Market Overview

The Saudi Arabia catalytic converters market, aligned with the autocatalyst segment, is assessed at about USD ~ million, based on a multi-year historical analysis of emission-control catalyst demand in the light- and heavy-vehicle parc. The broader heterogeneous catalyst space in the country generated roughly USD ~ million in environmental, refining and related applications in the preceding period, underscoring a strong installed base for catalytic technologies. Growth is primarily driven by rising vehicle production and sales, tighter exhaust standards, and high urbanization levels that push regulators and OEMs toward more advanced after-treatment solutions.

Within the KSA catalytic converters market, demand is concentrated around the Northern & Central and Western corridors, anchored by Riyadh, Jeddah, Makkah and Madinah, with the Eastern Region emerging as an industrial and logistics hub. These corridors host the densest urban populations, with over 31.8 million residents living in urban settings, driving high private-vehicle ownership and public transport fleets. Major import gateways, auto distribution hubs, industrial clusters and upcoming auto manufacturing initiatives under the national diversification agenda further reinforce these cities as focal points for catalytic converter fitment, replacement and upgrade demand.

Market Segmentation

By Vehicle Type

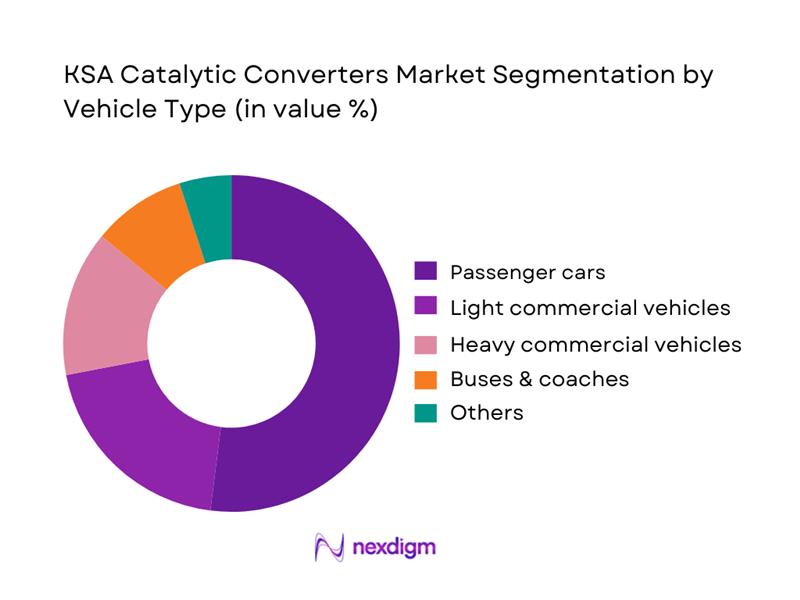

The KSA catalytic converters market is segmented by vehicle type into passenger cars, light commercial vehicles, heavy commercial vehicles, buses & coaches, and others including off-highway and special-purpose equipment. Passenger cars form the dominant sub-segment because the Kingdom’s car market has reached its highest volume in recent years, supported by rising urbanization, increased female driver participation and financing availability. OEMs and importers focus their product planning on gasoline passenger vehicles where three-way catalytic converters are mandatory, creating a large installed base and consistent replacement pool. Dense traffic conditions in major cities and longer average daily commutes further accelerate wear and tear, reinforcing the dominance of catalytic converters fitted to passenger cars compared with commercial and niche applications.

By Catalyst Type

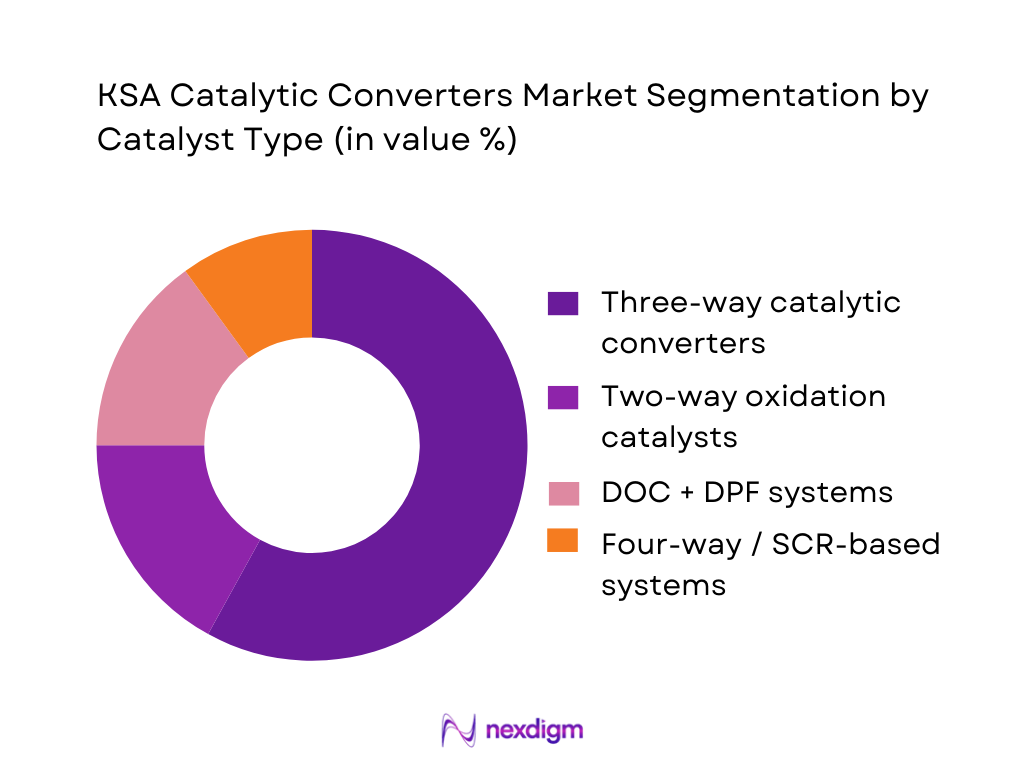

The KSA catalytic converters market is segmented by catalyst type into three-way catalytic converters, two-way oxidation catalysts, DOC+DPF systems and four-way/SCR-based architectures. Three-way catalytic converters dominate because the Saudi light-vehicle parc is still heavily skewed toward gasoline spark-ignition engines, where TWC architectures are the core emissions-control technology. Global suppliers such as BASF, Magneti Marelli, Faurecia and Tenneco have optimized TWC formulations for the local fuel and duty cycle environment, making them the default fitment on most imported and regionally assembled cars. Meanwhile, diesel-heavy truck and bus fleets, although significant, represent a smaller portion of the total vehicle count, limiting the relative share of DOC, DPF and SCR systems compared with TWC units.

Competitive Landscape

The KSA catalytic converters market is shaped by a mix of global catalyst majors, regional exhaust-system integrators and local manufacturing/assembly units. The Middle East catalytic converter landscape is led by players such as BASF Middle East LLC, Magneti Marelli Middle East, Faurecia Automotive Systems, Tenneco and Johnson Matthey, all of which provide advanced automotive catalyst technologies and supply chains into Saudi Arabia. Competition revolves around emission-standard coverage, PGM loading optimization, durability in high-temperature/dusty conditions, and the ability to support both OEM projects and a fast-moving aftermarket across central and coastal corridors. Localization of canning, assembly and potential coating lines, as well as PGM recycling partnerships, is becoming a key differentiator as the Kingdom pushes for industrial diversification and import substitution.

| Company | Establishment Year | Headquarters | KSA Presence Model | Key Product Focus (KSA) | Primary End-Use Segments in KSA | Technology Highlights | Regional Manufacturing / Supply Hubs | Notable KSA/MEA Partnerships |

| BASF Middle East LLC | 2002 | Dubai, UAE | ~ | ~ | ~ | ~ | ~ | ~ |

| Magneti Marelli Middle East | 2010 | Riyadh, Saudi Arabia | ~ | ~ | ~ | ~ | ~ | ~ |

| Faurecia Automotive Systems | 1997 (MEA Ops) | Nanterre, France (Global HQ) | ~ | ~ | ~ | ~ | ~ | ~ |

| Tenneco Inc. | 1940 | Illinois, USA | ~ | ~ | ~ | ~ | ~ | ~ |

| Johnson Matthey Plc | 1817 | London, UK | ~ | ~ | ~ | ~ | ~ | ~ |

KSA Catalytic Converters Market Analysis

Growth Drivers

Expansion of passenger and commercial vehicle parc

The catalytic converters market in KSA is underpinned by a rapidly expanding on-road vehicle base. Road Transport Statistics show registered and roadworthy vehicles in use rising from ~ million to over ~ million within one year, an increase of 1 million units, while new vehicle registrations exceeded 1,025,700 in the latest reported year versus about 878,100 previously. Over the same period, total population climbed from 32,175,224 to 33,702,731 and then 35,300,280 residents, highlighting continued motorization and rising vehicle density across the Kingdom. This expanding passenger and commercial parc directly translates into more factory-fitted and replacement catalytic converters across light-duty cars, SUVs and heavy vehicles, sustaining underlying demand for three-way and diesel after-treatment systems.

Tightening of exhaust-emission standards

Saudi regulators are progressively tightening emission norms, forcing OEMs and importers to use higher-efficiency catalytic converters. In 2024, authorities announced the rollout of Euro-5 equivalent gasoline and diesel specifications across the Kingdom, following earlier decisions to cap gasoline sulfur at 10 milligrams per kilogram, a standard aligned with advanced markets. At the same time, national per-capita CO₂ emissions remain among the world’s highest, at 18.81 metric tons and 18.48 metric tons in consecutive recent years, compared with a global average of about 4.76 metric tons, underscoring the pressure to decarbonize transport. These policy and environmental drivers together accelerate adoption of complex three-way catalysts, diesel oxidation catalysts and particulate filters designed to meet stricter NOx, HC and PM limits.

Challenges

High exposure to PGM price volatility

The KSA catalytic converters value chain is structurally exposed to volatility in platinum group metals (PGMs) used in washcoats and substrates. A World Bank commodity review notes that its precious-metals price index rose by 9 percent in the first quarter of one recent year, with gold and silver prices increasing 9 percent and 6 percent respectively, while platinum prices showed marked quarterly swings despite stable averages. This volatility directly affects catalyst manufacturing costs because PGMs such as platinum, palladium and rhodium constitute a significant share of catalyst material value. Even without quoting absolute prices, the combination of sustained industrial demand and supply disruptions in key mining regions creates unpredictable input costs that KSA assemblers and importers must manage through hedging, inventory strategies and product mix optimization.

Dependence on imported catalysts and substrates

KSA’s ambitious automotive and mobility agenda is currently supported by a heavily import-dependent industrial structure for complex components, including catalyst substrates and coated bricks. Non-oil imports moved by sea reached roughly 16 billion US dollars in value in 2022, accounting for about 20 percent of total non-oil exports, with chemicals, plastics and rubbers forming a large share, according to official trade data compiled from national statistics. Container handling at Saudi ports also rose from ~ million to ~ million TEUs between 2022 and 2023, highlighting the scale of inbound high-value industrial goods and automotive parts. In the absence of large-scale domestic production of ceramic substrates and coated catalysts, local exhaust-system suppliers remain vulnerable to global supply chain disruptions, shipping delays and currency movements.

Opportunities

Local catalyst-can assembly and coating lines

The push for industrial diversification and localization under Vision-linked programs creates strong headroom for domestic catalyst-can assembly and coating investments. Saudi Arabia’s GDP in current US dollars has risen from about ~ trillion to ~ trillion over recent years, while GDP per capita increased from roughly 55,800 to 58,700 US dollars, signalling robust domestic purchasing power and fiscal space for industrial incentives. Meanwhile, the on-road vehicle parc expanded to 15.8 million units, with more than 1,025,700 new vehicle registrations in the latest year, up 16.8 percent from the prior year. These dynamics make localized manufacturing of converter cans, substrates and coated bricks attractive, reducing import dependence and enabling tailored solutions for high-temperature desert duty cycles and regional fuel characteristics.

OE partnerships aligned with KSA auto cluster development

Saudi Arabia is actively positioning itself as a regional automotive hub through dedicated industrial clusters and large-scale FDI attraction. Recent official announcements point to multi-billion-dollar manufacturing commitments under programs such as NIDLP and the National Investment Strategy, with FDI inflows exceeding ~ billion US dollars in some recent years as new industrial and mobility projects are licensed. Concurrently, road freight flows through land ports reached ~ million tons of exports and ~ million tons of imports, underlining the importance of reliable commercial vehicles. These conditions encourage global OEMs and Tier-1 exhaust suppliers to form joint ventures with Saudi partners, embedding catalytic converter and after-treatment engineering capabilities into nascent vehicle, bus and truck assembly plants, and allowing technology transfer, regional customization and long-term supply contracts.

Future Outlook

Over the next several years, the KSA catalytic converters market is expected to expand steadily, supported by rising vehicle production, continued growth in the on-road parc and stricter exhaust-emission standards. The Saudi autocatalyst market to grow from USD ~ million to roughly USD ~ million between 2024 and 2033 at a CAGR of 3.3%, the implied trajectory for 2024–2030 remains in the ~3.3% CAGR range under a constant-growth scenario. Parallel insights show the Saudi heterogeneous catalyst market growing from USD ~ million to USD ~ million with a 3.8% CAGR over a similar horizon, reinforcing the broader tailwind for catalytic technologies.

Going forward, demand will be shaped by three structural forces. First, regulatory tightening will progressively align KSA emission norms with advanced global benchmarks, increasing average PGM loadings and potentially accelerating adoption of DOC+DPF and SCR systems in diesel platforms. Second, industrial localization under the national diversification agenda is likely to spur regional coating, canning and assembly investments, improving supply security and enabling tailored solutions for local duty cycles. Third, sustainability and circularity will gain prominence, opening opportunities for PGM recycling partnerships, converter take-back programs and new business models around end-of-life management. Even as EV adoption gradually rises, the large installed base of combustion vehicles will sustain meaningful replacement demand for catalytic converters well beyond the current forecast window.

Major Players:

- BASF Middle East LLC

- Magneti Marelli Middle East

- Faurecia Automotive Systems

- Tenneco Inc.

- Johnson Matthey Plc

- Continental AG

- Eberspächer Group

- Bosal Group

- AP Exhaust Products

- Corning Incorporated

- Sejong Industrial Co., Ltd.

- Friedrich Boysen GmbH & Co. KG

- OTAIBI Silencers Factory

- Marelli Holdings Co., Ltd.

Key Target Audience

- Automotive OEMs and regional vehicle assemblers

- Global and regional Tier-1 exhaust–after-treatment integrators

- Automotive component distributors and large multi-brand aftermarket networks

- Fleet operators and transport/logistics companies

- Investments and venture capitalist firms

- Government and regulatory bodies

- Industrial catalyst, PGM and recycling companies

- Industrial parks, free zones and economic-city developers

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing a detailed ecosystem map for the Saudi Arabia catalytic converters / autocatalyst market, covering automotive OEMs, exhaust system suppliers, catalyst manufacturers, distributors, workshops, recyclers and regulatory bodies. Extensive desk research leverages secondary databases, customs/HS-code trade data, vehicle-parc statistics and published reports to identify critical demand drivers such as parc size by fuel and vehicle type, emission-standard evolution, PGM pricing and localization policies.

Step 2: Market Analysis and Construction

In this phase, we compile and analyze historical data on autocatalyst revenues, heterogeneous catalyst spending and vehicle-production trends in Saudi Arabia. Bottom-up models quantify converter fitment per vehicle segment, replacement cycles by duty profile, and OEM vs. aftermarket demand. This is cross-checked against top-down regional catalytic-converter and catalyst market sizes to reconcile revenues and volumes. Special attention is given to the split by catalyst type (TWC, DOC, DPF, SCR), fuel type and distribution channel (OEM vs. aftermarket) to construct robust segment-level estimates.

Step 3: Hypothesis Validation and Expert Consultation

Key hypotheses regarding growth rates, technology mix shifts and localization potential are validated through structured interviews and computer-assisted telephone interviews with industry stakeholders. These include executives from catalyst suppliers, exhaust-system integrators, Saudi-based distributors, large fleet operators and workshop networks. Discussions focus on observed failure rates, price–performance trade-offs, regulatory enforcement on emissions, and plans for local manufacturing or PGM recycling. Insights from these interviews are critical for calibrating our assumptions on converter lifetimes, product mix, and realistic adoption timelines for advanced systems such as DOC+DPF and SCR.

Step 4: Research Synthesis and Final Output

The final phase integrates quantitative models and qualitative insights into a coherent market narrative and forecast. Segment-wise revenue and volume projections are generated for 2024–2030, anchored to Saudi autocatalyst size and growth outlook and cross-validated with broader catalyst market trends in the Kingdom. Sensitivity analysis is conducted around PGM price volatility, EV adoption, regulatory tightening and localization scenarios. The outcomes are synthesized into strategic implications, opportunity maps and risk assessments tailored for OEMs, suppliers, investors and policymakers interested in the KSA catalytic converters market.

- Executive Summary

- Research Methodology (On-road vehicle parc & new registrations, average km driven per vehicle, replacement cycles by vehicle class, PGM content per converter by technology, import–export data by HS code, OE fitment ratios, workshop & fleet interviews, triangulation of bottom-up parc model with top-down MEA exhaust system benchmarks)

- Definition, Scope and System Boundaries

- Market Genesis and Evolution in KSA Automotive Sector

- KSA Emission Regulation Landscape and Compliance Architecture

- Role of Catalytic Converters in KSA Fuel-Quality and Air-Quality Agenda

- Value Chain and Stakeholder Ecosystem Mapping

- Growth Drivers

Expansion of passenger and commercial vehicle parc

Tightening of exhaust-emission standards

Improvements in gasoline and diesel sulfur levels

Growth in commercial transport and logistics corridors

Higher inspection and compliance regimes - Challenges

High exposure to PGM price volatility

Dependence on imported catalysts and substrates

Limited local coating capacity

Counterfeit and sub-standard converters in aftermarket

Limited enforcement in older vehicle segments - Opportunities

Local catalyst-can assembly and coating lines

OE partnerships aligned with KSA auto cluster development

Premium high-durability converters for fleet duty cycles

Converter-upgrade programs for high-mileage fleets

Converter and PGM recycling ventures - Technology and Material Landscape

- Supply Chain, Sourcing and Trade Flow Analysis

- Regulatory, Certification and Compliance Requirements

- SWOT Analysis – KSA Catalytic Converters Market

- Stakeholder Ecosystem Mapping

- Porter’s Five Forces Analysis

- By Value, 2019-2024

- By Volume, 2019-2024

- Average Converter Revenue per Vehicle and per Unit, 2019-2024

- Installed Base of Catalytic Converters in Operation, 2019-2024

- By Vehicle Type (in Value %)

Share of vehicles and converters by passenger cars & SUVs

Pickups & light commercial vehicles

Medium & heavy trucks, buses & coaches

Off-highway/construction equipment - By Fuel and Engine Type (in Value %)

Gasoline spark-ignition vehicles

Diesel compression-ignition vehicles

CNG/LPG vehicles

Hybrid powertrains

Flex-fuel and niche alternative-fuel applications - By Converter Technology (in Value %)

Two-way oxidation catalysts for diesel and legacy applications

Three-way catalytic converters for gasoline

Diesel oxidation catalysts

Catalyzed DPF & combined DOC–DPF systems

SCR/LNT and integrated multi-brick systems - By Substrate and Form Factor (in Value %)

Ceramic monolith catalysts

Metallic monolith catalysts

Gasoline particulate filters

High cell-density thin-wall substrates

Canning & mounting variants suited to KSA thermal and dust conditions - By Emission Compliance Level of Vehicle (in Value %)

Legacy vehicles below current GCC-equivalent standards

Vehicles aligned with prior-generation standards

Vehicles aligned with current KSA-equivalent Euro-standard

Premium/import vehicles aligned with next-generation standards - By Sales and Distribution Channel (in Value %)

OEM/line-fit supply to vehicle manufacturers

OEM-authorized service networks

Independent multi-brand workshops

Specialist exhaust & muffler chains

Fleet-direct and industrial accounts - By Region within KSA (in Value %)

Central corridor including Riyadh and surrounding logistics belt

Western corridor including Jeddah

Makkah and Madinah

Eastern industrial and energy corridor including Dammam/Khobar/Jubail

Northern development and mega-project corridor

- Market Share Analysis of Major Players by Value and Volume

- Cross Comparison Parameters (Catalyst and converter technology portfolio depth, KSA OE/OES and aftermarket coverage, local coating/assembly and service capability, PGM sourcing and hedging strategy, emission-standard certification coverage in KSA, distribution and workshop-network strength, PGM recycling and take-back programs, revenue mix by OE vs. aftermarket vs. export)

- Strategic Initiatives and Recent Developments

- SWOT Snapshot of Major Players in KSA Catalytic Converters Space

- Detailed Profiles of Key Companies in KSA Catalytic Converters Market

BASF Middle East LLC

Magneti Marelli Middle East

Faurecia Automotive Systems

Tenneco Middle East

Johnson Matthey Plc

Continental Middle East

Eberspächer Gulf

Bosal Middle East

AP Exhaust Products Middle East

Bharat Forge Middle East

Corning Incorporated – MEA Automotive Substrates

Sejong Industrial Co., Ltd.

Friedrich Boysen GmbH & Co. KG

OTAIBI Silencers Factory (OSFCO)

- Passenger Vehicle Owner Profiles and Replacement Behavior

- Commercial Fleet and Logistics Operators

- Public Sector and Municipal Fleets

- Workshop, Service Network and Installer Landscape

- End User Needs, Pain Points and Purchase Criteria

- By Value, 2025-2030

- By Volume, 2025-2030

- Average Converter Revenue per Vehicle and per Unit, 2025-2030

- Installed Base of Catalytic Converters in Operation, 2025-2030