Market Overview

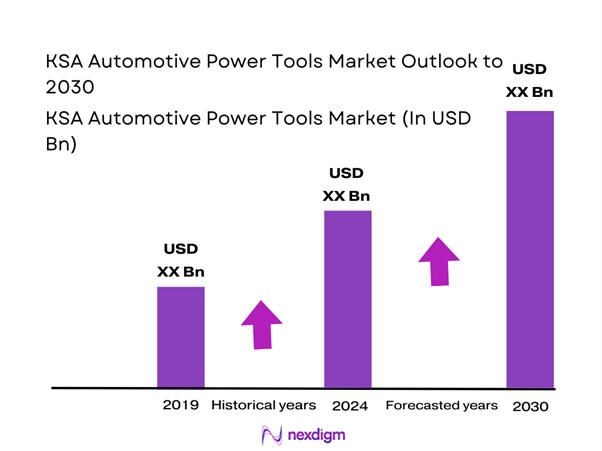

The KSA Automotive Power Tools market is valued at USD ~ million in the latest year, up from USD ~ million in the prior year, based on Saudi Arabia’s broader power-tools demand base and its rising pull from professional users shifting to cordless platforms. Growth is primarily driven by workshop throughput (mechanical + body & paint), fleet maintenance cycles, premiumization toward brushless tools, and recurring spend on batteries/chargers and accessories. Market sizing reference: Saudi Arabia Power Tools Market dataset.

In KSA, Riyadh, Jeddah/Makkah corridor, and Dammam–Khobar–Jubail dominate consumption because they concentrate the highest density of dealer workshops, independent garages, collision repair clusters, logistics fleets, and industrial service yards. On the supply side, the market is dominated by import/manufacturing hubs (notably China, Germany, Japan, and the U.S.) because they control global power-tool platforms, battery ecosystems, and professional-grade components (motors, gear trains, cells), which shape what KSA distributors stock for automotive workloads.

Market Segmentation

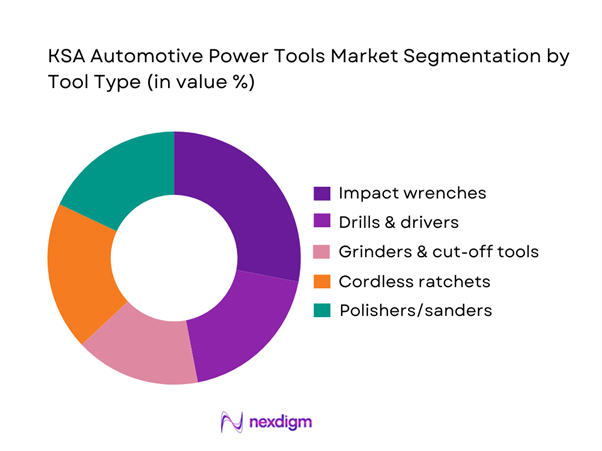

By Tool Type

KSA Automotive Power Tools market is segmented by tool type into impact wrenches, cordless ratchets, drills & drivers, grinders & cut-off tools, polishers/sanders, and specialty tools (heat guns, rivet tools, compact inflators, etc.). Recently, impact wrenches hold a dominant share in automotive workshops because tire service and underbody fastener removal are among the highest-frequency jobs across independent garages and fast-fit outlets. KSA workshops also value repeatable torque delivery and reduced downtime—driving adoption of pro-grade cordless impact kits that bundle batteries/chargers and simplify procurement. The dominance is reinforced by accessories availability (sockets, anvils, retention rings) and the ability to cover multiple bays with standardized battery platforms.

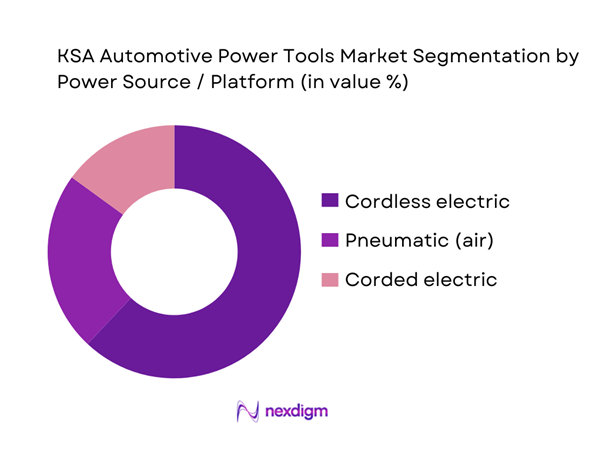

By Power Source / Platform

KSA Automotive Power Tools market is segmented by power source into cordless electric, corded electric, and pneumatic (air) tools. Cordless electric dominates because it improves bay productivity (no hose management), reduces trip hazards, and enables tool mobility across multi-bay workshops and roadside service. Battery tech improvements (higher energy density packs, faster chargers, brushless motors) have made cordless viable even for torque-heavy jobs, especially in tire and general mechanical service. Cordless also fits the KSA channel reality: distributors and retailers sell tool “ecosystems” (tool + battery + charger) that lock in repeat purchases of compatible packs, while workshops prefer platform standardization to reduce mixed inventory. Pneumatic retains niche strength in some high-duty, compressor-rich garages, but cordless is increasingly the default for new purchases.

Note (for both tables): Public sources typically publish Saudi power-tools segmentation at an overall-market level (not automotive-only). The above automotive-oriented splits are constructed to reflect workshop-heavy demand patterns and channel mix described in KSA power-tools segmentation scopes (tool types / modes / applications) and market structure references.

Competitive Landscape

The KSA Automotive Power Tools market is led by a mix of global professional brands and strong regional distributors/retailers that shape availability, warranty handling, and workshop adoption. Global brands dominate professional bays through battery-platform breadth, durability reputation, and accessories ecosystems, while local channel leaders strengthen reach via B2B counters, e-commerce fulfillment, and after-sales service coverage across Riyadh, Jeddah, and the Eastern Province.

| Company | Established | Headquarters | Core Automotive Tool Strength | Battery Platform Depth | KSA Channel Strength | Warranty / Service Model | Price Positioning | Typical Automotive Buyers |

| Bosch | 1886 | Germany | ~ | ~ | ~ | ~ | ~ | ~ |

| Makita | 1915 | Japan | ~ | ~ | ~ | ~ | ~ | ~ |

| DEWALT (Stanley Black & Decker) | 1924 | USA | ~ | ~ | ~ | ~ | ~ | ~ |

| Milwaukee (TTI) | 1924 | Hong Kong (TTI) | ~ | ~ | ~ | ~ | ~ | ~ |

| Ingersoll Rand | 1871 | USA | ~ | ~ | ~ | ~ | ~ | ~ |

KSA Automotive Power Tools Market Analysis

Growth Drivers

Vehicle Maintenance Throughput Growth

Saudi Arabia’s in-use vehicle base rose to ~ vehicles (from ~ vehicles the year before), and new vehicle registrations exceeded ~ (up from ~). More vehicles on-road, plus a higher inflow of newly registered units, mechanically expands preventive maintenance (brakes, tires, suspension, fluids) and collision-repair throughput—work that is power-tool intensive (impact fastening, grinding/cutting, surface prep and finishing). This load is concentrated in high-traffic regions: Riyadh accounted for ~ of first-time driving licenses issued, with Makkah at ~ and Eastern at ~, indicating where workshop capacity and bay utilization scale fastest—driving higher tool run-hours and earlier replacement cycles for automotive-grade power tools.

Workshop Formalization

Formalization is visible in the scale-up of registered enterprises and employment in the “Wholesale and retail trade; repair of motor vehicles and motorcycles” ecosystem that supplies and services workshops. In ~, the sector recorded ~ current enterprises and ~ employed persons, creating a larger “organized” buyer base that tends to purchase through documented channels (warranty-backed kits, authorized spares, battery platforms) rather than ad-hoc sourcing. Formal firms also standardize tool fleets to reduce downtime—typical outcomes include higher penetration of branded cordless kits, planned preventive servicing of tools, and tighter procurement cycles for consumables (discs, pads, sockets). As workshop operations move from informal single-bay garages to multi-bay formats, they also adopt safer, faster workflows—directly increasing the installed base of impacts, ratchets, grinders, and polishers per site.

Challenges

Counterfeit and Grey Imports

Grey-market flows and non-compliant imports distort reliability, safety, and warranty outcomes in KSA’s power-tool ecosystem. The compliance environment is large-scale: SABER’s cumulative footprint includes over ~ shipment certificates and over ~ conformity certificates, reflecting the breadth of regulated imports and the enforcement attention on product conformity. When tools or batteries enter outside these controlled channels, workshops face higher risks—mismatched chargers, non-genuine battery packs, unsafe grinders/discs, and missing conformity documentation—leading to higher failure rates and more disputes at the counter. On the broader market-governance side, the Ministry of Commerce referred ~ violations to the Anti-Concealment Law Committee in Q~, an indicator of ongoing enforcement against informal/hidden commercial activity that often overlaps with grey distribution pathways.

Warranty Enforcement Gaps

Warranty enforcement becomes inconsistent when the supply chain mixes authorized distribution, parallel imports, and informal sellers—especially in categories where batteries/chargers drive repeat purchases. The scale of the formal ecosystem is large—~ current enterprises and ~ employed persons in the broader wholesale/retail + motor-vehicle repair sector—so outcomes vary widely by channel maturity and documentation practices. Disputes often arise around battery health, charger damage, or tool misuse in high-heat/high-dust bays, where proof-of-purchase and conformity documentation matter. Enforcement pressure on informal practices is also visible: ~ Anti-Concealment violations were referred in Q~, showing that authorities are actively addressing irregular commercial activity. For power tools, these gaps translate into uneven after-sales response times and higher operational risk for workshops trying to standardize tool platforms across multiple sites.

Opportunities

EV Service Tooling

EV servicing is an emerging pull for specialized automotive power tools (insulated tools, torque-controlled fastening, underbody access tools, cooling system service tools, and more advanced finishing/repair capabilities for lightweight materials). Current EV adoption indicators are still small but strategically important: reports indicate ~ electric vehicles sold in the country “last year” and ~ charging stations nationwide as of ~, alongside the operational reality that some long corridors (e.g., the ~-km Riyadh–Mecca stretch referenced) lack charging coverage. These constraints create a workshop opportunity: as EVs enter fleets and private ownership, technicians will need safer, more precise tooling and new service routines. Even at low unit volumes, EV jobs are higher-skill and equipment-heavy, encouraging workshops to invest in better torque control, diagnostic-adjacent tooling, and dedicated bays—supporting premium power-tool demand without requiring any future market-size assumptions.

Smart/Connected Tool Management for Fleets

Fleet and multi-branch workshop operations in KSA are becoming large enough to justify connected tool management—tracking tool location, run-hours, service schedules, battery health, and loss prevention across bays and sites. The macro footprint supports this: road freight imports were ~ tons and exports ~ tons, pointing to sustained logistics activity; and the broader wholesale/retail + motor-vehicle repair sector employed ~ people, indicating scale and operational complexity in the service ecosystem. For fleet workshops, downtime is costly—so tool analytics (which tools fail most, which batteries degrade fastest, which bays overuse grinders) directly improves utilization and reduces unplanned stoppages. As more tools become “platform ecosystems,” distributors can bundle connected chargers, tagged batteries, and service SLAs, creating a higher-value opportunity anchored in current operational scale rather than future forecasts.

Future Outlook

Over the next few years, the KSA Automotive Power Tools market is expected to expand steadily as workshops professionalize, fleet maintenance scales with logistics growth, and cordless platforms continue replacing pneumatic/corded tools in everyday jobs. Battery ecosystem economics (recurring pack sales), brushless penetration, and more “automotive-specific” kits (ratchets, compact impacts, polishing systems) will lift value growth. Demand will also be shaped by regulation-driven formalization (quality documentation and conformity processes) and by the rapid build-out of giga-project infrastructure that increases vehicle utilization and service demand.

Major Players

- Robert Bosch

- Makita

- Stanley Black & Decker

- Techtronic Industries

- Hilti

- Ingersoll Rand

- Atlas Copco

- Snap-on

- Koki Holdings

- FEIN

- Festool

- Panasonic

- SACO

- Star Links

Key Target Audience

- Automotive dealership groups and OEM service networks

- Independent workshop chains and fast-fit / tire-service networks

- Collision repair centers and body & paint workshops

- Fleet operators

- Industrial service contractors with automotive maintenance yards

- B2B distributors, wholesalers, and modern retail buyers

- Investments and venture capitalist firms

- Government and regulatory bodies

Research Methodology

Step 1: Identification of Key Variables

We map the KSA automotive service ecosystem—dealer workshops, independent garages, body shops, fast-fit chains, and fleets—then define the tool-demand variables (bay count, job mix, tool-hours/day, battery platform preference, warranty expectations). Desk research is supported by channel mapping of distributors/retailers and brand platform availability.

Step 2: Market Analysis and Construction

We build a bottom-up demand model using workshop archetypes (mechanical, tire, body & paint, fleet yard) and tool baskets per bay. This is combined with a top-down check using published Saudi power-tools market baselines and related fastening-tool outlooks to ensure consistency.

Step 3: Hypothesis Validation and Expert Consultation

We validate assumptions through structured interviews (CATI/online) with KSA distributors, workshop owners/foremen, procurement heads of fleets, and brand service partners. Inputs focus on replacement cycles, failure modes, battery refresh cadence, and price-tier migration.

Step 4: Research Synthesis and Final Output

We triangulate findings across stakeholder inputs and published references, finalize segmentation logic, and produce competitive benchmarking on platform depth, channel reach, warranty handling, and accessories availability. Outputs include scenario notes (corded/pneumatic persistence vs cordless acceleration) and actionable go-to-market implications.

- Executive Summary

- Research Methodology (Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Primary Interviews With Workshop Owners, Dealer Service Heads and Tool Distributors, Secondary Research Approach, Data Triangulation and Validation, Limitations and Future Conclusions)

- Definition and Scope

- Market Genesis and Evolution

- Demand Centers and Workshop Density

- Vehicle Parc and Repair Intensity Context

- Business Cycle and Replacement Cycle

- Growth Drivers

Vehicle Maintenance Throughput Growth

Workshop Formalization

Fleet Servicing Expansion

Cordless Tool Migration

Fast-Fit Network Expansion - Challenges

Counterfeit and Grey Imports

Warranty Enforcement Gaps

Battery Platform Lock-In

Spare Parts Lead Time Volatility

Total Cost of Ownership Visibility - Opportunities

EV service tooling

Smart/connected tool management for fleets

High-durability accessories

Subscription/managed tool programs - Trends

Rising Brushless Motor Adoption

Higher Capacity Battery Packs

Fast Charging Penetration

Torque Precision and Control Features

B2B E-Commerce Procurement - Regulatory and Policy Landscape

- SWOT Analysis

- Stakeholder & Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competitive Intensity & Ecosystem Mapping

- By Value, 2019–2024

- By Volume, 2019–2024

- By Average Selling Price, 2019–2024

- Installed Base of Automotive Power Tools, 2019–2024

- Battery Pack Installed Base, 2019–2024

- By Tool Category (in Value %)

Impact Wrenches

Cordless Ratchets

Grinders and Cut-Off Tools

Drills and Drivers

Polishers and Sanders - By Power Source (in Value %)

Cordless Electric

Corded Electric

Pneumatic

Hydraulic

Hybrid - By Battery Platform (in Value %)

12V Platform

18V or 20V Platform

40V or 60V Platform - By End User Type (in Value %)

OEM Dealership Workshops

Independent Mechanical Workshops

Collision and Body Shops

Tire and Fast-Fit Chains

Fleet and Industrial Workshops - By Application (in Value %)

Tire and Wheel Service

Engine Bay Work

Underbody and Fastener Operations

Body Preparation and Finishing

Interior and Trim Work - By Distribution Channel (in Value %)

Authorized Distributors

Automotive Parts Wholesalers

Industrial Supply Houses

Modern Retail and Hardware Chains

B2B E-Commerce Marketplaces - By Region (in Value %)

Central Region

Western Region

Eastern Region

Northern Region

Southern Region - By Price Tier (in Value %)

Entry

Mid

Professional

Premium - By Purchase Model (in Value %)

Outright Purchase

Bundle Kits

Workshop Contracts

Tool Financing and Leasing

- Market Share of Major Players by Value and Volume

Category Leadership Mapping - Cross Comparison Parameters (Battery Platform Depth and Compatibility, Automotive-Grade Torque Coverage, Duty-Cycle and Heat Reliability, KSA After-Sales Footprint and Repair Turnaround, Authorized Channel Coverage, Anti-Counterfeit and Warranty Controls, Spare Parts and Battery Availability, Workshop Training and Fleet Contracting Capability)

- SWOT Analysis of Major Players

- Channel Strategy Analysis

- Pricing Analysis of Key Automotive Power Tool SKUs

- Recent Developments and Innovation Landscape

- Detailed Profiles of Major Companies

Robert Bosch GmbH

Makita Corporation

Stanley Black and Decker

Techtronic Industries

Hilti

Ingersoll Rand

Atlas Copco

Snap-on Incorporated

Koki Holdings

FEIN

Festool

Panasonic Industry

SACO

Star Links

- Market Demand and Utilization Patterns

- Purchasing Power and Budget Allocation

- Decision-Making Unit Structure

- Needs, Desires and Pain Point Analysis

- Warranty and After-Sales Expectations

- By Value, 2025–2030

- By Volume, 2025–2030

- By Average Selling Price, 2025–2030

- Installed Base Outlook, 2025–2030

- Battery Pack and Charger Outlook, 2025–2030