Market Overview

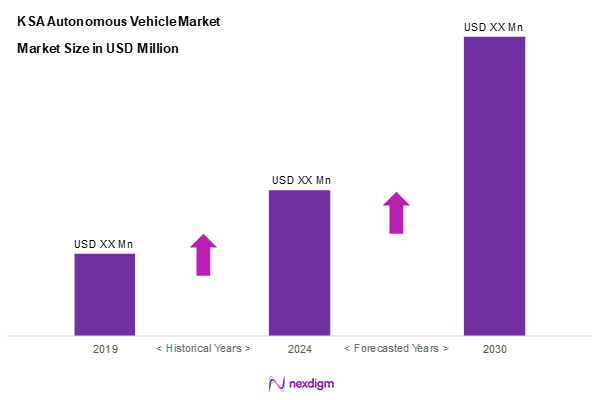

As of 2024, the KSA autonomous vehicle market is valued at USD 1,012.0 million, with a growing CAGR of 21.4% from 2024 to 2030, supported by increasing investments in smart transportation infrastructure and significant government funding for research and development in autonomous technologies. The decision to position smart mobility as a key part of the Vision 2030 initiatives has accelerated technology adoption, positioning the market for robust growth.

The dominant cities in the KSA Autonomous Vehicle market include Riyadh, Jeddah, and Dammam. These cities lead due to their considerable population density and progressively evolving transportation policies encouraging sustainable mobility solutions. Riyadh, being the capital, attracts substantial investments in smart mobility projects, while Jeddah and Dammam demonstrate increasing urban mobility demands that elevate market potential.

Market Segmentation

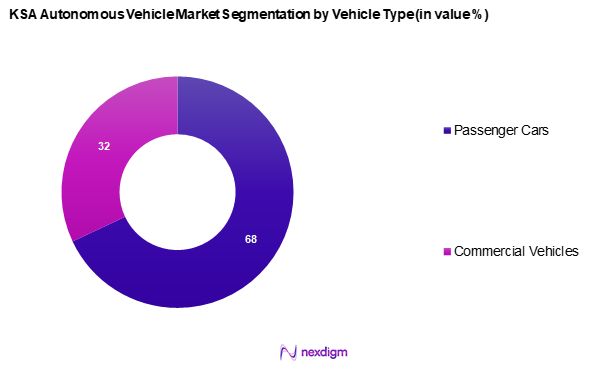

By Vehicle Type

The KSA autonomous vehicle market is segmented into passenger cars and commercial vehicles. The passenger car segment dominates the market share because of increasing consumer uptake of personal vehicles that offer autonomous features for enhanced convenience and safety. The rapid advancement in technology and the growing inclination towards personal mobility solutions facilitate the rise of this segment.

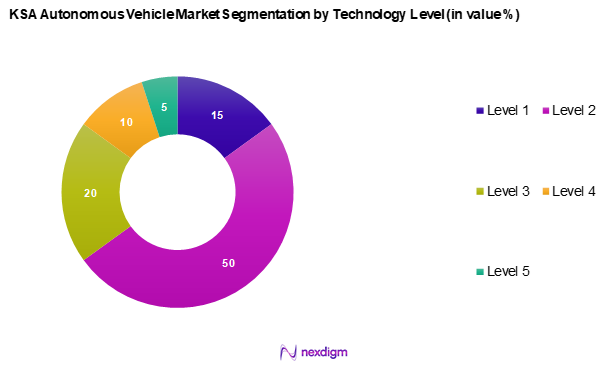

By Technology Level

The KSA autonomous vehicle market is segmented into level 1, level 2, level 3, level 4, and level 5 automation. Notably, Level 2 automation leads the market share, as it is increasingly available in consumer vehicles and aligns with the current capabilities of manufacturers. The combination of affordability and advanced driver-assistance systems make it appealing to a broader consumer base.

Competitive Landscape

The KSA autonomous vehicle market is dominated by several key players, including both established global brands and innovative local manufacturers. Major companies include Toyota, Tesla, BMW, and local entities that reflect the growing interest in autonomous technologies and their applications in everyday transportation. This concentration emphasizes competitive advantages in innovation, technology partnerships, and market expansion strategies.

| Company | Establishment Year | Headquarters | Revenue (USD) | Market Strategy | Market Share |

| Toyota Motor Corporation | 1937 | Tokyo, Japan | – | – | – |

| Tesla | 2003 | Texas, USA | – | – | – |

| BMW AG | 1916 | Munich, Germany | – | – | – |

| Nissan Motor Co., Ltd. | 1933 | Yokohama, Japan | – | – | – |

| Waymo LLC | 2009 | California, USA | – | – | – |

KSA Autonomous Vehicle Market Analysis

Growth Drivers

Government Initiatives for Smart Mobility

The Saudi Arabian government’s Vision 2030 plan emphasizes smart mobility, aiming to transform transportation infrastructure to reduce dependency on oil and encourage sustainable development. According to the Saudi Ministry of Finance, the government allocated over SAR 12 billion ($3.2 billion) towards research and infrastructure projects related to autonomous and electric vehicle technologies as part of this initiative. These investments are accelerating the adoption of autonomous vehicles by creating an ecosystem that supports advanced technology integration and reduces congestion in urban areas. The initiative also includes strategic public-private partnerships to innovate and implement smart mobility solutions.

Increased Investment in R&D

Research and Development (R&D) in Saudi Arabia is increasingly focused on autonomous vehicle technology, highlighting a commitment to advancing innovations in AI and vehicle automation. This strategic emphasis reflects Saudi Arabia’s ambition to become a leader in the high-tech automotive sector and draw global automakers to establish their manufacturing and R&D operations within the country. Industry experts consider these efforts crucial for driving advancements in autonomous vehicle technology and for enhancing the nation’s appeal as a destination for foreign direct investment, ultimately supporting the Kingdom’s broader economic diversification goals.

Market Challenges

Regulatory Hurdles

The regulatory landscape for autonomous vehicles in Saudi Arabia presents significant challenges, as comprehensive frameworks for testing and deploying these technologies are still evolving. A report by the Saudi Transport Authority noted that existing legislation does not sufficiently address liability, data privacy, and safety standards for autonomous vehicles. This regulatory uncertainty creates barriers for manufacturers and could slow down market progression unless resolved with clear guidelines and international collaboration for standardization. Enhanced cooperation between policymakers and industry stakeholders is essential to develop robust regulations that ensure the safe integration of autonomous vehicles into existing transportation systems.

Technological Limitations

Technological limitations, such as the current state of AI and sensor technologies, remain a major impediment to the large-scale deployment of autonomous vehicles in Saudi Arabia. Despite advancements, issues like poor sensor performance in extreme heat and sandstorms—a regular occurrence in the region—pose significant obstacles. A study in collaboration with King Abdulaziz City for Science and Technology highlighted that temperature variations could affect sensor accuracy and the reliability of AI-driven decision-making processes. Addressing these technological challenges requires substantial investment in technology-specific R&D and innovation tailored to local environmental conditions.

Opportunities

Government Vision 2030 Driving Smart Mobility Adoption

Saudi Arabia’s Vision 2030 emphasizes technological advancements, smart infrastructure, and sustainable transportation solutions, creating a strong foundation for autonomous vehicle (AV) adoption. The government is investing heavily in smart cities like NEOM, which are designed to incorporate AI-driven transportation networks. Regulatory support, partnerships with global AV firms, and dedicated pilot projects further enhance the market’s growth potential. As a result, Saudi Arabia is positioning itself as a regional leader in autonomous mobility, attracting investments and fostering innovation in the sector.

High Demand for Autonomous Solutions in Logistics and Ride-Sharing

With rapid urbanization and increasing e-commerce penetration, there is a growing need for efficient and cost-effective transportation solutions in Saudi Arabia. Autonomous vehicles offer a viable solution for logistics companies, reducing operational costs and improving last-mile delivery efficiency. Additionally, ride-sharing companies are exploring AV integration to enhance safety, reduce dependency on human drivers, and optimize fleet management. These factors contribute to the expansion of AV applications in both commercial and consumer segments, accelerating market growth in the Kingdom.

Future Outlook

Over the next five years, the KSA autonomous vehicle market is poised for substantial growth, driven by overarching government initiatives aimed at smart mobility, technological advancements in autonomous driving, and increasing consumer demand for efficient transportation solutions. The market trajectory suggests that investment in infrastructure and innovation will create an ecosystem conducive to the expansion of autonomous technologies.

Major Players

- Toyota Motor Corporation

- Tesla

- Waymo LLC

- Nissan Motor Co., Ltd.

- AUDI AG

- BMW AG

- Ford Motor Company

- Mercedes-Benz Group AG

- General Motors

- Honda Motor Co., Ltd.

- Hyundai Motor Company

- Volkswagen Group

- Baidu Research

- Zoox, Inc.

- Rivian

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies (Ministry of Transport, Saudi Arabian General Investment Authority)

- Automotive manufacturers

- Technology companies specializing in AI and machine learning

- Infrastructure developers

- Fleet management companies

- Logistics and freight companies

- Urban planning agencies

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves creating a comprehensive understanding of stakeholders and market drivers within the KSA autonomous vehicle market. This is achieved through extensive secondary research and the utilization of proprietary databases.

Step 2: Market Analysis and Construction

This phase focuses on collecting and analysing historical data related to market dynamics, evaluating penetration rates, and examining the revenue impact of various segments. This comprehensive approach ensures an accurate market depiction.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be developed and validated through interviews with industry experts to gather operational insights. This consultation process will encompass a diverse array of professionals from various companies involved in the KSA autonomous vehicle market, ensuring a robust verification of the underlying assumptions.

Step 4: Research Synthesis and Final Output

The final phase entails direct engagement with crucial stakeholders, including manufacturers, to acquire comprehensive data regarding their product offerings, sales performance, and emerging consumer preferences. This interaction will help corroborate the statistics derived from previous phases, leading to a well-rounded, validated market analysis.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Market Genesis

- Timeline of Major Players

- Business Cycle

- Supply Chain & Value Chain Analysis

- Growth Drivers

Government Initiatives for Smart Mobility

Increased Investment in R&D - Market Challenges

Regulatory Hurdles

Technological Limitations - Opportunities

Government Vision 2030 Driving Smart Mobility Adoption

High Demand for Autonomous Solutions in Logistics and Ride-Sharing - Trends

Growth of Mobility-as-a-Service (MaaS)

AI Integration in Autonomous Systems - Government Regulations

Safety Standards

Data Privacy Laws - SWOT Analysis

- Stakeholder Ecosystem

- Porter’s Five Forces

- By Value, 2019-2024

- By Volume, 2019-2024

- By Average Price, 2019-2024

- By Vehicle Type (In Value %)

Passenger Cars

Commercial Vehicles - By Technology Level (In Value %)

Level 1 (Driver Assistance)

Level 2 (Partial Automation)

Level 3 (Conditional Automation)

Level 4 (High Automation)

Level 5 (Full Automation) - By Sales Channel (In Value %)

Direct Sales

Online Platforms - By Component Type (In Value %)

Hardware

Software

Services - By Application (In Value %)

Urban Mobility

Industrial Applications

Logistics and Freight

Military and Defense

Others - By Propulsion (In Value %)

ICE

Electric - By Region (In Value %)

Riyadh

Jeddah

Dammam

Khobar

Makkah

- Market Share of Major Players by Value/Volume, 2024

Market Share of Major Players by Type of Vehicle Segment, 2024 - Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strengths, Weaknesses, Organizational Structure, Revenues, Distribution Channels, Number of Dealers, Market share, Production Capacity, Unique Value Propositions, and others)

- SWOT Analysis of Major Players

- Pricing Analysis of Major Players

- Profiles of Major Companies

TOYOTA MOTOR CORPORATION

Tesla

Waymo LLC

Nissan Motor Co., Ltd.

AUDI AG

BMW AG

Ford Motor Company

Mercedes-Benz Group AG

General Motors

Honda Motor Co., Ltd.

Hyundai Motor Company

Volkswagen Group

Baidu Research

Zoox, Inc.

Rivian

- Market Demand and Utilization

- Purchasing Power and Budget Allocations

- Regulatory and Compliance Requirements

- Needs, Desires, and Pain Point Analysis

- Decision Making Process

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average Price, 2025-2030