Market Overview

KSA Automated Data Analysis Solutions Market is valued at USD ~ million. The market reflects the Kingdom’s accelerating shift from descriptive reporting toward automated, intelligence-led decision systems across government and large enterprises. Structural demand is driven by exponential growth in enterprise data volumes, limited availability of advanced analytics talent, and the need to compress decision timelines across regulated and mission-critical operations. Automated data analysis platforms reduce dependency on manual modeling, enable faster insight generation, and embed analytics directly into operational workflows. Demand is further reinforced by national digital transformation programs, cloud-first enterprise IT strategies, and rising complexity in compliance, risk monitoring, and service performance management. As organizations transition from dashboard-centric analytics to automated insight engines, these solutions are increasingly positioned as core digital infrastructure rather than discretionary analytics tools.

Within KSA, demand is concentrated in major economic and administrative hubs where large-scale enterprises, government ministries, and regulated industries operate at high data intensity. These regions dominate adoption due to their concentration of cloud infrastructure, advanced digital maturity, and higher regulatory reporting requirements. Global technology ecosystems influence the market through platform innovation, AI model development, and cloud-native analytics architectures, shaping solution capabilities deployed locally. International vendors play a critical role by providing scalable automation frameworks, advanced machine learning engines, and security-aligned analytics platforms that align with KSA’s digital transformation priorities and enterprise-scale requirements.

Market Segmentation

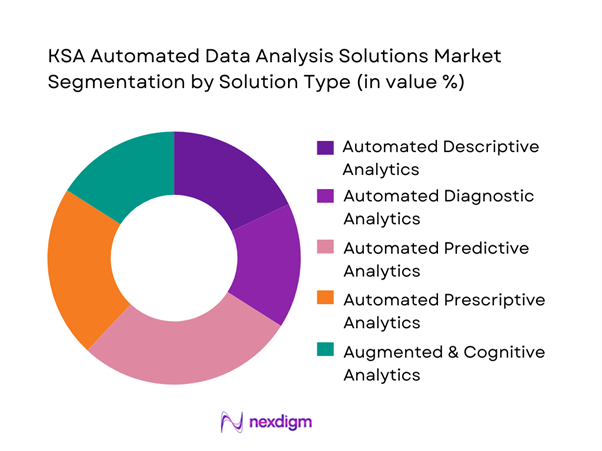

By Solution Type

The KSA Automated Data Analysis Solutions market is segmented into automated descriptive analytics, automated diagnostic analytics, automated predictive analytics, automated prescriptive analytics, and augmented & cognitive analytics. Among these, automated predictive and prescriptive analytics dominate market share due to their direct linkage with decision automation and ROI generation. Enterprises increasingly prioritize predictive insights to anticipate operational risks, customer behavior, and financial anomalies, while prescriptive analytics enables automated recommendations and actions. Government entities and BFSI institutions heavily deploy these solutions for fraud detection, forecasting, and policy modeling, supported by AI-driven rule engines and machine learning workflows embedded within analytics platforms.

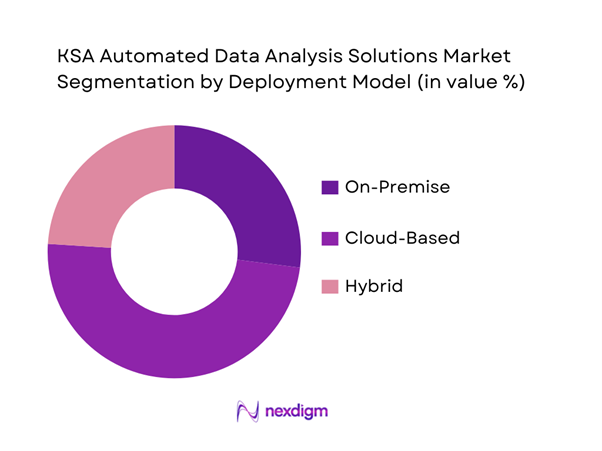

By Deployment Model

The market is segmented into on-premise, cloud-based, and hybrid solutions. Cloud-based deployment holds the dominant market share, driven by national cloud-first policies, scalability requirements, and lower infrastructure ownership costs. Cloud analytics platforms enable faster deployment, elastic compute scaling, and seamless AI model integration, making them attractive to both government and private enterprises. Hybrid models are growing in regulated industries where sensitive workloads remain on-premise while advanced analytics and visualization operate on cloud layers.

Competitive Landscape

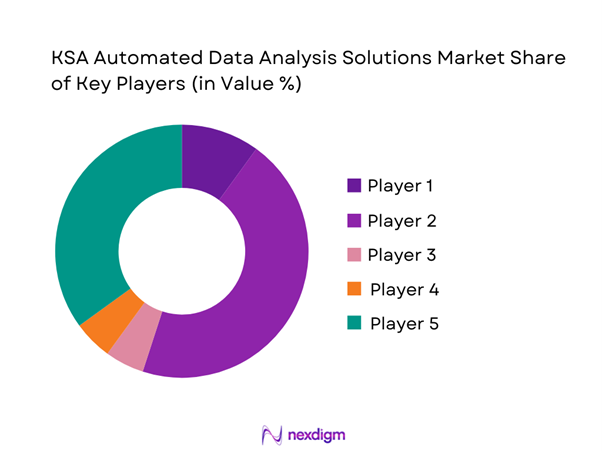

The KSA Automated Data Analysis Solutions market is dominated by a few major players, including SAS Institute and global or regional brands like IBM, Microsoft, Oracle, and SAP. This consolidation highlights the significant influence of these key companies.

| Company | Establishment Year | Headquarters | Deployment Model Support | AI/ML Integration | Industry Coverage | Pricing Flexibility | Data Security Compliance | Local Partnerships |

| IBM | 1911 | USA | ~ | ~ | ~ | ~ | ~ | ~ |

| Microsoft | 1975 | USA | ~ | ~ | ~ | ~ | ~ | ~ |

| SAP | 1972 | Germany | ~ | ~ | ~ | ~ | ~ | ~ |

| Oracle | 1977 | USA | ~ | ~ | ~ | ~ | ~ | ~ |

| SAS Institute | 1976 | USA | ~ | ~ | ~ | ~ | ~ | ~ |

KSA Automated Data Analysis Solutions Market Analysis

Growth Drivers

Vision-Aligned Digital Transformation Mandates

National digital transformation initiatives act as a primary growth engine for automated data analysis adoption across KSA. Public-sector entities and large enterprises are under sustained pressure to improve operational transparency, performance monitoring, and evidence-based decision-making at scale. Automated analytics platforms enable ministries and enterprises to convert fragmented operational data into continuous insights without relying on manual reporting cycles. This automation supports real-time performance tracking, early risk identification, and faster policy or operational adjustments. As digital platforms proliferate across healthcare, finance, utilities, and public services, data volumes exceed the capacity of traditional analytics teams. Automated solutions therefore become essential enablers of governance efficiency, operational resilience, and executive-level decision acceleration, reinforcing their role as strategic digital infrastructure.

Cloud-Native Enterprise Migration

The accelerating migration of enterprise workloads to cloud environments significantly strengthens demand for automated data analysis solutions. Cloud architectures enable scalable data ingestion, elastic compute, and centralized analytics orchestration, which are foundational for automation-driven analytics. Organizations increasingly prioritize platforms that integrate seamlessly with cloud data lakes, SaaS applications, and hybrid infrastructures. Automated analytics tools reduce complexity by abstracting data engineering and model development tasks, allowing enterprises to operationalize analytics faster in cloud-first environments. This alignment between cloud adoption and analytics automation lowers deployment friction, shortens implementation timelines, and improves return on digital investments, making automated data analysis a natural extension of enterprise cloud transformation strategies.

Challenge

Legacy System Fragmentation

Legacy system fragmentation remains a structural barrier to widespread automation. Many KSA enterprises operate heterogeneous IT environments built over extended periods, with siloed databases, inconsistent data standards, and limited interoperability. Automated analytics solutions rely on unified data pipelines and standardized metadata to function effectively. Fragmentation increases integration effort, delays value realization, and restricts automation scope. Organizations often must invest in data architecture modernization before achieving full automation benefits, slowing adoption and increasing implementation risk. This challenge is particularly acute in large public-sector and industrial organizations where mission-critical legacy systems cannot be easily replaced.

Model Explainability and Governance Constraints

Automated analytics solutions increasingly rely on advanced machine learning models that create explainability and governance challenges. Decision-makers in regulated sectors require transparency into how insights and recommendations are generated, particularly where outcomes affect financial risk, public services, or compliance obligations. Limited interpretability can reduce trust in automated outputs and constrain deployment in high-stakes decision environments. Organizations must balance automation efficiency with governance frameworks that ensure accountability, auditability, and regulatory alignment. Without clear explainability mechanisms, adoption may remain confined to low-risk analytical use cases.

Opportunity

Sector-Specific Analytics Accelerators

Significant opportunity exists for sector-specific automated analytics accelerators tailored to government, banking, healthcare, and energy use cases. Pre-configured data models, regulatory logic, and performance frameworks reduce deployment time and improve relevance. Enterprises increasingly favor solutions that embed domain intelligence rather than generic analytics platforms requiring extensive customization. Vendors that align automation capabilities with sector workflows and compliance requirements can differentiate strongly in the KSA market. This approach also lowers adoption barriers by enabling faster time-to-insight and reducing reliance on scarce analytics talent.

Arabic-Language and Executive-Facing Automation

Arabic-language analytics automation represents a critical growth opportunity. Platforms that support Arabic natural language querying, automated narrative insights, and executive-ready outputs expand analytics accessibility beyond technical teams. This capability enhances adoption among senior leadership and operational managers, accelerating enterprise-wide analytics usage. By aligning automation with local language and decision culture, vendors can significantly improve engagement, insight consumption, and perceived value, strengthening long-term platform stickiness in the KSA market.

Future Outlook

The KSA automated data analysis solutions market will evolve toward deeper automation, tighter integration with enterprise systems, and increased emphasis on explainable and governed AI. Vendors that combine automation with sector alignment, local compliance, and user-centric design will strengthen their market positioning. Analytics will increasingly be embedded directly into operational workflows, transforming automated insight generation into a standard enterprise capability rather than a standalone analytical function.

Major Players

- SAS Institute

- IBM

- Microsoft

- Oracle

- SAP

- Google Cloud

- AWS

- Qlik

- Tableau

- Alteryx

- DataRobot

- TIBCO Software

- MicroStrategy

Key Target Audience

- Government ministries and public sector agencies

- Banking and financial institutions

- Healthcare providers and payers

- Energy and utilities enterprises

- Large enterprises and conglomerates

- System integrators and technology consultants

- Investments and venture capitalist firms

- Government and regulatory bodies (KSA-specific)

Research Methodology

Step 1: Identification of Key Variables

Key variables include automation scope, deployment models, end-use industry adoption, technology maturity, and regulatory alignment. Market definitions and boundaries were established to ensure topic precision.

Step 2: Market Analysis and Construction

Historical trends, deployment patterns, and usage models were analyzed to construct market structure and segmentation logic. Emphasis was placed on automation depth and enterprise applicability.

Step 3: Hypothesis Validation and Expert Consultation

Findings were validated through expert interviews with technology providers, system integrators, and enterprise analytics leaders to ensure relevance and accuracy.

Step 4: Research Synthesis and Final Output

Insights were synthesized into a structured narrative, aligning quantitative frameworks with qualitative analysis to deliver a client-ready market assessment.

- Executive Summary

- Research Methodology (Market Definitions and Inclusions/Exclusions, Abbreviations, Topic-Specific Taxonomy, Market Sizing Framework, Revenue Attribution Logic Across Use Cases or Care Settings, Primary Interview Program Design, Data Triangulation and Validation, Limitations and Data Gaps)

- Definition and Scope

- Market Genesis and Evolution

- Automated Analytics Usage and Value-Chain Mapping

- Business Cycle and Demand Seasonality

- KSA Industry and Digital Service Delivery Architecture

- Growth Drivers

Vision-aligned digital transformation mandates

Data volume acceleration across regulated sectors

Cloud-native enterprise migration

AI talent productivity constraints

Executive demand for real-time decisioning

Compliance-driven analytics automation - Challenges

Legacy system fragmentation

Data residency and governance constraints

Model explainability and trust gaps

Skills shortages in advanced analytics

Integration complexity across vendors

Change management resistance - Opportunities

Sector-specific analytics accelerators

Arabic-language analytics enablement

Automation of regulatory reporting

Analytics-as-a-service adoption

GenAI-augmented decision intelligence

Mid-market enterprise penetration - Trends

No-code and low-code analytics platforms

Natural language-driven insight discovery

Embedded analytics in core systems

Convergence of BI and data science

Operationalization of AutoML

Responsible AI frameworks - Regulatory & Policy Landscape

- SWOT Analysis

- Stakeholder & Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competitive Intensity & Ecosystem Mapping

- By Value, 2019–2024

- By Deployment Spend, 2019–2024

- By Enterprise Analytics Budget Allocation, 2019–2024

- By Analytics Function Type (in Value %)

Descriptive analytics automation

Diagnostic analytics automation

Predictive analytics automation

Prescriptive analytics automation

Real-time streaming analytics automation - By Data Source Type (in Value %)

Enterprise structured data

Semi-structured operational data

Unstructured text and document data

IoT and machine data

External third-party data - By Technology / Product / Platform Type (in Value %)

AutoML platforms

Augmented analytics platforms

Decision intelligence platforms

Embedded analytics solutions

Natural language query analytics - By Deployment / Delivery / Distribution Model (in Value %)

On-premise

Private cloud

Public cloud

Hybrid cloud - By End-Use Industry / Customer Type (in Value %)

Government and public sector

Banking and financial services

Healthcare providers and payers

Energy and utilities

Retail and e-commerce

Telecommunications - By Region (in Value %)

Riyadh Region

Makkah Region

Eastern Province

Madinah Region

Other Regions

- Competition ecosystem overview

- Cross Comparison Parameters (platform automation depth, model governance capability, cloud compatibility, local data residency support, Arabic language analytics, integration with ERP/CRM, pricing flexibility, industry-specific accelerators)

- SWOT analysis of major players

- Pricing and commercial model benchmarking

- Detailed Profiles of Major Companies

SAS Institute

IBM

Microsoft

Oracle

SAP

Google Cloud

AWS

Qlik

Tableau

Alteryx

DataRobot

TIBCO Software

MicroStrategy

Informatica

Palantir

- Buyer personas and decision-making units

- Procurement and contracting workflows

- KPIs used for evaluation

- Pain points and adoption barriers

- By Value, 2025–2030

- By Deployment Spend, 2025–2030

- By Enterprise Analytics Budget Allocation, 2025–2030