Market Overview

Based on a recent historical assessment, the KSA ballistic missile market was valued at USD ~ billion, supported by sustained national defense allocations, strategic deterrence priorities, and long-term force modernization programs. Demand is driven by investments in missile force readiness, command and control integration, and indigenous defense manufacturing under national localization initiatives. Procurement activity is influenced by regional security considerations, technology transfer agreements, and lifecycle support requirements, with funding channeled through centralized defense budgets and government-to-government acquisition frameworks.

Based on a recent historical assessment, Saudi Arabia dominates this market, with strategic activities concentrated around Riyadh due to defense command headquarters, procurement authorities, and research institutions. Industrial activity is supported by facilities in Riyadh and Jeddah linked to defense manufacturing, logistics, and systems integration. International collaboration with partners in the United States, Europe, and East Asia reinforces technological depth, while proximity to key military bases and testing ranges supports operational deployment and sustainment of ballistic missile capabilities.

Market Segmentation

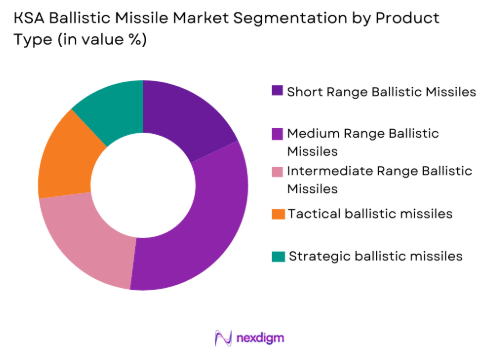

By Product Type

KSA Ballistic Missile market is segmented by product type into short-range ballistic missiles, medium-range ballistic missiles, intermediate-range ballistic missiles, tactical ballistic missiles, and strategic ballistic missiles. Recently, medium-range ballistic missiles have a dominant market share due to their balance of range, payload capacity, and strategic flexibility aligned with national deterrence requirements. These systems address regional security needs without the escalation risks associated with longer-range platforms. Strong alignment with existing launch infrastructure, proven operational reliability, and compatibility with command and control systems further reinforce their dominance, supported by sustained procurement and modernization programs.

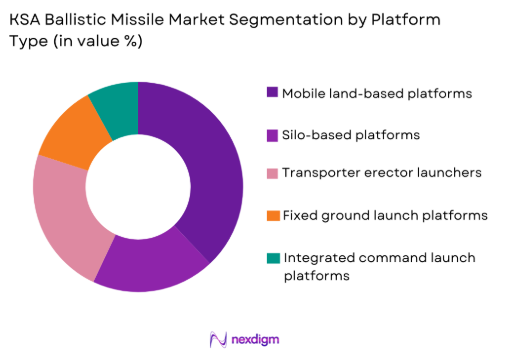

By Platform Type

KSA Ballistic Missile market is segmented by platform type into mobile land-based platforms, silo-based platforms, transporter erector launchers, fixed ground launch platforms, and integrated command launch platforms. Recently, mobile land-based platforms have a dominant market share due to enhanced survivability, rapid deployment capability, and operational flexibility under evolving threat conditions. These platforms support dispersal strategies, reduce vulnerability, and align with modern doctrine emphasizing mobility. Their compatibility with existing road infrastructure and ease of integration with multiple missile systems further strengthens adoption.

Competitive Landscape

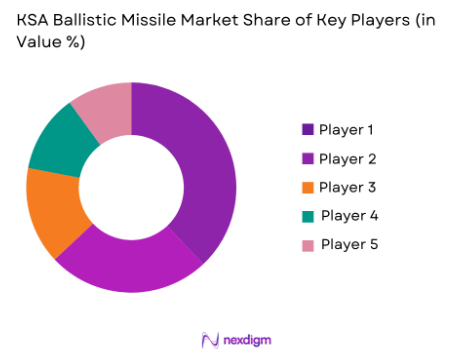

The competitive landscape of the KSA ballistic missile market is characterized by high entry barriers, strong government control, and a limited number of global defense primes operating through strategic partnerships and government agreements. Market structure reflects consolidation around technologically advanced suppliers with proven missile, propulsion, and guidance capabilities, supported by long-term contracts and localization commitments.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue | Regional Engagement Model |

| Lockheed Martin | 1995 | United States | ~ | ~ | ~ | ~ | ~ |

| Raytheon Technologies | 1922 | United States | ~ | ~ | ~ | ~ | ~ |

| Northrop Grumman | 1939 | United States | ~ | ~ | ~ | ~ | ~ |

| MBDA | 2001 | Europe | ~ | ~ | ~ | ~ | ~ |

| BAE Systems | 1999 | United Kingdom | ~ | ~ | ~ | ~ | ~ |

KSA Ballistic Missile Market Analysis

Growth Drivers

Strategic National Defense Modernization and Deterrence Reinforcement

Strategic National Defense Modernization and Deterrence Reinforcement: The KSA Ballistic Missile Market is fundamentally driven by Saudi Arabia’s long-term national defense modernization agenda, which prioritizes strengthening strategic deterrence capabilities amid persistent regional security volatility and asymmetric threat environments. This driver reflects sustained policy emphasis on maintaining credible missile forces that can support national sovereignty, deterrence stability, and strategic signaling objectives without reliance on external rapid-response guarantees. Continuous upgrades to missile command, control, communications, and integration with broader air and missile defense architectures reinforce the operational relevance of ballistic missile systems within national defense planning. The KSA Ballistic Missile Market benefits from centralized defense budgeting mechanisms that enable multi-year procurement commitments, reducing program uncertainty and supporting long-term system sustainment. Strategic deterrence requirements also encourage investment in survivable, mobile, and accurate missile platforms aligned with evolving doctrine. Indigenous industrial participation under national localization frameworks further amplifies this driver by embedding ballistic missile programs within domestic economic diversification goals. Integration with joint force structures enhances interoperability and operational readiness across land, air, and strategic commands. This comprehensive modernization focus ensures that ballistic missile capabilities remain a core pillar of national defense architecture rather than a peripheral or legacy asset.

Defense Industrial Localization and Technology Sovereignty Initiatives

Defense Industrial Localization and Technology Sovereignty Initiatives drive the KSA Ballistic Missile Market through structured policies aimed at increasing domestic content, technology absorption, and sovereign control over critical defense capabilities. Saudi Arabia’s defense industrial strategy emphasizes reducing long-term dependency on external suppliers for sensitive missile technologies, propulsion components, and guidance subsystems. This driver supports sustained demand for ballistic missile programs that incorporate local assembly, licensed production, and joint development frameworks. Localization initiatives also stimulate investments in testing infrastructure, quality assurance systems, and skilled workforce development directly linked to missile programs. The KSA Ballistic Missile Market gains resilience from these initiatives by embedding supply chains within national borders, improving lifecycle support responsiveness. Technology sovereignty objectives further encourage selective diversification of international partnerships to access advanced know-how while retaining national oversight. Alignment between defense procurement authorities and industrial development agencies ensures that ballistic missile acquisitions generate dual benefits of capability enhancement and industrial growth. Over time, this localization-driven demand sustains modernization cycles and incremental upgrades, reinforcing long-term market stability.

Market Challenges

International Arms Control Constraints and Technology Access Limitations

International Arms Control Constraints and Technology Access Limitations present a significant challenge for the KSA Ballistic Missile Market due to stringent global non-proliferation regimes and export control frameworks governing missile-related technologies. These constraints restrict access to advanced propulsion systems, guidance components, and testing equipment, complicating procurement timelines and system upgrades. Compliance requirements increase administrative complexity and prolong negotiation cycles with foreign suppliers. The KSA Ballistic Missile Market must navigate geopolitical sensitivities that influence supplier willingness and technology transfer depth. Restrictions can also limit interoperability options with allied systems, affecting integration efficiency. Regulatory scrutiny elevates program risk and necessitates extensive compliance verification processes. This challenge further impacts localization efforts by constraining the scope of permissible technology absorption. As a result, market participants face higher costs and elongated development schedules, which can dampen program agility and responsiveness.

High Capital Intensity and Long Development Cycles

High Capital Intensity and Long Development Cycles constrain the KSA Ballistic Missile Market by demanding sustained financial commitments over extended periods before operational benefits are realized. Ballistic missile programs require substantial upfront investment in research, infrastructure, testing facilities, and specialized human capital. These programs often span multiple planning cycles, increasing exposure to policy shifts and budget reprioritization risks. The KSA Ballistic Missile Market must accommodate complex system validation and certification processes that delay deployment. Long development timelines also reduce flexibility in responding rapidly to emerging threat profiles. Capital intensity limits the number of parallel programs that can be pursued simultaneously, concentrating risk. Additionally, cost escalation risks arise from technological complexity and supply chain dependencies. These factors collectively challenge efficient resource allocation and program optimization.

Opportunities

Expansion of Indigenous Missile Subsystem Manufacturing Capabilities

Expansion of Indigenous Missile Subsystem Manufacturing Capabilities represents a major opportunity for the KSA Ballistic Missile Market by enabling deeper localization across propulsion, guidance, and structural components. This opportunity aligns with national objectives to build resilient defense supply chains and enhance sovereign capability control. Local manufacturing reduces dependency risks associated with external geopolitical pressures. The KSA Ballistic Missile Market can leverage this opportunity to shorten maintenance cycles and improve system availability. Indigenous capability development also fosters innovation ecosystems supporting incremental upgrades. Collaboration with international partners under controlled frameworks accelerates knowledge transfer. Over time, domestic subsystem manufacturing enhances export potential for non-sensitive components. This opportunity supports sustainable market growth beyond initial acquisition phases.

Integration with Advanced Command, Control, and Missile Defense Networks

Integration with Advanced Command, Control, and Missile Defense Networks offers substantial opportunity for the KSA Ballistic Missile Market by enhancing operational effectiveness and strategic value. Ballistic missile systems increasingly function within network-centric defense architectures rather than standalone assets. This opportunity supports demand for system upgrades focused on data fusion, secure communications, and real-time targeting integration. The KSA Ballistic Missile Market benefits from investments in national digital defense infrastructure that enable seamless coordination. Enhanced integration improves deterrence credibility by increasing responsiveness and survivability. It also supports joint-force interoperability across defense branches. This opportunity encourages continuous modernization cycles rather than one-time procurement events. As networked defense capabilities mature, ballistic missile systems gain renewed relevance within integrated security strategies.

Future Outlook

The future outlook of the KSA Ballistic Missile Market over the next five years indicates steady progression driven by sustained national security priorities and long-term defense planning frameworks. Continued investments are expected to focus on enhancing missile survivability, operational readiness, and accuracy through incremental technological upgrades rather than abrupt capability shifts. Integration with advanced command, control, and missile defense networks will remain a central development theme, reinforcing joint-force interoperability and deterrence credibility. Regulatory oversight and international compliance requirements will continue to shape procurement structures, encouraging controlled localization and selective technology partnerships. On the demand side, evolving regional security dynamics and the need for strategic autonomy will support consistent acquisition, modernization, and lifecycle support activities across ballistic missile programs.

Major Players

- Lockheed Martin

- Raytheon Technologies

- Northrop Grumman

- Boeing Defense

- BAE Systems

- MBDA

- Thales Group

- L3Harris Technologies

- Israel Aerospace Industries

- Rafael Advanced Defense Systems

- Hanwha Aerospace

- Mitsubishi Heavy Industries

- General Dynamics

- Aerojet Rocketdyne

- Leonardo

Key Target Audience

- Defense ministries

- Strategic missile commands

- Government and regulatory bodies

- Defense procurement agencies

- Investments and venture capitalist firms

- Defense manufacturers

- System integrators

- National security agencies

Research Methodology

Step 1: Identification of Key Variables

Key variables for the KSA Ballistic Missile Market were identified through defense policy reviews, procurement documents, and security assessments. Demand-side and supply-side indicators were mapped. Strategic, technological, and regulatory variables were prioritized. These variables formed the analytical foundation.

Step 2: Market Analysis and Construction

Market structure was developed by analyzing procurement flows, program lifecycles, and industrial participation. Segmentation logic was validated against operational use cases. Competitive dynamics were assessed. The market framework was constructed accordingly.

Step 3: Hypothesis Validation and Expert Consultation

Preliminary findings were validated through expert consultations with defense analysts and industry specialists. Assumptions were stress-tested against regional security scenarios. Feedback loops refined market logic. Hypotheses were adjusted where required.

Step 4: Research Synthesis and Final Output

All validated data points were synthesized into a cohesive market narrative. Analytical consistency checks were conducted. Outputs were aligned with reporting objectives. Final conclusions were structured for decision relevance.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Rising regional security threats driving strategic deterrence investments

Expansion of indigenous defense manufacturing capabilities

Long-term military modernization and force transformation programs

Strategic alliances enabling advanced missile technology access

Emphasis on strengthening national deterrence posture - Market Challenges

International arms control and export restrictions

High capital intensity and long development cycles

Technological dependency on foreign suppliers

Complex integration with existing command structures

Operational secrecy and regulatory compliance constraints - Market Opportunities

Localization of missile subsystems and components

Development of advanced guidance and propulsion technologies

Expansion of regional defense collaboration initiatives - Trends

Shift toward solid-fuel and mobile launch systems

Increased focus on survivability and mobility of missile assets

Integration of advanced navigation and accuracy enhancement technologies

Emphasis on indigenous research and development capabilities

Alignment of missile programs with integrated air defense networks - Government Regulations & Defense Policy

Compliance with international non-proliferation frameworks

Strengthening of national defense procurement regulations

Policy support for local defense industry participation

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Short-range ballistic missile systems

Medium-range ballistic missile systems

Intermediate-range ballistic missile systems

Tactical ballistic missile systems

Strategic deterrence missile systems - By Platform Type (In Value%)

Mobile land-based launch platforms

Silo-based launch platforms

Transporter erector launcher platforms

Fixed ground launch infrastructure

Integrated command and control launch platforms - By Fitment Type (In Value%)

New system deployment

System upgrade and modernization

Retrofit and life extension programs

Technology transfer based integration

Indigenous assembly and production fitment - By End User Segment (In Value%)

Strategic missile forces

Air and missile defense command

Joint armed forces command

National deterrence and strategic command

Defense research and evaluation agencies - By Procurement Channel (In Value%)

Government to government agreements

Direct defense ministry procurement

Strategic defense partnerships

Licensed local production contracts

Offset based acquisition programs - By Material / Technology (in Value %)

Solid propellant propulsion systems

Advanced guidance and navigation technologies

Composite airframe and casing materials

Reentry vehicle and warhead integration technologies

Secure communication and telemetry systems

- Market share snapshot of major players

- Cross Comparison Parameters (system range capability, payload capacity, propulsion technology, guidance accuracy, launch mobility, integration complexity, local manufacturing involvement, lifecycle support, regulatory compliance)

- SWOT Analysis of Key Players

- Pricing & Procurement Analysis

- Porter’s Five Forces

- Key Players

Lockheed Martin

Raytheon Technologies

Northrop Grumman

Boeing Defense Space and Security

MBDA

Thales Group

L3Harris Technologies

Israel Aerospace Industries

Rafael Advanced Defense Systems

Hanwha Aerospace

Mitsubishi Heavy Industries

Aerojet Rocketdyne

General Dynamics Mission Systems

BAE Systems

Rostec

- Strategic forces prioritize deterrence reliability and readiness

- Defense command focuses on integration with national security architecture

- Procurement agencies emphasize long-term lifecycle support

- Research entities support testing, evaluation, and system optimization

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035