Market Overview

The KSA automotive diagnostic tools market (covering service-bay diagnostic scan tools and workshop test equipment used to diagnose, calibrate, and validate vehicle systems) generated USD ~ million in revenue in the latest year, up from USD ~ million in the prior year, as workshops increased spend on scan-tool refresh cycles, alignment and emissions validation, and electronics-driven troubleshooting workflows. This expansion is reinforced by a larger, aging vehicle parc, higher electronics content per vehicle, and the need to reduce “repeat repairs” through faster fault isolation and guided diagnostics.

Within the market, Riyadh, Jeddah, and Dammam/Khobar dominate demand because these metros concentrate the highest density of OEM dealer networks, multi-branch independent workshop chains, fleet operators, and logistics corridors—driving higher utilization of diagnostics bays, ADAS calibration, and periodic inspection readiness. At the supplier level, Germany, the U.S., China, Japan, and Italy remain influential through strong installed bases of workshop equipment and diagnostics platforms, wide vehicle-coverage databases, and local distributor/service capability that reduces downtime for calibration and updates.

Market Segmentation

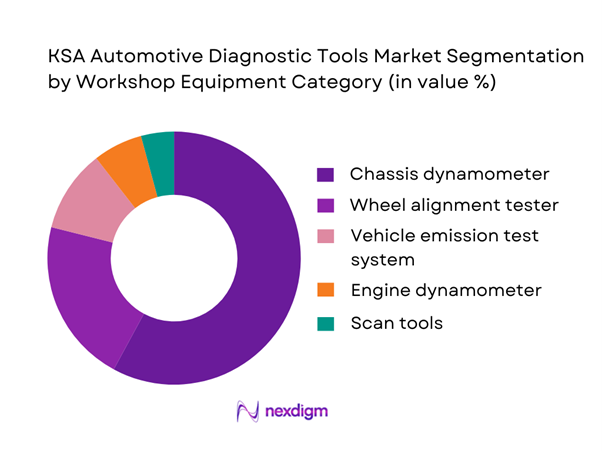

By workshop equipment category

Chassis dynamometers lead because they are embedded in higher-ticket diagnostic infrastructure used by OEM-aligned service operations, inspection-adjacent workflows, and performance/validation needs where repeatability matters. In KSA, the “diagnostics problem” is often not only code reading—it is confirming drivability outcomes after repairs, validating powertrain behavior, and supporting complex fault reproduction under load. Dyno systems are also sticky investments: once installed, they drive recurring calibration, maintenance, and complementary tool purchases (sensors, analyzers, scan-tool integration). As workshops professionalize (especially larger dealer groups and multi-branch independents), dynamometer-led bays become differentiation points that increase throughput and reduce comebacks—supporting continued budget priority for this category.

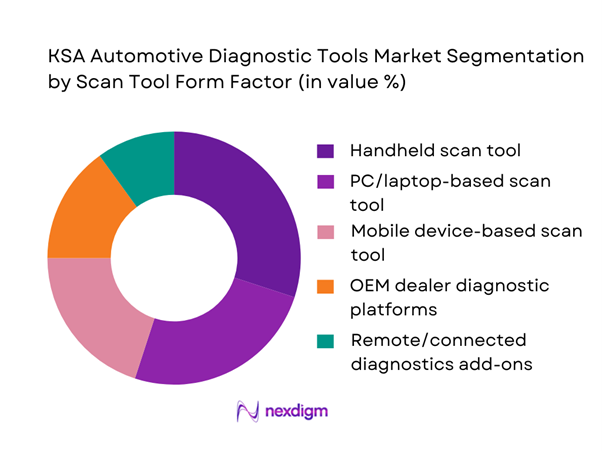

By scan tool form factor

Handheld workflows typically dominate workshop adoption because they align with how bays operate: quick VIN capture, rapid DTC reads, live data on the move, and immediate resets/adaptations without tying up a fixed workstation. In KSA, this operational advantage is amplified by high daily vehicle volumes in metro workshops and frequent “fast-lane” tasks (battery registration, TPMS relearn, service resets, basic actuator tests). Handheld platforms also scale well across multi-branch networks: one tool family can standardize technician training, update cadence, and accessory compatibility (modules, clamps, scopes). As vehicles become more software-defined, the winners are not only tools with coverage—but those with stable update ecosystems, guided troubleshooting, and calibration support that minimizes rework time.

Competitive Landscape

The KSA automotive diagnostic tools market is consolidated around globally established tool and workshop-equipment OEMs (scan tools, alignment, emissions, and dynamometer systems) supported by local distributors, calibration service partners, and training ecosystems. Competitive advantage is increasingly defined by vehicle coverage depth (incl. EV/ADAS), update cadence, Arabic-enabled support/training, uptime of calibration services, and integration into workshop management workflows rather than hardware alone.

| Company | Est. Year | HQ | KSA Channel Model | Core Diagnostic Stack | Coverage Strength | Update & Licensing Model | Calibration/Service Footprint | Primary Buyer Focus | Differentiation Lever |

| Bosch Automotive Service Solutions | 1886 | Germany | ~ | ~ | ~ | ~ | ~ | ~ | ~ |

| Snap-on | 1920 | USA | ~ | ~ | ~ | ~ | ~ | ~ | ~ |

| Continental (VDO/aftermarket tools) | 1871 | Germany | ~ | ~ | ~ | ~ | ~ | ~ | ~ |

| Denso | 1949 | Japan | ~ | ~ | ~ | ~ | ~ | ~ | ~ |

| ACTIA | 1986 | France | ~ | ~ | ~ | ~ | ~ | ~ | ~ |

KSA Automotive Diagnostic Tools Market Dynamics & Performance Analysis

Growth Drivers

Vehicle Parc Expansion

Saudi Arabia’s vehicle parc is expanding on a large installed base, which structurally raises diagnostic scan cycles (pre-purchase checks, periodic service, drivability complaints, emissions readiness, and module programming). Official road-transport statistics show registered and roadworthy vehicles at ~ million and newly issued vehicle registrations at ~ in the latest reporting cycle, both higher than the prior cycle. The same official dataset reports ~ serious traffic accidents, ~ injuries, and ~ fatalities—sustaining insurance-driven inspection and post-repair verification demand that depends on scan tools and calibration-ready workflows. Macro capacity to spend is supported by an economy of USD ~ trillion GDP and USD ~ GDP per capita, alongside a population base of ~ million that keeps utilization intensity high across major metros.

ECU Proliferation per Vehicle

The diagnostic tools market in KSA is increasingly “software-and-network” led because modern vehicles embed many controllers that require multi-module interrogation, guided troubleshooting, secure access, and post-repair coding. Peer-reviewed automotive communications research notes that a vehicle typically has between ~ and ~ electronic control units (ECUs), and in high-end vehicles it is common to have around ~ ECUs exchanging up to ~ signals—a complexity profile that directly increases the breadth of diagnostic coverage demanded from scan tools (CAN/LIN/Ethernet, gateway access, UDS service support, topology mapping). This complexity lands in KSA at scale due to the size of the active parc and the level of annual new registrations, which continually refresh the parc with ECU-dense platforms. From a macro lens, the Kingdom’s labor force of ~ expands the service ecosystem (dealers, independents, fleets) that must maintain ECU-heavy vehicles across long-distance operating cycles.

Challenges

High Tool Cost Sensitivity

Even with strong utilization drivers, many independent workshops and smaller fleet garages face investment sensitivity—especially when diagnostic capability requires frequent renewals, secure-access subscriptions, and multi-brand coverage. The market reality is shaped by a large, price-competitive aftermarket serving a parc of ~ million roadworthy vehicles, where workshop productivity hinges on tool ROI and technician throughput. Macro conditions matter here: a labor force of ~ supports a vast services base, but also intensifies competition in non-dealer servicing, pressuring margins and making capex decisions conservative. At the same time, population scale and high annual new registrations keep demand broad, so the challenge is less “need” and more “conversion” to higher-end tools across tiers of workshops. Inflation pressure is comparatively contained at ~, but cost sensitivity persists due to competitive pricing norms in routine servicing and the need to stock tools that keep pace with ECU and ADAS complexity without relying on market-size narratives.

Technician Skill Gaps

Tool sophistication is outpacing average workshop capability because diagnosis is increasingly about networks, software sessions, secure gateways, and calibration discipline. This creates a bottleneck where tools are available but underutilized. Saudi Arabia is scaling technical training capacity, but the magnitude of demand is huge: reports show ~ trainees enrolled and ~ graduates in the latest cited cycle across ~ institutions—a strong pipeline, yet small relative to the operational footprint implied by ~ million vehicles in service and ~ new registrations entering the parc. Road safety and repair volumes add pressure: ~ serious accidents and ~ injuries translate into repair complexity where diagnostic accuracy and calibration competence are critical. Macro fundamentals (GDP USD ~ trillion) support training investment, but workshops still face gaps in advanced diagnostics (UDS workflows, topology, coding) and ADAS procedures, making “skills” a gating factor for premium tool adoption.

Opportunities

ADAS Calibration Demand

The ADAS calibration opportunity is a “services expansion” pathway for tool vendors and workshops: camera and radar calibration frames, targets, alignment, and scan-tool workflows attached to collision repair, windshield replacement, suspension and steering work, and sensor replacements. Current official indicators already show the repair funnel is large: ~ serious accidents, ~ injuries, and ~ fatalities imply sustained collision repair volumes where calibration becomes part of “complete repair” definitions. At the same time, the parc is massive and keeps refreshing with feature-rich platforms via ~ new registrations, raising the absolute number of ADAS-equipped vehicles that will pass through service bays. From the technology side, sensor density can be significant, illustrating why calibration capability becomes a specialized revenue stream rather than a marginal add-on. The macro base supports continued consumer uptake of higher-trim vehicles in dominant metros, which lifts the calibration attach rate without requiring any forward-looking statistics to justify the opportunity.

EV Diagnostics Readiness

EV-readiness is an opportunity because the service ecosystem must prepare diagnostic stacks before EV parc saturation: high-voltage safety procedures, battery and thermal system diagnostics, inverter and charging fault isolation, and software-centric troubleshooting. Even without citing future numbers, the current market fundamentals justify near-term readiness: Saudi Arabia’s fleet base is ~ million vehicles with ~ new registrations, meaning any technology shift—hybridization, electrification, or more advanced power electronics—quickly translates into large absolute service volumes once it starts entering the parc. The technical driver is rising electronics density: research notes vehicles commonly have ~ ECUs, and high-end vehicles around ~ ECUs, which aligns with electrified platforms where diagnostics is heavily controller-driven. On the infrastructure and utilization side, logistics expansion to ~ activated logistics centers with ~ million m² total area signals growing organized fleets and professional operators that typically demand standardized diagnostic capability and technician certification—an immediate “readiness” pull. Macro conditions (GDP USD ~ trillion, labor force ~) underpin capacity-building for EV service training and tooling across the Kingdom.

Future Outlook

Over the next six years, the KSA automotive diagnostic tools market is expected to expand steadily as workshops modernize for electronics-heavy vehicles, adopt more structured diagnostic SOPs, and invest in equipment that improves bay throughput and first-time-fix rates. Growth will also be supported by increasing demand for calibration (ADAS, sensors), electrification readiness (battery and high-voltage diagnostics), and compliance-linked testing and verification in metro-centric workshop clusters. The market outlook implies a move from “tool-as-a-device” toward “tool-as-a-platform,” driven by software updates, guided repair content, and integrations.

Major Players

- Bosch Automotive Service Solutions

- Snap-on Incorporated

- Continental AG

- Denso Corporation

- ACTIA SA

- AVL List GmbH

- Softing AG

- Delphi Technologies

- KPIT Technologies

- Launch Tech

- Autel Intelligent Technology

- TEXA S.p.A.

- Hella Gutmann Solutions

- Mahle

Key Target Audience

- OEM Passenger Vehicle Dealer Groups

- Independent Multi-Branch Workshop Chains

- Fleet Operators and Fleet Maintenance Hubs

- Government and Regulatory Bodies

- Periodic Vehicle Inspection and Compliance Operators

- Insurance Networks and Claims-Linked Repair Ecosystems

- Automotive Tool and Equipment Distributors and Importers

- Investments and Venture Capitalist Firms

Research Methodology

Step 1: Identification of Key Variables

We map the KSA automotive diagnostics ecosystem across OEM dealers, independent workshops, fleets, distributors, and calibration partners, identifying variables such as installed base of diagnostic bays, tool refresh cycles, licensing models, and service uptime drivers. This stage uses structured secondary research and competitive landscaping to define market boundaries and segmentation logic.

Step 2: Market Analysis and Construction

We build a market model using the published KSA market sizing benchmarks and reconcile them against equipment category logic (scan tools, alignment, emissions, dyno) and workshop deployment patterns. Historical progression is validated through triangulation of distributor portfolio signals, OEM service footprint dynamics, and workshop modernization indicators.

Step 3: Hypothesis Validation and Expert Consultation

We validate diagnostic tool adoption hypotheses through structured interviews with workshop operators, distributor service heads, and technical trainers, focusing on utilization rates, common job-types, update cadence, calibration pain points, and brand switching triggers. Insights are captured through CATI-style scripts and cross-checked for consistency across respondent categories.

Step 4: Research Synthesis and Final Output

We synthesize top-down (market benchmark) and bottom-up (deployment and workflow) views, then stress-test outputs against competitive realities—coverage depth, service uptime, licensing economics, and training scalability. Final outputs include market narrative, segmentation structure, competitive benchmarking, and investment opportunity framing aligned to business decision-making.

- Executive Summary

- Research Methodology (Market Definition & Scope Boundaries, Diagnostic Tool Taxonomy Alignment, OEM–Aftermarket Mapping Logic, Bottom-Up Workshop-Level Data Validation, Top-Down Vehicle Parc Correlation Model, Primary Interviews with Dealerships & Independent Workshops, Distributor & Importer Triangulation, Regulatory Mapping Framework, Data Limitations & Assumptions)

- Definition and Scope

- Market Evolution and Technology Adoption Pathway

- Diagnostic Tools Ecosystem Genesis in KSA

- Automotive Service Industry Business Cycle

- Automotive Diagnostics Value Chain and Channel Flow Analysis

- Growth Drivers

Vehicle Parc Expansion

ECU Proliferation per Vehicle

ADAS Feature Penetration

Mandatory OBD Compliance

Fleet Digitization - Challenges

High Tool Cost Sensitivity

Technician Skill Gaps

OEM Software Lock-Ins

Frequent Software Update Costs

Grey Market Tool Risks - Opportunities

ADAS Calibration Demand

EV Diagnostics Readiness

Fleet Predictive Maintenance Adoption

AI-Driven Fault Prediction

Localization of Training & Support - Trends

Wireless Diagnostics Adoption

Subscription-Based Software Models

Multi-Brand Tool Preference Shift

Integration with Workshop Management Systems - Regulatory & Policy Landscape

- SWOT Analysis

- Stakeholder & Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competitive Intensity & Ecosystem Mapping

- By Value, 2019–2024

- By Unit Shipments, 2019–2024

- By Installed Base, 2019–2024

- By Average Selling Price Banding, 2019–2024

- By Fleet Type (in Value %)

Passenger Vehicles

Light Commercial Vehicles

Heavy Commercial Vehicles

Off-Highway Vehicles

Two & Three Wheelers - By Application (in Value %)

OBD-II Scanners (Basic & Enhanced)

Multi-System Diagnostic Scanners

OEM-Specific Diagnostic Tools

ADAS Calibration & Diagnostics Tools

Wireless / Bluetooth-Enabled Diagnostic Tools - By Technology Architecture (in Value %)

Standalone Diagnostic Tools

PC-Based Diagnostic Platforms

Cloud-Connected Diagnostic Systems

AI-Enabled Predictive Diagnostics

Remote / OTA Diagnostic Solutions - By Connectivity Type (in Value %)

Wired Diagnostic Interfaces

Bluetooth-Enabled Tools

Wi-Fi Enabled Diagnostic Platforms

Cloud-Synced Diagnostic Systems

Remote Diagnostics Interfaces - By End-Use Industry (in Value %)

OEM Authorized Dealerships

Independent Multi-Brand Workshops

Fleet Service Centers

Quick Service Chains

Government & Defense Workshops - By Region (in Value %)

Central Region

Western Region

Eastern Region

Southern Region

Northern Region

- Market Share Analysis by Value & Installed Base

- Cross Comparison Parameters (ECU & Protocol Coverage Breadth, OEM Compatibility Depth, Software Update Frequency, ADAS Calibration Capability, EV & Hybrid Readiness, Connectivity & Cloud Integration, Training & Technical Support Infrastructure, Distribution & Service Reach)

- Strategic Positioning Matrix

- SWOT Analysis of Key Players

- Pricing Analysis by Tool Category & Subscription Model

- Innovation & Product Roadmap Benchmarking

- Detailed Company Profiles

Bosch Automotive Service Solutions

Snap-on Incorporated

Launch Tech

Autel Intelligent Technology

Continental Automotive

Delphi Technologies

TEXA

AVL DiTEST

Actia Group

Mahle Diagnostics

Denso Diagnostics Solutions

OEM Dealer Diagnostic Platforms

OTC Tools

Brain Bee

- Diagnostic Tool Utilization Frequency

- Purchase Decision Hierarchy

- Budget Allocation & Replacement Cycles

- Pain Point & Unmet Needs Analysis

- Training, Certification & Skill Dependency Assessment

- By Value, 2025–2030

- By Unit Shipments, 2025–2030

- By Installed Base, 2025–2030

- By Average Selling Price Banding, 2025–2030