Market Overview

The KSA C5ISR Market market current size stands at around USD ~ million, reflecting sustained defense modernization momentum and active system deployments across multiple operational domains. Recent activity levels indicate platform upgrades numbering ~ units and active command systems exceeding ~ installations, supported by expanding secure network nodes. Capability expansion during recent cycles focused on joint operations, ISR fusion, and resilient communications. Procurement intensity has remained stable, with program continuity driven by long-term defense planning and integrated force readiness objectives.

Demand concentration is strongest across Riyadh, Eastern Province, and Western military zones due to command headquarters density and infrastructure maturity. These regions benefit from advanced data centers, satellite ground stations, and defense industrial clusters. Southern operational areas also demonstrate elevated adoption due to border security imperatives. Ecosystem maturity is reinforced by localization policies, integrator presence, and coordinated defense procurement frameworks enabling sustained C5ISR capability development nationwide.

Market Segmentation

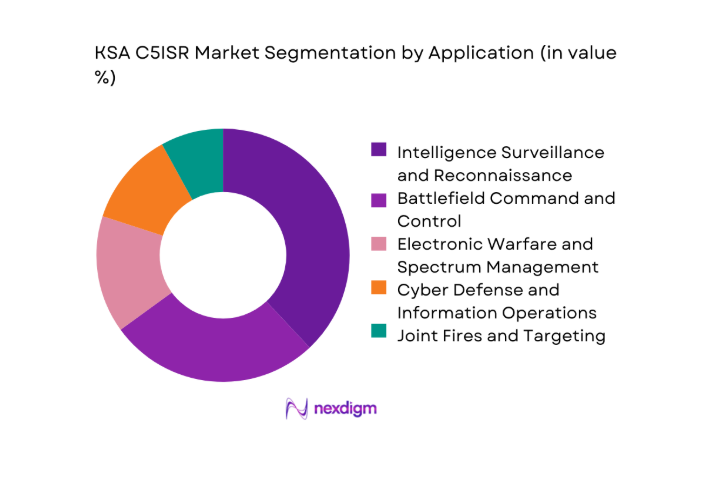

By Application

The market is dominated by intelligence surveillance and reconnaissance and battlefield command functions, reflecting Saudi Arabia’s focus on situational awareness and rapid decision superiority. Integrated ISR platforms are prioritized for border security, maritime awareness, and airspace monitoring. Command and control applications benefit from joint-force doctrine alignment and increasing data fusion requirements. Electronic warfare and cyber-enabled applications are expanding steadily as spectrum control and information dominance become operational priorities. Targeting and joint fires applications remain specialized but strategically critical. Overall dominance reflects mission-critical dependence on real-time intelligence dissemination and coordinated operational execution across services.

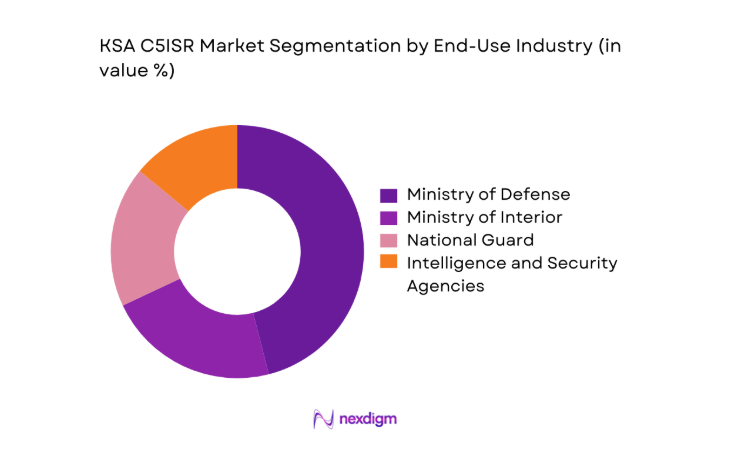

By End-Use Industry

Defense institutions represent the dominant end-use segment, driven by modernization programs and joint command restructuring. The Ministry of Defense leads adoption through integrated land, air, and naval programs. Internal security agencies maintain strong demand for ISR and secure communications to support counterterrorism and border operations. The National Guard emphasizes interoperable command systems aligned with national defense doctrine. Intelligence agencies focus on advanced analytics and data fusion platforms. Segment dominance reflects mission scope, procurement authority, and operational complexity across national security stakeholders.

Competitive Landscape

The competitive landscape is characterized by a mix of global defense primes and increasingly capable domestic integrators. Market participation is shaped by localization requirements, system integration depth, and long-term service commitments aligned with national defense priorities.

| Company Name | Establishment Year | Headquarters | Formulation Depth | Distribution Reach | Regulatory Readiness | Service Capability | Channel Strength | Pricing Flexibility |

| Lockheed Martin | 1995 | United States | ~ | ~ | ~ | ~ | ~ | ~ |

| Northrop Grumman | 1994 | United States | ~ | ~ | ~ | ~ | ~ | ~ |

| BAE Systems | 1999 | United Kingdom | ~ | ~ | ~ | ~ | ~ | ~ |

| Thales Group | 2000 | France | ~ | ~ | ~ | ~ | ~ | ~ |

| Saudi Arabian Military Industries | 2017 | Saudi Arabia | ~ | ~ | ~ | ~ | ~ | ~ |

KSA C5ISR Market Analysis

Growth Drivers

Rising defense expenditure aligned with Vision 2030

National defense planning emphasizes capability transformation, supporting sustained C5ISR investment aligned with Vision 2030 strategic security objectives. Budget prioritization enables modernization of command networks, ISR assets, and secure communications supporting joint force readiness across domains. Policy-driven localization mandates further reinforce spending continuity and long-term system sustainment commitments. Domestic integration programs expand technology absorption while reducing reliance on fragmented legacy architectures. Strategic alignment ensures multi-year program visibility for advanced C5ISR deployments. Defense doctrine evolution continues reinforcing digital command superiority imperatives. Integrated planning frameworks synchronize capital allocation with operational requirements. This alignment strengthens institutional commitment toward advanced decision-support capabilities. Sustained funding stability enhances supplier confidence and execution efficiency. Overall expenditure alignment remains a foundational growth catalyst.

Modernization of joint and multi-domain operations

Operational doctrine increasingly emphasizes synchronized land, air, sea, cyber, and space operations through integrated C5ISR frameworks. Modernization initiatives prioritize interoperability and real-time data sharing across services. Joint command structures require resilient networks and unified situational awareness platforms. Multi-domain threats accelerate adoption of integrated ISR and decision-support systems. Exercises and operational readiness programs reinforce technology standardization. Legacy system replacement drives incremental upgrades across platforms. Data-centric warfare concepts expand analytics and fusion requirements. Command agility becomes central to operational effectiveness. These factors collectively accelerate modernization momentum. Joint operational complexity sustains long-term C5ISR demand.

Challenges

High system integration complexity

C5ISR environments involve heterogeneous platforms requiring complex integration across legacy and modern systems. Technical interoperability challenges increase deployment timelines and implementation risks. Integration demands skilled workforce availability and rigorous systems engineering processes. Program coordination across services adds architectural complexity. Data standardization and latency management remain persistent issues. Cybersecurity integration further complicates system design. Testing and validation cycles extend due to mission-critical reliability requirements. Complexity elevates operational risk during transition phases. These factors constrain rapid scalability. Integration remains a significant execution challenge.

Dependence on foreign OEMs and IP restrictions

Advanced C5ISR capabilities often rely on foreign intellectual property and controlled technologies. Export controls constrain technology transfer depth and customization flexibility. Dependence limits autonomous upgrade cycles and local innovation potential. Licensing structures can restrict software modification rights. Sustainment timelines may be affected by external approvals. Strategic autonomy objectives intensify pressure to localize capabilities. IP constraints slow domestic capability maturation. Mitigation requires long-term localization investment. Transition risks remain during capability handovers. Dependency challenges persist across critical subsystems.

Opportunities

Localization of C5ISR manufacturing and software

Localization initiatives create opportunities for domestic manufacturing and software development across C5ISR layers. Policy frameworks encourage technology transfer and joint ventures. Local system integration enhances lifecycle control and responsiveness. Workforce development programs strengthen engineering capabilities. Domestic production improves supply chain resilience. Software localization enables tailored operational features. Long-term sustainment costs benefit from local presence. Export potential emerges for regionally adapted solutions. Ecosystem depth continues expanding. Localization represents a strategic growth opportunity.

Expansion of space-based ISR capabilities

Space-based ISR platforms offer enhanced coverage and persistent surveillance capabilities. National space initiatives support satellite deployment and ground segment development. Integration with terrestrial C5ISR systems enhances data fusion depth. Space assets strengthen border monitoring and maritime awareness. Technological advances improve resolution and revisit rates. Secure downlink infrastructure expands operational utility. Multi-domain integration elevates strategic intelligence capabilities. Partnerships accelerate capability rollout. Space ISR reduces dependence on manned assets. Expansion presents significant long-term opportunity.

Future Outlook

The KSA C5ISR Market outlook to 2035 indicates continued emphasis on integrated, data-driven command architectures. Policy alignment with Vision 2030, increasing localization, and multi-domain operational requirements will shape investment priorities. Technology adoption will increasingly focus on AI-enabled decision support and resilient connectivity. Long-term programs are expected to sustain steady capability expansion across defense and security institutions.

Major Players

- Lockheed Martin

- Northrop Grumman

- Raytheon Technologies

- BAE Systems

- Thales Group

- Leonardo

- Elbit Systems

- L3Harris Technologies

- Saab AB

- Airbus Defence and Space

- Boeing Defense

- Aselsan

- Saudi Arabian Military Industries

- Advanced Electronics Company

- General Dynamics Mission Systems

Key Target Audience

- Ministry of Defense procurement departments

- Ministry of Interior security divisions

- Saudi National Guard command units

- Intelligence and security agencies

- Defense system integrators

- Defense-focused investments and venture capital firms

- General Authority for Military Industries

- Communications and Information Technology Commission

Research Methodology

Step 1: Identification of Key Variables

Identification of Key Variables involved defining operational scope, system layers, and mission-specific C5ISR components relevant to Saudi defense structures.

Step 2: Market Analysis and Construction

Market Analysis and Construction focused on mapping programs, platforms, and deployment lifecycles across land, air, naval, and joint domains.

Step 3: Hypothesis Validation and Expert Consultation

Hypothesis Validation and Expert Consultation incorporated inputs from defense engineers, system integrators, and operational planners for accuracy refinement.

Step 4: Research Synthesis and Final Output

Research Synthesis and Final Output consolidated validated insights into structured analysis aligned with consulting-grade reporting standards.

- Executive Summary

- Research Methodology (Market Definitions and Operational Scope for KSA C5ISR, Platform and Mission-Based Segmentation Framework, Bottom-Up Program-Level Market Sizing and Forecasting, Revenue Attribution by System Layer and Lifecycle Phase, Primary Validation with Saudi MoD Integrators and OEMs, Triangulation Using SIPRI Jane’s and Local Offset Disclosures, Assumptions and Constraints Linked to Classified Procurement)

- Definition and Scope

- Market evolution

- Operational doctrine and mission usage pathways

- C5ISR ecosystem structure

- Supply chain and systems integration model

- Defense and cybersecurity regulatory environment

- Growth Drivers

Rising defense expenditure aligned with Vision 2030

Modernization of joint and multi-domain operations

Border security and asymmetric threat environment

Integration of AI and data fusion capabilities

Localization and offset-driven system upgrades - Challenges

High system integration complexity

Dependence on foreign OEMs and IP restrictions

Cybersecurity and data sovereignty risks

Lengthy procurement and approval cycles

Interoperability across legacy platforms - Opportunities

Localization of C5ISR manufacturing and software

Expansion of space-based ISR capabilities

AI-driven predictive and autonomous C2 systems

Regional export potential for Saudi-developed solutions

Public–private partnerships in defense technology - Trends

Shift toward network-centric and cloud-based C2

Adoption of AI/ML for ISR analytics

Increased focus on cyber-electromagnetic activities

Modular and open systems architectures

Joint force interoperability standardization - Government Regulations

- SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Value, 2020–2025

- By Volume, 2020–2025

- By Active Systems, 2020–2025

- By Average Selling Price, 2020–2025

- By Fleet Type (in Value %)

Land Forces Platforms

Air Force Platforms

Naval Platforms

Joint and Strategic Command Systems

Homeland Security and Border Guard Assets - By Application (in Value %)

Battlefield Command and Control

Intelligence Surveillance and Reconnaissance

Electronic Warfare and Spectrum Management

Cyber Defense and Information Operations

Joint Fires and Targeting - By Technology Architecture (in Value %)

Centralized Command Architectures

Distributed and Network-Centric Systems

Cloud-Enabled C2 and Data Fusion

AI-Enabled Decision Support Systems - By End-Use Industry (in Value %)

Ministry of Defense

Ministry of Interior

National Guard

Intelligence and Security Agencies - By Connectivity Type (in Value %)

Terrestrial Secure Networks

Satellite Communications

Tactical Data Links

Hybrid Multi-Domain Connectivity - By Region (in Value %)

Central Region

Western Region

Eastern Region

Southern Border Region

- Market structure and competitive positioning

Market share snapshot of major players - Cross Comparison Parameters (System integration capability, Localization and offset compliance, Technology maturity, Cybersecurity robustness, Interoperability standards, Lifecycle support, Pricing flexibility, Government relationships)

- SWOT Analysis of Key Players

- Pricing and Commercial Model Benchmarking

- Detailed Profiles of Major Companies

Lockheed Martin

Northrop Grumman

Raytheon Technologies

BAE Systems

Thales Group

Leonardo

Elbit Systems

L3Harris Technologies

Saab AB

Airbus Defence and Space

Boeing Defense

Aselsan

Saudi Arabian Military Industries (SAMI)

Advanced Electronics Company

General Dynamics Mission Systems

- Demand and utilization drivers

- Procurement and tender dynamics

- Buying criteria and vendor selection

- Budget allocation and financing preferences

- Implementation barriers and risk factors

- Post-purchase service expectations

- By Value, 2026–2035

- By Volume, 2026–2035

- By Active Systems, 2026–2035

- By Average Selling Price, 2026–2035