of automation, reducing the human resource requirement for operating complex artillery units. As defense technologies continue to evolve, KSA has the opportunity to become a leader in the development and deployment of smart artillery systems, thus strengthening its military capabilities. With a growing focus on cybersecurity and defense digitalization, the integration of smart technologies into artillery systems also opens up new avenues for R&D and innovation in the Kingdom’s defense sector.

Future Outlook

The future outlook of the KSA artillery systems market is optimistic, with continued investments in advanced technologies and modernization efforts. Over the next five years, growth is expected to be driven by the increasing demand for self-propelled artillery and rocket artillery systems, as well as the integration of smart technologies in defense systems. Technological advancements, particularly in precision targeting and automation, will play a key role in enhancing operational effectiveness. Additionally, the strategic alliances and defense partnerships that Saudi Arabia maintains with international suppliers will continue to strengthen the market. The government’s commitment to Vision 2030, which emphasizes national defense modernization, will provide sustained support to the artillery systems market, ensuring continued growth and development.

Major Players

• BAE Systems

• Lockheed Martin

• Thales Group

• Rheinmetall

• Hanwha Defense

• KMW (Krauss-Maffei Wegmann)

• Elbit Systems

• Raytheon Technologies

• Northrop Grumman

• Leonardo

• MBDA

• Saab Group

• Oshkosh Corporation

• L3 Technologies

Key Target Audience

• Government and regulatory bodies

• Defense contractors

• Military forces

• OEMs (Original Equipment Manufacturers)

• Research and development agencies

• International defense suppliers

• Military equipment distributors

Research Methodology

Step 1: Identification of Key Variables

The first step involves identifying the critical factors influencing the KSA artillery systems market, including technological advancements, defense budget allocation, and geopolitical factors.

Step 2: Market Analysis and Construction

Market analysis involves assessing the current state of the artillery systems market, focusing on major trends, challenges, and growth opportunities within the Saudi defense sector.

Step 3: Hypothesis Validation and Expert Consultation

This step includes validating hypotheses through consultation with defense industry experts, government officials, and key market players to refine insights.

Step 4: Research Synthesis and Final Output

The final step involves synthesizing research findings into a comprehensive report, drawing conclusions and providing actionable insights for stakeholders in the KSA artillery systems market.

- Executive Summary

- KSA Artillery Systems Research Methodology

(Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increased defense budgets and modernization efforts

Strategic geographical location influencing military procurement

Collaborations and alliances with international defense suppliers - Market Challenges

Technological integration and obsolescence risk

High cost of advanced artillery systems

Logistics and supply chain constraints - Market Opportunities

Emerging markets demand for advanced artillery systems

Technological advancements in guided artillery systems

Increasing regional security concerns driving defense investments - Trends

Shift towards networked and autonomous artillery systems

Integration of AI and machine learning in artillery targeting

Adoption of lighter, more mobile artillery platforms - Government Regulations & Defense Policy

Strict regulatory compliance on arms exports

Government-led defense modernization initiatives

Enhanced focus on sustainable defense procurement practices - SWOT Analysis (Capability Strengths, Cost Vulnerabilities, Competitive Pressures)

Porter’s Five Forces (Procurement Power, Supplier Concentration, Substitutes, Barriers to Entry)

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Self-propelled Howitzers

Towed Howitzers

Gun and Mortar Systems

Rocket Artillery Systems

Advanced Ammunition Technologies - By Platform Type (In Value%)

Land Platforms

Naval Platforms

Aerial Platforms

Integrated Defense Platforms

Mobile Systems - By Fitment Type (In Value%)

Mobile Mounted Systems

Integrated Artillery Systems

Remote-Controlled Systems

Manual Fitment Systems

Modular Artillery Systems - By EndUser Segment (In Value%)

Military Forces

Private Defense Contractors

Government Defense Bodies

Research & Development Agencies

OEMs (Original Equipment Manufacturers) - By Procurement Channel (In Value%)

Direct Government Purchases

Private Sector Procurement

International Defense Exports

Tenders & Bidding Processes

Public-Private Partnerships

- Market Share Analysis

- Cross Comparison Parameters

(Market Value, Installed Units, System Complexity, Procurement Channels, Platform Types) - SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

General Dynamics

BAE Systems

Lockheed Martin

Thales Group

Northrop Grumman

Elbit Systems

Raytheon Technologies

Rheinmetall

KMW (Krauss-Maffei Wegmann)

Hanon Systems

Artillery Systems Inc.

Shaanxi Baocheng Defense Technology

Hanwha Defense

ST Kinetics

Saab Group

- Military Forces leading modernization and procurement

- Private defense contractors increasing system development

- Government defense bodies pushing for regional defense strength

- OEMs focusing on increasing technological capabilities and collaborations

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035