Market Overview

The KSA Aviation Market is valued at approximately USD ~ billion, driven by increasing air traffic demand, expansion in airport infrastructure, and investments aligned with Saudi Arabia’s Vision 2030. Key drivers include the ambitious goals to become a global aviation hub, advancements in airport digitalization, and a rise in both leisure and religious tourism, notably Hajj and Umrah. The aviation sector continues to receive significant investment from the government, with ongoing fleet expansion and international partnerships boosting the industry’s resilience.

Riyadh and Jeddah are the primary cities driving the KSA Aviation Market due to their strategic locations as gateways for international air travel, with Riyadh serving as a business hub and Jeddah as a key entry point for pilgrims heading to Mecca. The expansion of King Abdulaziz International Airport in Jeddah, alongside improvements in King Khalid International Airport in Riyadh, solidifies their position as dominant players. Government-backed initiatives, such as the development of new terminals and expanded routes, reinforce their dominance in the region.

Market Segmentation

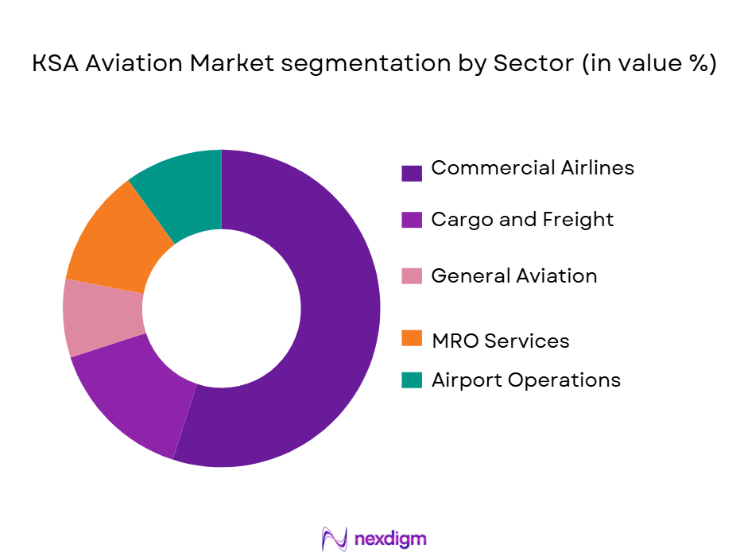

By Sector

The KSA Aviation Market is divided into several key sectors: Commercial Airlines, Cargo & Freight, General Aviation, Maintenance, Repair & Overhaul (MRO), and Airport Operations.

Commercial Airlines is the dominant sector, largely due to the dominance of Saudi Arabian Airlines (SAUDIA) and the recent rise of low-cost carriers such as Flynas and Flyadeal. These airlines benefit from a large domestic and international passenger base, supported by increased tourism flows from Hajj, Umrah, and leisure tourism. Additionally, government support to expand air routes under Vision 2030 fosters market growth in this sector.

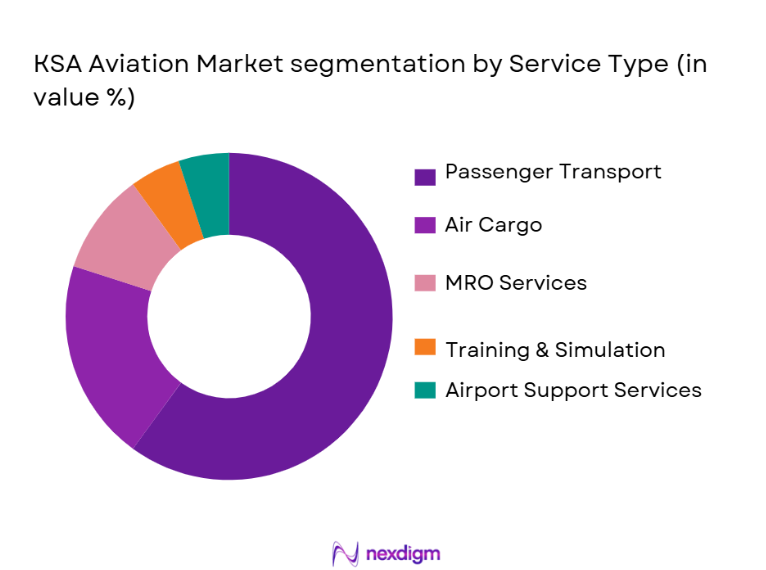

By Service Type

This segment includes Passenger Transport, Air Cargo, MRO Services, Training & Simulation, and Airport Support. Among these, Passenger Transport is the dominant sub-segment, owing to the increasing number of air passengers year-on-year, propelled by the influx of tourists, both for leisure and religious purposes. Airlines like Saudi Arabian Airlines and Flynas have expanded their fleets and routes to cater to rising demand, making passenger transport a critical driver for the aviation market.

Competitive Landscape

The KSA Aviation Market is highly competitive, with a few major players shaping the landscape. Local carriers such as Saudi Arabian Airlines (SAUDIA), Flynas, and Flyadeal dominate the commercial aviation sector, while foreign players like Emirates and Qatar Airways also have a significant share due to their strategic international connections. In the airport services segment, Saudi Ground Services and Menzies Aviation are key players. Companies offering MRO services, such as Saudia Aerospace Engineering Industries (SAEI) and Alsalam Aerospace Industries, are also critical contributors to the market.

| Company | Establishment Year | Headquarters | Fleet Size | Revenue | Market Segment | Employee Count | MRO Operations |

| Saudi Arabian Airlines (SAUDIA) | 1945 | Jeddah, KSA | ~ | ~ | ~ | ~ | ~ |

| Flynas | 2007 | Riyadh, KSA | ~ | ~ | ~ | ~ | ~ |

| Flyadeal | 2017 | Jeddah, KSA | ~ | ~ | ~ | ~ | ~ |

| Saudi Ground Services (SGS) | 1998 | Jeddah, KSA | ~ | ~ | ~ | ~ | ~ |

| Saudia Aerospace Engineering | 1979 | Jeddah, KSA | ~ | ~ | ~ | ~ | ~ |

KSA Aviation Market Analysis

Growth Drivers

Expansion of Air Traffic

The rising number of passengers, fueled by both religious tourism (Hajj and Umrah) and leisure travel, is driving significant growth in the KSA aviation market. Saudi Arabia’s efforts to become a global aviation hub, as part of Vision 2030, have further intensified investments in airports and airlines, which boosts air traffic both domestically and internationally.

Government Investments and Vision 2030 Initiatives

Government-backed infrastructure development, such as the expansion of King Abdulaziz International Airport and King Khalid International Airport, supports the growth of the aviation market. Vision 2030 emphasizes making Saudi Arabia a major player in global aviation, increasing the market size through new airlines, routes, and technology advancements.

Market Challenges

Regulatory and Compliance Hurdles

Strict regulatory frameworks for airlines and airports, alongside compliance with international aviation standards, present challenges for growth. Adapting to continuously evolving international air travel regulations and the high costs of meeting safety and environmental standards can be a significant burden on operators.

Fluctuating Fuel Prices

The volatility of global fuel prices remains a major challenge for airlines and cargo operators. The cost of fuel directly impacts operational expenses, leading to pricing volatility that can affect profitability and market sustainability.

Opportunities

Growth in Cargo and Logistics

With the rise of e-commerce and Saudi Arabia’s strategic location as a logistics hub, there is a growing opportunity in the air cargo and freight services sector. The expansion of airports and cargo facilities opens up new revenue streams for airlines and logistics companies, catering to a burgeoning demand for international freight transportation.

Advancements in Aircraft Technology

Innovations in fuel-efficient aircraft and the development of electric and hybrid planes offer significant opportunities for sustainability and cost savings. As the demand for eco-friendly air travel rises, operators investing in advanced, environmentally friendly technology stand to benefit from both consumer preferences and potential government incentives.

Future Outlook

Over the next six years, the KSA Aviation Market is poised for significant growth, driven by investments in airport infrastructure, fleet modernization, and an increase in both domestic and international air travel. The government’s strategic initiatives under Vision 2030 are expected to further bolster the sector, with a targeted increase in the number of international routes and services to attract more global carriers. Additionally, the rise of budget carriers and expanding airports, such as King Abdulaziz International Airport in Jeddah, are expected to ensure continued growth in the commercial and cargo aviation segments.

Major Players in the KSA Aviation Market

- Saudi Arabian Airlines (SAUDIA)

- Flynas

- Flyadeal

- Saudi Ground Services (SGS)

- Saudia Aerospace Engineering Industries (SAEI)

- Alsalam Aerospace Industries

- Menzies Aviation

- Emirates Airlines

- Qatar Airways

- Boeing Saudi Arabia

- Airbus Saudi Arabia

- Lockheed Martin Saudi Arabia

- Thales Group Saudi Arabia

- Raytheon Saudi Arabia

- Northrop Grumman Saudi Arabia

Key Target Audience

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies

- Airline Fleet Managers

- Airport Operators & Developers

- Maintenance, Repair, and Overhaul (MRO) Companies

- Aircraft Manufacturers

- Cargo & Freight Logistics Firms

- Tourism and Hospitality Operators

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map, outlining all major stakeholders within the KSA Aviation Market, including government bodies (GACA), airlines, airport operators, and MRO providers. This phase relies on extensive secondary research to gather comprehensive industry-level data, providing a foundation for subsequent analysis.

Step 2: Market Analysis and Construction

This phase consolidates data on key market drivers such as passenger volume, cargo throughput, fleet size, and government policies. The analysis is validated through direct industry interactions, ensuring an accurate assessment of growth prospects in both commercial and cargo aviation sectors.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are validated through expert consultations with senior executives and decision-makers from major airlines, MRO firms, and airport authorities. These consultations provide operational and financial insights that help refine the initial data models, ensuring the robustness of the market size estimation.

Step 4: Research Synthesis and Final Output

The final stage includes synthesizing primary and secondary research findings into a comprehensive report. The research is cross-checked with insights obtained from interviews with top executives to ensure the data’s reliability and accuracy, ensuring that the final output accurately reflects current and future market trends.

- Executive Summary

- Research Methodology (Market Definitions and Assumptions, Aviation Ecosystem Mapping Approach, Primary & Secondary Research Protocols, Supply Side & Demand Side Validation, Forecasting Models, Data Triangulation Logic, Limitations and Assumptions)

- Definition and Scope

- Industry Genesis and Evolution

- Saudi Vision 2030 Aviation Strategy & Policy Framework

- Air Transport Facilitation & Regulatory Framework

- Value Chain & Ecosystem Analysis

- Growth Drivers

Vision 2030 Aviation Targets

Surge in Religious & Leisure Tourism

Infrastructure Investment - Market Challenges

Talent & Skilled Workforce Gaps

Regulatory & Slot Constraints - Opportunities

Growth in Cargo, ECommerce Logistics

NextGen Aircraft & eVTOL/UAM Entry - Sector Trends

Fleet Modernization & LowCost Carrier Penetration

Airport Digitalization & Passenger Experience - Policy & Regulation Landscape

Air Transport Agreements & Open Skies

Safety, Security & Environment Standards - Competitive Intensity & Structural Forces

- Market Revenue 2020-2025

- Passenger Traffic Volume 2020-2025

- Air Cargo Throughput 2020-2025

- Fleet Size 2020-2025

- By Sector (In Value%)

Commercial Airlines

Cargo & Freight Aviation Services

General & Business Aviation

MRO & Aftermarket Services

Airport Operations & Ground Services - By Business Model (In Value%)

Scheduled Carriers

Charter Services

LowCost/Hybrid

FBO & Executive Jet Operators - By Service Type (In Value%)

Passenger Transport

Air Cargo

Maintenance, Repair & Overhaul

Training & Simulation Services

Airport Support Services - By Airport Type (In Value%)

International Airports

Domestic/Regional Airfields

Cargo & Logistics Hubs

FBO Terminals - By Geographic Region (In Value%)

Riyadh & Central Region

Jeddah & Western Region

Eastern Province (Dammam/Dhahran)

Northern & Southern Regional Airports

- Market Share

- Cross Comparison Parameters (Corporate Overview, Fleet Size & Route Network, Passenger Load, Factor & Yield Performance, Financial Performance, Operational Efficiency Metrics, Digital Adoption & Customer Experience, Maintenance & Safety Compliance Matrices, Strategic Alliances & Codeshare Networks)

- SWOT Analysis of Key Players

- Pricing & Yield Analysis by Segment

- Key Players:

Saudi Arabian Airlines (SAUDIA)

Riyadh Air

Flynas

Flyadeal

SaudiGulf Airlines

Saudi Ground Services (SGS)

Saudia Aerospace Engineering Industries (SAEI)

Alsalam Aerospace Industries

Advanced Electronics Company (AEC)

Boeing Saudi Arabia

Airbus Saudi Arabia

Thales Group Saudi Arabia

Lockheed Martin Saudi Arabia

Raytheon Saudi Arabia

Northrop Grumman Saudi Arabia

- Passenger Behavior & Demand Elasticity

- Cargo Shippers & Logistics Demand Patterns

- Travel Segments & Premium vs Economy Mix

- Fleet Utilization & Operational Metrics

- Decision Drivers for Airline Selection

- Revenue Forecasts 2026-2035

- Passenger Volume Projections 2026-2035

- Cargo Throughput Forecast 2026-2035

- Fleet Expansion & Seat Capacity Growth 2026-2035