Market Overview

The KSA cardiac biomarkers market is valued at USD ~, reflecting a structurally important segment within the country’s diagnostics ecosystem driven by rising cardiovascular disease incidence, increasing emergency admissions for acute coronary syndromes, and growing emphasis on early-stage detection. Demand is strongly supported by the rapid modernization of hospital laboratories, the expansion of tertiary and quaternary care facilities, and the prioritization of evidence-based clinical pathways in cardiac care. The market plays a central role in improving patient outcomes through faster triage, accurate risk stratification, and optimized treatment decisions across emergency, inpatient, and outpatient care settings.

Within the country, the market is concentrated in major metropolitan healthcare hubs where advanced hospitals, cardiac specialty centers, and reference laboratories are clustered due to higher patient inflows and better diagnostic infrastructure. These cities dominate adoption because they serve as referral centers for complex cardiac cases and are early adopters of high-sensitivity assays and automation platforms. On the supply and technology side, innovation and product leadership are influenced by global diagnostics leaders whose strong research pipelines, regulatory expertise, and large-scale manufacturing capabilities shape assay performance standards and system integration practices that are widely implemented across Saudi healthcare facilities.

Market Segmentation

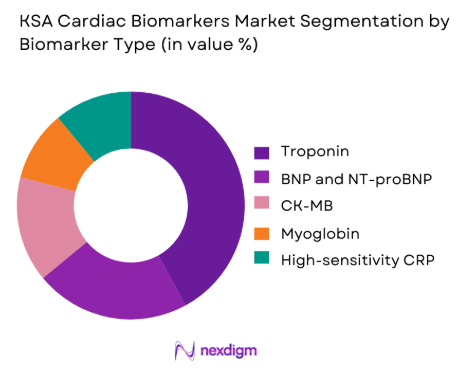

By Biomarker Type

The troponin segment dominates the KSA cardiac biomarkers market due to its indispensable role in diagnosing acute myocardial infarction and other ischemic cardiac events. Troponin assays are embedded in national and international clinical protocols for chest pain evaluation, making them a frontline diagnostic tool in emergency departments and intensive care units. The transition from conventional to high-sensitivity troponin testing has further strengthened this segment by enabling earlier detection of myocardial injury and improving clinical decision accuracy. Hospitals and cardiac centers prioritize investment in troponin platforms because of their proven clinical reliability, standardized interpretation, and ability to support rapid rule-in and rule-out pathways. As cardiac care increasingly emphasizes speed, precision, and risk stratification, troponin continues to remain the cornerstone biomarker driving test volumes and revenue generation across the country.

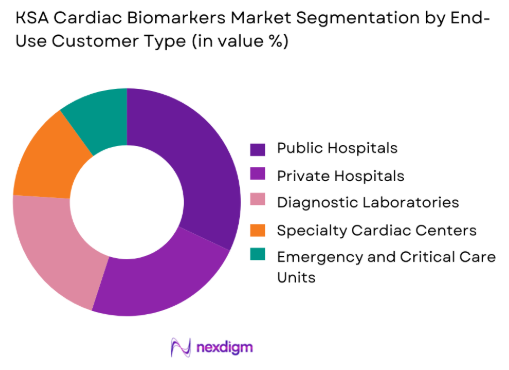

By End-Use Customer Type

Public and private hospitals together represent the dominant segment of the KSA cardiac biomarkers market, driven by their central role in acute and chronic cardiac care delivery. Hospitals account for the majority of emergency cardiac admissions and inpatient procedures, making them the primary users of rapid and high-throughput biomarker testing. Their dominance is reinforced by government-backed infrastructure expansion, higher diagnostic budgets, and the integration of cardiac biomarker testing into standardized care pathways. Unlike standalone laboratories that focus on routine or referral testing, hospitals require round-the-clock diagnostic readiness, pushing continuous demand for reagents, analyzers, and quality control materials. The growing complexity of cardiac cases and the need for multidisciplinary care teams further strengthen hospital reliance on comprehensive biomarker panels, cementing this segment’s leadership in overall market value.

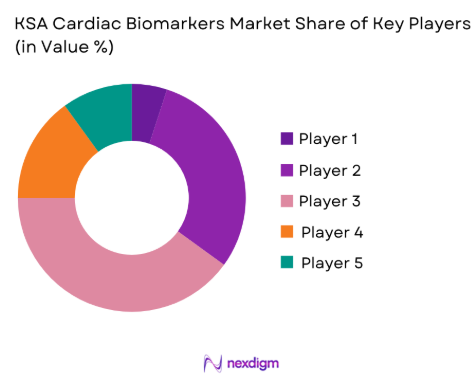

Competitive Landscape

The KSA Cardiac Biomarkers market is dominated by a few major players, including Roche Diagnostics and global brands like Abbott Diagnostics, Siemens Healthineers, and Beckman Coulter. This consolidation highlights the significant influence of these key companies.

| Company | Year Established | Headquarters | SFDA-Approved Assays | Local Distribution Network | Cardiac Portfolio Breadth | Service Support (Hospitals/Labs) | Technology Integration |

| Roche Diagnostics | 1896 | Basel, Switzerland | ~ | ~ | ~ | ~ | ~ |

| Abbott Diagnostics | 1888 | Illinois, USA | ~ | ~ | ~ | ~ | ~ |

| Siemens Healthineers | 1847 | Erlangen, Germany | ~ | ~ | ~ | ~ | ~ |

| Beckman Coulter | 1935 | California, USA | ~ | ~ | ~ | ~ | ~ |

| Ortho Clinical Diagnostics | 1939 | New Jersey, USA | ~ | ~ | ~ | ~ | ~ |

KSA Cardiac Biomarkers Market Analysis

Growth Drivers

Rising Cardiovascular Disease Burden

The increasing prevalence of cardiovascular diseases in the country is a fundamental driver of demand for cardiac biomarker testing. Lifestyle changes, urbanization, and rising incidence of diabetes and obesity have collectively elevated the risk profile of the population, leading to higher emergency admissions and long-term cardiac care needs. This trend directly fuels demand for rapid and accurate diagnostic tools that support early intervention and reduce mortality rates. As healthcare providers shift toward proactive disease management, biomarker testing becomes integral to routine screening, post-event monitoring, and chronic condition management, creating sustained growth momentum for the market.

Expansion of Tertiary Care Infrastructure

The continuous expansion of tertiary and quaternary healthcare facilities is strengthening diagnostic capacity across the country. Large-scale hospital development programs and modernization initiatives have significantly increased the number of high-end laboratories equipped with automated analyzers and advanced testing platforms. This infrastructure growth not only improves access to cardiac diagnostics but also raises quality standards by enabling the use of high-sensitivity assays and integrated information systems. As hospitals expand their service portfolios, cardiac biomarker testing becomes a standard component of emergency, cardiology, and intensive care workflows, amplifying both test volumes and revenue generation.

Challenges

High Cost of Advanced Diagnostic Systems

The financial burden associated with acquiring and maintaining advanced diagnostic analyzers poses a major challenge for market expansion, particularly for mid-sized hospitals and peripheral healthcare facilities. High capital expenditure requirements limit the speed at which newer technologies can be adopted, while ongoing costs related to reagents, calibration, and system upgrades strain operational budgets. This creates a disparity in diagnostic capabilities between large urban hospitals and smaller regional centers, potentially restricting uniform access to high-quality cardiac care. The challenge is further intensified by the need for continuous investment to keep pace with evolving assay technologies.

Shortage of Specialized Laboratory Professionals

A limited pool of trained laboratory professionals capable of operating advanced diagnostic platforms constrains the effective utilization of cardiac biomarker technologies. While system automation reduces manual workload, the interpretation of results and quality assurance still require skilled personnel. Workforce gaps lead to operational inefficiencies, longer turnaround times, and underutilization of installed capacity. This human resource challenge not only affects service quality but also impacts the return on investment for healthcare providers, making it a critical barrier to scaling advanced cardiac diagnostics nationwide.

Opportunities

Expansion of Point-of-Care Cardiac Testing

The growing emphasis on rapid decision-making in emergency and critical care settings presents a strong opportunity for point-of-care cardiac biomarker testing. Portable and easy-to-use diagnostic devices enable faster triage and treatment initiation, particularly in emergency departments and remote healthcare facilities. As healthcare delivery models evolve toward decentralized care, point-of-care testing offers a practical solution to improve access, reduce diagnostic delays, and enhance patient outcomes. This shift supports new revenue streams for manufacturers and distributors while strengthening the overall diagnostic ecosystem.

Integration of Digital Health and Diagnostics

The increasing integration of digital health platforms with diagnostic systems creates a transformative opportunity for the cardiac biomarkers market. Connectivity between analyzers, electronic medical records, and clinical decision support tools enhances workflow efficiency and data-driven care delivery. Advanced analytics can help clinicians track trends, predict risks, and personalize treatment strategies. This convergence of diagnostics and digital health not only improves clinical outcomes but also opens avenues for value-added services such as remote monitoring, population health management, and predictive care models, expanding the strategic relevance of cardiac biomarker solutions.

Future Outlook

The KSA cardiac biomarkers market is positioned for sustained strategic growth as healthcare delivery increasingly prioritizes early diagnosis, rapid intervention, and integrated care pathways for cardiovascular diseases. Ongoing investments in hospital infrastructure, digital transformation of diagnostics, and expansion of specialty cardiac services will continue to elevate the role of biomarker testing in clinical decision-making. The market’s evolution will be shaped by deeper penetration of high-sensitivity assays, wider deployment of point-of-care solutions, and closer alignment between diagnostics and preventive healthcare initiatives, reinforcing its importance within the national healthcare modernization agenda.

Major Players

- Roche Diagnostics

- Abbott Diagnostics

- Siemens Healthineers

- Beckman Coulter

- Ortho Clinical Diagnostics

- bioMérieux

- Thermo Fisher Scientific

- QuidelOrtho

- Fujirebio

- Sysmex Corporation

- Randox Laboratories

- Mindray Medical

- DiaSorin

- Hologic

- PerkinElmer

Key Target Audience

- Hospital procurement and diagnostics heads

- Cardiology department directors

- Laboratory directors and pathology managers

- Healthcare system CIOs and CMIOs

- Investments and venture capitalist firms

- Government and regulatory bodies

- Private healthcare investors and operators

- Medical device and diagnostics distributors

Research Methodology

Step 1: Identification of Key Variables

The research begins with constructing a comprehensive ecosystem map of stakeholders involved in the KSA cardiac biomarkers market. This phase relies on structured desk research to identify demand drivers, technology trends, regulatory frameworks, and competitive dynamics shaping market performance.

Step 2: Market Analysis and Construction

Historical and current market data are analyzed to evaluate test volumes, system penetration, and revenue streams across care settings. This step focuses on understanding how diagnostic utilization translates into commercial value for suppliers and healthcare providers.

Step 3: Hypothesis Validation and Expert Consultation

Market assumptions are validated through structured interviews with cardiologists, laboratory managers, and procurement professionals. These discussions provide operational insights that refine demand models and competitive positioning analysis.

Step 4: Research Synthesis and Final Output

Quantitative findings and qualitative insights are synthesized to develop a cohesive market narrative. Multiple validation layers ensure accuracy, consistency, and relevance for strategic decision-making.

- Executive Summary

- Research Methodology (Market definitions and scope boundaries, terminology and abbreviations, cardiac biomarker taxonomy and clinical pathway mapping, market sizing logic by test volume and reagent consumption, revenue attribution across assays analyzers and quality controls, primary interview program with hospitals labs distributors and regulators, data triangulation and validation approach, assumptions limitations and data gaps)

- Definition and Scope

- Market Genesis and Evolution of Cardiac Biomarker Testing in KSA

- Acute Coronary Syndrome Burden and Emergency Care Drivers

- Care Pathway Mapping Across ED ICU Cath Lab and Chest Pain Clinics

- Public Sector Procurement and Private Lab Network Dynamics

- Import Dependence and Authorized Distributor Ecosystem

- Growth Drivers

Rising burden of coronary artery disease and ACS admissions

Expansion of emergency care capacity and chest pain pathways

Adoption of high sensitivity troponin protocols

Growth of private hospital and lab networks

Focus on faster turnaround time and clinical decision support - Challenges

Tender driven pricing compression for reagents and consumables

Method harmonization issues across platforms and sites

Cold chain logistics and inventory continuity for imported reagents

POCT governance and operator training requirements

False positives and protocol adherence challenges in ED settings - Opportunities

Scaling high sensitivity troponin adoption across hospital networks

Expansion of POCT in ambulance and remote care settings

Bundled reagent and analyzer contracting models for lab networks

Integration of biomarker results into cardiac registries and analytics

Clinical education programs to standardize ACS rule out pathways - Trends

Shift toward high sensitivity troponin as primary MI marker

Increasing use of multiplex panels in complex presentations

Expansion of POCT for faster triage and patient flow improvement

Greater emphasis on QC analytics and accreditation readiness

Integration of biomarker testing with digital clinical pathways - Regulatory & Policy Landscape

SWOT Analysis

Stakeholder & Ecosystem Analysis

Porter’s Five Forces Analysis

Competitive Intensity & Ecosystem Mapping

- By Value, 2019–2024

- By Test Volume, 2019–2024

- By Hospital vs Independent Lab Revenue Split, 2019–2024

- By High Sensitivity Troponin Adoption Share, 2019–2024

- By Fleet Type (in Value %)

Government hospitals and medical cities

Private hospital networks

Independent reference laboratories

Emergency care and urgent care centers

Cardiology specialty centers - By Application (in Value %)

Acute myocardial infarction rule in and rule out

Heart failure diagnosis and monitoring

Thrombotic risk and ACS stratification

Inflammation and cardiovascular risk screening

Post PCI and cardiac surgery monitoring - By Technology Architecture (in Value %)

Central lab immunoassay analyzers and reagent systems

Point of care cardiac marker analyzers

High sensitivity troponin assay platforms

Multiplex biomarker panels and syndromic testing

Rapid test kits and lateral flow formats - By Connectivity Type (in Value %)

Standalone analyzers with local reporting

LIS integrated laboratory workflows

EHR integrated emergency department pathways

Cloud enabled quality management and QC analytics

Remote service monitoring and uptime management - By End-Use Industry (in Value %)

Emergency departments and chest pain units

Clinical laboratories and pathology networks

ICU and critical care units

Cardiology clinics and outpatient centers

Public health screening and wellness providers - By Region (in Value %)

Riyadh Region

Makkah Region

Eastern Province

Madinah Region

Asir and Southern Regions

- Competitive ecosystem structure across IVD majors specialty assay providers and distributor networks

- Positioning driven by assay performance turnaround time and platform footprint

- Partnership models between OEMs hospital groups and lab networks

- Cross Comparison Parameters (high sensitivity troponin assay performance, time to result and STAT workflow fit, analyzer throughput and scalability, sample type and handling requirements, reagent storage stability and cold chain needs, LIS and EHR connectivity readiness, QC and calibration burden, cost per reportable result)

- SWOT analysis of major players

- Pricing and commercial model benchmarking

- Porter’s Five Forces

- Detailed Profiles of Major Companies

Roche Diagnostics

Abbott

Siemens Healthineers

Beckman Coulter

Ortho Clinical Diagnostics

bioMérieux

DiaSorin

QuidelOrtho

Radiometer

Randox Laboratories

Getinge

Mindray

Meril Diagnostics

Thermo Fisher Scientific

Boditech Med

- ED clinician requirements for turnaround time and diagnostic confidence

- Lab director priorities for throughput method stability and QC burden

- Procurement models in public hospitals and private networks

- Decision criteria for central lab versus POCT deployment

- Total cost of ownership drivers across reagents calibrators and service

- By Value, 2025–2030

- By Test Volume, 2025–2030

- By Hospital vs Independent Lab Revenue Split, 2025–2030

- By High Sensitivity Troponin Adoption Share, 2025–2030