Market Overview

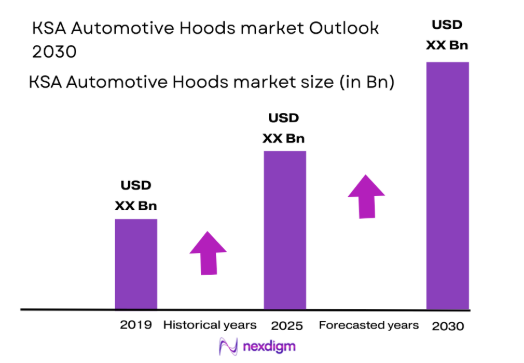

The KSA Automotive Hoods market is valued at approximately USD ~ billion in 2025, with expectations to reach USD ~ in 2024. The market is driven by several factors, primarily the robust automotive production in Saudi Arabia. Government initiatives, including the Vision 2030 plan, have propelled the growth of the automotive sector, creating a conducive environment for automotive component manufacturers. The shift towards lightweight materials, such as aluminum and composite materials, in vehicle manufacturing also contributes significantly to this market’s expansion. Additionally, the growing interest in electric vehicles (EVs) and the increase in local automotive production capacity further support market growth.

Riyadh, Jeddah, and Dammam are the key cities driving the KSA Automotive Hoods market. Riyadh, being the capital and economic hub of Saudi Arabia, has the highest concentration of automotive production facilities and industry-related infrastructure. Jeddah, with its strategic coastal location, plays a significant role as a trading and industrial hub, while Dammam is a critical location for automotive manufacturing due to its proximity to the oil and gas sector. These cities dominate the market due to strong industrial policies, investment in manufacturing, and proximity to key supply chain networks.

Market Segmentation

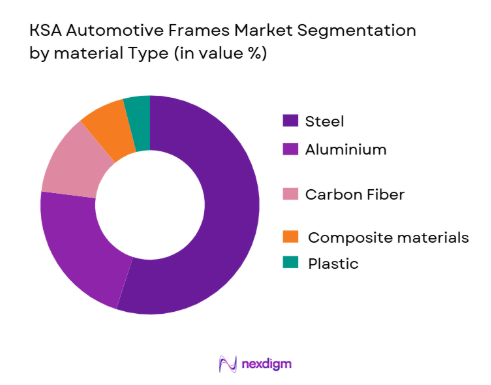

By Material Type

The KSA Automotive Hoods market is segmented by material types, with steel, aluminum, carbon fiber, composite materials, and plastic being the primary categories. Among these, steel remains the dominant material used in automotive hoods due to its durability, cost-effectiveness, and long-established presence in the automotive industry. Aluminum is gaining traction due to its lightweight properties, which are essential for electric vehicle manufacturers aiming to improve vehicle efficiency. Carbon fiber and composite materials, while more expensive, are increasingly used in premium and luxury vehicles, as they provide higher strength-to-weight ratios.

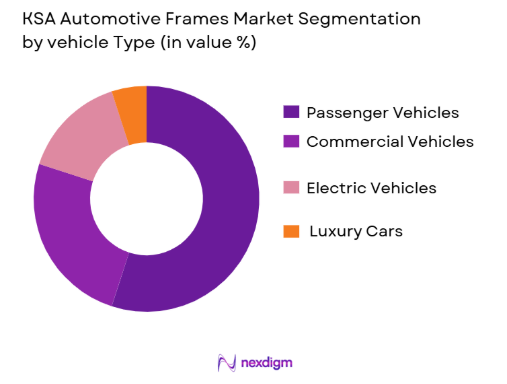

By Vehicle Type

The market is segmented by vehicle type into passenger vehicles, commercial vehicles, electric vehicles (EVs), and luxury cars. Passenger vehicles dominate the market due to their higher production volumes. However, the electric vehicle segment is rapidly growing as the demand for sustainable and eco-friendly transportation solutions rises. The shift toward electric vehicles is increasing the use of lightweight materials like aluminum and composite materials, which are crucial for improving vehicle efficiency and range. Luxury cars, although a smaller segment, contribute to the growth of high-value materials, such as carbon fiber and composites.

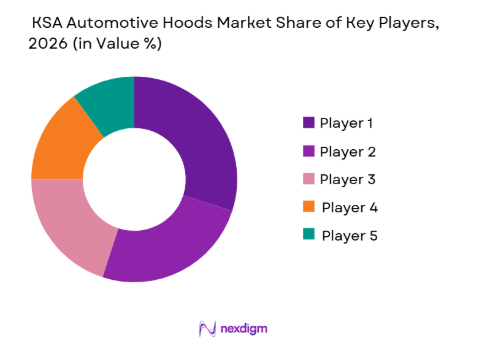

Competitive Landscape

The KSA Automotive Hoods market is characterized by the presence of both global and regional players. These companies dominate due to their manufacturing capabilities, technological expertise, and strategic alliances with OEMs. Major players such as Magna International, Faurecia S.A., and Lear Corporation provide a range of automotive components, including hoods, to the KSA market. These companies also benefit from the growing demand for advanced materials and lightweight hoods in line with the automotive industry’s shift towards electric vehicles.

| Company Name | Establishment Year | Headquarters | Key Product Focus | Manufacturing Capabilities | Material Expertise | Revenue (2023) |

| Magna International | 1957 | Canada | ~ | ~ | ~ | ~ |

| Faurecia S.A. | 1997 | France | ~ | ~ | ~ | ~ |

| Lear Corporation | 1917 | USA | ~ | ~ | ~ | ~ |

| Hyundai Mobis | 1977 | South Korea | ~ | ~ | ~ | ~ |

| Aisin Seiki Co., Ltd. | 1949 | Japan | ~ | ~ | ~ | ~ |

KSA Automotive Hoods Market Analysis

Growth Drivers

Urbanization

Saudi Arabia has experienced significant urbanization, with around 90% of its population now residing in urban areas. This growth leads to increased demand for personal vehicles, which, in turn, boosts the need for automotive parts, including hoods. Urban areas like Riyadh and Jeddah are key contributors to the automotive market as they host major industrial zones and vehicle manufacturing plants. As more people move to cities, the demand for new vehicles continues to rise, further stimulating the growth of the automotive hoods market.

Industrialization

The ongoing industrialization in Saudi Arabia, particularly in the automotive manufacturing sector, is a significant driver for the market. Vision 2030’s focus on expanding domestic manufacturing capacity is stimulating growth in the automotive sector. The establishment of industrial hubs like the King Abdullah Economic City has attracted investment in automotive production, which subsequently fuels demand for automotive components like hoods. With more manufacturers producing vehicles locally, the need for hoods and other automotive parts is expected to increase.

Restraints

High Initial Costs

A key restraint in the KSA automotive hoods market is the high initial cost associated with the production and procurement of advanced materials like composites and aluminum. While these materials offer improved strength and lightweight properties, their cost remains a challenge for mass-market vehicles. This results in higher overall vehicle costs, limiting their affordability for consumers in the price-sensitive segment of the market. Manufacturers often have to balance between cost and quality when deciding on materials, hindering widespread adoption.

Technical Challenges

The integration of new technologies in automotive hoods, such as lightweight materials and smart features, poses significant technical challenges. Manufacturers must invest in research and development to overcome the limitations of traditional materials and processes. The need to enhance the strength-to-weight ratio while maintaining cost-efficiency requires advanced manufacturing processes, which can be expensive and require skilled labor. These technical hurdles slow down the widespread implementation of these innovations, impacting the growth rate of the market.

Opportunities

Technological Advancements

Saudi Arabia’s automotive sector is experiencing a wave of technological advancements, particularly in manufacturing processes such as automation and 3D printing. These advancements open up opportunities for more efficient production of automotive hoods, reducing costs and lead times. With growing investment in the latest technologies, including AI-driven manufacturing and smart systems integrated into hoods, the KSA market stands to benefit from enhanced production capabilities and improved product quality, driving further growth.

International Collaborations

International collaborations between Saudi automotive manufacturers and global players are expected to expand the market for automotive hoods. Companies such as Magna International and Hyundai Mobis have established a significant presence in Saudi Arabia, and more international companies are likely to enter the market. These collaborations allow for the transfer of knowledge, technology, and production expertise, which will help local manufacturers improve the quality of automotive components and compete globally.

KSA Automotive Hoods Market Future Outlook

The KSA Automotive Hoods market is expected to witness significant growth in the coming years, driven by continued government support for local automotive manufacturing under Vision 2030. The adoption of electric vehicles (EVs) is a key factor, as manufacturers seek lightweight, durable materials to enhance vehicle efficiency. Additionally, advancements in manufacturing technologies, such as the use of smart materials and automation, will likely accelerate market growth. Over the next five years, the market will benefit from increased automotive production capacity and the growing trend towards vehicle customization.

Major Players

- Magna International

- Faurecia S.A.

- Lear Corporation

- Hyundai Mobis

- Aisin Seiki Co., Ltd.

- Tata AutoComp Systems Ltd.

- Schaeffler AG

- Benteler International AG

- Valeo S.A.

- Calsonic Kansei Corporation

- Martinrea International Inc.

- United Automotive Electronic Systems

- Dana Incorporated

- SGL Carbon

- AP Exhaust Products, Inc.

Key Target Audience

- Automobile Manufacturers

- Automotive Part Suppliers

- Raw Material Suppliers

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies

- Automotive Research and Development Institutions

- OEM and Aftermarket Automotive Companies

- Distributors and Third-Party Retailers

Research Methodology

Step 1: Identification of Key Variables

This step involves identifying and mapping key variables that influence the KSA automotive hoods market. Desk research and secondary data will be used to gather comprehensive information on stakeholders, consumer preferences, and market trends.

Step 2: Market Analysis and Construction

The second phase will involve analyzing historical data and market penetration trends. We will assess the performance of automotive hoods by different segments, including materials and vehicle types.

Step 3: Hypothesis Validation and Expert Consultation

To validate the findings, in-depth interviews with industry experts and stakeholders will be conducted. These consultations will provide insights into market dynamics, technological advancements, and future growth potential.

Step 4: Research Synthesis and Final Output

The final phase will consolidate the data gathered from primary and secondary sources, creating a comprehensive and validated market outlook for the KSA Automotive Hoods market. The output will include insights on market trends, opportunities, and challenges.

- Executive Summary

- Research Methodology (Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Overview Genesis & Evolution Path

- Timeline of Major Players

- Business Cycle & Technology Life Cycle

- Supply Chain and Value Chain Analysis

- Growth Drivers

Rising Automotive Production in Saudi Arabia

Demand for Lightweight Materials

Government Initiatives to Boost Automotive Manufacturing

Increase in Consumer Preferences for Electric Vehicles - Market Challenges

Raw Material Costs and Supply Chain Instabilities

Technological Barriers in Advanced Material Integration

Regulatory Compliance and Environmental Standards - Opportunities

Increasing Demand for Customization in Automotive Parts

Technological Advancements in Manufacturing

Rising Penetration of Electric Vehicles in the Marke - Trends

Adoption of Sustainable and Eco-Friendly Materials

Integration of Smart Technologies in Automotive Parts

Growing Aftermarket Industry for Automotive Parts

- By Value 2019-2025

- By Volume 2019-2025

- By Average Price per Unit 2019-2025

- By Distribution Channel 2019-2025

- By Material Type (In Value %)

Steel

Aluminum

Carbon Fiber

Composite Materials

Plastic - By Vehicle Type (In Value %)

Passenger Vehicles

Commercial Vehicles

Electric Vehicles

Luxury Car - By End-Use (In Value %)

OEM

Aftermarket - By Region (In Value %)

Western Region

Eastern Region

Central Region - By Distribution Channel (In Value %)

Direct Sales to Manufacturers

Third-party Distributors

Online Retail

- Market Share Analysis (Value/Volume)

- Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strengths and Weaknesses, Revenue by Material Type, Number of Dealers and Distributors, Production Plant and Capacity, Pricing and Costing Models)

- SWOT Analysis of Major Players

- Pricing Analysis Based on Material Types for Major Companies

- Porter’s Five Forces

- Detailed Profiles

Aisin Seiki Co., Ltd.

Magna International Inc.

Martinrea International Inc.

Dana Incorporated

Faurecia S.A.

Hyundai Mobis

Lear Corporation

Valeo S.A.

Sumitomo Electric Industries

Tata AutoComp Systems Ltd.

Schaeffler AG

Benteler International AG

Calsonic Kansei Corporation

Zhejiang Nanshan Aluminum Co., Ltd.

Oerlikon Balzers Coating

- Market Demand and Utilization

- Purchasing Power and Budget Allocations

- Regulatory and Compliance Requirements

- Needs, Desires, and Pain-Point Analysis

- Decision-Making Process for Consumers and Manufacturers

- By Value 2026-2030

- By Volume 2026-2030

- By Average Price per Unit 2026-2030