Market Overview

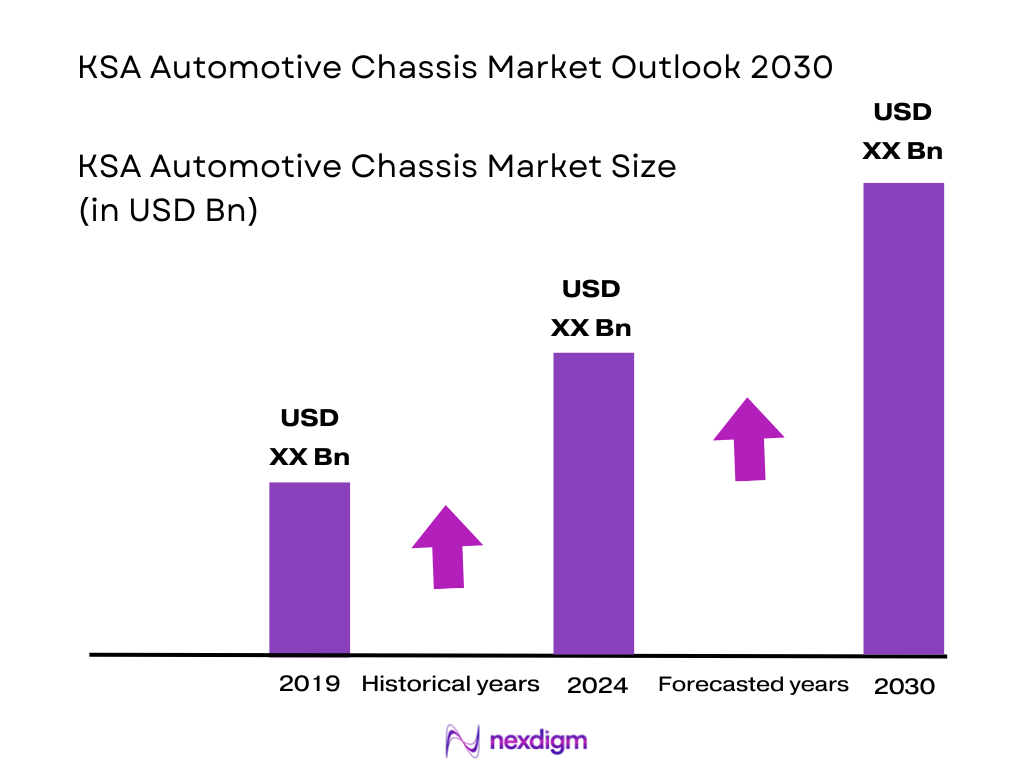

The KSA Automotive Chassis market is a significant component of the Saudi automotive industry, valued at USD ~ billion. The market’s growth is primarily driven by the increase in vehicle production, supported by the Kingdom’s Vision 2030 industrialization plans, which emphasize local manufacturing of vehicles and auto parts. The growing demand for lightweight, durable, and cost-efficient chassis systems, especially with the rise of electric vehicles (EVs) and commercial transport infrastructure, contributes to the expansion. The Kingdom’s push for more localized automotive production, as well as increasing foreign investments, is further propelling the market’s expansion, making it a crucial area of focus for both local manufacturers and international suppliers.

In the KSA Automotive Chassis market, Riyadh, Jeddah, and Dammam dominate the sector. Riyadh leads due to its strategic position as the political and industrial hub of Saudi Arabia, with many automotive assembly plants being set up as part of the Kingdom’s diversification strategy. Jeddah, with its port facilities, facilitates the importation of raw materials and components, while Dammam plays a crucial role due to its proximity to the Eastern Province’s petrochemical and manufacturing industries. The dominance of these cities is further bolstered by the government’s initiatives to develop integrated manufacturing hubs and encourage international automotive manufacturers to establish local operations within the region.

Market Segmentation

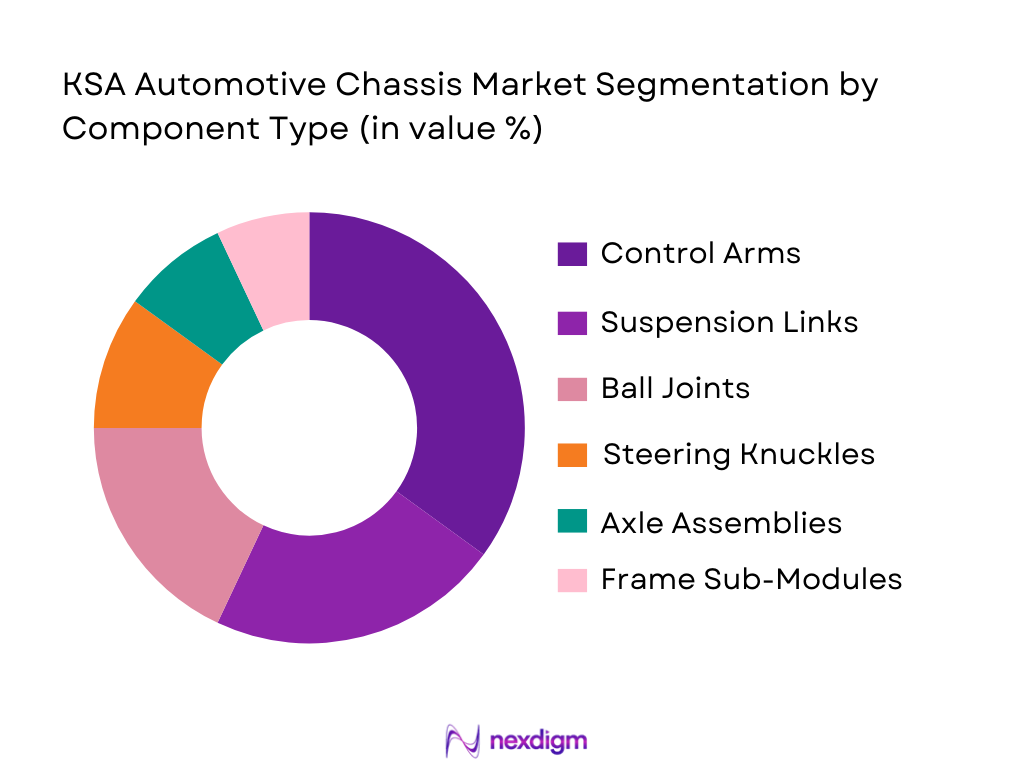

By Component Type

The KSA Automotive Chassis market is segmented by component type into various sub-segments such as control arms, suspension links, ball joints, steering knuckles, axle assemblies, and frame sub-modules. Among these, control arms dominate the market share in 2024. This dominance can be attributed to their essential role in ensuring the stability and handling of vehicles, especially in commercial vehicles and electric vehicles (EVs). The high demand for enhanced ride quality and stability has propelled the market for control arms, which are critical in both passenger and heavy-duty vehicle chassis.

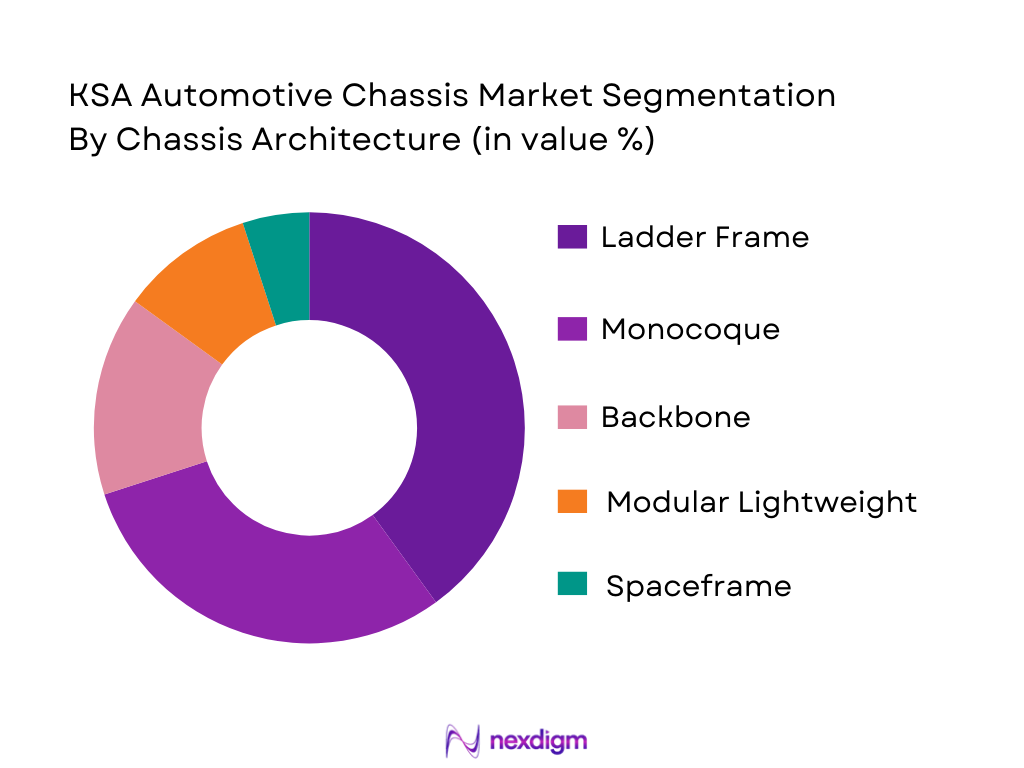

By Chassis Architecture

The market is also segmented by chassis architecture, which includes ladder frame, monocoque, backbone, modular lightweight, and spaceframe chassis types. The ladder frame architecture is the dominant segment in 2024. This is largely because of its widespread use in heavy commercial vehicles and SUVs, which are popular in Saudi Arabia due to the demand for off-road capabilities and durability. The robustness and cost-effectiveness of the ladder frame have made it the preferred choice for a range of vehicle types, further reinforced by its suitability for harsh operating environments.

Competitive Landscape

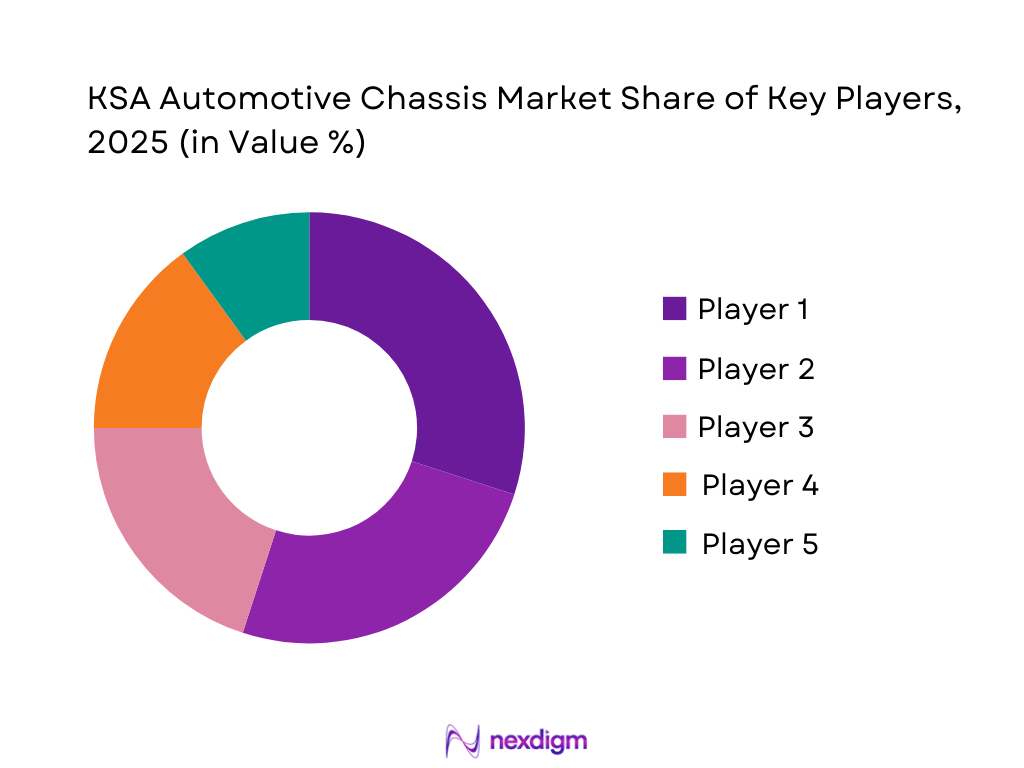

The KSA Automotive Chassis market is dominated by a few major global players, including American Axle & Manufacturing, ZF Friedrichshafen, Continental AG, and Hyundai Mobis. Local players, such as the Saudi Arabian company, Sabic, are also increasingly participating due to the government’s push for local manufacturing under Vision 2030. The competition among these players is primarily based on technological advancements, production capacity, and the ability to provide customized solutions for various vehicle types, especially for electric vehicles (EVs) and commercial fleets.

| Company Name | Establishment Year | Headquarters | Production Capacity | R&D Footprint | OEM Partnerships | Market Positioning |

| American Axle & Manufacturing | 1994 | USA | ~ | ~ | ~ | ~ |

| ZF Friedrichshafen | 1915 | Germany | ~ | ~ | ~ | ~ |

| Continental AG | 1871 | Germany | ~ | ~ | ~ | ~ |

| Hyundai Mobis | 1977 | South Korea | ~ | ~ | ~ | ~ |

| Sabic | 1976 | Saudi Arabia | ~ | ~ | ~ | ~ |

KSA Automotive Chassis Market Analysis

Growth Drivers

Urbanization

Saudi Arabia’s rapid urbanization is a pivotal engine for the automotive chassis market due to concentrated demand for vehicles and structural automotive components. In 2024, approximately ~% of the Kingdom’s population lived in urban areas, reflecting a significant shift from rural living and aggregating consumer transport needs in metropolitan centers such as Riyadh, Jeddah, and Dammam. This high urban residency drives the uptake of passenger and commercial vehicles—each requiring advanced chassis systems—by consolidating household mobility requirements and commercial transport services in densely populated regions. Urban population growth in the Kingdom has also stimulated infrastructure expansion across cities, which enhances mobility networks and increases chassis component replacements and upgrades in both private and fleet segments.

Industrialization

Industrialization in Saudi Arabia has broadened beyond hydrocarbons into vehicle manufacturing and automotive component production, strengthening demand for chassis systems. The manufacturing sector contributed roughly ~% of GDP in 2024 and was worth multi‑billion dollars, reflecting a strategic shift toward local production capabilities rather than reliance on imports. Growth in industrial enterprises, with over ~ factories, showcases a diversification in heavy industry that supports automotive sub‑assembly and chassis system production. Expansion of industrial zones and economic cities has attracted foreign direct investment into manufacturing infrastructure, thereby incentivizing chassis suppliers and OEM Tier‑1 firms to localize chassis production, improve supply chain resilience, and reduce import lead times

Restraints

High Initial Cost

High initial investment requirements pose a restraint on the automotive chassis market in Saudi Arabia, especially for new manufacturing setups. Establishing advanced chassis production facilities requires significant capital outlay for machinery, robotics, and skilled workforce training. For example, automotive assembly plant initiatives such as local EV manufacturing under the Public Investment Fund involve multi‑billion dollar commitments before production can scale, underscoring financial barriers for entrants. In 2024, the non‑oil GDP was a key driver of industrial activity but total GDP growth was moderate at about ~%, indicating fiscal caution in heavy‑capital sectors. This conservative macroeconomic environment constrains rapid chassis industrialization, as companies must allocate substantial resources toward plant setup and technological acquisition while balancing financial performance in other sectors.

Technical Challenges

Technical challenges impede rapid assimilation of cutting‑edge chassis technologies within the Saudi market. Chassis systems increasingly integrate complex materials (e.g., high‑strength steel, aluminum alloys) and smart control systems essential for modern vehicles. However, local production of sophisticated automotive components remains nascent, with major assembly and component manufacturers only recently establishing operations within the Kingdom. The expertise gap in advanced manufacturing techniques and digital engineering limits the speed at which chassis innovations can be localized. Furthermore, the relatively limited number of high‑skilled engineers in automotive systems compared to established global hubs—exacerbated by a still‑developing technical education ecosystem focused on automotive engineering—poses short‑term obstacles in engineering know‑how for chassis design, testing, and production integration.

Opportunities

Technological Advancements

Technological advancements present a strong opportunity for the KSA Automotive Chassis market by enabling higher performance, efficiency, and competitive advantage in global supply chains. Saudi Arabia’s push toward electrification, digital integration, and lightweight materials accelerates demand for next‑generation chassis systems, which are crucial for electric vehicles (EVs) and connected mobility. Notably, the Public Investment Fund and strategic partners aim to develop EV production capacity, including projects targeting hundreds of thousands of vehicles annually through localized facilities. This creates demand for advanced chassis architectures capable of handling battery systems and enhanced safety features. Additionally, the rise of digital engineering tools such as simulation platforms, additive manufacturing, and integrated design software enables chassis parts to be developed with precision and reduced lead times. Leveraging global partnerships in this technology wave will elevate the Kingdom’s capability to produce chassis systems that meet international performance benchmarks, opening opportunities for export as well as domestic supply strengthening.

International Collaborations

International collaborations form a major opportunity by allowing Saudi Arabia to bridge capability gaps, attract foreign investment, and accelerate automotive industrialization. Agreements with global automotive manufacturers and suppliers—including memorandum of understanding with major OEMs exploring local vehicle manufacturing—signal potential inflows of expertise and capital. Strategic cooperation with global firms facilitates technology transfer, supply chain development, and skills enhancement within the chassis and broader automotive ecosystem. Moreover, foreign partnerships can integrate Saudi Arabia into international automotive networks, increasing competitiveness for local chassis component producers in export markets. The Kingdom’s proactive engagement with international stakeholders complements its Vision 2030 objectives, creating a conducive environment for global OEMs to co‑develop localized chassis systems and strengthen Saudi Arabia’s position within the global automotive manufacturing landscape, particularly for electric and hybrid vehicle segments.

Future Outlook

Over the next 5 years, the KSA Automotive Chassis market is expected to experience steady growth, driven by technological innovations in lightweight materials and the continued expansion of electric vehicle (EV) manufacturing. The government’s Vision 2030 initiative, which prioritizes localization of manufacturing and import substitution, is expected to play a pivotal role in the expansion of this market. Additionally, growing demand for high-performance, fuel-efficient vehicles, alongside the increasing use of advanced suspension systems and active chassis technologies, will fuel demand across both OEM and aftermarket segments.

Major Players

- American Axle & Manufacturing

- ZF Friedrichshafen

- Continental AG

- Hyundai Mobis

- Magna International

- Schaeffler Group

- Aisin Seiki Co., Ltd.

- Bendix Commercial Vehicle Systems

- Thyssenkrupp AGDana Incorporated

- Hitachi Automotive Systems

- Faurecia (Forvia)

- Mitsubishi Electric Corporation

- Bosch Mobility Solutions

- Lear Corporation

Key Target Audience

- Automotive OEMs

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies (e.g., Saudi Standards Organization)

- Automotive Tier-1 Suppliers

- Automotive Aftermarket Retailers

- Automotive Manufacturing Associations

- Public Sector Enterprises (e.g., Saudi Automotive Manufacturing Initiative)

- Logistics & Commercial Fleet Operators

Research Methodology

Step 1: Identification of Key Variables

The first step involves defining the market’s key variables, including automotive chassis components, materials, and vehicle types. Secondary research through trusted automotive market databases will provide the foundational data for identifying these elements.

Step 2: Market Analysis and Construction

We will compile historical data and market trends concerning the automotive chassis sector in Saudi Arabia. This phase will assess production levels, supply chain disruptions, and the market’s overall revenue generation. Evaluation of material costs and technology advancements will also be included.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses regarding market trends and forecasts will be tested through consultations with industry experts from chassis manufacturers, vehicle OEMs, and government entities. These insights will validate the assumptions made from secondary research.

Step 4: Research Synthesis and Final Output

The final phase involves synthesizing the findings into a comprehensive market report. Interactions with key stakeholders will ensure the reliability of the findings, with a focus on the KSA automotive ecosystem’s long-term viability and growth trajectory.

- Executive Summary

- Research Methodology (Definitions & Scope of Chassis Systems Components, Abbreviations, Top‑Down & Bottom‑Up Forecasting Approach, Data Triangulation, Primary/Secondary Research Protocol, Saudi Market Assumptions, Localization Index Estimation, Limitations & Future Scope)

- Definition & Chassis Architecture Scope

- Axle & Steering Linkages, Active Kinematics Systems, Reinforced

- Lightweight Frames

- Historical Genesis & Saudi Automotive Structural Ecosystem

- Vision 2030 Industrial Strategy & Automotive Localization Initiatives

- Automotive Chassis Value & Supply Chain in KSA

- Market Drivers

Emerging Vehicle Production & Assembly Initiatives (Localization Deals, Facility Investments)

Vision 2030 Industrial Policy & Economic Diversification

Shift to Lightweight & High‑Safety Chassis (Material Innovation, Fuel Efficiency, Regulatory Safety Standards)

EV & Electrified Vehicle Structural Demands - Market Challenges & Restraints

Supply Chain Constraints & Raw Material Import Dependencies

Skilled Workforce & Advanced Manufacturing Gaps

Compliance & Safety Standard Barriers

Price Volatility & FX Impact on Imports - Trend & Innovation Landscape

Lightweight Materials & Multi‑Material Integration

Active Chassis Control & Smart Safety Systems

Modular & Flexible Manufacturing

OEM Tier‑1 Localization Collaboration Models - Regulatory, Policy & Compliance Framework

Saudi Standards (SASO) & Chassis Safety Directives

Localization Quota & Import Duty Structure - Environmental & Emissions Regulations Impact on Chassis Design

- SWOT & Strategic Framework

- Porter’s Five Forces Analysis

- By Value, 2019-2025

- By Volume, 2019-2025

- By Average Price of Platforms/Services, 2019-2025

- By Component Type (In Value %)

Control Arms

Suspension Links

Ball Joints

Steering Knuckles

Axle Assemblies - By Chassis Architecture (In Value %)

Ladder Frame

Monocoque

Backbone

Modular Lightweight

Spaceframe - By Material Composition (In Value %)

High‑Strength Steel

Aluminum Alloy

Composite Materials

Carbon Fiber

- Market Share — Value & Volume (By OEM Tier‑1 & System Suppliers)

- Cross Comparison Parameters (Company Overview, Core Chassis Portfolio, Tech Readiness, Localization Presence, Production Capacity, Revenue, Material Expertise, R&D Footprint, OEM Partnerships, Aftermarket Reach, Distribution Network, Warranty & Service Coverage, Pricing Positioning, Margin Profile)

- Competitor SWOT Summaries

- Pricing Benchmarking – Chassis & Sub‑Assembly SKUs

- Detailed Profiles of Key Industry Players

American Axle & Manufacturing (Chassis & Driveline Systems)

ZF Friedrichshafen AG

Continental AG

Schaeffler Group

Magna International

Hyundai Mobis Co., Ltd.

Aisin Seiki Co., Ltd.

Benteler Automotive

Dana Incorporated

Faurecia (Forvia)

Bosch Mobility Solutions

Thyssenkrupp AG

Isuzu Motors Saudi Arabia (Local Commercial Chassis Ecosystem)

Dana Holding Corp.

Hitachi Astemo

- OEM Spec & Procurement Economics

- Aftermarket Purchase Patterns

- Fleet Operators & Commercial Buyer Expectations

- Decision Drivers (Cost, Performance, Warranty, Local Content

- Future Market Size by Value, 2026-2030

- Future Market Size by Volume, 2026-2030

- Average Frame Cost Outlook, 2026-2030