Market Overview

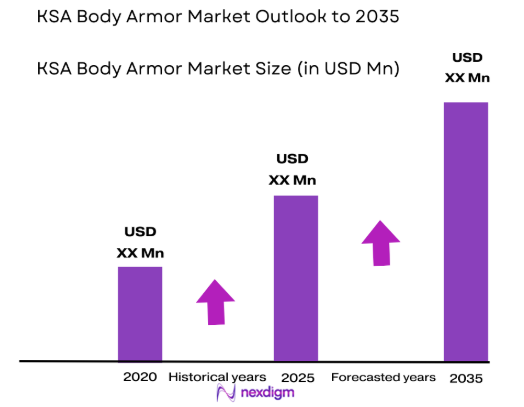

Based on a recent historical assessment, the KSA body armor market was valued at USD ~ million, supported by sustained defense expenditure, internal security modernization programs, and increasing operational requirements for personal protection equipment. Procurement by military forces, national guard units, and internal security agencies has been driven by heightened emphasis on personnel survivability, counterterrorism preparedness, and border security operations. The market has also benefited from structured procurement frameworks, long-term supplier contracts, and growing localization initiatives that encourage domestic assembly and material integration within national defense supply chains.

Based on a recent historical assessment, Saudi Arabia dominates the KSA body armor market due to centralized defense procurement, strong budgetary allocations, and the presence of major military and internal security headquarters in Riyadh. Riyadh functions as the primary procurement and decision-making hub, supported by logistics and distribution centers in Jeddah and Dammam that facilitate supply to western and eastern operational zones. The country’s dominance is reinforced by large standing armed forces, active internal security deployments, and continuous modernization programs aligned with national defense and industrial development strategies.

Market Segmentation

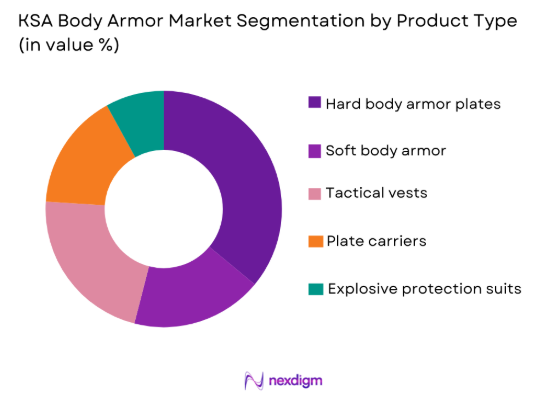

By Product Type

KSA Body Armor market is segmented by product type into soft body armor, hard body armor, tactical vests, plate carriers, and specialized explosive protection suits. Recently, hard body armor has a dominant market share due to its superior ballistic resistance, suitability for high-threat combat environments, and widespread adoption by military and special operations forces. Increased deployment in border security and counterinsurgency missions has accelerated demand for ceramic and composite hard armor plates capable of defeating rifle-level threats. Additionally, compatibility with modular carrier systems, extended service life, and alignment with standardized protection requirements have further strengthened adoption across defense and internal security procurement programs.

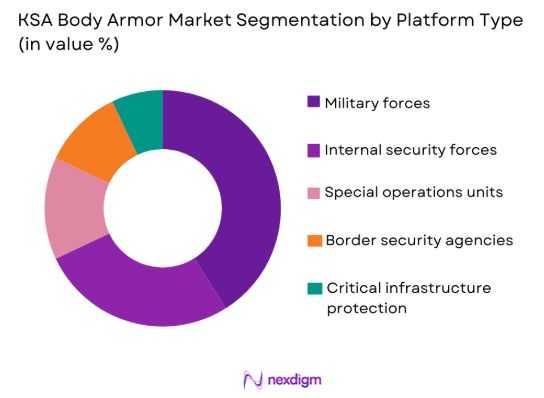

By Platform Type

KSA Body Armor market is segmented by platform type into military forces, internal security forces, special operations units, border security agencies, and critical infrastructure protection units. Recently, military forces have a dominant market share due to continuous force modernization, higher operational exposure, and prioritized budget allocation for soldier survivability systems. The military’s requirement for high-performance ballistic protection across training, deployment, and combat scenarios has resulted in consistent procurement cycles. Integration of body armor within broader soldier modernization programs and compatibility with advanced combat gear further reinforce the dominance of military platforms in overall demand.

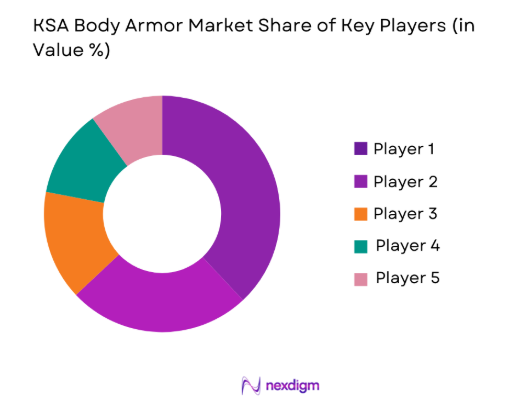

Competitive Landscape

The KSA body armor market is moderately consolidated, characterized by a mix of domestic defense manufacturers, regional integrators, and established international suppliers. Major players influence procurement outcomes through long-term government relationships, compliance with national standards, and technology transfer commitments. Competitive positioning is shaped by product performance, localization capabilities, certification compliance, and the ability to support large-scale, multi-year defense programs aligned with national industrial objectives.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue | Localization Capability |

| Saudi Military Industries | 2017 | Riyadh, Saudi Arabia | ~ | ~ | ~ | ~ | ~ |

| Advanced Electronics Company | 1988 | Riyadh, Saudi Arabia | ~

|

~

|

~

|

~

|

~

|

| MKU Limited | 1985 | New Delhi, India | ~

|

~

|

~

|

~

|

~

|

| Point Blank Enterprises | 1973 | Florida, USA | ~

|

~

|

~

|

~

|

~

|

| NP Aerospace | 1926 | Coventry, UK | ~

|

~

|

~

|

~

|

~

|

KSA Body Armor Market Analysis

Growth Drivers

Defense modernization and soldier survivability enhancement

Defense modernization and soldier survivability enhancement drives the KSA body armor market through sustained investment in personal protection systems that align with evolving threat environments and operational doctrines across land forces, internal security, and special units. Saudi Arabia’s emphasis on reducing personnel casualties has increased the prioritization of advanced ballistic protection capable of countering rifle, fragmentation, and explosive threats encountered in asymmetric warfare conditions. Body armor procurement is increasingly integrated into comprehensive soldier systems that include communication, mobility, and situational awareness components, reinforcing demand consistency. Standardization of protection levels across units has encouraged bulk procurement and long-term supplier relationships. Localization policies further amplify this driver by encouraging domestic assembly and component manufacturing, reducing reliance on imports. Increased training intensity and deployment readiness requirements also elevate replacement and upgrade cycles. Continuous evaluation of global conflict trends informs procurement specifications, sustaining demand. The convergence of modernization objectives and survivability imperatives ensures body armor remains a non-discretionary procurement category within defense budgets.

Internal security expansion and border protection requirements

Internal security expansion and border protection requirements significantly contribute to market growth as law enforcement and border forces face increasing operational complexity and exposure to armed threats. Saudi Arabia’s extensive land borders and critical infrastructure necessitate well-equipped personnel capable of operating in diverse risk environments. Body armor adoption has expanded beyond frontline military units into police, border guards, and specialized rapid response teams. Enhanced patrol frequency and deployment duration increase wear and replacement needs. Procurement frameworks emphasize durability and multi-threat protection, supporting demand for higher-grade armor systems. Coordination between defense and interior ministries enables synchronized procurement cycles. National security strategies prioritize readiness against infiltration, smuggling, and terrorism, reinforcing sustained investment. As internal security roles diversify, the functional scope of body armor broadens, further accelerating demand across agencies.

Market Challenges

High cost of advanced ballistic materials and systems

High cost of advanced ballistic materials and systems presents a significant challenge for the KSA body armor market by increasing procurement expenditure and lifecycle costs for government buyers. Ceramic composites, advanced polyethylene fibers, and hybrid materials required for high-level protection involve complex manufacturing processes and imported raw materials. Budget optimization pressures may limit procurement volumes or delay replacement cycles. Cost sensitivity is heightened when armor must meet stringent performance standards while remaining lightweight and ergonomic. Maintenance, inspection, and replacement of damaged plates further add to total ownership costs. Localization initiatives mitigate but do not eliminate dependence on imported technologies. Price volatility in raw materials complicates long-term contract planning. Balancing performance requirements with fiscal efficiency remains a persistent procurement challenge.

Certification complexity and regulatory compliance burden

Certification complexity and regulatory compliance burden constrain market efficiency by extending procurement timelines and increasing entry barriers for new suppliers. Body armor must meet national and international ballistic standards, requiring extensive testing and validation. Compliance processes involve coordination among defense authorities, testing laboratories, and manufacturers. Delays in certification can postpone deployment schedules. Frequent updates to protection standards necessitate redesign and requalification. Smaller suppliers face resource constraints in meeting compliance requirements. Regulatory oversight ensures quality but reduces flexibility. Navigating certification frameworks remains a structural challenge for market participants.

Opportunities

Expansion of domestic manufacturing and localization initiatives

Expansion of domestic manufacturing and localization initiatives represents a major opportunity for the KSA body armor market as national defense policy increasingly prioritizes self-reliance, supply chain security, and industrial capability development. Government-backed localization programs encourage foreign manufacturers to establish local production lines, joint ventures, and technology transfer arrangements within Saudi Arabia. This creates opportunities for reduced lead times, improved responsiveness to operational requirements, and lower long-term procurement costs. Local manufacturing also supports compliance with national content requirements, improving supplier eligibility for large defense contracts. Workforce development initiatives linked to localization strengthen technical expertise in advanced materials, ballistic testing, and system integration. Domestic facilities enable customization of body armor systems to suit local climatic conditions and mission profiles. Localization further enhances lifecycle support, maintenance, and repair capabilities within the country. As procurement authorities increasingly favor suppliers with strong local footprints, companies investing in domestic manufacturing gain a structural competitive advantage. This opportunity aligns closely with broader industrial diversification objectives and provides a stable platform for sustained market growth.

Adoption of advanced lightweight and multi-threat protection technologies

Adoption of advanced lightweight and multi-threat protection technologies presents a significant opportunity as operational requirements increasingly emphasize mobility, endurance, and user comfort alongside high protection levels. Advances in material science, including improved ceramic composites, next-generation polyethylene fibers, and hybrid armor architectures, enable substantial weight reduction without compromising ballistic performance. Demand is growing for armor solutions capable of protecting against rifle threats, fragmentation, and blast effects within a single integrated system. Lightweight designs improve soldier agility, reduce fatigue, and enhance mission effectiveness, driving user preference and procurement interest. Opportunities also exist for integrating body armor with wearable electronics, sensors, and soldier systems to improve situational awareness and health monitoring. Modular designs that allow scalable protection based on mission risk further expand applicability across military and internal security roles. Suppliers that invest in research, testing, and ergonomic design can command premium positioning. This opportunity supports long-term differentiation and aligns with evolving modernization priorities across Saudi defense and security forces.

Future Outlook

The KSA body armor market is expected to maintain steady growth over the next five years, supported by continued defense modernization and internal security investments. Technological development will focus on lightweight composites, modular designs, and enhanced ergonomics. Regulatory support for localization will strengthen domestic production capabilities. Demand will remain driven by military readiness, border security, and infrastructure protection priorities.

Major Players

- Saudi Military Industries

- Advanced Electronics Company

- SAMI Defense Systems

- MKU Limited

- NP Aerospace

- Point Blank Enterprises

- DuPont Protection Solutions

- ArmorSource

- Avon Protection

- Revision Military

- Survitec Group

- International Golden Group

- Cooneen Protection

- Safariland Group

- Morgan Advanced Materials

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Defense ministries and procurement agencies

- Military modernization program offices

- Internal security and police departments

- Border and coast guard authorities

- Defense manufacturing companies

- Strategic defense suppliers

Research Methodology

Step 1: Identification of Key Variables

Key market variables were identified through review of defense procurement policies, security expenditure patterns, and protection equipment demand indicators. Primary variables included procurement volume, protection standards, and end-user requirements. Secondary variables captured technology adoption and localization impact. These variables established the analytical framework.

Step 2: Market Analysis and Construction

Market structure was constructed using supply-side assessment and demand-side validation. Procurement data and industry disclosures informed market sizing. Competitive positioning was analyzed through capability mapping. This step ensured internal consistency.

Step 3: Hypothesis Validation and Expert Consultation

Initial findings were validated through consultation with defense industry experts and procurement specialists. Assumptions were stress-tested against operational realities. Feedback refined segmentation and competitive insights. This enhanced accuracy.

Step 4: Research Synthesis and Final Output

Validated insights were synthesized into a structured market model. Findings were cross-verified for coherence and relevance. Final outputs were aligned with client information needs. The report ensures decision-grade clarity.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Rising defense expenditure focused on soldier survivability

Modernization of internal security and law enforcement equipment

Increased operational deployment in asymmetric threat environments

Localization of defense manufacturing under national industrial programs

Higher adoption of modular and scalable protection systems - Market Challenges

High lifecycle cost of advanced ballistic materials

Complex certification and testing requirements

Dependence on imported raw ballistic materials

Balancing mobility with enhanced protection levels

Procurement delays linked to regulatory approvals - Market Opportunities

Expansion of local manufacturing and technology transfer initiatives

Growing demand for lightweight and multi threat armor solutions

Integration of smart textiles and sensor enabled armor systems - Trends

Shift toward modular and mission configurable armor systems

Increased use of lightweight composite and hybrid materials

Emphasis on ergonomic and thermal comfort design

Adoption of standardized ballistic protection levels

Integration of body armor with soldier modernization programs - Government Regulations & Defense Policy

Implementation of national military standards for ballistic protection

Defense localization mandates supporting domestic suppliers

Strategic procurement aligned with long term defense readiness goals

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Soft body armor systems

Hard ballistic plate systems

Modular tactical armor systems

Covert and concealable armor

Explosive ordnance protective suits - By Platform Type (In Value%)

Dismounted infantry personnel

Armored vehicle crew integration

Law enforcement patrol units

Special forces and tactical teams

Critical infrastructure security units - By Fitment Type (In Value%)

Standalone armor configurations

Plate carrier based systems

Integrated uniform mounted armor

Vehicle crew specific fitment

Mission adaptable modular fitment - By End User Segment (In Value%)

Military ground forces

Internal security and police forces

Border and coast guard units

Special operations forces

Critical infrastructure protection agencies - By Procurement Channel (In Value%)

Direct government procurement

Defense ministry framework contracts

Local defense integrator sourcing

Foreign military sales programs

Emergency and rapid acquisition channels - By Material / Technology (in Value %)

Aramid fiber based armor

Ultra high molecular weight polyethylene armor

Ceramic composite armor

Hybrid metal composite armor

Advanced nano engineered ballistic materials

- Market share snapshot of major players

- Cross Comparison Parameters (Protection level compliance, Material technology mix, Weight to protection ratio, Modular adaptability, Local manufacturing presence, Certification standards adherence, Cost efficiency, Supply chain reliability, After sales support capability)

- SWOT Analysis of Key Players

- Pricing & Procurement Analysis

- Porter’s Five Forces

- Key Players

Saudi Military Industries

Advanced Electronics Company

SAMI Defense Systems

MESCO Defense

Arabian International Company for Steel Structures

Tactical Defense Solutions Saudi

International Golden Group

Point Blank Enterprises

DuPont Protection Solutions

ArmorSource

Avon Protection

MKU Limited

NP Aerospace

Survitec Group

Revision Military

- Military units prioritize high threat level ballistic resistance with mobility

- Law enforcement agencies focus on concealable and lightweight protection

- Special forces demand mission specific modular armor configurations

- Infrastructure security units emphasize durability and extended wear comfort

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035