Market Overview

The KSA biosensors market is valued at ~, driven by the country’s increasing healthcare investments and the growing demand for innovative medical technologies. The market’s expansion is fueled by the rising prevalence of chronic diseases such as diabetes and cardiovascular diseases, which are among the ~ leading causes of mortality in Saudi Arabia. Additionally, the Saudi government’s Vision 2030 initiative, which emphasizes modernizing the healthcare system, is further propelling the adoption of point-of-care diagnostics and personalized healthcare solutions. Rising awareness about the importance of early diagnosis and remote health monitoring is also supporting the demand for biosensors, creating new opportunities for manufacturers and technology developers in the region.

Riyadh, Jeddah, and Dammam are the dominant cities driving the growth of the biosensors market in Saudi Arabia. These cities are home to the largest healthcare infrastructure, including hospitals, clinics, and medical research centers, which act as hubs for the deployment and adoption of advanced medical technologies. Riyadh, in particular, leads as the capital city with the highest concentration of government healthcare initiatives and medical professionals. Furthermore, these cities attract global manufacturers and service providers due to their well-developed distribution networks, enhancing market accessibility. Their strategic position also facilitates ease of access to international research and collaboration, boosting innovation in the biosensors sector.

KSA Biosensors Market Segmentation

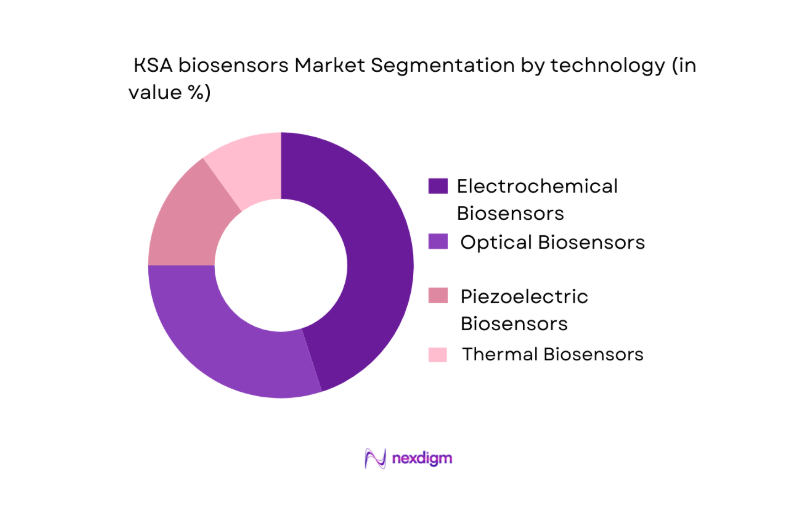

By Technology

The KSA biosensors market is segmented by technology into electrochemical, optical, piezoelectric, and thermal biosensors. Among these, electrochemical biosensors dominate the market due to their cost-effectiveness, high sensitivity, and broad application in diabetes management and glucose monitoring systems. Electrochemical sensors are highly favored in point-of-care diagnostic devices, making them an integral part of both hospital and home healthcare settings. They provide real-time analysis, a key advantage in managing chronic conditions such as diabetes. The affordability and widespread availability of electrochemical biosensors further strengthen their market leadership. Additionally, advancements in microelectromechanical systems (MEMS) have led to more compact and portable devices, making them increasingly popular for personal healthcare.

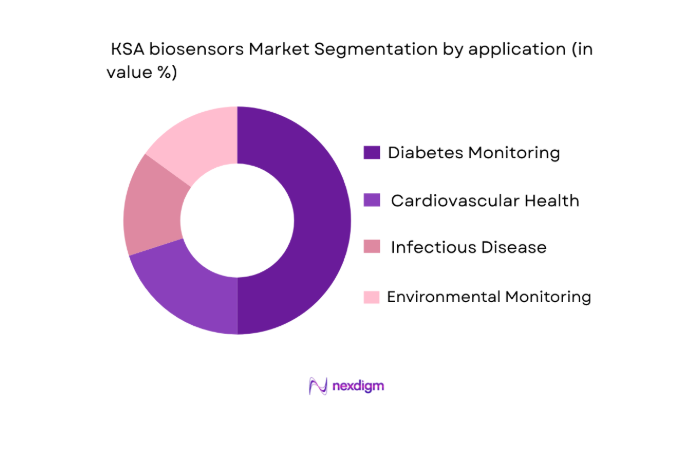

By Application:

The market is also segmented by application, including diabetes monitoring, cardiovascular health, infectious disease diagnostics, and environmental monitoring. The diabetes monitoring segment holds the largest market share, driven by the high prevalence of diabetes in Saudi Arabia. The country’s healthcare system is heavily focused on managing and monitoring chronic diseases, especially diabetes, which affects a significant portion of the population. Biosensors used in continuous glucose monitoring (CGM) systems are widely used by diabetic patients for real-time blood sugar levels. The increased adoption of wearable biosensors, combined with the Saudi government’s efforts to promote health and wellness, has positioned diabetes management as the dominant application in the biosensors market.

Competitive Landscape

The KSA biosensors market is dominated by global and local players, including Abbott Laboratories, Siemens Healthineers, and Medtronic. These companies lead due to their robust product portfolios, strong distribution networks, and established presence in the region’s healthcare system. As the market is highly competitive, players are investing heavily in R&D and forming strategic partnerships with local distributors to enhance their market presence.

| Company | Establishment Year | Headquarters | Product Portfolio | R&D Investment | Regulatory Approvals | Distribution Channels |

| Abbott Laboratories | 1888 | Chicago, USA | ~ | ~ | SFDA Approved | ~ |

| Siemens Healthineers | 1847 | Erlangen, Germany | ~ | ~ | SFDA Approved | ~ |

| Medtronic | 1949 | Dublin, Ireland | ~ | ~ | SFDA Approved | ~ |

| Roche Diagnostics | 1896 | Basel, Switzerland | ~ | ~ | SFDA Approved | ~ |

| Bio-Rad Laboratories | 1952 | California, USA | ~ | ~ | SFDA Approved | ~ |

KSA biosensors Market Analysis

Growth Drivers

Rising Chronic Disease Prevalence (Diabetes, CVD)

Chronic diseases like diabetes and cardiovascular diseases (CVD) continue to increase in Saudi Arabia. In 2022, Saudi Arabia reported a diabetes prevalence rate of ~, with over ~ people affected by diabetes. The rising prevalence of diabetes is contributing to the higher demand for glucose monitoring biosensors. Additionally, the World Health Organization (WHO) estimates that cardiovascular diseases were responsible for 44% of all deaths in the Kingdom in 2022. The increasing burden of these diseases is pushing the healthcare system to adopt more efficient, real-time diagnostic tools like biosensors to aid early detection and management. This has led to significant investment in healthcare infrastructure, supporting the adoption of biosensors for managing chronic conditions.

Expansion of Point-of-Care Testing Adoption

Point-of-care (POC) testing in Saudi Arabia has been growing steadily. In 2022, the Saudi government allocated approximately USD 10 billion for healthcare sector improvements, focusing heavily on decentralizing healthcare services and increasing access to diagnostic tools at the point of care. This includes the integration of POC testing devices such as biosensors in hospitals and clinics. The Saudi Health Council plans to implement a national healthcare framework that incorporates more decentralized testing to cater to remote areas. As a result, the demand for efficient, portable, and real-time diagnostic tools like biosensors is projected to expand significantly.

Market Restraints

High Technology and Manufacturing Costs

The high cost of biosensor technology remains a significant restraint in Saudi Arabia’s biosensor market. In 2022, the production costs for advanced biosensor devices were reported to be ~ higher than for traditional diagnostic equipment. Factors contributing to these elevated costs include the need for highly specialized raw materials, labor costs, and advanced production technology. Moreover, although the Saudi government is investing in the healthcare sector, local production facilities for these high-tech devices are limited, which increases reliance on expensive imports.

Regulatory Compliance and SFDA Approval Timelines

The Saudi Food and Drug Authority (SFDA) enforces stringent regulations for medical devices, including biosensors, to ensure safety and effectiveness. The approval process for new medical devices in Saudi Arabia often takes between 9 to 12 months, which can delay the introduction of new biosensor technologies in the market. Additionally, biosensor manufacturers must comply with both international standards (such as ISO 13485) and local regulations, which can complicate and lengthen the certification process. These regulatory delays create a significant bottleneck for companies looking to enter the market.

Market Opportunities

Wearable & IoT-enabled Sensors

The market for wearable and IoT-enabled biosensors in Saudi Arabia is expanding rapidly. In 2022, there was a noticeable increase in the adoption of wearable devices that monitor vital health metrics such as blood glucose, heart rate, and oxygen levels. The IoT-based sensors are particularly beneficial for real-time monitoring of patients with chronic conditions, providing data that can be analyzed remotely. Currently, the Kingdom is focusing on improving its healthcare delivery infrastructure by integrating IoT-enabled devices into healthcare systems, as part of the Vision 2030 initiative. In 2022, there were more than ~ devices in use across hospitals and clinics, with wearables becoming a preferred choice for both healthcare providers and consumers.

Telehealth Integration

Telehealth is another key growth opportunity for the KSA biosensors market. In 2022, the Saudi government launched multiple telehealth initiatives aimed at improving healthcare access in remote areas. This includes providing patients with the ability to use biosensors at home to monitor their health remotely. The integration of telehealth and biosensors is enhancing patient outcomes by allowing continuous monitoring without the need for in-person visits. Currently, there are over 200 telehealth centers operational in Saudi Arabia, serving thousands of patients nationwide. The government’s investment in telemedicine infrastructure is expected to drive further adoption of biosensors in the coming years.

Future Outlook

Over the next five years, the KSA biosensors market is poised for substantial growth driven by technological advancements, increased healthcare digitization, and rising demand for personalized healthcare solutions. Government support for healthcare innovation, combined with the rising prevalence of chronic diseases, is expected to propel market demand. Furthermore, the growing trend of home healthcare and wearable biosensors will expand the reach of diagnostic technologies, benefiting both consumers and healthcare providers. Investment in research and development will play a critical role in accelerating the adoption of next-generation biosensors, making the Saudi market a key focal point for global manufacturers and innovators.

Major Players

- Abbott Laboratories

- Siemens Healthineers

- Medtronic

- Roche Diagnostics

- Bio-Rad Laboratories

- PerkinElmer

- QIAGEN

- Becton Dickinson

- Thermo Fisher Scientific

- Philips Healthcare

- Agilent Technologies

- Nova Biomedical

- ACON Laboratories

- Johnson & Johnson

- General Electric Healthcare

Key Target Audience

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies

- Healthcare Providers (Hospitals and Clinics)

- Medical Device Manufacturers

- Hospitals and Healthcare Providers

- Healthcare Technology Providers (Wearable Devices, IoT)

- Pharmaceutical Companies

- Distributors and Wholesalers of Medical Devices

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves mapping the major stakeholders within the KSA biosensors market, identifying critical factors that impact market dynamics. This is done through secondary research using industry reports, market trends, and available databases.

Step 2: Market Analysis and Construction

This phase involves the collection and analysis of historical data related to biosensors in the KSA market. The analysis focuses on assessing trends such as market penetration, technology adoption rates, and demand for specific applications like diabetes monitoring.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be validated through expert interviews, including consultations with industry leaders, healthcare professionals, and device manufacturers. These interviews will provide valuable insights into real-time market conditions, enabling the validation of the data collected.

Step 4: Research Synthesis and Final Output

The final output involves synthesizing the research findings and ensuring the accuracy of market data. Collaboration with local stakeholders, including biosensor manufacturers and distributors, will ensure the integrity of the final market analysis.

- Executive Summary

- Research & Methodology (Market Definitions & Classification, Research Assumptions & Hypotheses, Data Sources & Validation Protocols, Primary Research Outreach, Market Modeling & Forecasting Techniques , Limitations and Future Market Data Enhancements)

- Market Context and Strategic Importance

- Evolution & Market Genesis

- Market Maturity & Lifecycle Assessment

- Healthcare Delivery Ecosystem Mapping

- Biosensor Value Chain & Stakeholder Network

- Growth Drivers

Rising chronic disease prevalence

Expansion of point‑of‑care testing adoption

Health tech policy & digital health roadmap

Demand for real‑time monitoring tools - Market Restraints

High technology and manufacturing costs

Regulatory compliance and SFDA approval timelines

Limited local production capabilities - Market Opportunities

Wearable & IoT‑enabled sensors

Telehealth integration

Local R&D and manufacturing incentives

Personalized medicine and AI analytics - Market Trends

Integration of AI and predictive diagnostics

Multimodal biosensing systems

Telemedicine and remote patient monitoring

- Historical revenue trend

- Volume & Unit Sales

- Average Selling Price Trends

- Unit Deployment by End‑Use

- By Technology (in value %)

Electrochemical Biosensors (e‑health, glucose monitoring)

Optical Biosensors (pathogen detection, imaging)

Piezoelectric Biosensors (lab diagnostics)

Thermal / Acoustic Biosensors

Wearable Biosensor Platforms (PPG, ECG) - By Product / Device Type (in value %)

Continuous Glucose Monitors (CGMs)

Point‑of‑Care Diagnostic Biosensors

Implantable Biosensors

Wearable Health Sensors

Environmental & Food Safety Biosensors - By Application (in value %)

Diabetes & Metabolic Disease Management

Cardiovascular Monitoring

Infectious Disease Diagnostics

Personalized & Preventive Health

Environmental Monitoring (air, water) - By End‑User (in value %)

Hospitals & Clinics

Diagnostic Laboratories

Research Institutions

Home & Telehealth Platforms

Consumer Wellness & Fitness - By Distribution Channel (in value %)

Direct OEM Sales

Medical Device Distributors

eCommerce/Online Health Platforms

Retail Medical Outlets

- Market Competiton

- Cross‑Comparison Parameters (Company Overview, Product Portfolio Depth, R&D Intensity, Regulatory Approvals, Local Presence, Distribution Network Strength, Installed Base Units, Pricing Model Strategy)

- SWOT Profiles — Top Biosensor Providers

- Pricing Benchmarking by SKU & Technology

- Detailed Company Profiles

Abbott Laboratories

Siemens Healthineers

Roche Diagnostics

Medtronic plc

Bio‑Rad Laboratories

Thermo Fisher Scientific

Agilent Technologies

Johnson & Johnson

BD (Becton, Dickinson & Co

Abbott Point of Care

PerkinElmer

QIAGEN

Eppendorf AG

ACON Laboratories

Nova Biomedical

- Adoption Rate by Healthcare Setting

- Purchasing Behavior

- Utilization Patterns by Disease Category

- Decision‑Making Criteria

- Market Size Forecast — Value & CAGR Projections (2026-2030)

- Market Volume Forecast (2026-2030)

- Market Price Trend Forecast (2026-2030)

- Market Segment Growth Forecasts (2026-2030)