Market Overview

The KSA Aviation Weather Radar Market recorded a total market size of USD ~ million based on a recent historical assessment, supported by procurement disclosures from civil aviation authorities, defense budget allocations, and airport infrastructure contracts. Market expansion is driven by sustained investments in airport modernization, rising commercial flight movements, and defense-led upgrades of airbase weather surveillance systems. Increasing regulatory emphasis on aviation safety, coupled with the operational need for real-time meteorological intelligence in desert climates, has reinforced demand. Integration of weather radar data with air traffic management systems and national meteorological platforms further sustains procurement activity.

Riyadh, Jeddah, and Dammam dominate the KSA Aviation Weather Radar Market due to concentration of major international airports, military airbases, and national aviation command centers. Riyadh leads as the regulatory and defense coordination hub, while Jeddah benefits from high passenger throughput and complex coastal weather patterns. Eastern Province locations gain prominence due to dense industrial aviation activity and military installations. National dominance is reinforced by centralized procurement under aviation authorities, strong defense spending, and long-term airport expansion programs aligned with national transport and logistics strategies.

Market Segmentation

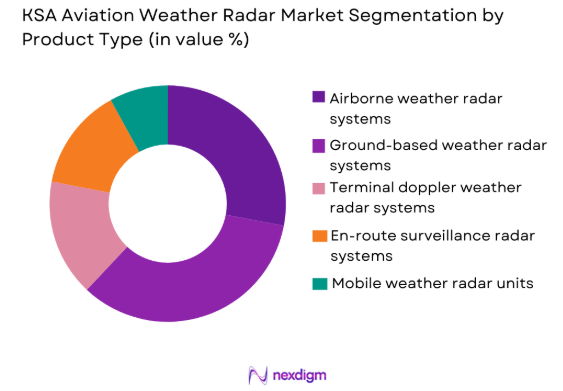

By Product Type

KSA Aviation Weather Radar Market is segmented by product type into airborne weather radar systems, ground-based weather radar systems, terminal doppler weather radar systems, en-route surveillance radar systems, and mobile weather radar units. Recently, ground-based weather radar systems have a dominant market share due to factors such as mandatory deployment at major airports, continuous monitoring requirements, and integration with national meteorological infrastructure. These systems support real-time runway visibility assessment, storm tracking, and wind shear detection, which are critical in high-temperature and dust-prone environments. Government-led airport expansion programs prioritize fixed radar installations, ensuring consistent procurement volumes. Additionally, defense airbases rely on ground-based systems for operational readiness, reinforcing demand stability. Long operational lifecycles and centralized maintenance further enhance adoption, making ground-based systems the most commercially entrenched product category.

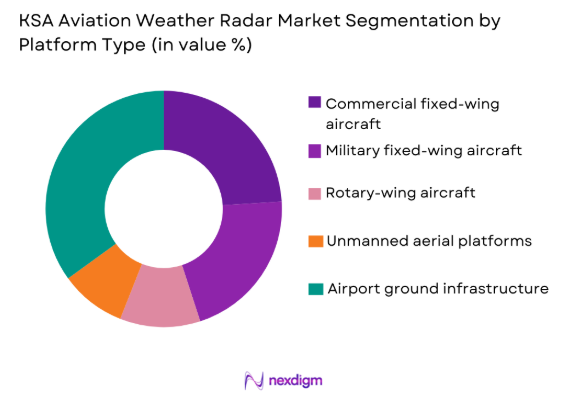

By Platform Type

KSA Aviation Weather Radar Market is segmented by platform type into commercial fixed-wing aircraft, military fixed-wing aircraft, rotary-wing aircraft, unmanned aerial platforms, and airport ground infrastructure. Recently, airport ground infrastructure has a dominant market share due to centralized investment priorities, regulatory mandates, and continuous operational usage. Airports require persistent weather surveillance to manage takeoffs, landings, and air traffic flow during adverse conditions such as sandstorms and convective weather. Large international hubs deploy multiple radar layers for redundancy and coverage, increasing system density. Integration with air traffic control towers and meteorological centers strengthens the role of ground platforms. Military and unmanned platforms contribute to demand, but airport infrastructure remains the primary procurement focus due to safety compliance and passenger traffic growth.

Competitive Landscape

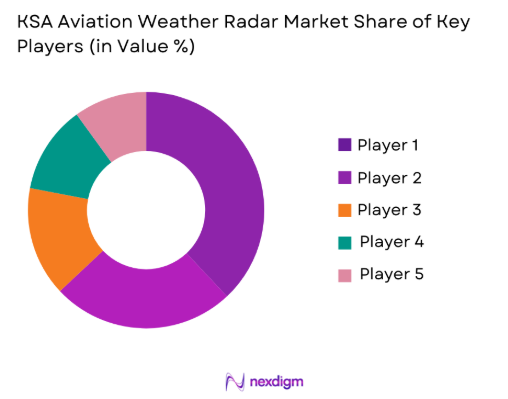

The KSA Aviation Weather Radar Market is moderately consolidated, with a limited number of global aerospace and defense technology providers capturing the majority of large-scale contracts through long-term framework agreements with civil aviation authorities and defense procurement agencies. Competition is shaped by deep technical portfolios, established certification credentials, and the ability to deliver ruggedized radar systems capable of operating in extreme environmental conditions such as high temperatures and dust-laden atmospheres. Major players leverage localized service networks, strategic partnerships with regional systems integrators, and compliance with national industrial participation policies to strengthen competitive positioning. Smaller and regional suppliers participate primarily through subcontracting or niche product offerings, but face barriers related to certification complexity, scale of deployment, and integration requirements. The presence of multinational incumbents with demonstrated performance histories and comprehensive aftermarket support further intensifies competitive dynamics, making technological differentiation and service reliability key determinants in procurement decisions.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue | Regional Presence |

| Raytheon Technologies | 1922 | United States | ~ | ~ | ~ | ~ | ~ |

| Thales Group | 1893 | France | ~ | ~ | ~ | ~ | ~ |

| Leonardo S.p.A. | 1948 | Italy | ~ | ~ | ~ | ~ | ~ |

| Honeywell Aerospace | 1906 | United States | ~ | ~ | ~ | ~ | ~ |

| Saab AB | 1937 | Sweden | ~ | ~ | ~ | ~ | ~ |

KSA Aviation Weather Radar Market Analysis

Growth Drivers

Airport Infrastructure Expansion and Modernization Programs

Airport Infrastructure Expansion and Modernization Programs are a primary growth driver for the KSA Aviation Weather Radar Market as large-scale airport development projects continue across major and secondary cities, increasing the need for advanced weather monitoring capabilities. New terminal construction, runway expansions, and capacity enhancement initiatives require reliable weather radar systems to ensure safe aircraft operations during adverse conditions such as sandstorms, heat-induced turbulence, and reduced visibility events. Regulatory authorities mandate continuous and accurate weather surveillance as part of airport certification and operational approval, reinforcing procurement of modern radar solutions. Integration of weather radar data with air traffic management systems further amplifies demand by enabling predictive decision-making and congestion management. As multiple airports are upgraded simultaneously, cumulative radar installations increase across the national aviation network. Long-term infrastructure planning ensures repeat demand for system upgrades, spare parts, and maintenance services. Public funding support and centralized procurement mechanisms reduce adoption barriers for operators. These combined factors make airport modernization a sustained and structurally embedded driver of market growth.

Defense Aviation Readiness and Airbase Modernization

Defense Aviation Readiness and Airbase Modernization significantly drive demand in the KSA Aviation Weather Radar Market as military aviation operations require uninterrupted weather intelligence to maintain mission readiness. Airbase upgrades prioritize advanced radar systems capable of operating reliably in extreme desert environments, supporting both training and operational sorties. Weather radar integration with command, control, and surveillance networks enhances situational awareness and operational planning accuracy. Defense procurement cycles favor long-term contracts, creating stable demand for high-performance and secure radar technologies. Modernization initiatives also include replacement of legacy systems with digitally integrated solutions, expanding procurement volumes. National defense strategies emphasize self-reliance and operational resilience, encouraging sustained investment in surveillance infrastructure. The need for redundancy and high system availability further increases deployment density at military installations. These factors collectively position defense aviation requirements as a consistent growth catalyst.

Market Challenges

High Capital Expenditure and Lifecycle Cost Burden

High Capital Expenditure and Lifecycle Cost Burden present a major challenge in the KSA Aviation Weather Radar Market due to the significant upfront investment required for advanced radar systems. Procurement budgets must account not only for system acquisition but also for installation, calibration, and integration with existing aviation infrastructure. Ongoing maintenance, software upgrades, and component replacements add to total ownership costs over extended operational lifecycles. For airport operators, balancing radar investments against competing infrastructure priorities can delay purchasing decisions. Defense users face similar pressures when aligning radar upgrades with broader modernization programs. Dependence on specialized foreign components increases cost sensitivity to supply chain disruptions. Long approval cycles further complicate budget planning. These financial constraints can slow adoption despite strong operational need.

Regulatory Certification and Environmental Adaptation Complexity

Regulatory Certification and Environmental Adaptation Complexity constrain market expansion as aviation weather radar systems must meet stringent civil and military certification standards. Compliance processes involve extensive testing, documentation, and validation, extending deployment timelines. Systems must be engineered to withstand extreme heat, dust, and sand exposure, increasing design complexity and qualification costs. Environmental adaptation requirements limit the pool of eligible suppliers capable of meeting performance benchmarks. Integration with national aviation and meteorological systems adds further technical hurdles. Delays in certification can postpone project commissioning and revenue realization. Operators may face operational risks during transition periods. These factors collectively elevate entry barriers and slow market responsiveness.

Opportunities

Localization and Technology Transfer Initiatives

Localization and Technology Transfer Initiatives create significant opportunities within the KSA Aviation Weather Radar Market as national policies encourage domestic participation in aerospace programs. Partnerships between global manufacturers and local entities enable assembly, maintenance, and component manufacturing within the country. These initiatives improve supply chain resilience and reduce long-term dependency on imports. Local capability development enhances responsiveness to operational needs and regulatory requirements. Suppliers that align with localization objectives gain competitive advantage in public procurement. Technology transfer also supports workforce skill development and knowledge retention. Over time, localized operations can lower lifecycle costs. This strategic shift opens new collaboration and investment pathways.

Integration with Digital Air Traffic and Meteorological Platforms

Integration with Digital Air Traffic and Meteorological Platforms represents a strong opportunity as aviation authorities increasingly adopt data-driven operational models. Weather radar systems integrated with predictive analytics enhance flight scheduling, capacity planning, and safety management. Real-time data sharing between radar networks and air traffic control improves response to rapidly changing weather conditions. Advanced analytics support proactive disruption mitigation and fuel efficiency optimization. Integration aligns with broader smart airport and digital aviation initiatives. Vendors offering interoperable and scalable solutions gain differentiation. This convergence of technologies expands the functional value of radar systems. As digital aviation ecosystems mature, integration-driven demand is expected to rise.

Future Outlook

The KSA Aviation Weather Radar Market is expected to experience steady development over the next five years, supported by continued airport expansion, defense modernization, and regulatory focus on aviation safety. Advancements in solid-state radar, dual-polarization technologies, and data analytics integration are anticipated to enhance system capabilities. Government-backed infrastructure programs and localization policies will reinforce procurement stability. Demand-side growth will remain aligned with rising air traffic volumes and operational resilience requirements.

Major Players

- Raytheon Technologies

- Thales Group

- Leonardo S.p.A.

- Honeywell Aerospace

- Saab AB

- Northrop Grumman

- Lockheed Martin

- Indra Sistemas

- HENSOLDT

- Mitsubishi Electric

- Rockwell Collins

- Vaisala

- Enterprise Electronics Corporation

- Baron Weather Innovations

- Gematronik

Key Target Audience

- Commercial airlines

- Airport operators

- Defense aviation authorities

- Civil aviation regulators

- Military procurement agencies

- Meteorological agencies

- Investments and venture capitalist firms

- Government and regulatory bodies

Research Methodology

Step 1: Identification of Key Variables

Key market variables were identified through analysis of aviation infrastructure investments, defense procurement programs, and regulatory requirements. Data points included system deployments, budget allocations, and technology adoption trends. Both demand-side and supply-side indicators were mapped. This step established the analytical foundation.

Step 2: Market Analysis and Construction

Market structure was developed using secondary data from aviation authorities, defense disclosures, and industry publications. Segmentation frameworks were constructed to reflect product and platform dynamics. Data triangulation ensured consistency across sources. Market sizing logic was validated.

Step 3: Hypothesis Validation and Expert Consultation

Preliminary findings were reviewed through expert inputs from aviation technology specialists and industry analysts. Assumptions related to demand drivers and constraints were tested. Feedback refined segmentation logic and competitive assessment. Validation ensured analytical robustness.

Step 4: Research Synthesis and Final Output

All validated insights were synthesized into a structured market narrative. Quantitative and qualitative findings were aligned. Consistency checks were performed across sections. Final outputs were prepared to meet reporting standards.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Expansion of airport infrastructure and new aviation hubs

Rising air traffic volumes across commercial and cargo aviation

Increased focus on aviation safety and weather risk mitigation

Modernization of military aviation surveillance systems

Adoption of advanced digital avionics and sensor fusion - Market Challenges

High capital cost of advanced radar systems

Complex certification and regulatory compliance requirements

Integration challenges with legacy avionics platforms

Dependence on imported high end radar components

Skilled workforce limitations for radar maintenance and calibration - Market Opportunities

Deployment of smart airports and digital air traffic management

Upgrading legacy weather radar systems across regional airports

Integration of AI based predictive weather analytics - Trends

Shift toward solid state and phased array radar architectures

Increased use of dual polarization weather radar technology

Integration of weather radar data with cockpit decision support systems

Growing demand for compact and lightweight airborne radar units

Adoption of real time data sharing between aircraft and ATC

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Airborne Doppler Weather Radar

Ground Based Airport Weather Radar

Terminal Weather Radar Systems

Enroute Surveillance Weather Radar

Mobile and Tactical Weather Radar - By Platform Type (In Value%)

Commercial Fixed Wing Aircraft

Business Jets and VIP Aircraft

Military Aircraft Platforms

Airport Ground Infrastructure

Unmanned Aerial Systems Support - By Fitment Type (In Value%)

Line Fit Installations

Retrofit Installations

Integrated Avionics Suites

Standalone Radar Units

Modular Upgrade Kits - By End User Segment (In Value%)

Commercial Airlines

Military and Defense Aviation

Airport Authorities

General Aviation Operators

Meteorological and ATC Agencies - By Procurement Channel (In Value%)

Direct OEM Procurement

Government Defense Contracts

Airport Authority Tenders

System Integrator Contracts

Aftermarket and MRO Channels - By Material / Technology (in Value %)

X Band Radar Technology

C Band Radar Technology

Solid State Transmitter Systems

Phased Array Antenna Systems

AI Enabled Weather Processing Software

- Market share snapshot of major players

- Cross Comparison Parameters (Radar Range Capability, Detection Accuracy, System Integration Level, Certification Compliance, Platform Compatibility, Lifecycle Cost, After Sales Support, Technology Maturity, Localization Capability, Upgrade Flexibility)

- SWOT Analysis of Key Players

- Pricing & Procurement Analysis

- Porter’s Five Forces

- Key Players

Raytheon Technologies

Honeywell Aerospace

Thales Group

Leonardo S.p.A.

Hensoldt

Indra Sistemas

Saab AB

Northrop Grumman

Collins Aerospace

Telephonics Corporation

Bharat Electronics Limited

ASELSAN

Israel Aerospace Industries

Rohde and Schwarz

Mitsubishi Electric

- Airlines prioritize reliability and real time hazard detection for flight safety

- Military users focus on multi mission capability and secure data integration

- Airport authorities emphasize all weather operational continuity

- ATC and meteorological agencies demand high accuracy and coverage

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035