Market Overview

The KSA Blood Glucose Test Strips market current size stands at around USD ~ million, supported by a patient base of nearly ~ million individuals requiring routine monitoring. Annual consumption is estimated at ~ million units, while active monitoring platforms exceed ~ million systems across home and care settings. Average revenue per test remains close to USD ~, reflecting stable purchasing behavior. Over the most recent assessment cycle, overall market value increased by an additional USD ~ million, highlighting steady utilization growth.

Market activity is highly concentrated in Riyadh, Jeddah, and Dammam, where advanced healthcare infrastructure, dense pharmacy networks, and higher awareness levels drive consistent demand. These cities benefit from mature chronic care ecosystems, strong private sector participation, and favorable reimbursement mechanisms. The presence of specialized diabetes centers and large hospital clusters further reinforces testing frequency. Policy emphasis on preventive care and early diagnosis has strengthened adoption across urban regions, creating a stable and well-integrated supply environment.

Market Segmentation

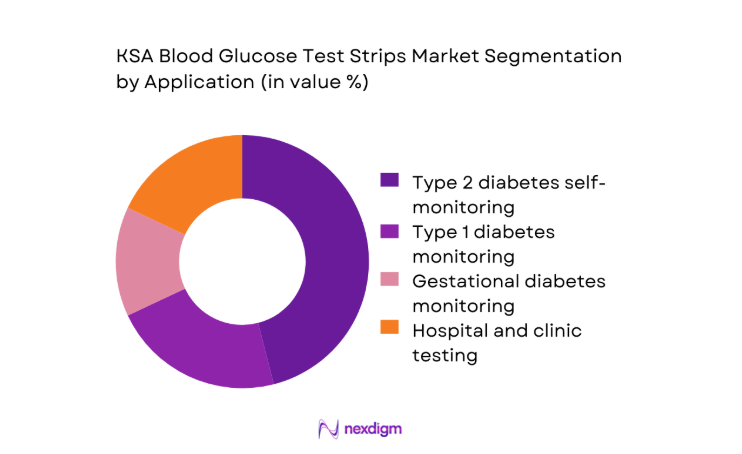

By Application

Self-monitoring for type two diabetes dominates application demand due to its widespread prevalence and long-term management requirements. This segment benefits from strong physician endorsement of routine testing and increasing patient awareness of glycaemic control outcomes. Home-based monitoring practices have expanded significantly, supported by pharmacy accessibility and insurance-backed reimbursement for consumables. Hospitals and clinics contribute steadily through point-of-care testing, yet the recurring nature of home usage ensures higher consumption continuity. Gestational and type one monitoring remain niche but important contributors, particularly within urban maternity care and pediatric endocrinology settings. Overall, application-led demand is shaped by lifestyle changes, chronic disease management policies, and the growing emphasis on preventive healthcare behaviors.

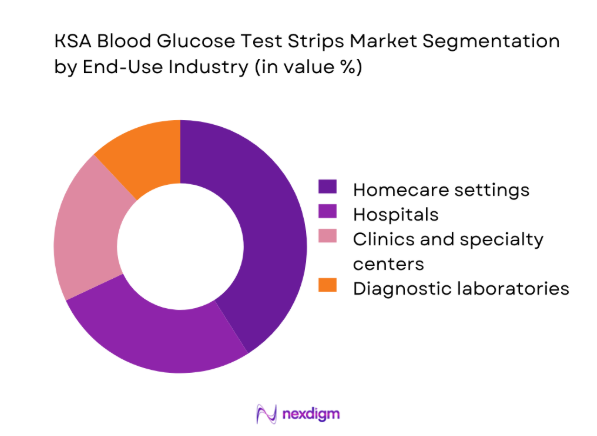

By End-Use Industry

Homecare settings represent the most influential end-use segment, driven by the rising preference for convenient, self-managed testing routines. Patients increasingly rely on personal monitoring systems, reducing dependency on frequent clinical visits while maintaining consistent health oversight. Hospitals remain key institutional buyers, particularly for inpatient glucose management and emergency care protocols. Clinics and specialty centers support ongoing follow-up and therapy adjustments, contributing to stable procurement volumes. Diagnostic laboratories account for a smaller share, primarily through screening and confirmation testing. The end-use landscape is shaped by accessibility, affordability of consumables, and the expanding role of community pharmacies as frontline healthcare touchpoints.

Competitive Landscape

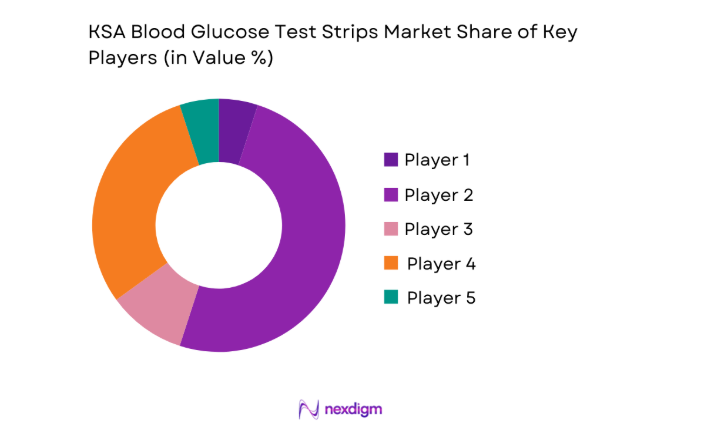

The market exhibits moderate concentration, with a small group of established international brands holding significant influence alongside a growing presence of regional distributors. Competitive dynamics are shaped by product reliability, regulatory compliance, and the ability to maintain consistent supply across public and private healthcare channels. Differentiation increasingly depends on service quality, training support, and channel partnerships rather than pure price competition.

| Company Name | Establishment Year | Headquarters | Formulation Depth | Distribution Reach | Regulatory Readiness | Service Capability | Channel Strength | Pricing Flexibility |

| Abbott Diabetes Care | 1981 | United States | ~ | ~ | ~ | ~ | ~ | ~ |

| Roche Diabetes Care | 1896 | Switzerland | ~ | ~ | ~ | ~ | ~ | ~ |

| Ascensia Diabetes Care | 2016 | Switzerland | ~ | ~ | ~ | ~ | ~ | ~ |

| LifeScan | 1986 | United States | ~ | ~ | ~ | ~ | ~ | ~ |

| i-SENS | 2000 | South Korea | ~ | ~ | ~ | ~ | ~ | ~ |

KSA Blood Glucose Test Strips Market Analysis

Growth Drivers

Rising diabetes prevalence and aging population

The addressable testing population has expanded to nearly ~ million individuals, with annual diagnosed cases increasing by ~ thousand across urban centers. Demand intensity is reflected in recurring consumption exceeding ~ million units per year, supported by more than ~ million active monitoring platforms. Public healthcare programs allocate over USD ~ million annually to chronic disease supplies, reinforcing access continuity. The aging demographic adds ~ thousand new long-term monitoring users each cycle, directly lifting strip utilization volumes. These numeric shifts underline the structural expansion of the testing base and sustain long-term demand visibility.

Expansion of home-based self-monitoring practices

Home monitoring adoption has resulted in the deployment of over ~ million personal glucose systems nationwide, driving strip usage above ~ million units annually in non-clinical settings. Pharmacy-led distribution channels account for sales exceeding USD ~ million, reflecting strong retail pull. The number of households practicing routine testing has crossed ~ million, reducing dependence on institutional care. This transition has increased average consumption frequency by ~ tests per patient each month, translating into incremental revenue of nearly USD ~ million across the retail segment.

Challenges

Price sensitivity and reimbursement constraints in public tenders

Public procurement budgets for glucose monitoring supplies are capped at approximately USD ~ million annually, while tender volumes exceed ~ million units, creating margin compression. Reimbursement ceilings limit per-unit realization to around USD ~, affecting supplier participation depth. Delays in tender cycles can postpone orders worth over USD ~ million, disrupting supply continuity. Hospitals report backlog requirements of ~ million units during peak periods, highlighting mismatch between demand intensity and funding allocations. These numeric pressures restrict pricing flexibility and constrain market value expansion in institutional channels.

Competition from continuous glucose monitoring systems

Adoption of alternative monitoring technologies has reached ~ thousand users, diverting strip demand by nearly ~ million units annually. Spending on sensor-based systems now exceeds USD ~ million, reducing budget share for traditional consumables. Clinical programs allocate ~ thousand new device placements each cycle, gradually shifting patient cohorts away from strip-based testing. This substitution effect translates into foregone revenue of approximately USD ~ million, creating measurable headwinds for volume growth in conventional test strip categories.

Opportunities

Penetration into underserved rural and peripheral regions

Rural healthcare centers currently serve over ~ million residents with limited access to regular monitoring supplies. Expanding distribution could unlock incremental demand of ~ million units annually, translating into potential revenue of USD ~ million. Mobile clinics and community pharmacies are projected to deploy ~ thousand additional testing points, increasing regional coverage density. Household adoption rates in peripheral zones remain below ~ million users, indicating a sizeable untapped base that can materially lift national consumption volumes with targeted outreach initiatives.

Partnerships with digital health and telemedicine platforms

Integration with remote care services can connect more than ~ million chronic patients to structured monitoring programs, boosting strip usage by ~ million units per year. Teleconsultation platforms currently manage over ~ million consultations annually, creating direct channels for prescription-linked sales valued at USD ~ million. Collaborative programs enabling automated refill systems can raise adherence frequency by ~ tests per patient each month, generating incremental market value of nearly USD ~ million through improved continuity of care.

Future Outlook

The KSA Blood Glucose Test Strips market is positioned for steady evolution as healthcare delivery increasingly shifts toward preventive and home-based models. Policy alignment with chronic disease management, combined with digital health integration, will reshape demand patterns over the coming years. Urban centers will continue to anchor volume, while regional expansion will unlock new consumption pockets. The balance between traditional monitoring and emerging technologies will define competitive strategies through 2030.

Major Players

- Abbott Diabetes Care

- Roche Diabetes Care

- Ascensia Diabetes Care

- LifeScan

- i-SENS

- Arkray

- ACON Laboratories

- TaiDoc Technology

- Trividia Health

- Bionime Corporation

- Sinocare

- Yuwell Medical

- ForaCare

- Beurer

- AccuBioTech

Key Target Audience

- Public hospital procurement departments

- Private hospital and clinic administrators

- Retail pharmacy chains and distributors

- Homecare service providers

- Digital health and telemedicine platforms

- Health insurance providers

- Investments and venture capital firms

- Saudi Food and Drug Authority and Ministry of Health

Research Methodology

Step 1: Identification of Key Variables

Key demand indicators, supply-side capacities, and regulatory frameworks were mapped across public and private healthcare channels. Patient base dynamics, testing frequency, and distribution intensity were defined as core variables. Technology adoption and care pathway structures were also incorporated to frame market boundaries.

Step 2: Market Analysis and Construction

Quantitative models were developed to align consumption patterns with healthcare utilization metrics. Channel-wise demand allocation and end-use prioritization were structured to reflect real-world purchasing flows. Scenario layers were built to test sensitivity across policy and access conditions.

Step 3: Hypothesis Validation and Expert Consultation

Initial assumptions were cross-checked through structured discussions with healthcare administrators and procurement leaders. Clinical workflow alignment and reimbursement logic were validated to ensure practical relevance. Feedback loops refined adoption and substitution dynamics.

Step 4: Research Synthesis and Final Output

All analytical streams were consolidated into a unified market framework. Insights were stress-tested for internal consistency and strategic clarity. Final outputs were structured to support investment, policy, and operational decision-making.

- Executive Summary

- Research Methodology (Market definitions and scope boundaries, blood glucose test strip taxonomy across SMBG and hospital grade formats, market sizing logic by strip consumption and active user base, revenue attribution across strips devices bundling and distribution margins, primary interview program with pharmacies hospitals and distributors, data triangulation validation assumptions and limitations)

- Definition and Scope

- Market evolution

- Care and testing pathways

- Ecosystem structure

- Supply chain and channel structure

- Regulatory environment

- Growth Drivers

Rising diabetes prevalence and aging population

Expansion of home-based self-monitoring practices

Government focus on chronic disease management under Vision 2030

Improving reimbursement and insurance coverage for SMBG supplies

Growth of private healthcare and retail pharmacy networks

Increasing awareness of glycemic control and preventive care - Challenges

Price sensitivity and reimbursement constraints in public tenders

Competition from continuous glucose monitoring systems

Regulatory compliance costs and approval timelines

Supply chain dependence on imports and currency fluctuations

Limited patient adherence to regular testing routines

Pressure on margins due to private label and low-cost brands - Opportunities

Penetration into underserved rural and peripheral regions

Partnerships with digital health and telemedicine platforms

Localization of packaging and distribution to reduce costs

Expansion of gestational diabetes screening programs

Premiumization through accuracy-focused and pain-free testing solutions

Private sector growth in homecare and chronic care management - Trends

Shift toward no-code and easy-to-use strip technologies

Integration of SMBG data with mobile health applications

Growing preference for bulk purchasing through pharmacies and e-commerce

Rising role of private labels in hospital and pharmacy channels

Increased focus on accuracy standards and quality certifications

Bundling of strips with meters and patient support programs - Government Regulations

- SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Value, 2019–2024

- By Test Volume, 2019–2024

- By Installed Base or Active Systems or Platforms, 2019–2024

- By Average Selling Price or Revenue per Test or Unit Economics, 2019–2024

- By Fleet Type (in Value %)

Public healthcare facilities

Private hospitals and clinics

Homecare users

Retail pharmacies and diagnostics chains - By Application (in Value %)

Type 1 diabetes self-monitoring

Type 2 diabetes insulin-treated patients

Gestational diabetes monitoring

Hospital and clinic point-of-care testing - By Technology Architecture (in Value %)

Glucose oxidase enzyme strips

Glucose dehydrogenase enzyme strips

Electrochemical measurement strips

Photometric measurement strips - By End-Use Industry (in Value %)

Hospitals

Clinics and specialty centers

Homecare settings

Diagnostic laboratories - By Connectivity Type (in Value %)

Standalone glucose meters

Bluetooth-connected meters

NFC-enabled systems

App-integrated digital platforms - By Region (in Value %)

Central Region

Western Region

Eastern Region

Southern Region

Northern Region

- Market structure and competitive positioning

Market share snapshot of major players - Cross Comparison Parameters (product portfolio breadth, enzyme technology used, accuracy and MARD performance, SFDA regulatory approvals, average price per strip, distribution footprint in KSA, private label presence, after-sales and training support)

- SWOT Analysis of Key Players

- Pricing and Commercial Model Benchmarking

- Detailed Profiles of Major Companies

Abbott Diabetes Care

Roche Diabetes Care

Ascensia Diabetes Care

LifeScan

i-SENS

Arkray

ACON Laboratories

TaiDoc Technology

Trividia Health

Bionime Corporation

Sinocare

Yuwell Medical

ForaCare

Beurer

AccuBioTech

- Demand and utilization drivers

- Procurement and tender dynamics

- Buying criteria and vendor selection

- Budget allocation and financing preferences

- Implementation barriers and risk factors

- Post-purchase service expectations

- By Value, 2025–2030

- By Test Volume, 2025–2030

- By Installed Base or Active Systems or Platforms, 2025–2030

- By Average Selling Price or Revenue per Test or Unit Economics, 2025–2030