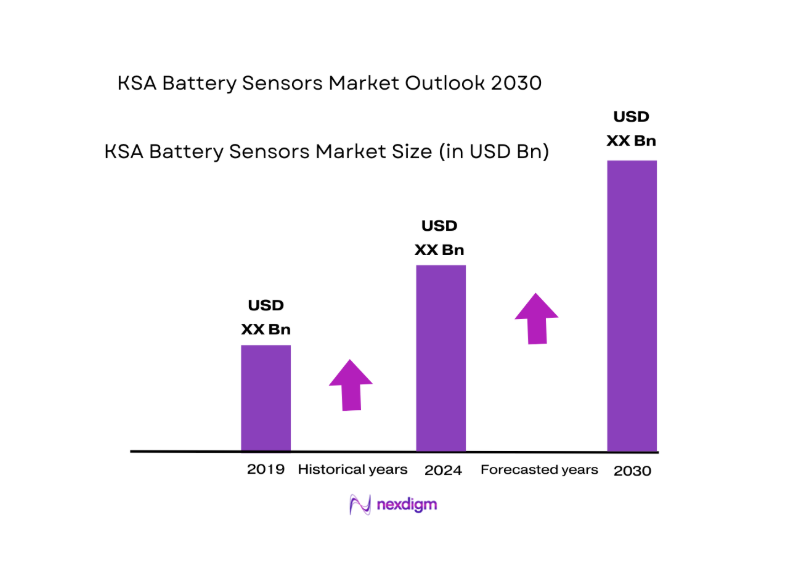

Market Overview

The KSA battery sensors market is valued at USD ~ in 2024. This market is primarily driven by the increasing adoption of electric vehicles (EVs) and renewable energy storage solutions, particularly within the automotive sector. Additionally, the government’s support for Vision 2030, emphasizing the reduction of carbon emissions and fostering a sustainable energy landscape, contributes significantly to this growth. The rising demand for energy-efficient solutions is expected to further fuel the market’s expansion, with advancements in battery technologies and monitoring systems being key drivers.

Saudi Arabia, particularly cities like Riyadh and Jeddah, dominates the KSA battery sensors market due to the rapid development of electric vehicle infrastructure and the increasing investments in energy storage solutions. Riyadh’s strategic importance as a business hub and Jeddah’s proximity to international shipping routes position these cities at the forefront of the market. The government’s significant investments in the automotive and energy sectors also make these regions leaders in battery sensor deployment and technological advancements.

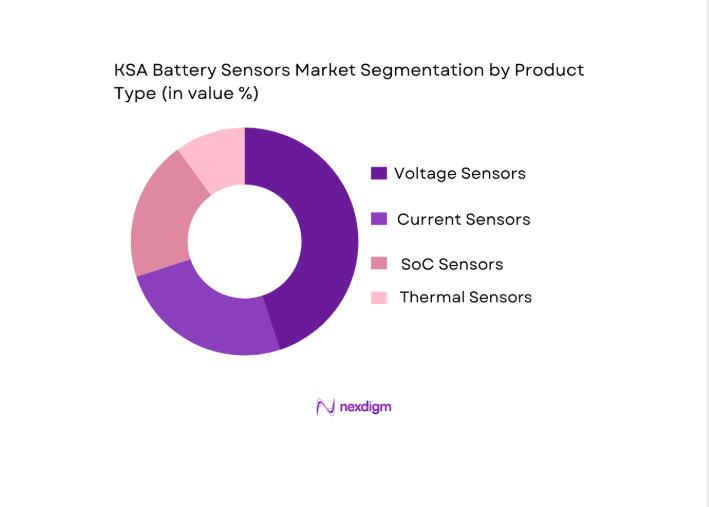

KSA Battery Sensors Market Segmentation

By Product Type

The KSA battery sensors market is segmented by product type into Voltage Sensors, Current Sensors, State of Charge (SoC) Sensors, and Thermal Sensors. Among these, Voltage Sensors hold the largest market share due to their critical role in ensuring the safety and efficiency of both electric vehicles and energy storage systems. The continuous expansion of the EV market in Saudi Arabia, along with advancements in battery health monitoring systems, has propelled the demand for Voltage Sensors. The need for real-time monitoring of battery voltage in electric vehicles, coupled with the growing emphasis on reliable and durable energy storage systems, further supports the dominance of this segment.

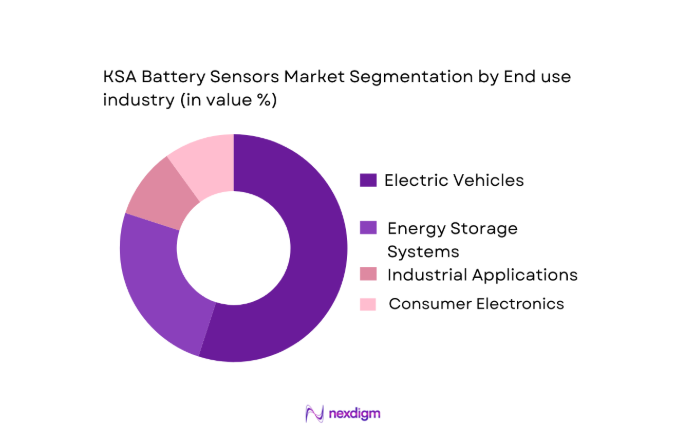

By End-Use Industry

The KSA battery sensors market is segmented by end-use industry into Electric Vehicles, Energy Storage Systems, Industrial Applications, and Consumer Electronics. The Electric Vehicle sector dominates this segmentation, owing to the rapid adoption of electric vehicles as part of Saudi Arabia’s Vision 2030 objectives. With the government’s incentives for green transportation and the development of EV infrastructure, there is a high demand for battery monitoring and sensor systems. These sensors are crucial for optimizing the performance and safety of EV batteries, contributing to their dominance in the market.

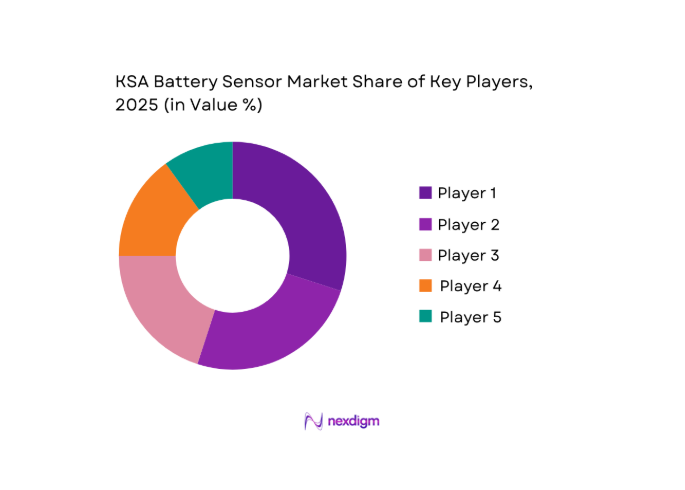

Competitive Landscape

The KSA battery sensors market is highly competitive, with major global and local players. Companies like Bosch, Continental, and Denso dominate the market, leveraging their technological advancements in battery sensor development. These players, along with Saudi-based manufacturers, have been key contributors to the market’s growth by continuously enhancing their product offerings, particularly in the electric vehicle sector. Local companies are also expanding their R&D capabilities to create region-specific solutions that meet the needs of the Saudi market.

| Company Name | Establishment Year | Headquarters | Product Portfolio | Technology Focus | Revenue (USD) | Market Penetration | Distribution Channels |

| Bosch | 1886 | Germany | Voltage, Current, Thermal Sensors | ~ | ~ | ~ | Global |

| Continental | 1871 | Germany | Voltage, Thermal Sensors | ~ | ~ | ~ | Global |

| Denso | 1949 | Japan | Current, Thermal Sensors | ~ | ~ | ~ | Global |

| Al-Dhowayan Advanced Technologies | 2010 | Saudi Arabia | Voltage, SoC Sensors | ~ | ~ | ~ | Local/Regional |

| STMicroelectronics | 1987 | Switzerland | Voltage, Thermal Sensors | ~ | ~ | ~ | Global |

KSA Battery Sensor Market Analysis

KSA Battery Sensor Market Analysis

Growth Drivers

National Renewable Energy & Energy Storage Expansion

The KSA government’s push for a renewable energy transition is evident in its Vision 2030 framework, with the country aiming to derive ~ of its energy from renewables by 2030. Saudi Arabia’s Ministry of Energy has allocated approximately USD 20 billion to fund renewable energy projects, including solar and wind power. The Saudi Green Initiative launched in 2021 is a critical part of this transformation, ensuring substantial investments in energy storage systems that are pivotal for managing renewable energy. The total installed capacity of solar energy in KSA is expected to exceed 3 GW by the end of 2024, significantly increasing demand for energy storage solutions.

EV Adoption & Electrification of Transportation

Saudi Arabia has set ambitious goals for electric vehicles, intending to have 30% of all vehicles be electric by 2030. As of 2024, the KSA government has partnered with international automakers to establish a domestic electric vehicle manufacturing industry. This includes a USD ~ investment by Lucid Motors to build its electric car plant in the Kingdom. Additionally, the number of electric vehicle charging stations is set to increase to over 1,000 by 2025, enhancing the infrastructure required to support electric vehicle adoption. This rapid EV adoption is driving the demand for battery sensors for performance monitoring, optimization, and safety.

Market Restraints

Limited Local Manufacturing Base

Despite the growth of the renewable energy sector, Saudi Arabia’s reliance on international imports for high-tech components, such as advanced battery sensors, is a significant challenge. The Kingdom’s local manufacturing base for these advanced technologies remains underdeveloped, with a few domestic players involved in assembly and distribution. In 2024, local production of battery sensors still accounts for less than ~ of the total market demand. This limitation is compounded by the country’s heavy reliance on international trade and the lack of a comprehensive local supply chain for these high-precision components, delaying growth in the sensor market.

Technical Integration Challenges with Legacy Battery Systems

In the transition to more advanced energy storage and electric vehicle systems, many industries in Saudi Arabia still rely on older, legacy battery management systems. These systems often struggle to integrate with newer, more efficient battery sensors and monitoring technologies, limiting the effectiveness of battery monitoring solutions. As of 2024, approximately ~ of the battery management systems in use are based on older technologies, which do not support modern IoT-enabled sensors or advanced predictive analytics. Overcoming these integration challenges is a key barrier to the widespread adoption of advanced battery sensors in the Kingdom.

Opportunities

Predictive Diagnostics & AI-Enabled Monitoring Platforms

AI-driven battery monitoring platforms are revolutionizing the way energy storage systems and electric vehicles are managed in Saudi Arabia. These platforms enable predictive diagnostics that identify potential failures before they occur, reducing downtime and maintenance costs. The Saudi government’s investment in AI and big data analytics is expected to continue driving the adoption of these solutions. In 2024, the number of battery sensors integrated with AI platforms is expected to increase significantly, driven by the need for more efficient energy management systems across EVs, solar energy systems, and industrial applications.

Localization of Sensor Manufacturing

Localizing the manufacturing of advanced battery sensors presents a significant growth opportunity in Saudi Arabia. As of 2024, the government has allocated substantial funds to boost local manufacturing capabilities in the high-tech sector. By encouraging local players to build the capacity to produce these sensors, the Kingdom can reduce its reliance on imports, increase the security of its supply chains, and develop a competitive advantage in the renewable energy market. The government’s focus on strengthening the manufacturing base aligns with its long-term goal of diversifying the economy away from oil dependence.

Future Outlook

Over the next five years, the KSA battery sensors market is expected to experience robust growth driven by continuous government support for electric vehicles and renewable energy storage systems. Technological advancements, particularly in smart sensors and AI-driven monitoring systems, will play a crucial role in shaping the market’s future. The expansion of EV infrastructure, backed by significant investments in green transportation and energy storage, will further solidify the market’s trajectory, contributing to higher adoption rates of advanced battery sensors.

Major Players in the Market

- Bosch

- Continental

- Denso

- STMicroelectronics

- Infineon Technologies

- Analog Devices

- NXP Semiconductors

- Sensata Technologies

- HBL Power Systems Ltd.

- Al-Dhowayan Advanced Technologies

- ABB Saudi Arabia

- Saudi Batteries Company (SBC)

- Abunayyan Trading Corporation

- Advanced Electronics Company (AEC)

- Al-Futtaim Group

Key Target Audience

- Investors and Venture Capitalist Firms

- Government and Regulatory Bodies

- Automotive OEMs and EV Manufacturers

- Energy Storage Solution Providers

- Battery Manufacturers

- Telecommunication Companies

- Renewable Energy Project Developers

- Industrial Equipment Manufacturers

Research Methodology

Step 1: Identification of Key Variables

The first phase involves identifying key market variables related to battery sensor types and their applications within the KSA market. This is achieved through a combination of secondary research from industry reports, news, and publications, followed by expert consultations to understand the dynamics.

Step 2: Market Analysis and Construction

During this phase, historical data and current market trends are compiled and analyzed, including technological advancements, adoption rates of electric vehicles, and the demand for energy storage systems. This information helps to assess future market trends and growth trajectories.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses regarding future growth trends and key drivers are validated through expert interviews with manufacturers, OEMs, and government agencies. These discussions provide insights into product preferences, technological advancements, and regulatory frameworks.

Step 4: Research Synthesis and Final Output

The final phase involves synthesizing all data points to provide a comprehensive market outlook. This includes in-depth analysis of key players, competitive dynamics, market trends, and forecasts, ensuring that the report offers an accurate reflection of the market’s potential.

- Executive Summary

- Research Methodology (Market Definitions and Scope, Primary & Secondary Data Sources, Top‑Down and Bottom‑Up Market Sizing, Data Triangulation and Validation Approach, Forecasting Assumptions and Inflation Adjustment Method, Limitations and Data Confidence Levels)

- Market Definition and Technology Scope

- Strategic Context: Vision 2030 & Energy Transition

- Linkage with KSA Battery Storage, EV & Renewable Infrastructure Investments

- Industry Genesis & Evolution

- Growth Drivers

National Renewable Energy & Energy Storage Expansion

EV Adoption & Electrification of Transportation

Smart Grid & IoT Integration

Safety & Reliability Requirements in Harsh Climate Conditions

- Market Restraints

Limited Local Manufacturing Base

Technical Integration Challenges with Legacy Battery Systems

Data Security & Privacy Concerns - Opportunities

Predictive Diagnostics & AI‑Enabled Monitoring Platforms

Localization of Sensor Manufacturing

- Market Size by Revenue (Battery Sensors & Monitoring Solutions)

- Market Volume & Unit Demand (Units Deployed / Installed Base)

- Average Selling Price & ASP Trends (Sensor Tiering & Intelligence Levels)

- By Sensor Technology (In Value %)

Voltage Monitoring Sensors (Parameter: Voltage Sensitivity & Precision)

Current & Thermal Sensors (Parameter: Temp Accuracy & Safety Threshold)

State‑of‑Charge (SoC / SoH) Estimation Sensors (Parameter: Data Analytics Capability)

Smart / AI‑Integrated Sensors (Parameter: Embedded ML Predictive Algorithms)

IoT‑Enabled Connectivity Sensors (Parameter: Connectivity Protocol Support) - By Communication Protocol (In Value %)

Can‑Bus Enabled Sensors (Parameter: Network Integration Capability)

LIN Communication (Parameter: Low‑Latency Controls)

Wireless Sensor Networks (Parameter: Frequency & Security Protocols)

Proprietary Protocols - By Battery Platform (In Value %)

Automotive Battery Sensors (12V / 24V / HV) (Parameter: Voltage Tier)

EV Battery Module Sensors (Parameter: Cell Stack Compatibility)

Stationary Storage Sensors (Parameter: Energy Storage System Type)

Telecom Backup Battery Sensors

Industrial Power Systems - By End‑Use Industry (In Value %)

Automotive OEM (Parameter: EV / BEV / PHEV Fleet Penetration)

Energy & Storage (Parameter: Renewable Grid Integration)

Telecom Infrastructure

Industrial & Manufacturing Plants

Consumer & Commercial Appliances - By Deployment Mode (In Value %)

Original Equipment Manufacturer (OEM)

Aftermarket & Retrofitting

Managed Service / Remote Monitoring

- KSA Battery Sensors Market Share by Company

- Cross‑Comparison Parameters (Product Portfolio Breadth, Technology Differentiators, Local Assembly / Manufacturing Footprint, OEM Tier Status, Aftermarket Distribution Reach, Service & After‑Sale Analytics Support, Channel Penetration & Regional Deployment)

- Price Benchmarking & SKU Pricing Structures

- Competitive Positioning Matrix (Value vs Innovation)

- Detailed Company Profiles

Bosch Automotive Sensors

Continental AG

Denso Corporation

Infineon Technologies

NXP Semiconductors

Sensata Technologies

STMicroelectronics

Analog Devices

Texas Instruments

HBL Power Systems Ltd.

Saudi Batteries Company (SBC)

Abunayyan Trading Corporation

ABB Saudi Arabia

Advanced Electronics Company (AEC)

Al‑Dhowayan Advanced Technologies

- Demand by End‑User Profiles

- Total Cost of Ownership (TCO) & ROI Analysis

- Decision‑Making Patterns (OEM vs Aftermarket)

- Procurement & Budget Cycle Analysis

- Market Forecast: Value & Volume (2026-2030)

- Technology Adoption Curve Forecast (2026-2030)

- Legacy to AI‑Integrated Sensor Transition (2026-2030)

- Wireless & IoT Deployment Penetration (2026-2030)

- Key Growth Enablers (2026-2030)