Market Overview

The KSA battery packs market is valued at about USD ~ billion, based on recent national battery market assessments, up from nearly USD ~ billion in the preceding base year, reflecting strong underlying demand across automotive, industrial and energy storage uses. Growth is fuelled by Vision 2030’s push to diversify the economy, rising deployment of grid-scale storage, and rapid EV adoption; for instance, local EV sales grew from around 779 units to about 24,092 units, sharply lifting demand for traction battery packs and supporting components.

Battery pack demand is concentrated around Riyadh and the broader Central Region, the Western corridor (Jeddah, Makkah, Red Sea projects) and the Eastern Province. These hubs host giga-scale renewable projects, large industrial loads and flagship microgrids, such as the 400 MW/1.3 GWh Red Sea solar-plus-storage project using Huawei’s smart string ESS, and multi-GWh grid-scale tenders by Saudi Electricity Company leveraging Chinese suppliers like BYD. Lucid’s plant in King Abdullah Economic City, designed for up to 155,000 EVs annually, further anchors EV pack demand in the Western region.

Market Segmentation

By Application

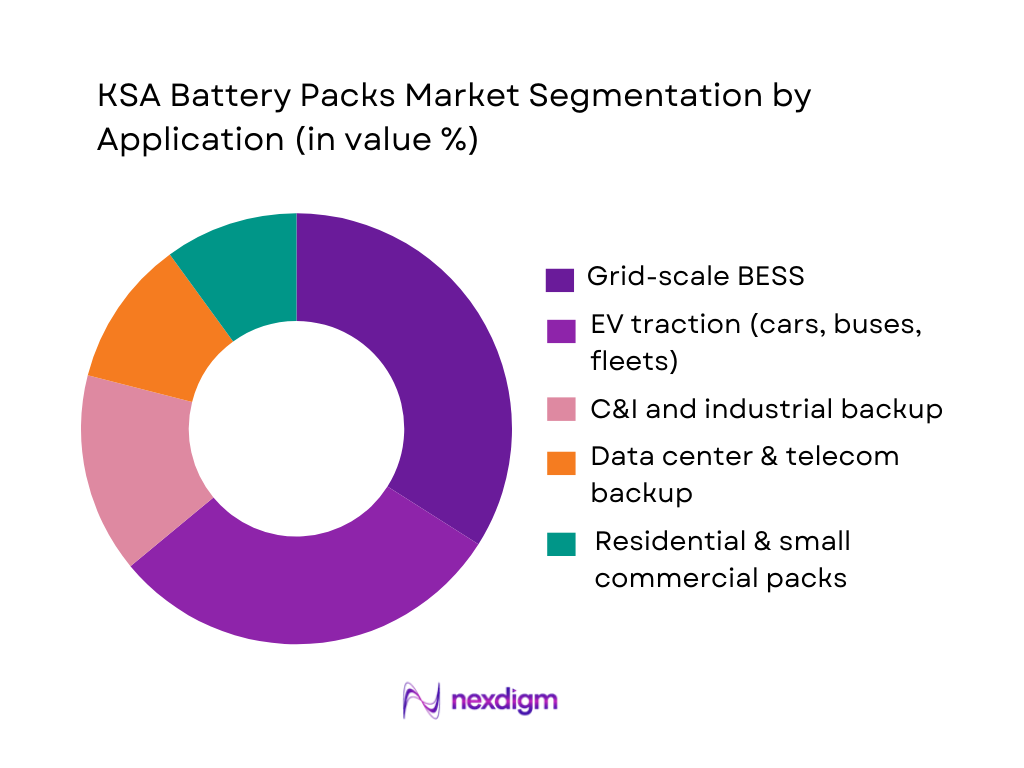

The KSA battery packs market is segmented by application into grid-scale battery energy storage systems (BESS), EV traction packs for passenger and commercial vehicles, C&I and industrial backup systems, data center & telecom backup solutions, and residential & small commercial storage. Grid-scale BESS holds the leading share due to Saudi Arabia’s aggressive utility-scale storage pipeline: targets of 8 GWh and 22 GWh of storage in the near term and record-low bids around USD 73–75/kWh for recent 4.9 GWh tenders have unlocked large multi-GWh projects with BYD, Huawei and other suppliers. These systems dominate installed MWh and revenue, making BESS the anchor application for battery packs in the Kingdom.

By Chemistry

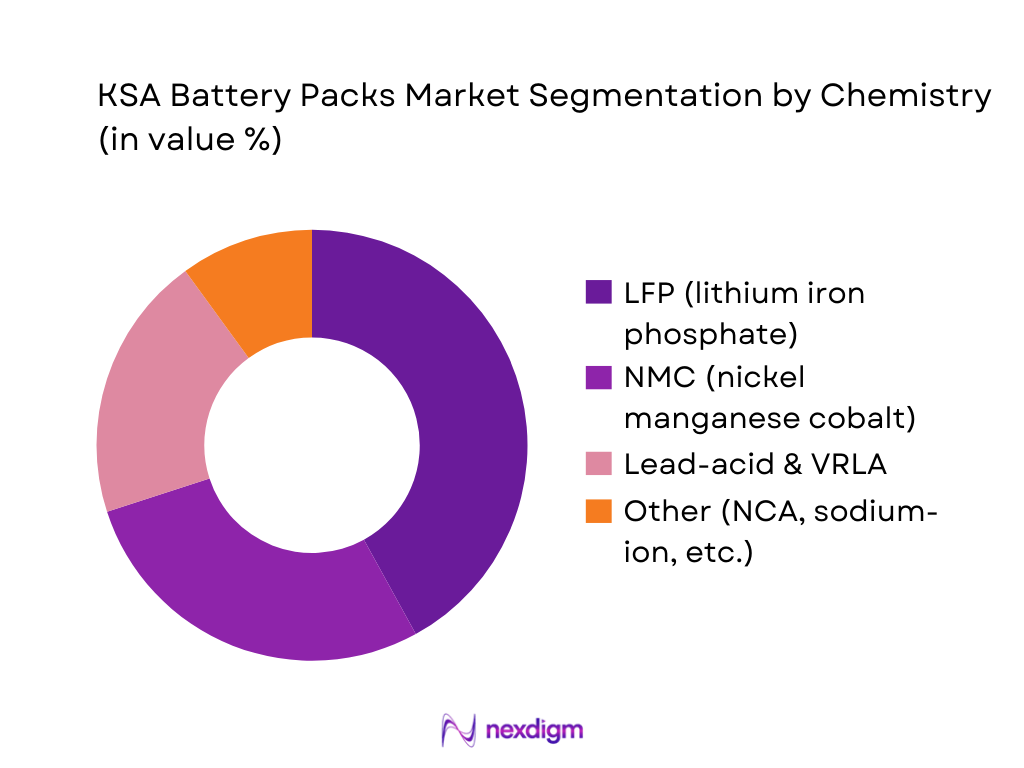

The KSA battery packs market is segmented by chemistry into LFP, NMC, lead-acid/VRLA and a cluster of emerging chemistries such as NCA and sodium-ion. LFP packs currently dominate, reflecting their growing use in large BESS projects and cost-sensitive EVs. Saudi tenders for grid batteries increasingly favour LFP due to its thermal stability and favourable USD/kWh economics, while mega-projects like the Red Sea 1.3 GWh microgrid and multi-GWh BYD energy-storage contracts rely heavily on LFP cells. At the same time, global lithium-ion demand growth and efforts to scale local lithium processing underpin LFP’s strong position across stationary and mobility applications.

Competitive Landscape

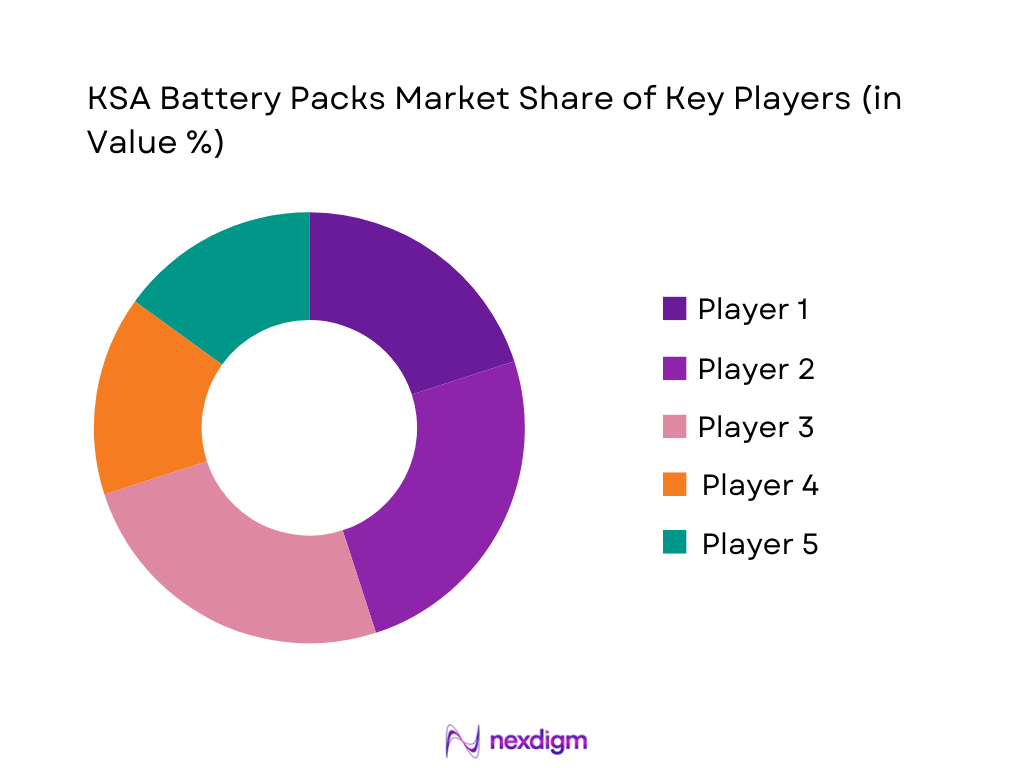

The KSA battery packs market is shaped by a mix of global technology leaders and regional integrators. Chinese suppliers such as BYD and Huawei Digital Power are deeply entrenched in giga-scale BESS deployments with Saudi Electricity Company and ACWA Power. Lucid Group anchors local EV traction pack demand through its KAEC plant and long-term supply commitment to the Kingdom, while global cell and storage providers like CATL and Fluence complement the ecosystem with advanced chemistries and turnkey systems. This mix creates a competitive but partnership-driven landscape, with Saudi policy actively encouraging localization, JVs and technology transfer.

| Company | Establishment Year | Headquarters | Primary Role in KSA Packs Market | Core Application Focus in KSA | Dominant Chemistry / Tech Focus | KSA Presence Type | Notable KSA Projects | Strategic Edge in KSA Packs Market |

| BYD Energy Storage | 1995 | Shenzhen, China | ~ | ~ | ~ | ~ | ~ | ~ |

| Huawei Digital Power | 1987 (Huawei) | Shenzhen, China | ~ | ~ | ~ | ~ | ~ | ~ |

| Lucid Group | 2007 | Newark, USA | ~ | ~ | ~ | ~ | ~ | ~ |

| CATL | 2011 | Ningde, China | ~ | ~ | ~ | ~ | ~ | ~ |

| Fluence Energy | 2018 | Arlington, USA | ~ | ~ | ~ | ~ | ~ | ~ |

KSA Battery Packs Market Market Analysis

Growth Drivers

Rising EV Penetration Targets and Local EV Manufacturing Ambitions

Saudi Arabia is rapidly building an EV ecosystem that will directly lift demand for traction battery packs. Registered EVs grew from about 375 vehicles to more than 12,000 within two years, a 425% jump, creating a fast-expanding in-country pack base that will need replacement and second-life management over time. Riyadh’s city plan targets 30 out of every 100 cars on its roads to be electric, signalling large structural demand for packs in one metropolitan area alone. In parallel, the Lucid plant at King Abdullah Economic City is being designed for 155,000 EVs per year at full ramp-up, implying very large multi-GWh annual pack requirements that investors and local assemblers can anchor on.

Giga Projects, Smart Cities, and Microgrids with Embedded Storage

The battery-pack opportunity is reinforced by giga projects and smart-city developments that embed distributed storage into their design. Saudi Arabia leads global construction activity with an estimated 1.5-trillion-dollar pipeline of unawarded projects, a large share linked to Vision-aligned destinations such as NEOM and associated tourism zones. NEOM alone is described as a 1.5-trillion-dollar long-term development in official investment briefs, with massive off-grid and hybrid-grid requirements that favour solar-plus-storage clusters and microgrids. At the Red Sea tourism project, a 400 MW solar asset is paired with approximately 1,300 MWh of battery storage to provide 24/7 off-grid power, one of the world’s largest resort microgrids. Meanwhile, around 80 out of every 100 residents already live in major urban centres such as Riyadh, Jeddah, Mecca, and Dammam, concentrating demand for resilient, low-emission power solutions where battery packs can support metro systems, smart buildings, and e-bus depots.

Market Challenges

Supply Chain Dependencies for Cells and Advanced Chemistries

Although Saudi Arabia is investing heavily in energy-transition minerals, it still enters the battery-pack era largely dependent on imported cells and advanced materials. The country estimates its domestic mineral endowment at roughly ~ trillion riyals, yet mining’s current GDP contribution is about ~ billion riyals, showing that most of this value is still locked in the ground and not yet converted into refined lithium, nickel, or manganese for battery-grade products. The sector has attracted more than ~ billion riyals in investments so far, and exploration spending exceeded 1.05 billion riyals in a recent year, but the time needed to move from exploration to commercial refining leaves a multi-year gap where cell imports from East Asia will dominate. Strategic deals such as the 2.5-billion-dollar Vale base-metals stake and Aramco–Ma’aden’s transition-minerals JV show intent to diversify feedstock, yet they also highlight how exposed pack assemblers remain to price and availability risks outside the Kingdom, particularly for high-nickel chemistries used in premium EVs and long-duration ESS.

Project Bankability, Long-Term Performance, and Warranty Risks

Battery-pack projects in Saudi Arabia are capital-intensive and exposed to bankability constraints despite strong policy support. Operational renewable plants totalling 6,551 MW have already absorbed about ~ billion riyals in investment, with roughly ~ billion riyals committed to projects commissioned in the most recent year alone. A single tender round added 4.5 GW of new solar capacity at an estimated ~ billion riyals investment, while an ~ billion dollar programme is deploying 15 GW of renewables across four regions. These large ticket sizes require long-term off-take agreements, robust degradation guarantees, and credible 10–15 year performance warranties on packs. At the macro level, Saudi Arabia’s GDP of around ~ trillion dollars comes alongside projected fiscal deficits and heavy capex needs, prompting the IMF to highlight the importance of careful debt management even as non-oil GDP continues to expand. In this context, lenders scrutinize storage revenue stacks, merchant risk, and technology-obsolescence risk, making bankable pack projects contingent on sophisticated contract structuring and Tier-1 supplier participation.

Opportunities

Localization of Pack Assembly, Testing, and Integration Hubs

Localizing pack assembly and system integration represents one of the clearest upside pathways in the KSA battery-packs market. Saudi Arabia’s GDP of around ~ trillion dollars, coupled with Vision-driven FDI and non-oil export targets, provides a large industrial base for localisation requirements and long-term procurement of in-Kingdom value. Mining GDP has reached ~ billion riyals with more than ~ billion riyals in cumulative investments and over ~ billion riyals in exploration spending, laying the foundations for upstream raw-material supply. On the demand side, renewable capacity of 6,551 MW and a 148-MW data-centre footprint create immediate offtake for locally assembled ESS packs, while the Lucid plant’s planned 155,000-vehicle annual capacity anchors automotive pack demand. With ports handling ~ million TEU of containers in a single year and major hubs like King Abdulaziz Port moving over ~ million TEU alone, Saudi Arabia already has the logistics scale to serve as a regional pack export hub into MENA and beyond. Near-shoring final pack assembly and testing to industrial cities in the Eastern, Central, and Western regions can capture value from these flows and reduce lead times for projects.

Second-Life Use of EV Packs in Stationary Storage and Microgrids

The fast-growing in-country stock of EV batteries opens a medium-term opportunity to repurpose packs into stationary storage. Registered EVs increased from about 375 vehicles to more than 12,000 over two years, driven by national sustainability programmes and a rapidly expanding charging network that aims for 5,000 public charging points by 2030. Parallel to this, EV-related capital commitments in the Kingdom are reported to exceed 10 billion dollars across multiple OEM and joint-venture announcements. These flows will translate into tens of thousands of high-voltage battery packs in circulation, with a significant portion reaching end-of-vehicle life while retaining a large percentage of their original capacity and cycle life. At the same time, renewable projects totalling 6,551 MW and off-grid assets such as the 400 MW/1,300 MWh Red Sea microgrid demonstrate strong demand for mid-duration storage in communities, resorts, and commercial districts. Matching ageing automotive packs with these applications, using standardized testing and re-certification protocols, can lower system costs, reduce waste, and create a circular economy niche within the broader pack market.

Future Outlook

Over the next decade, the KSA Battery Packs Market is projected to expand rapidly in line with the broader battery market’s mid-teens compound growth trajectory and Vision 2030 decarbonization targets. Large-scale tenders by the Saudi Power Procurement Company, the roll-out of 15 GW of new solar and wind capacity, and the objective of sourcing 50% of electricity from renewables will structurally increase demand for utility-scale BESS packs. At the same time, EV penetration is set to rise sharply from a low base, supported by Lucid’s KAEC plant, a planned Hyundai facility and ambitious fleet electrification targets, which will underpin traction pack volumes.

Major Players

- BYD Company Limited

- HiTHIUM Energy Storage

- Huawei Digital Power

- Alfanar Projects

- Desert Technologies

- Lucid Group

- Tesla, Inc.

- CATL

- Saft

- Ghad Al Taqat Company

- Lento Industries

- Vision Battery

- Fluence Energy

- TAQAT Group

- Ceer

Key Target Audience

- Power utilities and IPPs

- Renewable energy developers and EPC contractors

- EV OEMs, fleet operators and mobility platforms

- Industrial and heavy-process energy users

- Data centers and telecom operators

- Real estate developers and infrastructure concessionaires

- Investment and venture capitalist firms

- Government and regulatory bodies

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map of the KSA Battery Packs Market, capturing utilities, IPPs, EV OEMs, BESS integrators, pack assemblers and upstream materials players. Extensive desk research using secondary and proprietary databases is undertaken to benchmark battery market size, energy-storage capacity additions, EV volumes, chemistry mix and localization initiatives. The goal is to define critical variables affecting demand, including installed GWh, EV sales, renewable build-out, pack lifecycles and policy incentives.

Step 2: Market Analysis and Construction

In the second phase, we compile and analyse historical data on Saudi Arabia’s battery, lithium-ion and energy-storage markets, triangulating values reported by multiple research houses and official announcements. This includes assessing pack-relevant penetration in grid-scale tenders, BESS projects, telecom/data-center backup and EV deployments. Revenue pools are constructed using a combination of bottom-up project lists (MWh × USD/kWh ranges) and top-down category splits from national battery-market assessments, with adjustments for pack vs cell vs BOS (balance of system) shares.

Step 3: Hypothesis Validation and Expert Consultation

Third, we develop hypotheses about application-wise and chemistry-wise splits for the KSA Battery Packs Market and validate them through structured interviews and computer-assisted telephone interviews with utilities, EPCs, ESS integrators, EV OEMs, fleet operators, distributors and financial stakeholders. These experts provide on-ground insights into current tender structures, technology preferences (LFP vs NMC), pricing bands, contract durations and localisation plans, allowing us to refine volume estimates, application mixes and forward-looking CAGR expectations.

Step 4: Research Synthesis and Final Output

Finally, we synthesise quantitative models and qualitative insights into an integrated market view for the KSA Battery Packs Market. Cross-checks are made with BMS, lithium-ion battery and grid-storage market data to ensure consistency in pack-level revenues and installed capacity. Direct inputs from participants in giga-scale storage and EV manufacturing projects (such as Red Sea microgrids, SEC tenders and Lucid’s KAEC plant) are used to stress-test assumptions. The result is a validated, decision-oriented output covering market size, segmentation, competitive landscape, outlook and opportunity mapping.

- Executive Summary

- Research Methodology (Market Definitions and Taxonomy for the KSA Battery Packs Market, Scope, Inclusions, and Exclusions, Data Sources and Assumptions for Pack-Level Sizing and Installed Base, Market Sizing Approach for Historical and Forecast Assessments, Top-Down and Bottom-Up Triangulation of Pack Shipments, Installed GWh, and Project Pipeline, Primary Research Approach – Utilities, IPPs, EPCs, OEMs, Fleet Operators, and Channel Partners, Secondary Research Approach – Policy Documents, Tender Databases, Corporate Filings, Validation, Limitations, and Data Reconciliation Framework)

- Definition and Scope of Battery Packs

- Evolution and Genesis of the KSA Battery Packs Market

- Value Chain Mapping

- KSA Policy, Industrial, and Decarbonization Context for Battery Packs

- Role of Battery Packs in Renewables, Grid Flexibility, and EV Adoption Targets

- Stakeholder Mapping – Utilities, IPPs, EPCs, OEMs, Channel Partners, Technology Providers.

- Growth Drivers

Rising EV Penetration Targets and Local EV Manufacturing Ambitions

Rapid Scale-Up of Solar and Wind Capacity Requiring Firming and Flexibility

Giga Projects, Smart Cities, and Microgrids with Embedded Storage

Backup Power Needs for Data Centers, Telecom, and Critical Infrastructure

National Industrial Strategy for Battery Value Chain and Local Content - Market Challenges

Supply Chain Dependencies for Cells and Advanced Chemistries

Project Bankability, Long-Term Performance, and Warranty Risks

Grid-Integration, Interconnection Approvals, and Technical Standards

Upfront Capex, Financing Structures, and Revenue Certainty

Skills, Workforce, and O&M Capacity Constraints in Advanced ESS and EV Packs - Opportunities

Localization of Pack Assembly, Testing, and Integration Hubs

Second-Life Use of EV Packs in Stationary Storage and Microgrids

Pack-as-a-Service, Energy-as-a-Service, and Leasing Models

Advanced BMS/EMS, Monitoring Platforms, and Digital Twins for Packs

Niche Applications – Ports, Airports, Rail, Mining, and Off-Grid Industrial Sites - Trends

Shift Towards LFP, High-Voltage Platforms, and Safer Pack Architectures

Increasing Pack Energy Density, C-Rates, and Cycle Life Expectations

Cell-to-Pack and Pack-to-System Integration Innovations

Thermal Management, Safety Enhancements, and Compliance with Local Codes

Emerging Solid-State, Sodium-Ion, and Hybrid Chemistries for KSA Use Cases - Regulatory, Policy, and Standards Landscape

Role of Energy, Industry, and Transport Regulators in Pack Deployment

Grid Codes, Interconnection Standards, and Storage Participation Rules

Local Content, Industrial Clusters, and Incentive Schemes for Battery Packs

Environmental, Health & Safety (EHS), Fire Codes, and Recycling Guidelines - Stakeholder Ecosystem

- Porter’s Five Forces Analysis for KSA Battery Packs

- By Value, 2019-2024

- By Volume, 2019-2024

- By Application Cluster, 2019-2024

- By Region, 2019-2024

- Historical Price and Cost Movements at Pack Level, 2019-2024

- By Application Cluster (in Value %)

Grid-Scale Utility and IPP Battery Energy Storage System Packs

Commercial & Industrial (C&I) Behind-the-Meter Packs

Residential Solar-Plus-Storage Packs

EV Traction Packs – Passenger Cars and Premium Mobility

EV Traction Packs – Buses, Trucks, Off-Highway and Material Handling - By Chemistry Platform (in Value %)

Lithium Iron Phosphate (LFP) Packs

Nickel Manganese Cobalt (NMC) Packs

Nickel Cobalt Aluminum (NCA) and High-Nickel Packs

Lead-Acid / VRLA and Advanced Lead Packs

Sodium-Ion and Other Emerging Chemistries - By Pack Architecture and Form Factor (in Value %)

Containerized Rack-Level BESS Packs

Modular Cabinet and String ESS Packs

EV Skateboard and Underfloor Packs

Swappable and Modular Battery Packs for Mobility and C&I

Pack-in-Chassis and Integrated Structural Packs - By Voltage Class and Power Rating (in Value %)

Low-Voltage Packs for Residential, Light Mobility, and Small C&I

Medium-Voltage Packs for Telecom, Data Centers, and Industrial Systems

High-Voltage Traction Packs for EVs and Fleet Mobility

High-Voltage Containerized Packs for Utility-Scale Projects - By End-Use Sector (in Value %)

Power Utilities, IPPs, and Grid Companies

Oil & Gas, Petrochemical, and Heavy Industry

Commercial Real Estate, Hospitality, and Retail Malls

Data Centers, Telecom Operators, and Mission-Critical Infrastructure

Residential Prosumers and Small Commercial Users - By Region (in Value %)

Riyadh and Central Region

Western Region

Eastern Province

Northern Region

Southern Region

- Market Share of Major Players by Value and Installed GWh

- Market Share by Application Cluster (EV, Grid-Scale BESS, C&I/Residential, Telecom/Industrial)

- Market Share by Chemistry Platform (LFP, NMC, NCA, Lead-Acid, Others)

- Cross Comparison Parameters (Company Overview and Ownership Structure, Pack Application Focus, Chemistry and Form Factor Portfolio, Pack Energy and Voltage Range Offered, KSA Installed Base and Reference Projects, Localization and Manufacturing Footprint in KSA/GCC, BMS/EMS and System Integration Capabilities, Service, Warranty, and O&M Models in KSA)

- SWOT Analysis of Major Players in the KSA Battery Packs Market

- Pricing and Offer Structure Analysis for Major Players

- Detailed Profiles of Major Companies

BYD Company Limited

HiTHIUM Energy Storage

Huawei Digital Power

Alfanar Projects

Desert Technologies

Lucid Group

Tesla, Inc.

CATL

Saft

Ghad Al Taqat Company

Lento Industries Pvt. Ltd.

Vision Battery

Fluence Energy

TAQAT Group

- Utilities and IPPs

- Oil & Gas, Petrochemical, and Heavy Industrial Users

- Data Centers and Telecom

- Commercial Real Estate, Hospitality, and Malls

- Residential Prosumers

- By Value, 2025-2030

- By Volume, 2025-2030

- By Application Cluster, 2025-2030

- By Region, 2025-2030

- Historical Price and Cost Movements at Pack Level, 2025-2030