Market Overview

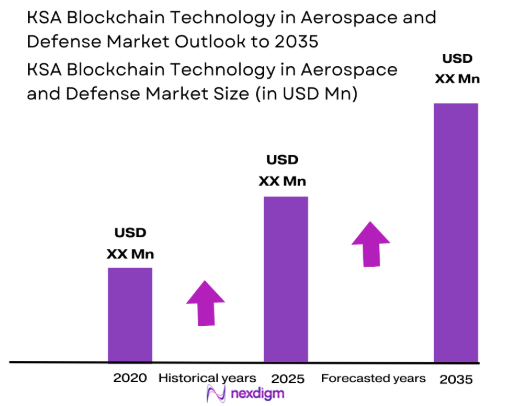

Based on a recent historical assessment, the KSA Blockchain Technology in Aerospace and Defense Market was valued at approximately USD ~ million, driven by secure data management requirements, defense digitalization programs, and growing adoption of distributed ledger technologies across sensitive aerospace workflows. Government backed modernization initiatives, rising cybersecurity investments, and the need for tamper resistant systems in mission critical operations have accelerated adoption. Blockchain deployment has been supported by defense supply chain digitization, secure identity management needs, and integration with command, control, communications, and intelligence systems, strengthening trust and operational transparency across defense platforms.

Based on a recent historical assessment, Riyadh dominates the KSA Blockchain Technology in Aerospace and Defense Market due to its concentration of defense ministries, digital transformation authorities, and national cybersecurity agencies. Jeddah and Dhahran also play key roles, supported by aerospace logistics hubs, naval operations, and proximity to major defense contractors. National dominance is reinforced by Saudi Arabia’s centralized defense procurement model, strong regulatory oversight, sustained sovereign investment, and alignment with long term national security digitization objectives.

Market Segmentation

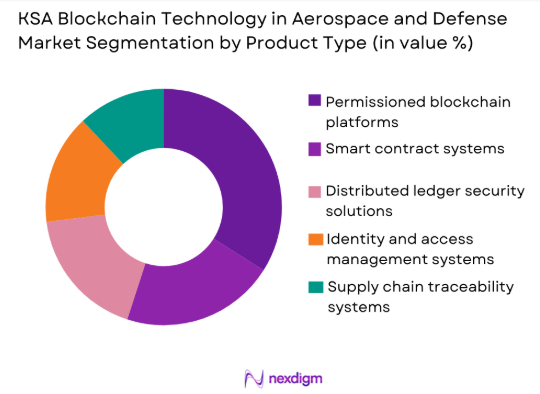

By Product Type

KSA Blockchain Technology in Aerospace and Defense Market is segmented by product type into permissioned blockchain platforms, smart contract systems, distributed ledger security solutions, identity and access management systems, and supply chain traceability platforms. Recently, permissioned blockchain platforms have held a dominant market share due to strict defense security requirements, controlled access needs, and regulatory compliance mandates. Defense organizations prefer permissioned architectures as they allow verified participants, enhanced governance, and reduced exposure to public network vulnerabilities. These platforms align with classified data handling protocols and sovereign data residency requirements. Integration flexibility with existing defense IT systems further strengthens adoption. Government backed pilots and contracts have prioritized permissioned models for logistics, maintenance records, and secure communications. Their scalability across multi agency defense environments has reinforced dominance.

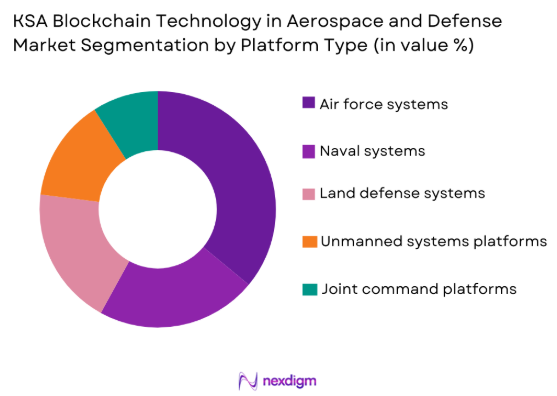

By Platform Type

KSA Blockchain Technology in Aerospace and Defense Market is segmented by platform type into air force systems, naval systems, land defense systems, unmanned systems platforms, and joint command platforms. Recently, air force systems have accounted for the dominant market share due to complex operational requirements, high value assets, and extensive data exchange needs. Air operations require secure mission data, maintenance logs, and asset tracking across geographically distributed bases. Blockchain enables tamper resistant records and real time validation for flight operations and logistics. Continuous modernization of air capabilities and integration with advanced digital command systems have accelerated adoption. Strategic focus on aerospace superiority has further reinforced platform dominance.

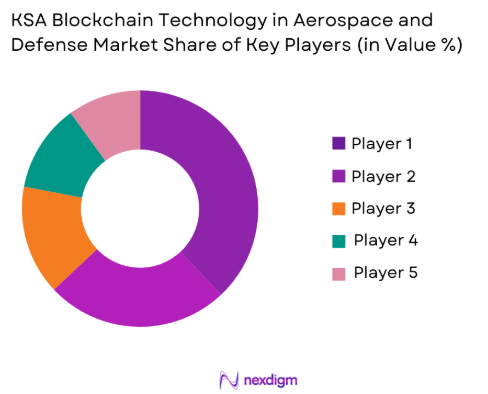

Competitive Landscape

The KSA Blockchain Technology in Aerospace and Defense Market is moderately consolidated, with a mix of global defense technology providers and national digital champions. Major players influence adoption through long term defense contracts, localized partnerships, and integrated cybersecurity capabilities. Strategic collaborations with government entities and system integrators shape competitive positioning, while high entry barriers limit new participants.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue | Defense Integration Capability |

| Saudi Information Technology Company | 1985 | Riyadh | ~ | ~ | ~ | ~ | ~ |

| STC Solutions | 1998 | Riyadh | ~ | ~ | ~ | ~ | ~ |

| SAMI Advanced Electronics | 1988 | Riyadh | ~ | ~ | ~ | ~ | ~ |

| IBM Saudi Arabia | 1911 | Riyadh | ~ | ~ | ~ | ~ | ~ |

| Thales Saudi Arabia | 1893 | Riyadh | ~ | ~ | ~ | ~ | ~ |

KSA Blockchain Technology in Aerospace and Defense Market Analysis

Growth Drivers

Defense Digital Transformation and Secure Data Modernization Initiatives

Defense Digital Transformation and Secure Data Modernization Initiatives represent a critical growth driver for the KSA Blockchain Technology in Aerospace and Defense Market as Saudi defense institutions continue large scale modernization of digital infrastructure supporting national security operations. Defense organizations are transitioning from fragmented legacy databases toward unified digital environments that demand high integrity, traceability, and controlled access across classified systems. Blockchain technology directly supports these requirements by enabling immutable records, secure transaction validation, and transparent audit trails across mission critical workflows. The technology strengthens confidence in data exchanged between command centers, maintenance units, logistics providers, and procurement authorities operating within sensitive defense ecosystems. Saudi Arabia’s emphasis on sovereign digital capabilities further accelerates adoption, as blockchain architectures can be designed to comply with strict data localization and national security governance frameworks. Integration of blockchain with existing command, control, communications, computers, intelligence, surveillance, and reconnaissance systems improves operational continuity without full system replacement. Defense digitalization programs also prioritize long lifecycle asset management, where blockchain enhances visibility into maintenance histories, component authenticity, and system readiness. Government backed funding mechanisms and long term defense contracts reduce investment risk for blockchain deployment, encouraging sustained implementation across aerospace and defense platforms.

Escalating Cybersecurity Threats and Demand for Tamper Resistant Defense Systems

Escalating Cybersecurity Threats and Demand for Tamper Resistant Defense Systems strongly drive blockchain adoption as Saudi aerospace and defense networks face increasing exposure to sophisticated cyber risks. Modern defense operations rely on interconnected digital platforms that exchange sensitive operational data across geographically distributed environments, creating vulnerabilities to data manipulation, unauthorized access, and system compromise. Blockchain mitigates these risks through decentralized verification, cryptographic security mechanisms, and consensus based validation that significantly reduce single points of failure. Immutable data structures ensure that once operational records are created, they cannot be altered without detection, which is essential for mission assurance and forensic accountability. Defense agencies increasingly require trusted data provenance to support autonomous systems, advanced analytics, and artificial intelligence driven decision making. Blockchain strengthens identity and access management by enforcing controlled permissions across classified user groups, aligning with zero trust cybersecurity frameworks being adopted within defense architectures. The technology also supports secure collaboration between government entities and defense contractors by maintaining shared yet controlled ledgers. Rising awareness of cyber warfare and information integrity threats reinforces institutional demand for resilient digital foundations, positioning blockchain as a strategic cybersecurity enabler within Saudi aerospace and defense modernization efforts.

Market Challenges

Complex Integration with Legacy Defense and Aerospace Systems

Complex Integration with Legacy Defense and Aerospace Systems remains a major challenge for the KSA Blockchain Technology in Aerospace and Defense Market because a large portion of existing military and aerospace infrastructure was developed long before distributed ledger technologies were conceived. Defense organizations operate highly customized legacy platforms built on proprietary software, closed networks, and rigid architectures that are difficult to adapt to decentralized blockchain models. Integrating blockchain requires extensive system reengineering to ensure interoperability with command systems, logistics databases, maintenance records, and classified communication networks. These integration efforts significantly increase implementation timelines and project costs, particularly when operational continuity must be maintained without disruption to mission readiness. Defense systems also require multiple layers of validation, testing, and certification before any new technology can be deployed, further slowing integration processes. Limited availability of locally experienced blockchain architects with defense domain expertise compounds the challenge, as specialized skills are required to align distributed ledger functionality with military standards. Custom development and system tailoring reduce scalability and repeatability across platforms. Security accreditation and compliance reviews add additional complexity. Collectively, these factors constrain rapid deployment and limit the pace of blockchain adoption across Saudi aerospace and defense ecosystems.

Regulatory Compliance, Data Sovereignty, and Governance Constraints

Regulatory Compliance, Data Sovereignty, and Governance Constraints present a significant barrier to widespread blockchain adoption within the KSA Blockchain Technology in Aerospace and Defense Market due to the sensitive nature of defense data and strict national security oversight. Blockchain architectures must align with Saudi regulations governing classified information, sovereign data ownership, and restricted access protocols. Approval processes for new digital technologies in defense environments are highly rigorous and time intensive, often requiring multi agency validation before deployment authorization. Distributed ledger models must be carefully designed to ensure that data storage, validation nodes, and access rights remain fully compliant with national data localization policies. Any ambiguity regarding data residency or cross border information exchange can delay or halt implementation. Governance frameworks for blockchain in defense contexts are still evolving, creating uncertainty around accountability, audit authority, and long term operational control. Compliance costs increase as organizations must invest in legal reviews, cybersecurity certification, and regulatory alignment initiatives. These constraints limit experimentation and slow innovation cycles. As a result, regulatory and governance challenges continue to restrict near term scalability and delay large scale blockchain rollouts within Saudi aerospace and defense programs.

Opportunities

Blockchain Enabled Defense Supply Chain Transparency and Asset Traceability

Blockchain Enabled Defense Supply Chain Transparency and Asset Traceability represents a substantial opportunity for the KSA Blockchain Technology in Aerospace and Defense Market as defense procurement and logistics operations become increasingly complex and security sensitive. Saudi aerospace and defense supply chains involve multiple domestic and international suppliers, system integrators, and maintenance providers, creating challenges in tracking components, verifying authenticity, and maintaining accurate lifecycle records. Blockchain provides a unified and immutable ledger that enables real time tracking of parts, equipment, and subsystems from manufacturing through deployment and maintenance. This capability reduces the risk of counterfeit components entering defense platforms, which is a critical concern for mission safety and operational reliability. Enhanced traceability improves inventory management, maintenance planning, and lifecycle cost control across high value defense assets. Government emphasis on procurement transparency and accountability further supports blockchain adoption in logistics environments. Integration of blockchain with existing enterprise resource planning and logistics systems enhances operational efficiency without disrupting established workflows. Secure supplier validation and automated compliance checks strengthen trust between defense authorities and contractors. These benefits position blockchain as a foundational technology for modernizing defense supply chain governance and long term asset management.

Integration of Blockchain with Artificial Intelligence and Autonomous Defense Platforms

Integration of Blockchain with Artificial Intelligence and Autonomous Defense Platforms offers a high impact growth opportunity as Saudi defense strategies increasingly prioritize advanced technologies and autonomous capabilities. Autonomous aerial, land, and naval platforms rely on vast volumes of data for navigation, decision making, and mission execution, making data integrity and trust critical requirements. Blockchain ensures secure data provenance by verifying the origin, integrity, and usage history of data consumed by artificial intelligence algorithms. This capability enhances reliability and accountability in AI driven defense systems, reducing the risk of compromised or manipulated inputs. Blockchain also supports secure coordination among autonomous systems by enabling trusted data exchange across distributed platforms. Defense innovation initiatives and technology incubation programs encourage experimentation with converged digital architectures that combine blockchain, AI, and secure communications. Integration enhances resilience of autonomous operations in contested environments. As reliance on intelligent defense systems grows, blockchain becomes a key enabler for secure, scalable, and trustworthy autonomous defense ecosystems within Saudi aerospace and defense modernization programs.

Future Outlook

The KSA Blockchain Technology in Aerospace and Defense Market is expected to experience sustained growth over the next five years, supported by defense digitalization priorities and cybersecurity investments. Technological convergence with AI and secure communications will enhance adoption. Regulatory clarity and government support will further strengthen demand. Increased focus on supply chain transparency and resilient data architectures will continue to drive market expansion.

Major Players

- Saudi Information Technology Company

- STC Solutions

- SAMI Advanced Electronics

- IBM Saudi Arabia

- Thales Saudi Arabia

- Lockheed Martin Saudi Arabia

- Raytheon Saudi Arabia

- Oracle Saudi Arabia

- SAP Saudi Arabia

- Huawei Cloud Saudi Arabia

- Accenture Saudi Arabia

- BAE Systems Saudi Arabia

- Elm Company

- NEOM Digital

- Tata Consultancy Services Saudi Arabia

Key Target Audience

- Defense ministries

- Armed forces and military commands

- Aerospace manufacturers

- Defense system integrators

- Cybersecurity agencies

- Defense logistics operators

- Investments and venture capitalist firms

- Government and regulatory bodies

Research Methodology

Step 1: Identification of Key Variables

This step involved identifying core demand drivers, technology adoption indicators, and defense procurement variables. Industry frameworks were reviewed to define scope. Key performance metrics were shortlisted. Market boundaries were finalized.

Step 2: Market Analysis and Construction

Market structure was developed using secondary defense data sources. Technology adoption patterns were analyzed. Demand mapping was conducted across platforms. Assumptions were validated through triangulation.

Step 3: Hypothesis Validation and Expert Consultation

Industry experts from defense and cybersecurity domains were consulted. Hypotheses were tested against operational realities. Feedback refined assumptions. Validation ensured analytical accuracy.

Step 4: Research Synthesis and Final Output

All insights were consolidated into a structured framework. Data consistency checks were performed. Findings were synthesized into actionable analysis. Final outputs were reviewed for accuracy and relevance.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Rising demand for secure and tamper proof defense data systems

Increasing focus on supply chain transparency in defense procurement

National digital transformation initiatives supporting advanced technologies

Growing cyber threat landscape in aerospace and defense operations

Modernization of command control and communication infrastructures - Market Challenges

Complex integration with legacy defense systems

High initial deployment and compliance costs

Data sovereignty and regulatory uncertainties

Limited skilled workforce in blockchain defense applications

Interoperability challenges across multi vendor platforms - Market Opportunities

Expansion of blockchain enabled defense logistics networks

Adoption of smart contracts in long term defense procurement

Integration of blockchain with AI and IoT defense systems - Trends

Shift toward permissioned and private blockchain models

Increased collaboration between defense agencies and technology firms

Focus on zero trust security architectures

Growing use of blockchain for lifecycle asset management

Emphasis on interoperable digital defense ecosystems

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Permissioned blockchain networks for defense logistics

Distributed ledger systems for secure communications

Smart contract platforms for procurement automation

Identity and access management blockchain systems

Data integrity and traceability blockchain solutions - By Platform Type (In Value%)

Air force command and control platforms

Naval fleet management platforms

Land defense systems integration platforms

Unmanned systems and drone platforms

Joint defense and aerospace digital platforms - By Fitment Type (In Value%)

New system integration in defense programs

Retrofit integration in legacy platforms

Hybrid deployment across old and new systems

Cloud based blockchain fitment

On premises secure blockchain fitment - By End User Segment (In Value%)

Defense ministries and armed forces

Aerospace OEMs and system integrators

Defense logistics and supply chain operators

Cybersecurity and defense IT agencies

Maintenance repair and overhaul organizations - By Procurement Channel (In Value%)

Direct government contracts

Defense OEM partnerships

System integrator led procurement

Public private partnership programs

Strategic technology alliances - By Material / Technology (in Value %)

Distributed ledger technology

Smart contracts and automation protocols

Cryptographic security algorithms

Consensus mechanisms and validation tools

Interoperability and integration middleware

- Market share snapshot of major players

- Cross Comparison Parameters (technology maturity, defense compliance readiness, system interoperability, cybersecurity robustness, scalability, deployment flexibility, integration capability, local partnership strength, lifecycle support)

- SWOT Analysis of Key Players

- Pricing & Procurement Analysis

- Porter’s Five Forces

- Key Players

Saudi Information Technology Company

STC Solutions

SAMI Advanced Electronics

IBM Saudi Arabia

Oracle Saudi Arabia

Accenture Middle East Defense Practice

BAE Systems Saudi Development and Training

Thales Saudi Arabia

Lockheed Martin Saudi Arabia

Raytheon Saudi Arabia

NEOM Digital and Technology

Elm Company

SAP Saudi Arabia

Huawei Cloud Saudi Arabia

Tata Consultancy Services Saudi Arabia

- Defense agencies prioritizing secure data sharing across units

- Aerospace manufacturers adopting blockchain for parts traceability

- Logistics operators leveraging blockchain for inventory visibility

- IT and cybersecurity units focusing on resilient digital architectures

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035