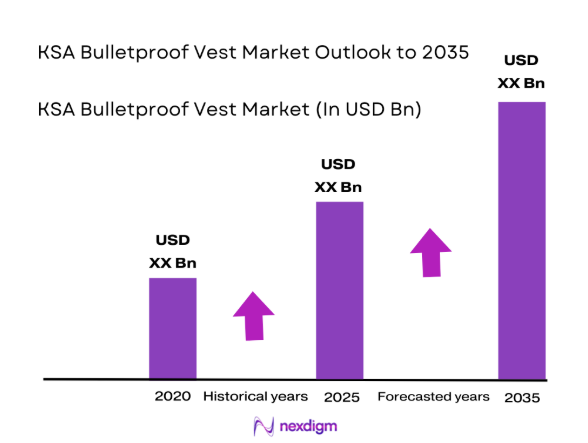

Market Overview

The KSA Bulletproof Vest market current size stands at around USD ~ million, supported by procurement volumes exceeding ~ units and active deployments near ~ units. Demand intensity reflects equipment refresh cycles of 3 and 5 years, with protection levels ranging across 2, 3, and 4 standards. Operational requirements emphasize weight reductions of 15 and 20 percent, while mission readiness metrics highlight utilization rates above 80 percent across frontline units.

Demand concentration is strongest in Riyadh, Eastern Province, and Western urban corridors, driven by dense security infrastructure and strategic asset protection needs. These regions benefit from mature defense ecosystems, centralized procurement authorities, and advanced testing facilities. Policy emphasis on localization, coupled with integrated military bases and industrial zones, reinforces supplier presence. Border-adjacent regions show rising adoption due to patrol intensity, while specialized units cluster near critical energy and transport infrastructure hubs.

Market Segmentation

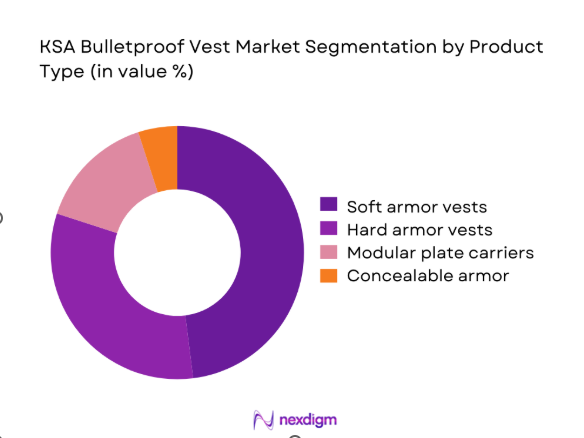

By Product Type

Soft armor vests dominate adoption due to flexibility, thermal comfort, and suitability for routine patrol and urban security operations. Usage intensity remains high among law enforcement and internal security units requiring extended wear durations. Hard armor and modular plate carrier systems follow, driven by tactical missions and elevated threat environments. Replacement cycles differ significantly, with soft armor averaging shorter service life. Procurement decisions prioritize adaptability, compatibility with existing gear, and compliance with national ballistic standards, reinforcing product differentiation across operational roles.

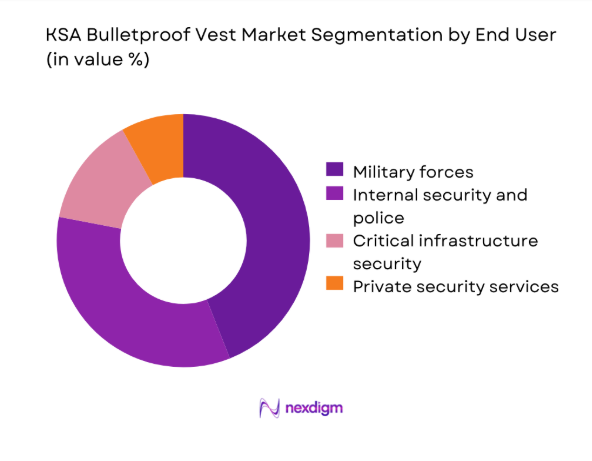

By End User

Defense forces represent the largest end-user segment, reflecting sustained modernization initiatives and structured replacement programs. Internal security agencies maintain consistent demand linked to urban policing and counterterror operations. Critical infrastructure operators increasingly procure armor for facility protection teams, influenced by risk mitigation frameworks. Private security adoption remains selective, focused on high-value assets. End-user preferences emphasize reliability, lifecycle support, and interoperability with communication and load-bearing systems, shaping procurement specifications and supplier qualification processes.

Competitive Landscape

The competitive environment features a mix of global armor specialists and regionally anchored manufacturers aligned with localization objectives. Differentiation centers on material technology, certification readiness, and ability to meet government procurement protocols.

| Company Name | Establishment Year | Headquarters | Formulation Depth | Distribution Reach | Regulatory Readiness | Service Capability | Channel Strength | Pricing Flexibility |

| BAE Systems | 1999 | United Kingdom | ~ | ~ | ~ | ~ | ~ | ~ |

| DuPont | 1802 | United States | ~ | ~ | ~ | ~ | ~ | ~ |

| Honeywell International | 1906 | United States | ~ | ~ | ~ | ~ | ~ | ~ |

| Point Blank Enterprises | 1973 | United States | ~ | ~ | ~ | ~ | ~ | ~ |

| MKU Limited | 1985 | India | ~ | ~ | ~ | ~ | ~ | ~ |

KSA Bulletproof Vest Market Analysis

Growth Drivers

Rising defense and internal security spending in Saudi Arabia

Increased allocation cycles during 2024 and 2025 strengthened procurement continuity across defense and internal security institutions nationwide. Budget prioritization favored personal protection upgrades, reflecting heightened readiness benchmarks and evolving threat assessments across multiple operational theaters. Procurement frameworks emphasized lifecycle sustainment, driving repeat orders and structured replacement planning across military and policing units. Centralized purchasing improved volume consolidation, enabling standardized specifications and broader deployment consistency. Security modernization agendas reinforced integration of advanced protection solutions within broader equipment programs. Demand resilience persisted despite fiscal optimization, indicating strategic importance of force protection investments. Multi-year programs created predictable acquisition pipelines, stabilizing supplier engagement and production planning. Inter-agency coordination improved alignment between defense and homeland security equipment standards. Increased training intensity elevated wear rates, accelerating replacement demand across frontline personnel. Strategic spending alignment supported continuous capability enhancement without disruptive procurement gaps.

Modernization of soldier and law enforcement personal protection equipment

Equipment modernization initiatives accelerated adoption of next-generation armor designs during 2024 and 2025 across operational units. Programs emphasized ergonomic improvements, reducing fatigue and improving mobility during extended missions. Compatibility with communication and load-bearing systems became a central requirement within modernization roadmaps. Standardization efforts reduced fragmentation across legacy equipment inventories. Field feedback loops informed iterative upgrades, improving acceptance among end users. Modernization aligned with broader digitization and soldier system integration strategies. Procurement specifications increasingly referenced modularity and scalability attributes. Training curricula adapted to incorporate new protective equipment handling and maintenance. Modernization cycles supported incremental upgrades rather than disruptive overhauls. These initiatives collectively reinforced sustained demand momentum across procurement authorities.

Challenges

High cost of advanced ballistic materials and imported components

Advanced ballistic fibers and ceramic components continued to rely on international supply chains during 2024 and 2025. Import dependence exposed procurement budgets to currency and logistics variability. Limited local raw material availability constrained rapid cost optimization. Specialized manufacturing requirements restricted supplier diversification options. Long qualification timelines increased holding costs for approved materials. Inventory buffering became necessary to mitigate supply disruptions. Cost pressures influenced specification trade-offs between weight reduction and affordability. Smaller procurement batches reduced economies of scale benefits. Localization efforts progressed gradually, limiting immediate cost relief. These factors collectively pressured procurement efficiency and planning flexibility.

Stringent certification and testing requirements

Ballistic certification protocols imposed rigorous testing timelines across 2024 and 2025 procurement cycles. Compliance with national and international standards extended product qualification durations. Testing capacity constraints created scheduling bottlenecks for new designs. Documentation and audit requirements increased administrative workload for suppliers. Minor design modifications often triggered full revalidation processes. Certification costs added to overall program complexity. Delays impacted deployment schedules for newly configured units. Coordination between testing bodies and procurement agencies required continuous alignment. Smaller suppliers faced higher barriers to entry due to compliance intensity. These requirements reinforced quality assurance but constrained market agility.

Opportunities

Expansion of local manufacturing under Vision 2030 localization mandates

Localization mandates during 2024 and 2025 encouraged establishment of domestic assembly and manufacturing capabilities. Policy incentives supported technology transfer and joint ventures with global armor specialists. Local production reduced lead times and improved supply reliability. Workforce development programs strengthened technical manufacturing skills. Domestic facilities enabled faster customization for operational requirements. Localization improved alignment with government procurement preferences. Incremental indigenization reduced long-term import dependency risks. Proximity to end users enhanced after-sales support responsiveness. Local manufacturing supported strategic autonomy objectives. These dynamics positioned localization as a structural growth lever.

Adoption of lightweight composite and hybrid armor technologies

Technological advancements accelerated adoption of lightweight composite solutions during 2024 and 2025. Hybrid material architectures balanced protection levels with mobility requirements. Reduced weight improved endurance in high-temperature operating environments. Advances in material science enhanced multi-threat protection capabilities. Composite innovations supported modular armor configurations. End users reported improved comfort and operational efficiency. Technology adoption aligned with modernization objectives. Development cycles shortened through collaborative testing frameworks. Lightweight solutions expanded applicability across diverse mission profiles. These innovations created differentiation opportunities for technologically advanced suppliers.

Future Outlook

The KSA Bulletproof Vest market is expected to evolve steadily through 2035, supported by sustained security modernization priorities. Localization initiatives will deepen, enhancing domestic capabilities and supply resilience. Technological innovation will emphasize lighter, modular, and integrated protection systems. Procurement frameworks are likely to favor long-term partnerships and lifecycle support models.

Major Players

- BAE Systems

- DuPont

- Honeywell International

- 3M

- Point Blank Enterprises

- Safariland Group

- ArmorSource

- Survitec Group

- Avon Protection

- Rheinmetall Defence

- MKU Limited

- NP Aerospace

- CoorsTek Defense

- Teijin Aramid

- Saudi Arabian Military Industries

Key Target Audience

- Ministry of Defense Saudi Arabia

- Ministry of Interior Saudi Arabia

- Saudi Arabian Military Industries procurement units

- National Guard procurement departments

- Critical infrastructure security operators

- Private security service providers

- Defense equipment distributors and integrators

- Investments and venture capital firms focused on defense manufacturing

Research Methodology

Step 1: Identification of Key Variables

The study defined protection levels, end-user categories, and deployment contexts relevant to Saudi security forces. Emphasis was placed on operational usage patterns and replacement cycles. Regulatory and certification frameworks were incorporated to bound scope assumptions.

Step 2: Market Analysis and Construction

Segmentation structures were developed based on product type and end-user demand logic. Qualitative indicators from procurement cycles and modernization programs informed market structure development. Data normalization ensured consistency across segments.

Step 3: Hypothesis Validation and Expert Consultation

Insights were validated through structured discussions with procurement specialists and armor system integrators. Feedback focused on technology adoption, localization progress, and operational requirements. Assumptions were refined to reflect on-ground realities.

Step 4: Research Synthesis and Final Output

Findings were synthesized into a cohesive analytical narrative. Cross-verification ensured alignment between qualitative drivers and structural trends. The final output emphasizes decision-relevant insights and strategic clarity.

- Executive Summary

- Research Methodology (Market Definitions and scope aligned to NIJ ballistic protection standards and KSA defense procurement categories, Product taxonomy mapping across soft armor and hard armor vest configurations used by KSA forces, Bottom-up market sizing using unit procurement volumes from defense and internal security tenders, Revenue attribution by armor class pricing and contract-level ASP normalization, Primary interviews with KSA MoD, MISA-registered suppliers and certified armor integrators, Data triangulation across tender disclosures, customs imports and local manufacturing capacity, Assumptions covering threat level mix, replacement cycles and localization mandates)

- Definition and scope of ballistic protection vests in the KSA security and defense context

- Market evolution driven by internal security modernization and regional threat dynamics

- Usage patterns across military, law enforcement and critical infrastructure protection

- Industry ecosystem including raw material suppliers, armor panel manufacturers and vest integrators

- Supply chain structure with increasing local assembly and Vision 2030 localization focus

Regulatory and certification environment including NIJ standards and Saudi defense procurement rules

- Growth Drivers

Rising defense and internal security spending in Saudi Arabia

Modernization of soldier and law enforcement personal protection equipment

Regional geopolitical tensions and asymmetric threat environment

Vision 2030-driven localization of defense manufacturing

Increased focus on force survivability and mobility

Procurement programs for border and critical infrastructure security - Challenges

High cost of advanced ballistic materials and imported components

Stringent certification and testing requirements

Dependence on foreign technology for high-level armor

Lengthy government procurement and tender cycles

Weight and comfort trade-offs impacting user acceptance

Limited local raw material supply for ballistic fibers - Opportunities

Expansion of local manufacturing under Vision 2030 localization mandates

Adoption of lightweight composite and hybrid armor technologies

Growing demand from private security and infrastructure operators

Customization of armor solutions for desert and high-temperature environments

Strategic partnerships between global armor OEMs and Saudi firms

Lifecycle replacement demand from existing installed base - Trends

Shift toward modular and scalable vest systems

Increasing use of lightweight UHMWPE and advanced ceramic plates

Integration of armor with wearable soldier systems

Rising emphasis on ergonomics and heat management

Local assembly and partial indigenization of armor components

Preference for multi-threat protection capabilities - Government Regulations

SWOT Analysis

Stakeholder and Ecosystem Analysis

Porter’s Five Forces Analysis

Competition Intensity and Ecosystem Mapping

- By Value, 2020–2025

- By Volume, 2020–2025

- By Installed Base, 2020–2025

- By Average Selling Price, 2020–2025

- By Fleet Type (in Value %)

Military combat units

Internal security forces

Border and coastal security units

Critical infrastructure protection units

Private security fleets - By Application (in Value %)

Ballistic threat protection

Riot and civil disturbance control

Counter-terrorism operations

VIP and executive protection

Training and reserve stockpiles - By Technology Architecture (in Value %)

Soft armor vests

Hard armor plate carrier vests

Modular and scalable armor systems

Concealable armor solutions - By End-Use Industry (in Value %)

Defense

Homeland security and police

Oil and gas infrastructure security

Government facilities and public safety

Private security services - By Connectivity Type (in Value %)

Non-connected standalone armor

Integrated wearable systems with sensors

Body-worn system compatible armor - By Region (in Value %)

Central Region

Western Region

Eastern Region

Southern Region

Northern Region

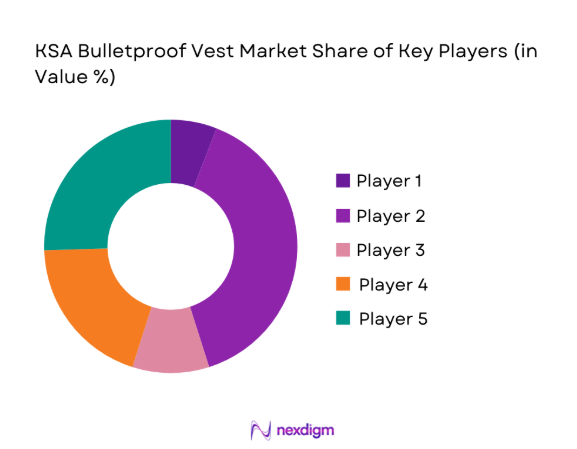

- Market structure and competitive positioning

- Market share snapshot of major players

Cross Comparison Parameters (Ballistic protection level, Material technology, Weight and ergonomics, Localization and offset compliance, Pricing and contract flexibility, Certification and testing compliance, Production capacity and lead time, After-sales and lifecycle support) - SWOT Analysis of Key Players

- Pricing and Commercial Model Benchmarking

- Detailed Profiles of Major Companies

BAE Systems

DuPont

Honeywell International

3M

Point Blank Enterprises

Safariland Group

ArmorSource

Survitec Group

Avon Protection

Rheinmetall Defence

MKU Limited

NP Aerospace

CoorsTek Defense

Teijin Aramid

Saudi Arabian Military Industries

- Operational threat assessment and mission-specific demand drivers

- Government procurement, tenders and offset requirements

- Buying criteria including protection level, weight and compliance standards

- Budget allocation within defense and internal security programs

- Implementation challenges related to training and fitment

- After-sales support, warranty and replacement expectations

- By Value, 2026–2035

- By Volume, 2026–2035

- By Installed Base, 2026–2035

- By Average Selling Price, 2026–2035