Market Overview

The Saudi Arabia automotive components industry — encompassing chassis and structural frame assemblies — reflects the broader strength of the country’s automotive value chain. According to a trusted industry report, the Saudi Arabia Automotive Components Market — which includes body & chassis components — is valued at USD ~ billion in 2024. This strong base reflects rising vehicle ownership, government incentives for local manufacturing under Vision 2030, and increasing OEM investment to localize supply chains, enabling components demand including frames.

Within the automotive components segment, cities such as Riyadh, Jeddah, Dammam, and Eastern Province cities dominate production and consumption of automotive frames. Riyadh’s dominance stems from its role as a commercial and industrial hub and proximity to OEM assembly operations. Jeddah and Dammam benefit from port access for imported raw materials and components. Eastern Province has strong industrial infrastructure supporting manufacturing and fabrication. These geographic advantages position these centers as focal points for frame production, assembly, and aftermarket distribution.

Market Segmentation

By Frame Type

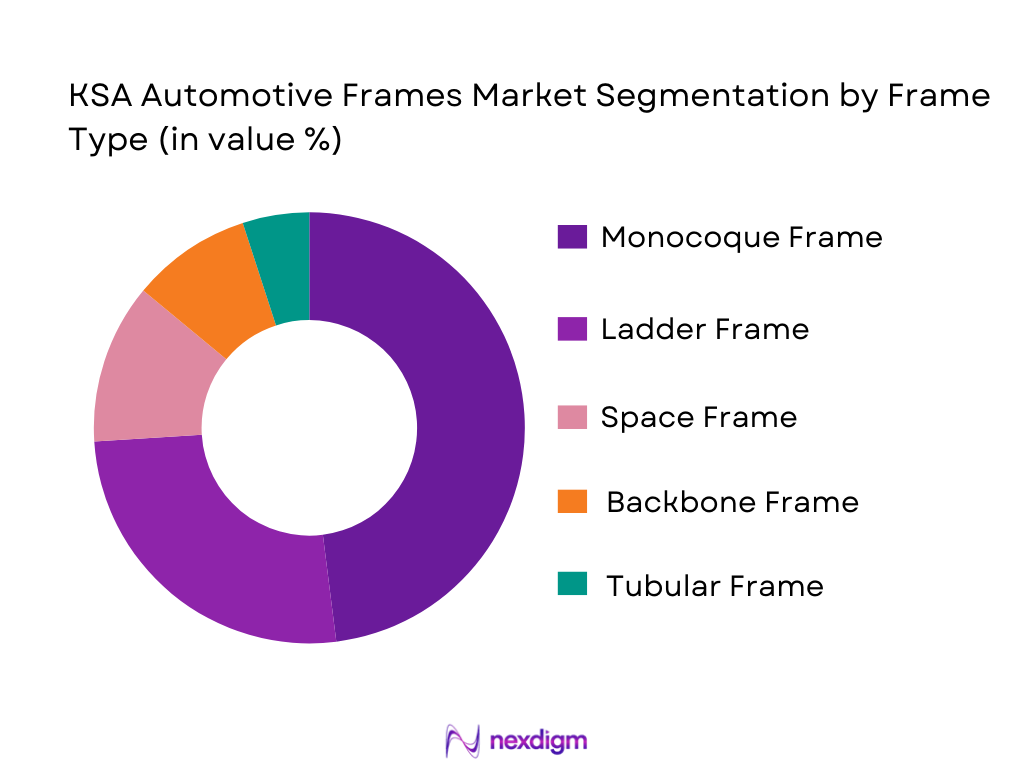

The KSA automotive frames market, when segmented by frame type, shows monocoque frames with a dominant share of ~48%. Monocoque construction, integrating body and frame as a unified structural element, provides superior rigidity, safety and weight efficiencies compared to traditional ladder designs. With increasing adoption of passenger vehicles and SUVs — where fuel efficiency and crash safety are paramount — monocoque frames are prioritized by OEMs operating in the Kingdom. Additionally, global OEM platforms manufactured in KSA, such as passenger cars and light commercial vehicles, are typically based on monocoque architecture, reinforcing its high usage. Growing demand for aluminum and hybrid monocoque structures, and investments in lightweighting for EV platforms, further support this segment’s leadership in the market.

By Vehicle Type

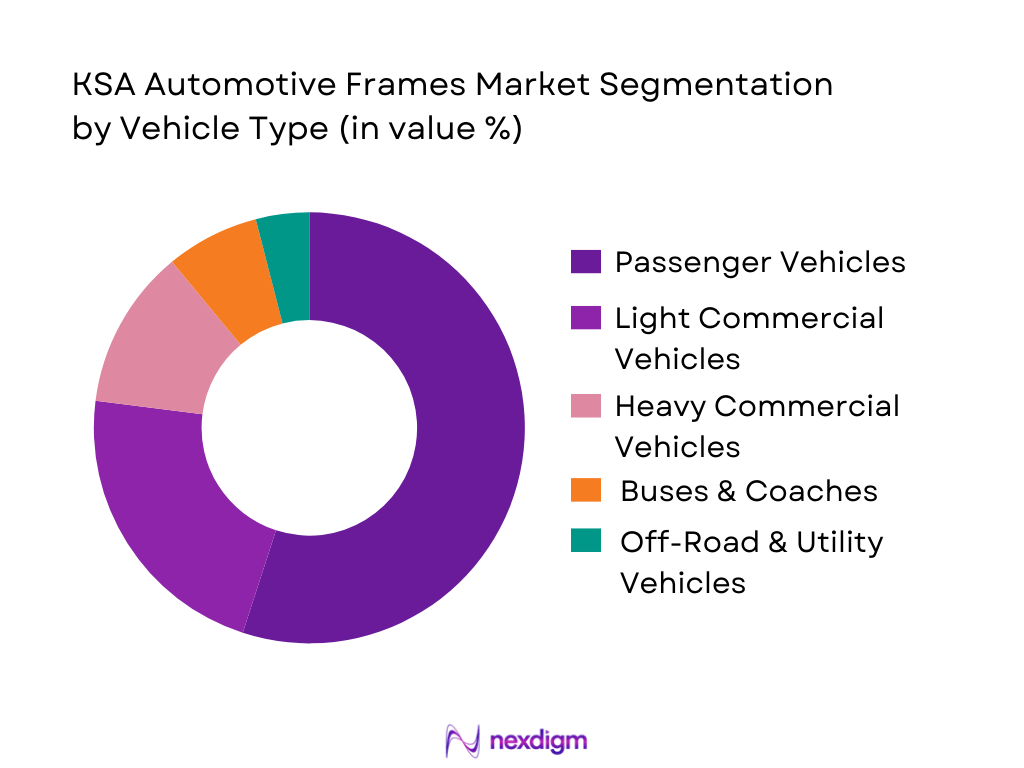

In the KSA automotive frames market, passenger vehicles account for around 55% share in 2024, reflecting robust consumer demand for personal mobility. Passenger cars form the largest stock of vehicles on the road owing to expansive urban populations, rising middle-income segments, and family ownership models. Passenger vehicle assembly — both imported and locally CKD/AKD assembled — drives the need for frames that balance safety, comfort and fuel/energy efficiency. With many international OEMs partnering with local assemblers and parts suppliers, the structural frame supply chain for passenger vehicles has matured, outpacing commercial segments. Meanwhile, light commercial vehicles benefit from fleet upgrades within logistics and last-mile delivery sectors, but remain secondary in frames demand.

Competitive Landscape

The KSA automotive frames industry is strongly influenced by global chassis and automotive component players, OEM affiliates, and local fabricators. This consolidation highlights the significant influence of large global suppliers and regional manufacturers meeting OEM specifications and aftermarket demand.

| Company | Est. Year | Headquarters | Frame Tech Focus | OEM Tie-ups | Manufacturing Capability | Local Content Level | Distribution Network | Material Expertise |

| Saudi Arabian Military Industries (SAMI) | 2017 | Riyadh, KSA | ~ | ~ | ~ | ~ | ~ | ~ |

| Ceer Automotive Manufacturing | 2022 | Jeddah, KSA | ~ | ~ | ~ | ~ | ~ | ~ |

| Zamil Steel Automotive Division | 2002 | Dammam, KSA | ~ | ~ | ~ | ~ | ~ | ~ |

| Al-Babtain Automotive Manufacturing | 1980 | Riyadh, KSA | ~ | ~ | ~ | ~ | ~ | ~ |

| Isuzu Motors Saudi Arabia | 2011 | Dammam, KSA | ~ | ~ | ~ | ~ | ~ | ~ |

| Magna International | 1957 | Canada | ~ | ~ | ~ | ~ | ~ | ~ |

| Gestamp Automoción | 1997 | Spain | ~ | ~ | ~ | ~ | ~ | ~ |

| Benteler Automotive | 1876 | Germany | ~ | ~ | ~ | ~ | ~ | ~ |

| Aisin Seiki | 1949 | Japan | ~ | ~ | ~ | ~ | ~ | ~ |

| Dana Incorporated | 1904 | USA | ~ | ~ | ~ | ~ | ~ | ~ |

KSA Automotive Frames Market Analysis

Growth Drivers

Vehicle Production Localization

Saudi Arabia’s localization drive is structurally positive for automotive frames because frames sit early in the vehicle value chain (stamping, welding, sub-assemblies, chassis integration). Macro fundamentals support sustained industrial demand: Saudi Arabia’s economy is USD 1,239.8 billion in output and USD 35,121.7 GDP per capita, creating a large domestic vehicle demand base that OEMs increasingly want to serve with localized supply chains. On the demand side, the national vehicle parc reached 15.8836 million registered vehicles in use by end-period, up from 14.8574 million, which expands replacement cycles and accident-repair throughput that ultimately consumes frame rails, subframes, cross-members and body-in-white structural parts. On the supply side, localization is moving from “parts trading” into “industrial making”: the national industrial transformation program reports 284 initiatives tracked and 163 completed by end-period, reinforcing enabling infrastructure (industrial zones, logistics, supplier development) that supports frame-grade steel processing and fabrication. With inflation and unemployment both relatively contained (1.7 and 3.9 respectively), the operating environment is generally supportive of long-cycle industrial investments such as frame welding lines, jigs/fixtures and stampings.

Vision 2030 Manufacturing Push

Vision 2030 implementation is translating into concrete industrial execution, which matters for frames because they require heavy industrial capability (press shops, robotic welding, metrology, corrosion protection, and certified QA). Saudi Arabia’s macro base—USD 1,239.8 billion GDP and USD 35,121.7 GDP per capita—supports a scale case for bringing more structural component manufacturing into-country. The government’s industrial agenda is also visible in program delivery: the national industrial program annual reporting indicates 284 initiatives encompassed and 163 completed, creating the “factory-ready” conditions (utilities, logistics, permitting, localization incentives) that chassis/frame suppliers depend on. On the mobility side, the vehicle parc of 15.8836 million vehicles and new registrations exceeding one million in the latest year strengthen the case for deeper localization of high-volume structural components, including front/rear subframes, ladder-frame rails for pickups, and cross-members for LCVs. Saudi Arabia’s low-to-moderate inflation environment (World Bank shows inflation at 1.7) reduces volatility for long-term capex planning in press/weld operations. In practical terms, Vision 2030’s manufacturing push is not just about final assembly; it is about migrating value into Tier-1/Tier-2 manufacturing—exactly where frames sit—thereby accelerating demand for local stamping, welding consumables, frame-grade steel processing and structural QA services.

Market Challenges

High Tooling Costs

Automotive frames are tooling-intensive: press dies, welding jigs, fixtures, gauges, and metrology systems must be built to OEM tolerances and validated through PPAP-like processes. This creates a high fixed-cost barrier that is harder to amortize when localized volumes are still ramping. Macro conditions can support investment, but they don’t remove tooling intensity: Saudi Arabia’s economy at USD 1,239.8 billion and GDP per capita of USD 35,121.7 indicate demand potential, yet frame tooling requires long payback and stable model pipelines. The market’s operational pull is strong—registered vehicles reached 15.8836 million and new registrations exceeded one million—but much of this demand still routes through imported platforms, meaning local suppliers may face uncertainty on awarded volumes and platform lifecycles. Even with relatively contained inflation (1.7) and unemployment (3.9), which improves project predictability, frame tooling remains a capital-heavy decision that requires guaranteed OEM offtake, certified supplier status, and stable raw material sourcing. As a result, the challenge is less about “demand exists” and more about converting demand into bankable, multi-year supply awards that justify press shops, robotic welding lines, and corrosion systems locally.

Steel Price Volatility

Frames rely heavily on steel (mild steel, HSLA, AHSS), making them sensitive to global metals cycles. Even when local demand is strong—vehicle parc at 15.8836 million and new registrations above one million—input volatility can disrupt planning for frame makers and repair ecosystems that stock structural rails and cross-members. The World Bank highlighted a sharp move in metals markets: its metals and minerals price index rose by 9 in April (month-on-month movement referenced in the World Bank’s discussion of metals prices), underscoring ongoing commodity-driven variability that manufacturers must hedge against. Macro conditions in Saudi Arabia are otherwise supportive—GDP of USD 1,239.8 billion, inflation around 1.7—but imported steel and alloy-linked inputs can still swing irrespective of domestic inflation, affecting frame-grade coil and plate procurement and bill-of-material stability. This challenge is especially acute for ladder frames and commercial chassis components where steel content is high and where suppliers must maintain consistent mechanical properties to meet safety requirements. It increases the need for multi-sourcing, contract structures tied to indices, and stronger inventory planning—areas where newer local suppliers may still be developing capability.

Opportunities

EV Skateboard Platforms

EV “skateboard” architectures concentrate structural demand into the floor, underbody, and front/rear subframes, creating opportunities for suppliers that can build EV-grade structural modules. Saudi Arabia already has proof of EV industrial activity: Lucid’s KAEC AMP-2 facility began SKD assembly with expected annual capacity of 5,000 vehicles, establishing a local base of EV handling, finishing, and logistics that can progressively deepen into localized structural content. The opportunity is amplified by scale: the national vehicle parc reached 15.8836 million, meaning EV adoption and servicing can build on a very large mobility ecosystem (dealers, repair networks, parts distribution) that can transition into EV structural modules over time. Macro stability supports investment into EV-grade welding/metrology: GDP USD 1,239.8 billion, inflation 1.7, unemployment 3.9—conditions favorable for long-horizon industrial programs and workforce development. For frame makers, the near-term “current” opportunity is to supply subframes, cross-members, battery tray reinforcements, and crash management structures aligned to EV platforms being assembled or planned locally, while building qualification experience that can be leveraged across future EV programs.

Modular Frame Localization

Modular frames—standardized rails, cross-members, bolt-on subframes—reduce complexity and can accelerate localization because suppliers can standardize tooling and reuse welding cells across variants. Saudi Arabia’s industrial execution supports this play: the national industrial program reports 284 initiatives included and 163 completed, indicating steady build-out of enabling infrastructure that modular suppliers need (industrial zones, logistics corridors, supplier development). Demand-side scale is strong: registered vehicles reached 15.8836 million and new registrations exceeded one million, which increases both OEM platform volumes and the aftermarket’s need for repairable modular structural parts. Macro predictability strengthens the case to invest in modular welding and metrology lines: GDP USD 1,239.8 billion and inflation 1.7 support capital planning and stable operating economics. The opportunity is to localize “modules first” (front subframes, rear subframes, cross-members, body mounts) rather than full frames immediately—building a qualification track record and scaling content per vehicle over time, especially for high-volume passenger and LCV platforms.

Future Outlook

Over the next six years, the KSA automotive frames market is poised for strong growth, supported by Vision 2030 localisation targets, expanding vehicle production facilities (including potential passenger vehicle manufacturing partnerships such as Stellantis), and the evolution of EV platform investments. Increased local fabrication capacity, skilled workforce development, and incentives for advanced manufacturing will further strengthen the frames supply chain. Additionally, the shift toward lightweight materials and advanced chassis designs for electrification and fuel-efficiency objectives will create new product and investment opportunities across OEM, aftermarket and fleet segments.

Major Players

- Saudi Arabian Military Industries (SAMI)

- Ceer Automotive Manufacturing

- Zamil Steel Automotive Division

- Al-Babtain Automotive Manufacturing

- Isuzu Motors Saudi Arabia

- Magna International

- Gestamp Automoción

- Benteler Automotive

- Aisin Seiki

- Dana Incorporated

- Toyota Motor Manufacturing

- Hyundai Mobis

- Robert Bosch GmbH

- ZF Friedrichshafen AG

- Valeo

Key Target Audience

- OEM Vehicle Manufacturers & Assembly Plants

- Tier-1 Automotive Suppliers

- Fleet Owners & Commercial Transport Operators

- Investments & Venture Capitalist Firms (Automotive & Advanced Materials Sectors)

- Government & Regulatory Bodies (Ministry of Industry & Mineral Resources, Saudi Standards, Metrology and Quality Org., National Industrial Development Center)

- Automotive Parts Distributors & Logistics Companies

- Automotive Aftermarket Retail Chains & Service Providers

- Industrial Fabrication & Steel Manufacturing Companies

Research Methodology

Step 1: Identification of Key Variables

The initial phase establishes the core ecosystem of KSA automotive frames, covering OEM platforms, tier-1 suppliers, material sources, and assembly/value chain participants through exhaustive secondary research across industry databases, published reports, and import/export data. This defines the critical variables influencing market size, cost structures, and demand drivers.

Step 2: Market Analysis and Construction

Historical data, production volumes, and component demand from vehicle registrations and assembly operations are compiled and analyzed. This includes assessing vehicle population growth, OEM manufacturing footprints, and import data on chassis/frames to construct a reliable baseline and sectoral structure.

Step 3: Hypothesis Validation and Expert Consultation

Market assumptions and segmented trends are validated through structured interviews with industry stakeholders — including OEM technical leads, manufacturing heads, supply chain managers, and aftermarket distributors — delivering actionable insights that refine quantitative estimations and qualitative drivers.

Step 4: Research Synthesis and Final Output

The final phase synthesizes bottom-up market construction with expert insights, cross-verified against global chassis trends and KSA-specific drivers. This delivers validated market size, competitive positioning, and forward-looking opportunities in automotive frame systems.

- Executive Summary

- Research Methodology (Market Definitions and Scope Mapping, Automotive Frame Classification Logic, Abbreviations, Market Sizing Framework, Bottom-Up Production Capacity Assessment, Import–Export Mapping, OEM & Tier-1 Interview Framework, Dealer & Fabricator Survey Approach, Validation Through Vehicle Production & Sales Correlation, Assumptions, Limitations, and Analyst Conclusions)

- Definition and Scope

- Market Genesis and Evolution

- Timeline of Frame Technology Adoption in KSA

- Automotive Manufacturing and Assembly Business Cycle

- Localized vs Imported Frame Ecosystem

- Supply Chain and Automotive Value Chain Integration

- Growth Drivers

Vehicle Production Localization

Vision 2030 Manufacturing Push

Rising Commercial Vehicle Demand

Frame Weight Optimization

EV Platform Development - Market Challenges

High Tooling Costs

Steel Price Volatility

Limited Local Composite Capability

Skilled Welding Workforce Shortage

OEM Certification Barriers - Opportunities

EV Skateboard Platforms

Modular Frame Localization

Defense & Utility Vehicle Programs

Export-Oriented Frame Manufacturing

Lightweighting Initiatives - Market Trends

Shift Toward Aluminum & Hybrid Frames

Hydroformed Chassis Adoption

Modular Platforms

Digital Twin-Based Frame Design

Sustainability Compliance - Government Regulations and Standards

SASO Compliance

Local Content Requirements

Industrial Localization Policies

Automotive Safety Standards - SWOT Analysis (Market-Wide)

- Stakeholder Ecosystem (OEMs, Tier-1s, Steel Suppliers, Fabricators, Logistics)

- Porter’s Five Forces Analysis (Automotive Frame Industry)

- Competitive Intensity and Entry Barrier Assessment

- Market Size by Value, 2019-2025

- Market Size by Volume, 2019-2025

- Average Frame Cost Benchmarking, 2019-2025

- OEM vs Aftermarket Consumption Split, 2019-2025

- By Frame Type (In Value %)

Ladder Frame

Monocoque Frame

Space Frame

Backbone Frame

Tubular Frame - By Vehicle Type (In Value %)

Passenger Cars

Light Commercial Vehicles

Heavy Commercial Vehicles

Buses & Coaches

Off-Road & Utility Vehicles - By Material Type (In Value %)

Mild Steel

High-Strength Steel

Aluminum Alloy

Carbon Fiber Composite

Hybrid Multi-Material Frames - By Manufacturing Technology (In Value %)

Stamping & Press Forming

Welding & Fabrication

Hydroforming

Modular Frame Assembly

Advanced Composite Molding - By Sales Channel (In Value %)

OEM Supply Contracts

Authorized Aftermarket

Independent Fabricators

Fleet & Government Procurement

Replacement & Accident Repair Market - By Region (In Value %)

Central Region

Western Region

Eastern Region

Southern Region

Northern Region

- Market Share Analysis (Value & Volume Basis)

- Cross-Comparison Parameters (Manufacturing Capacity, Frame Type Portfolio, Material Expertise, OEM Tie-Ups, Localization Level, Technology Capability, Pricing Range, Supply Lead Time)

- SWOT Analysis of Major Players

- Pricing Analysis (Frame Type & Vehicle Class Basis)

- Detailed Company Profiles

Saudi Arabian Military Industries (SAMI)

Ceer Automotive Manufacturing

Zamil Steel Automotive Division

Al-Babtain Automotive Manufacturing

National Metal Manufacturing (Ma’aden Downstream)

Hyundai Motor Manufacturing Saudi Arabia

Isuzu Saudi Arabia Manufacturing

Toyota Motor Manufacturing KSA

Arabian Vehicle Assembly Company

Magna International

Gestamp Automoción

Benteler Automotive

Aisin Seiki

Dana Incorporated

Thyssenkrupp Automotive

- OEM Demand Patterns

- Fleet & Government Procurement Behavior

- Cost Structure and Budget Allocation

- Certification, Compliance, and Quality Expectations

- Purchase Decision Drivers and Pain Points

- Future Market Size by Value, 2026-2030

- Future Market Size by Volume, 2026-2030

- Average Frame Cost Outlook, 2026-2030