Market Overview

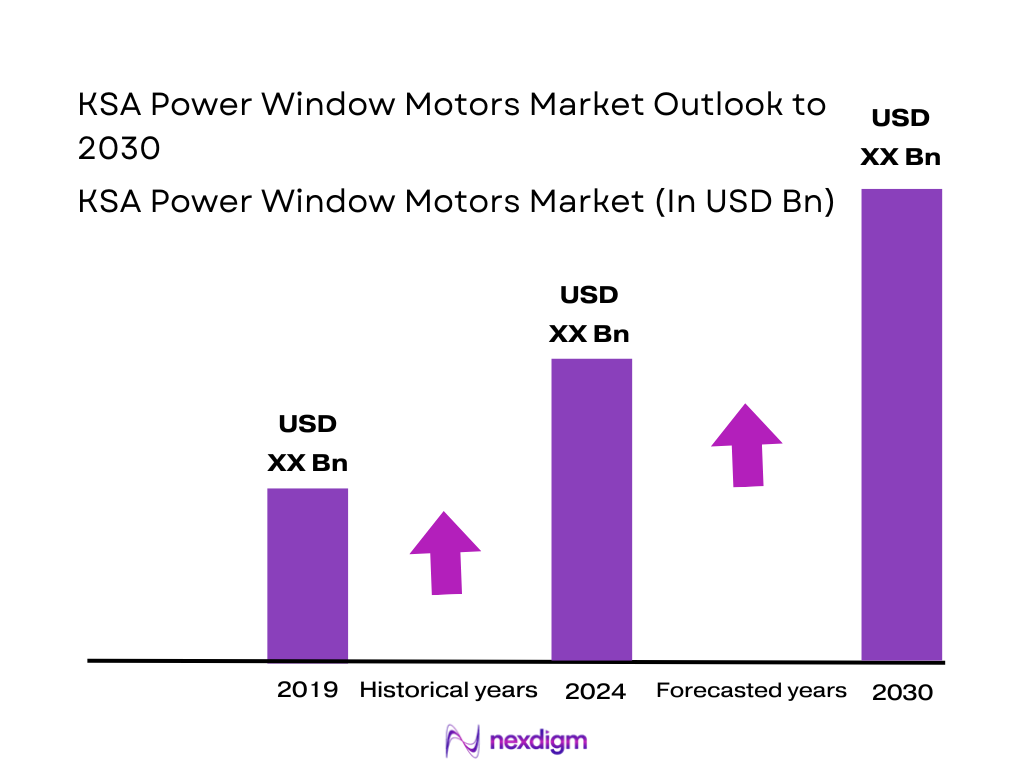

The KSA Power Window Motors Market is valued at USD ~ million in the prior year and USD ~ million in the latest year, based on a published Saudi Arabia window lift motors market value of USD ~ million and a one-year back-calculation for continuity in reporting. Demand is being driven by the high base of imported passenger vehicles, steady replacement cycles for window regulators/motors, and the aftermarket’s preference for complete motor-regulator assemblies to reduce rework and warranty claims.

Within the Kingdom, demand concentrates in Riyadh, Jeddah, and Dammam/Khobar because these metros account for the densest vehicle parc, higher utilization intensity (daily commuting, fleets), and the strongest concentration of dealership networks, multi-brand workshops, and parts distribution hubs. These cities also have faster adoption of feature-rich trims, which tend to use higher-spec window lift systems (lower noise, better durability) and drive repeat replacement demand through service networks rather than informal channels.

Market Segmentation

By Vehicle Type

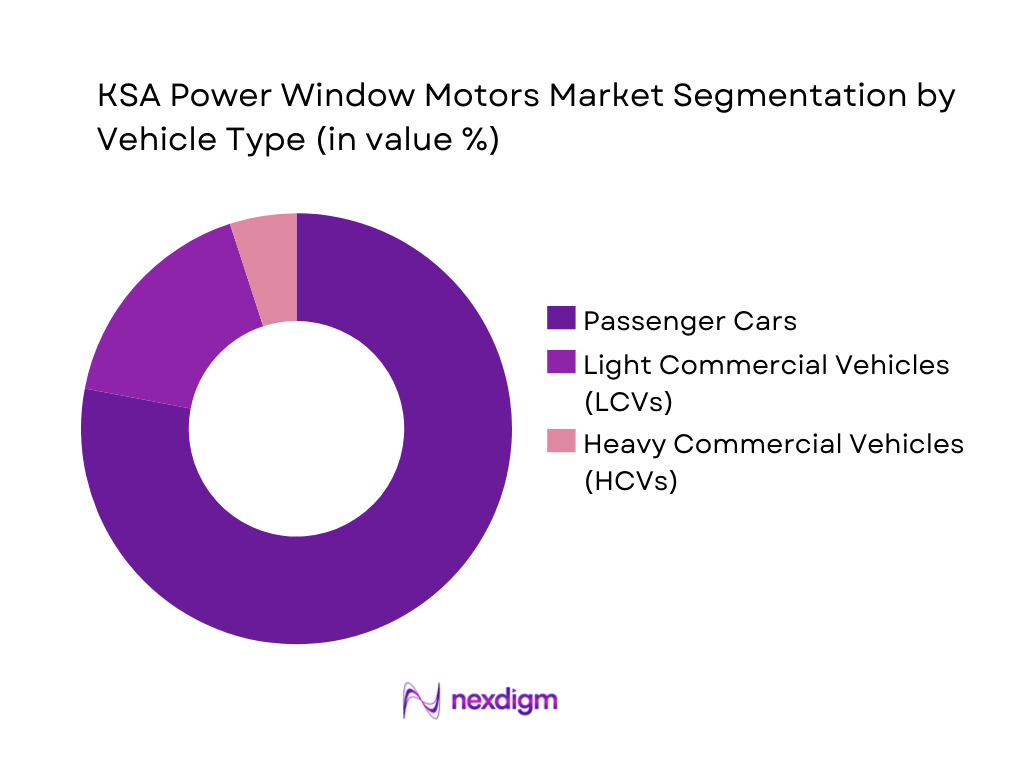

Passenger cars dominate because the installed base is larger and more replacement-prone than commercial categories. In KSA, the window motor failure mode is typically linked to frequent actuation, regulator wear, dust ingress, and door-harness stress—conditions more common in daily-driven passenger vehicles than fleet-heavy trucks. Passenger vehicles also have a higher penetration of multi-window power systems (front and rear), increasing motor count per vehicle and therefore the serviceable opportunity. Additionally, dealerships and multi-brand workshop chains stock passenger-vehicle window motor SKUs more aggressively due to faster inventory turns and stronger fitment standardization across popular Japanese/Korean models, making replacements easier and quicker. LCVs contribute meaningfully through delivery and service fleets, but HCVs are smaller in volume and often feature different door architectures and procurement routes.

By Sales Channel

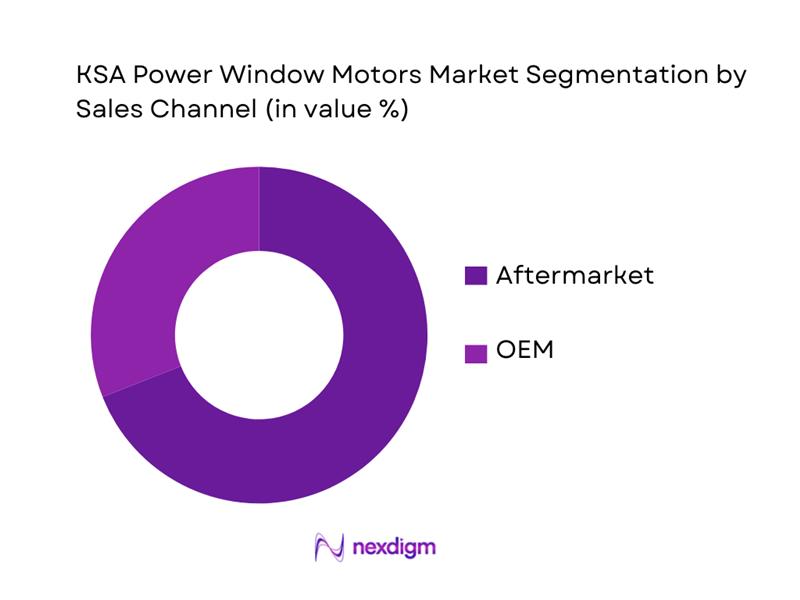

The aftermarket dominates because window motors are a classic mid-life failure component: once a motor begins to draw higher current or the regulator develops binding, workshops typically replace the assembly to restore smooth operation and avoid repeat visits. In KSA, the aftermarket is further supported by strong parts trading networks in Riyadh and Jeddah, cross-border sourcing, and the availability of parallel imports across multiple quality tiers (value, mid, premium). Customers also exhibit high willingness to replace window motors quickly due to safety, security, and comfort issues (stuck-open windows, non-functional driver-side windows). While OEM fitment is steady, it is limited to new vehicle sales volumes, whereas the aftermarket expands with the installed base and replacement frequency. Warranty-period replacements exist in dealerships, but most volume is captured after warranty expiration.

Competitive Landscape

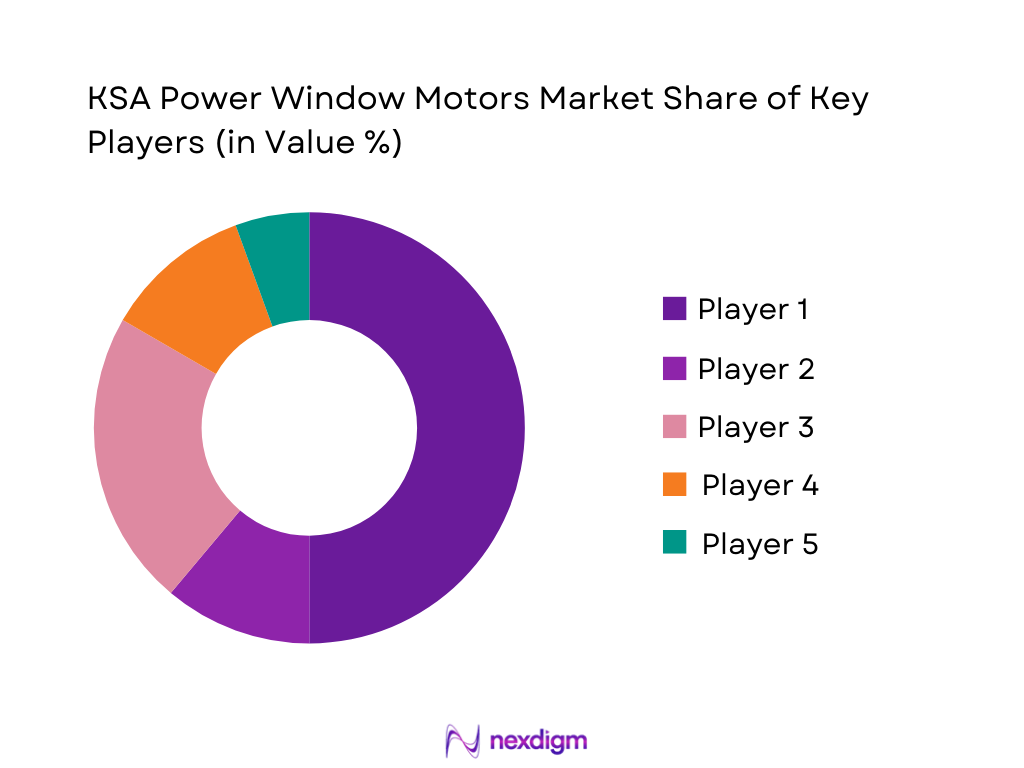

The KSA Power Window Motors market is influenced by a combination of global tier-~ suppliers (supplying OEM platforms and premium aftermarket) and aftermarket-focused brands with broad SKU coverage for Japanese/Korean/US vehicle parc. The competitive intensity is highest in the aftermarket, where availability, fitment breadth, warranty handling, and price-positioning determine workshop preference.

| Company | Established Year | Headquarters | Primary Route in KSA | Product Positioning | SKU Breadth (JP/KR/US) | Typical Supply Form | Warranty Handling | Local Availability Strength |

| Denso | 1949 | Japan | ~ | ~ | ~ | ~ | ~ | ~ |

| Bosch | 1886 | Germany | ~ | ~ | ~ | ~ | ~ | ~ |

| Valeo | 1923 | France | OEM + Aftermarket | Premium / mid | Medium | Assemblies common | Strong | Medium–Strong |

| Brose | 1908 | Germany | ~ | ~ | ~ | ~ | ~ | ~ |

| Aisin | 1949 | Japan | ~ | ~ | ~ | ~ | ~ | ~ |

KSA Power Window Motors Market Analysis

Growth Drivers

Rising Passenger Vehicle Sales and SUV Preference

KSA’s power window motor demand rises with the expanding in-use vehicle base and sustained inflow of newly registered vehicles, because each additional vehicle adds multiple door-window actuations (front and rear) and expands the replacement pool for motors/regulators over time. Government road-transport statistics show registered and roadworthy vehicles increased from ~ million to ~ million, while vehicles registered as a new issue reached ~ thousand. The same release shows newly issued driving licenses increased to ~ thousand, indicating more active drivers and higher utilization intensity (more daily window cycles, more wear on motors and regulators). On the macro side, Saudi Arabia’s economy recorded GDP of USD ~ trillion and GDP per capita of USD ~, supporting continued vehicle ownership and service spend capacity in a market where comfort features are standard expectations. SUV/crossover usage is structurally favored in the Kingdom due to long-distance commuting, desert/hot climate operations, and family-oriented mobility patterns; this matters for window motors because SUVs typically see higher family occupancy and higher door usage, increasing duty cycles on window mechanisms over the vehicle life.

Increasing Standardization of Power Windows Across Trims

Power windows are no longer limited to premium trims in KSA’s new-vehicle fleet; standardization means the “addressable unit count” of window motors rises almost one-for-one with new registrations because even entry trims typically include powered front windows (and, increasingly, all four). This is crucial for the window motor market because a “manual-to-power” mix shift is far more powerful than demonstrating incremental vehicle growth alone: every additional power-equipped door adds a motor/regulator system that eventually enters the aftermarket replacement cycle. Government road-transport data indicates ~ thousand new vehicle registrations were recorded, and the total in-use fleet reached ~ million vehicles—both figures imply a broad base of modern vehicles with powered comfort systems circulating through authorized and independent service channels. Standardization also aligns with a consumer environment where time-cost is high and repair turnaround matters: when a power window fails, replacing the motor/regulator assembly is a common workshop choice to restore function quickly.

Challenges

Price Sensitivity in Aftermarket Segment

Aftermarket purchasing for window motors in KSA is highly price-sensitive because replacement decisions are often made at workshop counters where customers choose between multiple quality tiers (OE-grade, mid-tier, value imports) for the same fitment. This sensitivity intensifies when the addressable installed base is large and diverse—workshops must stock fast-moving SKUs and offer price bands that match vehicle age and owner willingness to pay. Government road-transport statistics show the installed base is substantial at ~ million registered and roadworthy vehicles, which naturally includes a wide spread of vehicle ages and ownership profiles; that breadth translates into a broad affordability spectrum in repair behavior. The same statistics show ~ traffic accident fatalities and ~ traffic accident injuries, and ~ serious accidents, underscoring high vehicle utilization and operating stress—conditions that increase repair incidence and make maintenance budgeting a frequent reality for owners, further reinforcing cost-conscious replacement behavior for non-safety-critical comfort parts like window motors.

Dependence on Imported Components

KSA’s window motor market remains structurally dependent on imports because most passenger vehicles are imported and the component ecosystem for door modules (motors, regulators, switches, harnesses) is still predominantly supplied through cross-border sourcing and distributor networks. This dependence becomes a direct operational risk when demand spikes or when inbound logistics face bottlenecks, because workshops and dealers need model-specific SKUs and cannot substitute easily without fitment and connector compatibility. The market’s import dependence is reinforced by the scale of the operating vehicle fleet: government statistics show ~ million registered and roadworthy vehicles, and ~ thousand vehicles registered as a new issue, meaning a large and continuously expanding stock of vehicles requiring parts support. The same release reports road freight imports through land ports reached ~ million tons, illustrating how much inbound flow is needed simply to keep the economy supplied, including automotive parts traded through regional land routes. From a macroeconomic base, the country’s USD ~ trillion GDP reflects the size of domestic consumption that imports must serve.

Opportunities

Adoption of Brushless Motors in Premium and Electric Vehicles

Brushless window motors are an opportunity area because premium and EV platforms increasingly prioritize lower noise, improved durability, and better energy efficiency—attributes that align with brushless designs and tighter control electronics. KSA’s EV ecosystem is still early-stage, but credible, current indicators show meaningful momentum that supports a premiumization pathway in body electronics and comfort modules. Reports indicate ~ electric vehicles were sold and note ~ charging stations nationwide at that time—small in absolute terms, but large enough to create a visible premium EV user segment that typically demands higher-spec components, including quieter and more reliable window lift systems. On the enabling side, deployed network footprints include ~ locations, ~ chargers, and ~ connectors, showing the infrastructure is becoming tangible in the key metros that lead premium vehicle adoption. This matters for window motor suppliers because premium and EV vehicles also tend to use more integrated door modules, and customers in these segments are less tolerant of window noise, slow actuation, or repeat failures—raising the value placed on higher-grade motor technology and verified assemblies in the aftermarket.

Localization Opportunities under Saudi Industrial Strategy

Localization is an opportunity for the window motor category because it can begin with “near-local” value creation—regional warehousing, local packaging, harness/connector adaptation, faster fulfillment, and eventually partial assembly for high-runner SKUs—without requiring immediate deep manufacturing localization. The opportunity is supported by the Kingdom’s scale indicators and throughput reality: the in-use fleet stands at ~ million registered and roadworthy vehicles, and ~ thousand vehicles registered as a new issue indicates large annual additions to the serviced base, which strengthens the business case for local stocking and localization of fast-moving window motor assemblies. Government transport statistics also show road freight imports through land ports reached ~ million tons, demonstrating the logistics backbone already moving high volumes; suppliers that convert part of this flow into KSA-based distribution (instead of multi-hop re-export channels) can shorten lead times and reduce workshop downtime, improving channel preference.

Future Outlook

Over the next five years, the KSA Power Window Motors Market is expected to expand steadily, supported by a growing installed base of feature-rich passenger vehicles, increasing workshop formalization, and higher replacement rates for complete motor-regulator assemblies. Product migration toward lower-noise designs, improved durability, and better water/dust protection will lift the value mix. Growth is also supported by continued parts distribution strengthening in major metros and broader access to verified-fitment catalogs through digitized parts platforms.

Major Players

- Denso

- Robert Bosch

- Valeo

- Brose

- Aisin

- Continental

- Johnson Electric

- Mitsuba

- Magna

- Hi-Lex

- Ficosa

- Hella

- ZF

- Dorman

Key Target Audience

- Automotive OEM & localization teams

- Tier-~ & tier-~ automotive component suppliers

- Aftermarket parts importers & master distributors

- Dealership groups and authorized service networks

- Multi-brand workshop chains and fleet maintenance networks

- E-commerce auto parts platforms and marketplace category heads

- Investments and venture capitalist firms

- Government and regulatory bodies

Research Methodology

Step 1: Identification of Key Variables

The initial phase develops an ecosystem map covering OEMs, tier suppliers, importers, distributors, and workshop channels within the KSA Power Window Motors Market. Desk research is used to define variables such as installed base exposure, failure modes, SKU proliferation, channel mark-ups, and warranty practices. The output is a consolidated variable set that governs demand and pricing behavior across metros.

Step 2: Market Analysis and Construction

This phase compiles historical indicators for vehicle parc mix, replacement intensity proxies, and channel throughput patterns to construct the demand stack for window motors and motor-regulator assemblies. We assess channel splits (OEM vs aftermarket), parts movement logic (import-led vs local redistribution), and category price architecture (value, mid, premium). Triangulation is performed to align the revenue model with published directional market anchors.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are validated through CATI-style interviews with aftermarket importers, workshop owners, parts traders, and dealership parts managers. These interviews refine assumptions on top-selling applications, failure frequency by vehicle type, preferred supply forms (motor-only vs assembly), and the practical impact of warranty handling on purchase decisions.

Step 4: Research Synthesis and Final Output

Findings are synthesized into a finalized market model and competitive assessment, cross-checking supplier positioning, channel access, and value propositions. The final output integrates the segmentation view, competitive benchmarking, and forward outlook, and aligns conclusions with available syndicated references for window lift/power window motor category behavior.

- Executive Summary

- Research Methodology (Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Bottom-Up and Top-Down Validation, Primary Interviews with OEMs, Tier-1 Suppliers and Aftermarket Distributors, Secondary Research Sources, Demand–Supply Modelling, Limitations and Assumptions)

- Definition and Scope

- Market Evolution and Technology Genesis

- Automotive Production and Vehicle Parc Trends in KSA

- Power Window Penetration by Vehicle Category

- Automotive Component Supply Chain and Value Chain Analysis

- Growth Drivers

Rising Passenger Vehicle Sales and SUV Preference

Increasing Standardization of Power Windows Across Trims

Growth of Vehicle Assembly and CKD Operations - Challenges

Price Sensitivity in Aftermarket Segment

Dependence on Imported Components - Opportunities

Adoption of Brushless Motors in Premium and Electric Vehicles

Localization Opportunities under Saudi Industrial Strategy - Trends

Shift Towards Lightweight and Energy-Efficient Motors

Integration with Smart Door and Comfort Systems - Government Regulations and Standards

- SWOT Analysis

- Stakeholder Ecosystem

- Porter’s Five Forces Analysis

- Competition Ecosystem

- By Value, 2019–2024

- By Volume, 2019–2024

- By Average Unit Price, 2019–2024

- By Fleet Type (in Value %)

Passenger Cars

SUVs and Crossovers

Light Commercial Vehicles

Heavy Commercial Vehicles

Off-Road and Utility Vehicles - By Application (in Value %)

Brushed DC Motors

Brushless DC Motors - By Technology Architecture (in Value %)

Scissor Type

Cable Type - By Connectivity Type (in Value %)

OEM Fitment

Aftermarket Replacement - By End-Use Industry (in Value %)

ICE Vehicles

Hybrid Vehicles

Electric Vehicles - By Region (in Value %)

Central Region

Western Region

Eastern Region

Southern Region

Northern Region

- Market Share Analysis of Key Players

- Cross Comparison Parameters (Product Portfolio Breadth, OEM Tie-Ups in KSA, Localization Presence, Technology Type Offering, Average Price Positioning, Aftermarket Network Strength, Supply Reliability, Strategic Partnerships)

- SWOT Analysis of Major Players

- Pricing Analysis by Vehicle Segment and Motor Type

- Detailed Profiles of Major Companies

Bosch

Denso Corporation

Valeo

Brose Fahrzeugteile

Magna International

Aisin Corporation

Johnson Electric

Mitsuba Corporation

Nidec Corporation

Continental

ZF Friedrichshafen

HELLA

Mabuchi Motor

SHB Automotive

- OEM Demand Dynamics

- Aftermarket Replacement Cycles

- Purchasing and Sourcing Criteria

- Pain Points and Failure Analysis

- Decision-Making Parameters

- By Value, 2025–2030

- By Volume, 2025–2030

- By Average Unit Price, 2025–2030