Market Overview

The KSA Automotive Tailgates market is valued at approximately USD ~ billion, based on industry-level vehicle component and spare parts market analyses in Saudi Arabia that capture body components such as plastic and metal tailgates within the broader automotive parts segment. This valuation aligns with the tailgate component share of the automotive supply chain, which is driven by increasing vehicle ownership levels, expansion of passenger cars and light commercial vehicles on Saudi roads, and the rising replacement demand from an aging vehicle fleet. The overall automotive spare parts market in the Kingdom was valued at USD ~ billion in 2024, demonstrating the significant base within which tailgates operate.

Major cities such as Riyadh, Jeddah, and Dammam dominate the Automotive Tailgates market due to their high vehicle density, concentrated distribution and service networks, and substantial industrial activity that requires frequent vehicle maintenance. Riyadh acts as a logistics and aftermarket hub, while Jeddah’s ports facilitate parts imports for OEM and aftermarket channels. Dammam supports vehicles serving eastern industrial and logistics operations, creating robust demand for durable and replacement tailgates in this region.

Market Segmentation

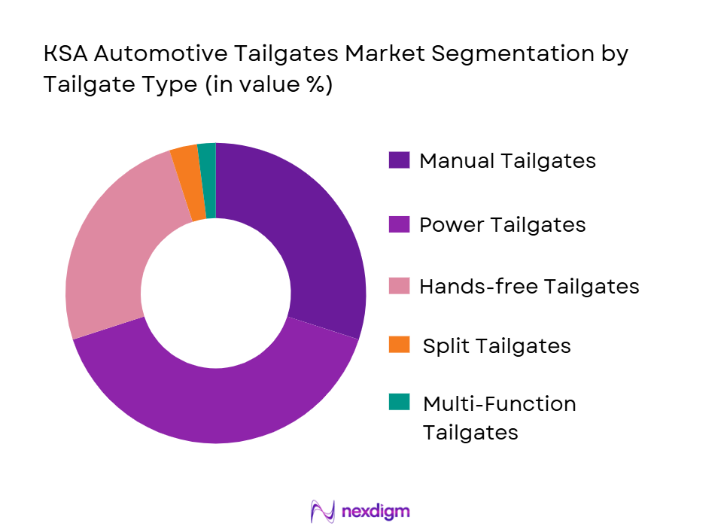

By Tailgate Type

The KSA market sees power tailgates capturing the largest share at 40% due to rising consumer preferences for convenience and premium features in SUVs and pickup trucks—two vehicle categories with strong demand in the Kingdom. Power tailgates provide ease of use, particularly in high-end passenger vehicles that are increasingly popular among Saudi buyers. Manual tailgates remain relevant at 30% share, particularly in commercial vehicle fleet segments where cost considerations outweigh feature preferences. Hands-free tailgates have seen rising adoption due to lifestyle trends and technology integration in new vehicle models sold by OEMs in the Kingdom. Split and multi-function tailgates hold smaller portions, mostly in customized or specialized vehicles that cater to niche commercial applications. Overall, demand is influenced by vehicle type preferences and increasing feature premiumization in new car purchases.

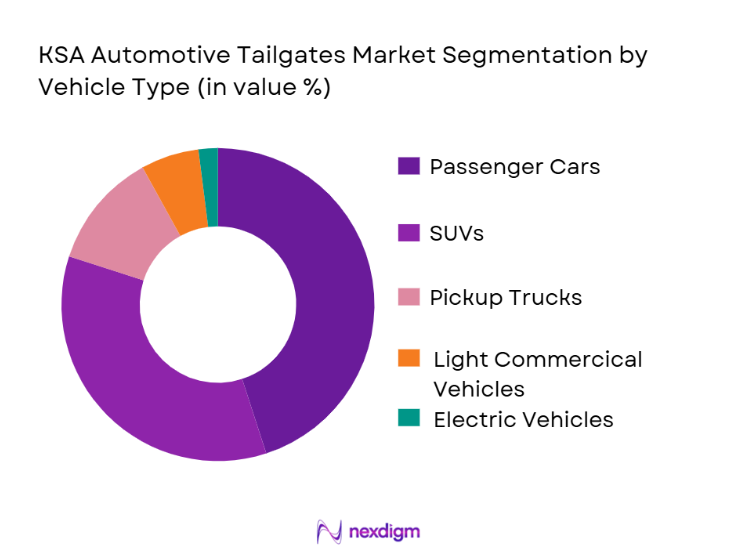

By Vehicle Type

Under this segmentation, passenger cars dominate with 45% share due to their sheer numbers in the vehicle parc and frequent aftermarket replacement needs. Passenger vehicle owners often seek both OEM and aftermarket tailgates, driven by aesthetic upgrades and utility features. SUVs follow closely at 35%, reflecting strong consumer preference for SUVs in the Saudi market, where road conditions and lifestyle demands favour larger vehicles. Pickup trucks hold a noteworthy position at 12%, attributed to their use in commercial, logistics, and construction applications that naturally necessitate robust tailgates. Light commercial vehicles and electric vehicles occupy smaller shares, with EVs at 2% largely due to the early stage of EV adoption in KSA. This segmentation highlights how vehicle preferences influence tailgate demand patterns.

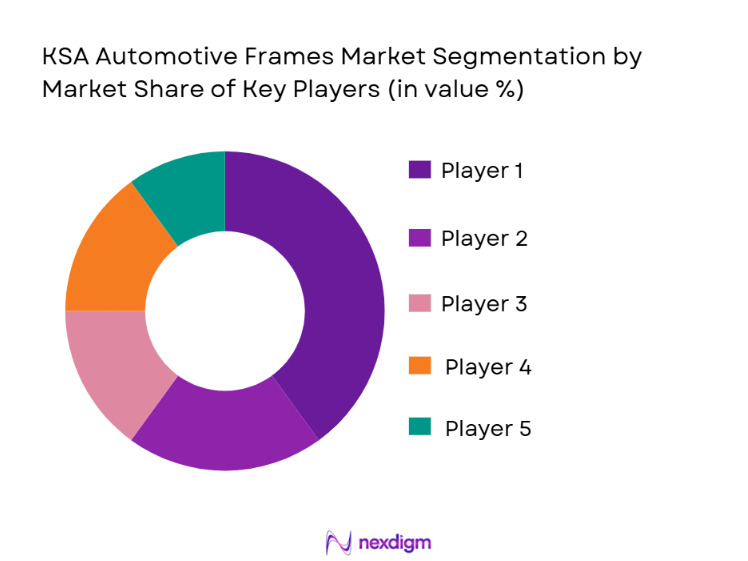

Competitive Landscape

The competitive landscape of the KSA Automotive Tailgates market reflects a combination of international component manufacturers and local distributors that supply both OEMs and aftermarket channels. Global OEM component suppliers partner with automotive assemblers and aftermarket networks to provide tailgate assemblies and related mechanisms, showcasing both product breadth and distribution strength.

| Company | Establishment Year | Headquarters | Tailgate Technology Offering | Local Manufacturing Presence | OEM Partnerships | Aftermarket Reach | Material Innovation Focus |

| Magna International | 1957 | Canada | ~ | ~ | ~ | ~ | ~ |

| Brose Fahrzeugteile | 1908 | Germany | ~ | ~ | ~ | ~ | ~ |

| Plastic Omnium | 1946 | France | ~ | ~ | ~ | ~ | ~ |

| Valeo | 1923 | France | ~ | ~ | ~ | ~ | ~ |

| Toyota Boshoku | 1918 | Japan | ~ | ~ | ~ | ~ | ~ |

KSA Automotive Tailgates Market Analysis

Growth Drivers

Increasing Vehicle Ownership

With Saudi Arabia’s growing population and increasing urbanization, the demand for vehicles, especially passenger cars and SUVs, is steadily rising. The automotive sector is seeing continuous growth in both new vehicle sales and the vehicle parc, with over ~ new vehicles registered annually. This surge in vehicle ownership directly contributes to the higher demand for automotive tailgates for both OEM fitment and replacement purposes. The rising number of vehicles also ensures consistent demand for durable and advanced tailgate components.

Expansion of the Light Commercial Vehicle Market

The demand for light commercial vehicles in Saudi Arabia is seeing an upward trend, particularly in logistics, construction, and e-commerce sectors. These vehicles require robust and functional tailgates for cargo handling. With the continuous growth in trade and logistics, driven by KSA’s strategic position in the Gulf region, the demand for durable tailgates designed for commercial use is expected to remain strong. The expansion of industrial infrastructure and government projects further fuels this growth.

Market Challenges

High Import Dependency

Despite growth in the local automotive sector, Saudi Arabia still heavily depends on imports for automotive parts, including tailgates. The reliance on foreign suppliers, particularly for specialized tailgate components like power tailgates, leads to supply chain vulnerabilities. Shipping delays, import duties, and the fluctuating cost of raw materials such as steel and aluminium can lead to price instability and production delays, hindering market growth.

Fluctuations in Raw Material Prices

The cost of materials used in tailgate production, such as steel, aluminium, and composite materials, is subject to global price volatility. These fluctuations directly affect manufacturers’ ability to maintain competitive pricing, which may limit the market’s growth potential. The global supply chain disruptions, coupled with increasing transportation costs, put additional pressure on manufacturers, potentially leading to higher end-user costs and delayed production timelines.

Opportunities

Localization of Manufacturing

Saudi Arabia’s Vision 2030 aims to diversify the economy and reduce dependency on oil exports, with significant investments in local manufacturing. This presents a key opportunity for tailgate manufacturers to set up localized production facilities, which could reduce costs, mitigate import dependency, and enhance product availability in the domestic market. The government is actively supporting manufacturing initiatives, making it an attractive proposition for both local and international automotive suppliers.

Electric Vehicle Growth

The rise of electric vehicles (EVs) in Saudi Arabia presents a significant opportunity for tailgate manufacturers. As the government accelerates its push toward eco-friendly vehicles, the demand for specialized EV tailgates—designed with lightweight materials and advanced features like hands-free access and energy-efficient motors—will increase. Although still in its nascent stages, the electric vehicle market is expected to grow rapidly, opening up new revenue streams for tailgate suppliers focused on the evolving needs of EV manufacturers.

Future Outlook

The KSA Automotive Tailgates market is poised for steady growth over the coming years, underpinned by sustained vehicle sales, Vision 2030 initiatives that support vehicle manufacturing and aftermarket expansion, and consumer preferences shifting toward convenience and safety features. Increasing investments in electric and hybrid vehicles, along with deeper integration of smart technologies in automotive components, are expected to drive tailgate innovation and demand. The aftermarket will continue to expand, supported by a growing fleet age and robust vehicle ownership trends.

Major Players

- Magna International

- Brose Fahrzeugteile

- Plastic Omnium

- Valeo

- Toyota Boshoku

- AISIN Corporation

- Gestamp

- Hyundai Mobis

- Inteva Products

- Samsung SDI

- Stabilus

- Kiekert AG

- Faurecia

- National Auto Parts Company

- DJ Auto

Key Target Audience

- Automotive OEM Procurement Heads

- Aftermarket Distribution Heads

- Auto Parts Importers & Wholesalers

- Dealership Parts & Service Heads

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies

- Fleet Management Companies

- Auto Electrification & Technology Suppliers

Research Methodology

Step 1: Market Definition and Component Mapping

The process began with defining tailgate components within the automotive value chain, using both primary and secondary resources to map all hardware, mechanisms, and technologies integral to the segment.

Step 2: Data Collection & Historical Analysis

Secondary data was collected from industry databases, validated reports on automotive parts markets, and import/export statistics to derive a 2023–2024 baseline, followed by triangulation with primary interviews of OEM suppliers and aftermarket distributors.

Step 3: Forecast Construction

Using top-down analysis from broader automotive parts market growth (~ % CAGR regionally) and tailgate component trends globally, forecast projections for 2024–2030 were developed, accounting for consumer preferences and regional automotive policy shifts.

Step 4: Validation & Expert Consultation

Insights and projections were validated through consultations with industry stakeholders, including parts distributors, manufacturing partners, and auto service networks in Saudi Arabia to ensure realistic and actionable outcomes.

- Executive Summary

- Research Methodology (Market Definitions & Assumptions, Abbreviations, KSA Vehicle Parc Consideration, OEM vs Aftermarket Coverage Logic, Import–Local Assembly Split, Market Sizing Logic, Bottom-Up Component Cost Build-Up, Top-Down Vehicle Production Mapping, Primary Interviews with OEMs & Tier-1s, Channel Checks with Distributors & Body Shops, Limitations & Assumptions)

- Definition and Scope

- Market Evolution and Genesis

- Automotive Manufacturing & Assembly Landscape in KSA

- Vehicle Ownership Trends and Fleet Penetration

- Supply Chain & Value Chain Mapping

- Localization vs Import Dependency Assessment

- Tailgate Role in Vehicle Design & Safety Architecture

- Growth Drivers

Technological Advancements in Tailgate Systems

Rising Demand for Electric Vehicles

Growing Automotive Industry in Saudi Arabia - Market Challenges

High Cost of Advanced Tailgate Systems

Supply Chain Disruptions in Automotive Components

Regulatory Barriers in Vehicle Production - Market Opportunities

Expansion of Electric Vehicle Market in Saudi Arabia

Increasing Urbanization and Automotive Demand

Potential for Smart Tailgate Integration - Trends

Shift Towards Electric and Autonomous Vehicles

Integration of IoT and Smart Features in Tailgates

Increasing Adoption of Power Tailgates in Commercial Vehicles - Government Regulations

Vehicle Safety Standards and Tailgate Regulations

Environmental Policies Encouraging Electric Vehicles

Import Tariffs and Local Production Incentives

- By Market Value 2019-2025

- By Installed Units 2019-2025

- By Average System Price 2019-2025

- By System Complexity Tier 2019-2025

- By System Type (In Value%)

Tailgate Liftgate

Manual Tailgate

Electric Tailgate

Smart Tailgate

Power Tailgate - By Platform Type (In Value%)

Passenger Vehicles

Commercial Vehicles

Electric Vehicles

Light Duty Vehicles

Heavy Duty Vehicles - By Fitment Type (In Value%)

OEM (Original Equipment Manufacturer)

Aftermarket

Integrated Fitment

Custom Fitment

Retrofitted Fitment - By EndUser Segment (In Value%)

Individual Consumers

Fleet Operators

Automotive OEMs

Car Rental & Leasing Companies

Logistics & Delivery Companies - By Procurement Channel (In Value%)

Direct Procurement

Third-Party Retailers

E-commerce Platforms

Distribution Networks

Wholesale Procurement

- Market Share Analysis

- CrossComparison Parameters

[Market Share, Pricing Strategies, Product Innovation, Supply Chain Network, Customer Support] - SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Porter’s Five Forces

- Key Players

Toyota Motor Corporation

Ford Motor Company

General Motors

Hyundai Motor Company

Nissan Motor Co. Ltd.

BMW Group

Daimler AG

Volkswagen AG

Kia Corporation

Honda Motor Co., Ltd.

Tata Motors

Renault S.A.

Fiat Chrysler Automobiles

Isuzu Motors Ltd.

Mitsubishi Motors Corporation

- Shift in Consumer Preferences for Automated Tailgates

- Impact of Fleet Operations on Tailgate Demand

- Role of E-commerce in Tailgate Market Growth

- Integration of Tailgates in Ride-Hailing Services

- Forecast Market Value 2026-2030

- Forecast Installed Units 2026-2030

- Price Forecast by System Tier 2026-2030

- Future Demand by Platform 2026-2030