Market Overview

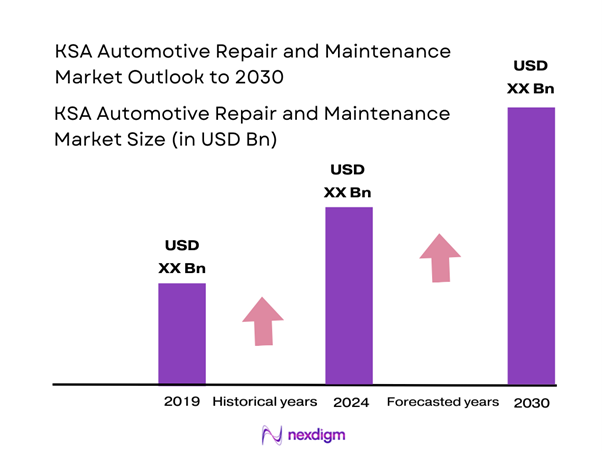

The KSA Automotive Repair and Maintenance market is valued at USD 1.5 billion in 2024 with an approximated compound annual growth rate (CAGR) of 8% from 2024-2030, based on a five-year historical analysis. This growth is driven by a surge in vehicle ownership, an increasing number of automobiles on the road, and a growing consumer preference for professional repair services over DIY methods. Additionally, improvements in disposable incomes among Saudi citizens encourage investment in vehicle upkeep, leading to an expansion in service offerings.

The dominant cities in the KSA Automotive Repair and Maintenance market include Riyadh, Jeddah, and Dammam. Riyadh, as the capital, serves as a central hub for automotive services, benefiting from a high population density and a large number of vehicle registrations. Jeddah, known for its commercial activities and proximity to significant maritime trade routes, has a strong presence of service centers catering to a diverse vehicle population.

The KSA government has implemented stringent import regulations for automotive parts as part of its effort to enhance safety and quality standards in the automotive repair sector. These regulations, enforced by the Saudi Standards, Metrology and Quality Organization, require that all imported auto parts demonstrate compliance with established quality benchmarks. For instance, in 2023, approximately 40% of imported auto parts failed to meet these standards, leading to increased scrutiny and enforcement actions.

Market Segmentation

By Service Type

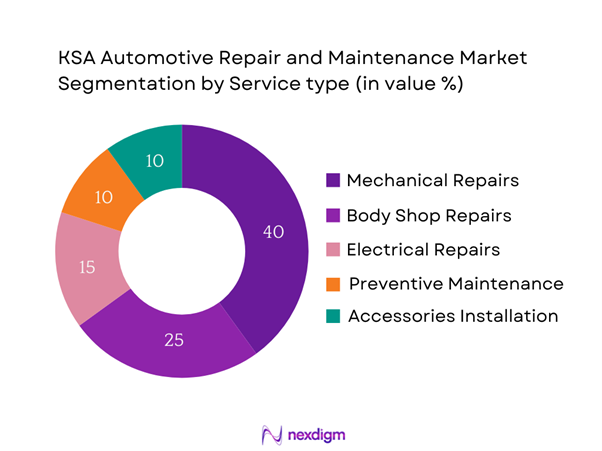

The KSA Automotive Repair and Maintenance market is segmented by service type, which includes mechanical repairs, body shop repairs, electrical repairs, preventive maintenance, and accessories installation. The mechanical repairs sub-segment dominates the market share, as they are essential for optimal vehicle performance and safety. Mechanical repair services address common issues such as engine problems, transmission issues, and brake maintenance. The complexity and necessity of these services ensure high demand, further supported by the increasing number of vehicles requiring regular servicing. Therefore, this sub-segment continues to drive the growth of the overall market.

By Vehicle Type

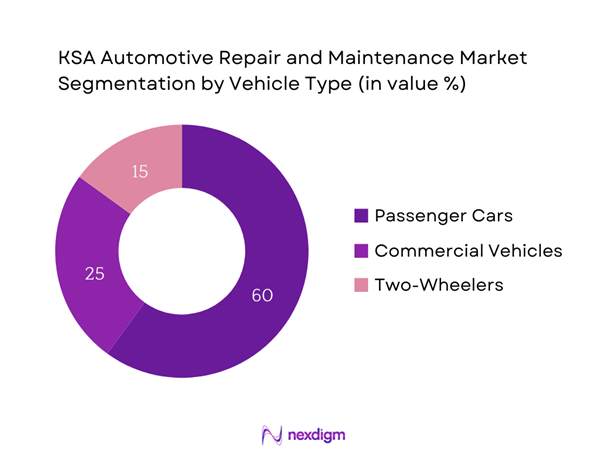

The market is also segmented by vehicle type, comprising passenger cars, commercial vehicles, and two-wheelers. Passenger cars hold a significant market share due to their prevalent usage in urban environments for private and family transport. The increase in urbanization and the growing middle-class population in KSA are driving vehicle registrations in this category. As these vehicles typically require more frequent maintenance and repairs, they constitute a substantial portion of the automotive repair and maintenance market.

Competitive Landscape

The KSA Automotive Repair and Maintenance market is dominated by several major players, reflecting the competitive nature of the industry. Companies such as Al-Futtaim Group, Abdul Latif Jameel, and Al-Jomaih Automotive lead the market with their extensive service networks and strong brand presence. This consolidation not only highlights the influence of these key companies but also showcases a competitive landscape that fosters innovation and customer loyalty.

| Company | Establishment Year | Headquarters | Market Reach | Service Type | Customer Engagement Strategies | Technological Adoption |

| Al-Futtaim Group | 1930 | Dubai, UAE | – | – | – | – |

| Abdul Latif Jameel | 1955 | Jeddah, KSA | – | – | – | – |

| Al-Jomaih Automotive | 1965 | Riyadh, KSA | – | – | – | – |

| Binsina Group | 1976 | Riyadh, KSA | – | – | – | – |

| Al-Muqarram Group | 1980 | Jeddah, KSA | – | – | – | – |

KSA Automotive Repair and Maintenance Market Analysis

Growth Drivers

Rising Vehicle Ownership

The KSA automotive sector has seen a significant increase in vehicle ownership, with over 3 million new registrations in 2023 alone, according to the Saudi Arabian Traffic Department. This rise is attributed to a growing middle class and increasing disposable incomes, with the average household income reaching approximately USD 25,000 in recent years (World Bank). The preference for personal transportation is on the rise, resulting in 18.3 million registered vehicles as of 2023. Consequently, this surge in vehicle ownership is creating a greater demand for automotive repair and maintenance services across the nation.

Increased Traffic Congestion

Traffic congestion in urban centers like Riyadh and Jeddah has risen significantly, with average commute times exceeding 45 minutes during peak hours. According to a 2023 World Bank report, the rapid urbanization in KSA has led to a rise in the number of vehicles on the road, which is projected to increase by 2 million vehicles each year. This heightened traffic not only intensifies wear and tear on vehicles but also boosts the demand for maintenance services, as vehicle owners prioritize regular service to ensure vehicle longevity amid challenging road conditions.

Market Challenges

Fragmented Market Structure

The KSA automotive repair market is characterized by a fragmented industry structure, comprising over 5,000 service centers and independent workshops. This saturation leads to stiff competition and challenges in service standardization. A report by the Saudi Ministry of Commerce highlighted that around 75% of these workshops lack accreditation, impacting service quality and consumer confidence. Furthermore, this fragmentation complicates regulatory oversight, creating hurdles for consistent quality assurance and undermining the potential for industry-wide improvements.

Regulatory Compliance Issues

Compliance with local regulations poses significant challenges for businesses in the KSA automotive repair sector. Regulatory bodies have implemented stringent safety and quality standards that necessitate constant updates in workshops and service methods. According to the Saudi Standards, Metrology and Quality Organization, approximately 30% of repair shops struggle to meet these requirements, resulting in potential fines and loss of operating licenses. The need for ongoing workforce training to stay compliant adds to the operational costs for many service providers, creating a challenging environment for small and medium-sized enterprises.

Opportunities

Shift Towards EV Maintenance

The increasing penetration of electric vehicles (EVs) represents a substantial opportunity within the KSA automotive repair and maintenance market. EV sales have surged, with more than 15,000 units registered in 2023, a growth driven by government incentives aimed at promoting greener transport solutions. Currently, the Kingdom’s National Industrial Development and Logistics Program encourages investment in EV technology and infrastructure, paving the way for a new market segment focused on EV maintenance and servicing. The current statistics indicate that the demand for specialized service technicians is expected to increase significantly in the coming years, leading to innovation and growth within the sector.

Integration of Technology in Services

The integration of technology into automotive repair services is quickly becoming a focal point for growth within the KSA market. Digital platforms and mobile applications for service booking and tracking repairs are increasingly popular, with reports suggesting that 45% of consumers prefer to book their service appointments online. This shift towards tech-enabled services enhances customer convenience and streamlines operations for repair shops. Additionally, data analytics is used to track maintenance history and customer preferences, providing repair businesses with insights that can drive tailored service offerings. This technological evolution represents a key growth area for the industry, contributing to improved service efficiency and customer satisfaction.

Future Outlook

The KSA Automotive Repair and Maintenance market is expected to witness remarkable growth driven by continuous improvements in vehicle technology, changes in consumer behaviors, and the increasing importance of vehicle maintenance for performance and safety. Innovations in service delivery, such as the integration of digital platforms for bookings and diagnostics, are also expected to play a vital role in shaping the market landscape. Furthermore, with the government’s push towards increasing vehicle safety and efficiency, the upcoming years are poised for significant advancements and growth within the sector.

Major Players

- Al-Futtaim Group

- Abdul Latif Jameel

- Al-Jomaih Automotive

- Binsina Group

- Al-Muqarram Group

- Saudi Arabian Oil

- National Automotive Industry

- Olayan Automotive

- Al-Nakhli Group

- Haji Husein Alireza

- Gulf Motors

- Fawaz Al-Hokair Group

- Autoworld

- Al-Mahmal Group

- Al-Muqarram Group

Key Target Audience

- Automotive Manufacturers

- Service Center Owners

- Independent Repair Shops

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies (Ministry of Commerce, Saudi Standards, Metrology and Quality Organization)

- Fleet Management Companies

- Automotive Parts Suppliers

- Insurance Companies

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing a comprehensive ecosystem map encompassing all key stakeholders within the KSA Automotive Repair and Maintenance market. This step is underpinned by extensive desk research, utilizing a mix of secondary and proprietary databases to gather thorough industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics, including demand drivers and competitive forces.

Step 2: Market Analysis and Construction

In this phase, historical data related to the KSA Automotive Repair and Maintenance market will be compiled and analyzed. This process includes assessing market penetration, understanding the ratio of service centers to the total vehicle population, and estimating resultant revenue generation. An evaluation of service quality statistics will also be conducted to ensure that all revenue estimates are reliable and accurate, which will inform market size calculations.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be formulated and validated through computer-assisted telephone interviews (CATIs) with industry experts representing a diverse array of companies operating within the automotive sector. These consultations aim to gather valuable operational and financial insights directly from industry practitioners, which will significantly contribute to refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase encompasses direct engagement with various automotive repair service providers and manufacturers to acquire detailed insights into service segments, performance metrics, consumer preferences, and other pertinent factors. This interaction helps verify and complement statistics derived from the bottom-up approach, thereby ensuring a comprehensive analysis of the KSA Automotive Repair and Maintenance market is accomplished.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Historical Market Overview

- Key Industry Developments

- Business Cycle Analysis

- Supply Chain and Value Chain Analysis

- Growth Drivers

Rising Vehicle Ownership

Increased Traffic Congestion

Growth of Aftermarket Services - Market Challenges

Fragmented Market Structure

Regulatory Compliance Issues - Opportunities

Shift Towards EV Maintenance

Integration of Technology in Services - Trends

Increasing Use of Mobile Apps for Services

Eco-Friendly Repair Practices - Government Regulations

Import Regulations for Auto Parts

Safety and Quality Standards - SWOT Analysis

- Stakeholder Ecosystem

- Porter’s Five Forces Analysis

- By Revenue, 2019-2024

- By Number of Outlets, 2019-2024

- By Average Service Cost, 2019-2024

- By Service Type (In Value %)

Mechanical Repairs

– Engine Repairs

– Transmission and Gearbox Services

– Suspension and Brake System Services

– Exhaust System Repair

Body Shop Repairs

– Denting and Painting

– Collision Repair

– Frame Alignment

– Glass Replacement

Electrical Repairs

– Battery and Charging System

– Starter Motor and Alternator Services

– Lighting and Wiring Repairs

– ECU and Sensor Diagnosis

Preventive Maintenance

– Oil Change Services

– Filter Replacements

– Tire Rotation and Balancing

– Coolant/Brake Fluid Check

Accessories Installation

– Infotainment Systems

– Dash Cameras

– GPS and Tracking Devices

– Custom Lighting - By Vehicle Type (In Value %)

Passenger Cars

– Sedans

– SUVs

– Hatchbacks

Commercial Vehicles

– Light Commercial Vehicles (LCVs)

– Heavy Commercial Vehicles (HCVs)

– Buses

Two-Wheelers

– Motorcycles

– Scooters - By Distribution Channel (In Value %)

Authorized Service Centers

– OEM-Backed Facilities

– Dealership Service Units

Independent Repair Shops

– Local Garages

– Franchise Repair Chains

Online Service Booking Platforms

– Aggregator Platforms

– OEM Apps & Portals - By Region (In Value %)

Riyadh

Al Kharj

Dammam

Khobar

Dhahran

Jeddah

Makkah

Madinah

Abha

Jazan

Najran - By Customer Segment (In Value %)

Individual Consumers

Fleet Owners

Corporate Clients

- Market Share of Major Players on the Basis of Revenue, 2024

Market Share of Major Players by Service Type, 2024 - Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strengths, Weaknesses, Organizational Structure, Revenues, Revenues by Service Type, Service Offerings, Technological Adoption, Customer Engagement Strategies, Market Reach, Number of Service Centers, Channel Strategy, Customer Satisfaction Ratings, Workforce Capabilities, Unique Value Offering, and others)

- SWOT Analysis of Major Players

- Pricing Analysis for Key Services

- Detailed Profiles of Major Companies

Al-Futtaim Group

Abdul Latif Jameel

Al-Jomaih Automotive

Binsina Group

Al-Muqarram Group

Saudi Arabian Oil Company (Aramco)

National Automotive Industry

Olayan Automotive

Al-Nakhli Group

Al-Yusuf Group

Haji Husein Alireza

Gulf Motors

Fawaz Al-Hokair Group

Autoworld

Al-Mahmal Group

- Market Demand and Utilization Trends

- Consumer Behavior and Preferences

- Regulatory and Compliance Considerations

- Needs, Desires, and Pain Point Analysis

- Decision-Making Criteria

- By Revenue, 2025-2030

- By Number of Outlets, 2025-2030

- By Average Service Cost, 2025-2030