Market Overview

The KSA biomarkers market is experiencing significant growth, driven by the increasing prevalence of chronic diseases, a growing emphasis on personalized medicine, and advancements in diagnostic technologies. With a focus on improving healthcare outcomes, the market is expected to reach a value of approximately USD ~ billion. This growth is supported by government initiatives, investments in healthcare infrastructure, and a rising demand for early disease detection and personalized treatment options.

In Saudi Arabia, cities like Riyadh, Jeddah, and Dammam are key players in the development and adoption of biomarkers, largely due to their advanced healthcare systems and proximity to major healthcare facilities. Riyadh, the capital, is home to the nation’s largest medical centers and is a hub for both public and private healthcare investments. These cities are crucial in driving the demand for innovative biomarker solutions in diagnostics, therapeutics, and personalized medicine.

Market Segmentation

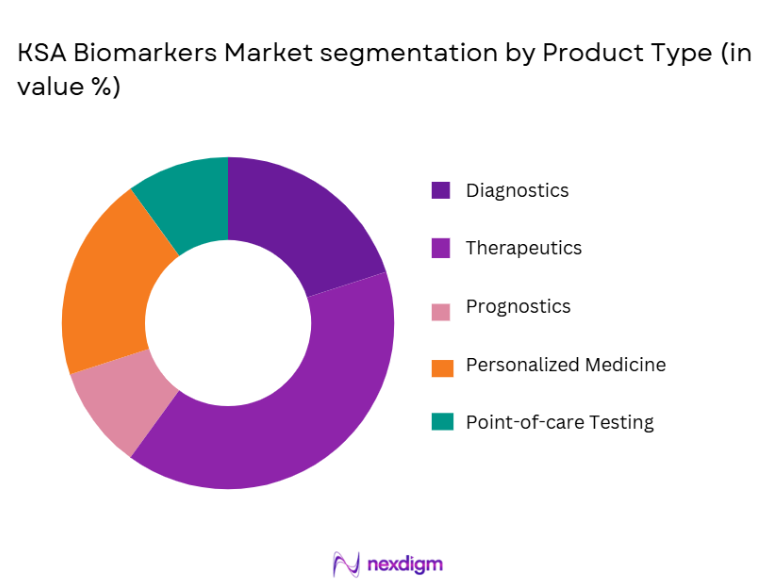

By Product Type

The KSA biomarkers market is segmented by product type into diagnostics, therapeutics, prognostics, personalized medicine, and point-of-care testing. Currently, the diagnostics sub-segment holds a dominant market share due to the increasing demand for early disease detection, supported by improved healthcare awareness and diagnostic infrastructure. Moreover, advancements in genetic testing and non-invasive diagnostics are further contributing to its growth. The ability to accurately diagnose diseases early on, particularly chronic and genetic conditions, makes diagnostic biomarkers a vital component in Saudi Arabia’s healthcare landscape.

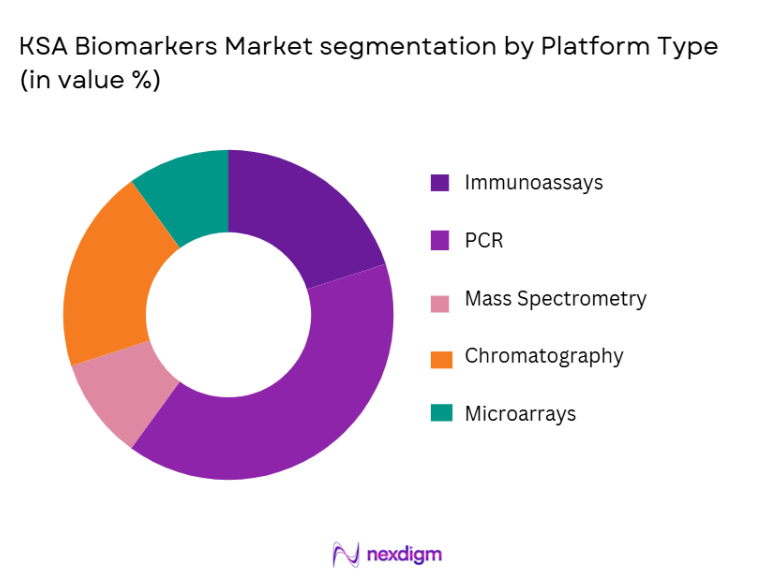

By Platform Type

The market is segmented by platform type into immunoassays, polymerase chain reaction (PCR), mass spectrometry, chromatography, and microarrays. Immunoassays currently lead the market due to their high efficiency, accuracy, and cost-effectiveness in biomarker testing. Immunoassays are widely used in diagnostics, particularly for detecting various biomarkers in blood samples. The technology’s widespread adoption in clinical diagnostics and the increasing demand for early disease detection continue to bolster the immunoassay platform’s dominance in the market.

Competitive Landscape

The KSA biomarkers market is moderately consolidated, with a few global players dominating the sector, including companies like Thermo Fisher Scientific, Roche, and Abbott. These companies lead due to their established infrastructure, robust product portfolios, and strong regulatory compliance. Local players have been focusing on strategic collaborations and partnerships with these multinational companies to enhance their market presence. The competitive landscape is also influenced by continuous innovation, especially in diagnostic technologies and personalized medicine, which are expected to be key factors for future growth.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue (USD) | Regulatory Compliance |

| Thermo Fisher | 1956 | Waltham, USA | ~

|

~

|

~

|

~

|

~

|

| Roche | 1896 | Basel, Switzerland | ~

|

~

|

~

|

~

|

~

|

| Abbott | 1888 | Chicago, USA | ~

|

~

|

~

|

~

|

~

|

| Siemens Healthineers | 1847 | Erlangen, Germany | ~

|

~

|

~

|

~

|

~

|

| Illumina | 1998 | San Diego, USA | ~

|

~

|

~

|

~

|

~

|

KSA Biomarkers Market Analysis

Growth Drivers

Technological Advancements in Diagnostic Platforms

Technological advancements in biomarker discovery and diagnostic platforms have driven significant growth in the KSA biomarkers market. Innovations in platforms like mass spectrometry, PCR, and immunoassays have enhanced the accuracy, sensitivity, and speed of biomarker testing. The integration of next-generation sequencing and bioinformatics has also expanded the possibilities of identifying novel biomarkers for disease detection and personalized treatment. These technologies support early disease diagnosis, which is particularly crucial for managing chronic diseases like cancer and diabetes, two of the leading health concerns in Saudi Arabia. Additionally, the growing use of liquid biopsy technologies has reduced the need for invasive procedures, making diagnostic tests more accessible to a broader patient population. As a result, healthcare providers in Saudi Arabia are adopting these innovative platforms to enhance their diagnostic capabilities, leading to market expansion.

Government Initiatives and Healthcare Investments

Government initiatives and increasing investments in healthcare infrastructure have been vital in driving the growth of the KSA biomarkers market. Saudi Arabia’s Vision 2030, which emphasizes the modernization and expansion of the healthcare sector, has led to significant public and private sector investments in healthcare infrastructure, including the development of state-of-the-art diagnostic and treatment facilities. This is coupled with growing awareness about the importance of early disease detection and personalized medicine. Moreover, the Saudi government has been funding research and development programs focused on biomarker discovery and validation, aiming to position the country as a regional hub for advanced healthcare solutions. These factors have created a favorable environment for biomarker adoption, boosting the market for diagnostic tools and personalized treatment options.

Market Challenges

High Development and Regulatory Costs

One of the major challenges facing the KSA biomarkers market is the high cost of developing new biomarkers and diagnostic technologies. The process of biomarker discovery, validation, and commercialization requires significant investments in research and development. Additionally, obtaining regulatory approval for new biomarkers involves rigorous testing and validation processes, which can be time-consuming and expensive. These factors limit the ability of smaller companies and research institutions in Saudi Arabia to enter the market. While global players can absorb these costs, local firms face challenges in funding such large-scale research and complying with stringent regulatory requirements. This barrier to entry could slow down the overall market growth, especially in the emerging stages of biomarker development and adoption.

Lack of Standardization in Biomarker Testing

Another significant challenge in the KSA biomarkers market is the lack of standardization in biomarker testing. With multiple diagnostic platforms and biomarker types being used across healthcare providers, discrepancies in test results and diagnostic accuracy can arise. The absence of clear guidelines and protocols for biomarker testing can lead to inconsistent results, which can undermine the reliability of diagnostic tests and reduce their adoption. Additionally, the lack of standardization poses difficulties for regulatory bodies, making it challenging to enforce uniform testing protocols and ensure the reliability of biomarker-based diagnostics across different healthcare facilities. Establishing standardized practices is essential for improving the accuracy and trustworthiness of biomarker diagnostics in the country.

Opportunities

Expansion of Point-of-care Testing Solutions

The KSA biomarkers market is witnessing significant opportunities in the expansion of point-of-care (POC) testing solutions. Point-of-care diagnostics allow healthcare professionals to perform tests and receive results immediately at the site of patient care, eliminating the need for laboratory tests and reducing delays in diagnosis. In Saudi Arabia, where there is a high demand for accessible and rapid diagnostic services, POC tests have the potential to revolutionize disease detection, particularly in remote and underserved areas. The government’s ongoing efforts to improve healthcare access in rural regions align with the growing adoption of POC biomarkers for conditions such as diabetes, cancer, and infectious diseases. With advancements in molecular diagnostics and miniaturization of equipment, POC testing is expected to become more accurate and widely used, creating new growth opportunities in the market.

Collaborations and Partnerships in Biomarker Research

Collaborations and partnerships between public and private sector entities are presenting significant opportunities for growth in the KSA biomarkers market. By forming alliances with international research institutions and biotech companies, local players can gain access to advanced technologies and global expertise in biomarker discovery and development. These partnerships not only promote the exchange of knowledge but also enhance the availability of innovative biomarkers for various diseases prevalent in the region. Moreover, strategic collaborations with healthcare providers and pharmaceutical companies can lead to the creation of personalized treatment options tailored to the specific genetic profiles of the Saudi population. Such initiatives will foster the growth of the biomarkers market, making it an attractive area for investment and innovation.

Future Outlook

The KSA biomarkers market is expected to continue its growth trajectory over the next five years, fueled by technological advancements in diagnostic platforms, government initiatives aimed at healthcare modernization, and rising consumer demand for personalized medicine. With significant investments in healthcare infrastructure and a growing focus on non-invasive diagnostics, the market is likely to see increased adoption of innovative biomarker technologies. Regulatory support and research collaboration will further accelerate the development and commercialization of new biomarkers, while the ongoing expansion of point-of-care testing will provide new opportunities for market players.

Major Players

- Thermo Fisher Scientific

- Roche

- Abbott

- Siemens Healthineers

- Illumina

- PerkinElmer

- Bio-Rad Laboratories

- Merck

- Agilent Technologies

- GE Healthcare

- QIAGEN

- Beckman Coulter

- ThermoFisher Scientific

- Johnson & Johnson

- Becton Dickinson

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Pharmaceutical companies

- Healthcare providers

- Diagnostic labs and centers

- Biotechnology firms

- Medical equipment manufacturers

- Insurance companies

Research Methodology

Step 1: Identification of Key Variables

Key market variables, including technological advancements, healthcare infrastructure development, and demographic trends, are identified to assess their impact on the biomarkers market.

Step 2: Market Analysis and Construction

In-depth analysis is conducted using primary and secondary research to gather relevant data on market size, growth trends, and competitive landscape.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses regarding growth drivers, challenges, and opportunities are validated through expert consultations with industry professionals and key stakeholders.

Step 4: Research Synthesis and Final Output

The findings from research are synthesized into a comprehensive market report, which is then validated and finalized for publication.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Technological Advancements in Biomarker Discovery

Increasing Prevalence of Chronic Diseases

Growing Adoption of Personalized Medicine - Market Challenges

High Development Costs for Biomarkers

Regulatory Barriers and Compliance Issues

Lack of Standardization in Biomarker Testing - Market Opportunities

Expansion of Point-of-care Biomarker Solutions

Strategic Partnerships with Healthcare Providers

Emerging Markets for Biopharmaceuticals - Trends

Integration of AI in Biomarker Discovery

Rise of Liquid Biopsy Technologies

Increased Investment in Genomic-based Biomarkers - Government Regulations

Regulation on Biomarker Discovery and Development

Approval Processes for Diagnostic Biomarkers

Healthcare Data Privacy and Security Standards

- By Market Value 2019-2025

- By Installed Units 2019-2025

- By Average System Price 2019-2025

- By System Complexity Tier 2019-2025

- By System Type (In Value%)

Diagnostics

Therapeutics

Prognostics

Personalized Medicine

Point-of-care Testing - By Platform Type (In Value%)

Immunoassays

Polymerase Chain Reaction (PCR)

Mass Spectrometry

Chromatography

Microarrays - By Fitment Type (In Value%)

In-house Testing

Outsourced Testing

Laboratory-based

Point-of-care

At-home Diagnostics - By EndUser Segment (In Value%)

Hospitals

Clinical Laboratories

Pharmaceutical Companies

Research Institutions

Diagnostic Centers - By Procurement Channel (In Value%)

Direct Sales

Distributors

Online Sales

B2B Marketplaces

Partnerships

- Market Share Analysis

- CrossComparison Parameters

[Technology integration level, Regulatory compliance readiness, Market accessibility, Product differentiation, Pricing competitiveness] - SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Porter’s Five Forces

- Key Players

AbbVie

Roche

Pfizer

Novartis

Siemens Healthineers

Thermo Fisher Scientific

GE Healthcare

Illumina

BD Biosciences

Abbott Laboratories

PerkinElmer

Qiagen

Bio-Rad Laboratories

Merck

Agilent Technologies

- Increasing Adoption in Clinical Laboratories

- Growing Demand in Hospitals for Precision Medicine

- Need for Biomarkers in Pharmaceutical Research

- Expansion of Diagnostic Centers in Emerging Markets

- Forecast Market Value 2026-2030

- Forecast Installed Units 2026-2030

- Price Forecast by System Tier 2026-2030

- Future Demand by Platform 2026-2030