Market Overview

The KSA CBRNE Defense market current size stands at around USD ~ million and reflects sustained procurement momentum across detection, protection, and response capabilities. Modernization programs continue to prioritize readiness improvements across integrated detection, protection, and response platforms. Procurement activity remains aligned with national security preparedness objectives and multi-agency coordination requirements. Ongoing upgrades emphasize operational resilience, interoperability across response units, and enhanced situational awareness. Capability enhancement initiatives focus on strengthening preparedness for complex threat scenarios across critical infrastructure and public safety environments.

Demand concentration remains strongest across metropolitan security clusters and industrial corridors supported by mature emergency response infrastructure. Strategic cities exhibit higher deployment density due to transportation hubs, energy assets, and public venue protection requirements. Regional adoption aligns with ecosystem maturity, availability of specialized responders, and proximity to logistics nodes enabling rapid sustainment. Policy emphasis on resilience planning and continuity frameworks reinforces procurement prioritization. Interagency coordination platforms further consolidate demand around command centers and specialized response units.

Market Segmentation

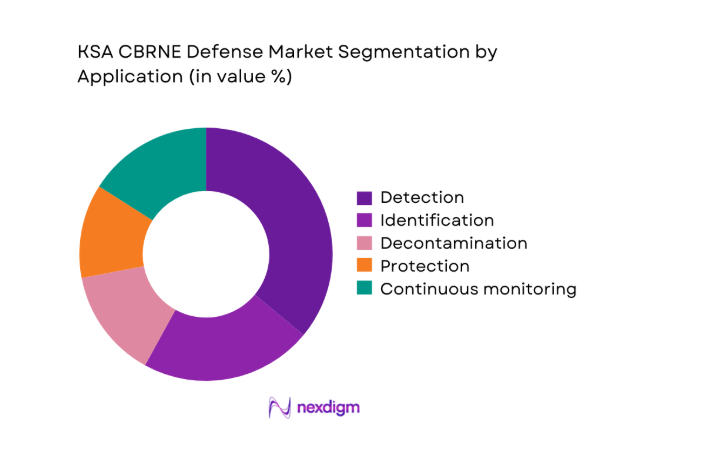

By Application

Operational demand is dominated by detection and identification applications driven by border security modernization, critical infrastructure protection mandates, and urban safety programs. Field deployments prioritize rapid threat recognition to enable timely containment protocols across transport hubs, industrial zones, and public venues. Decontamination applications follow episodic demand patterns linked to readiness exercises and contingency planning requirements. Continuous monitoring platforms gain relevance within command centers supporting situational awareness across dispersed assets. Training and simulation usage expands adoption cycles by embedding operational familiarity among first responders. Integrated protection systems increasingly align with multi-agency response workflows.

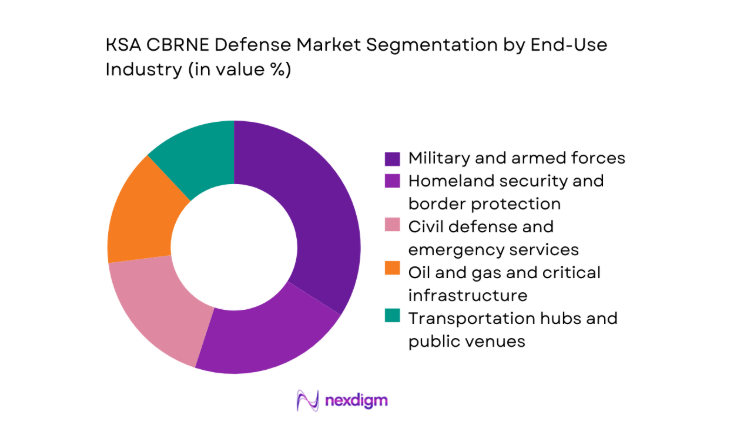

By End-Use Industry

Military and homeland security remain the primary end users due to mission-critical preparedness mandates and continuous readiness obligations. Civil defense agencies represent a growing share as urban resilience programs expand across metropolitan regions. Energy and critical infrastructure operators adopt integrated solutions to safeguard high-risk assets and maintain continuity protocols. Transportation hubs drive adoption to mitigate exposure risks across passenger dense environments. Healthcare emergency preparedness supports surge response capabilities during incident simulations and coordinated exercises. Public venue operators increasingly align with authorities to deploy portable systems supporting crowd safety planning.

Competitive Landscape

The competitive environment reflects a mix of integrated solution providers and specialized technology vendors offering detection, analytics, and response platforms. Market positioning is shaped by system interoperability, lifecycle support, and regulatory readiness across multi-agency deployments.

| Company Name | Establishment Year | Headquarters | Formulation Depth | Distribution Reach | Regulatory Readiness | Service Capability | Channel Strength | Pricing Flexibility |

| Thales Group | 1893 | Paris, France | ~ | ~ | ~ | ~ | ~ | ~ |

| Saab AB | 1937 | Stockholm, Sweden | ~ | ~ | ~ | ~ | ~ | ~ |

| Rheinmetall AG | 1889 | Düsseldorf, Germany | ~ | ~ | ~ | ~ | ~ | ~ |

| RTX | 1922 | Arlington, United States | ~ | ~ | ~ | ~ | ~ | ~ |

| Smiths Detection | 1914 | London, United Kingdom | ~ | ~ | ~ | ~ | ~ | ~ |

KSA CBRNE Defense Market Analysis

Growth Drivers

Modernization of Saudi defense capabilities

Modernization programs accelerated procurement cycles across sensor networks, response platforms, and integrated command systems nationally. Capability upgrades prioritized multi threat detection architectures supporting interoperability across agencies and rapid deployment readiness. Training cadence expanded as joint exercises incorporated networked systems across urban and industrial security zones. Equipment refreshes programs aligned with operational readiness frameworks supporting standardized response protocols across agencies. Integration milestones improved data sharing latency across command centers and mobile response units. Procurement frameworks emphasized lifecycle support alignment with sustainment planning and technical refresh schedules. Standardization reduced integration friction across legacy platforms and newly fielded detection capabilities. Capability roadmaps prioritized resilience and redundancy across critical nodes supporting continuity operations planning. Deployment density increased across high risk facilities and transportation corridors under security modernization mandates. Interoperability testing cycles strengthened operational confidence and accelerated deployment approvals across agencies.

Rising focus on critical infrastructure protection

Protection mandates expanded across energy facilities, transport hubs, and public venues with elevated threat exposure. Operators adopted layered detection architectures supporting early warning and rapid containment protocols. Integration with access control and surveillance platforms improved coordinated response effectiveness across sites. Exercises validated response workflows across multi stakeholder incident management frameworks. Infrastructure owners increased readiness drills supporting continuity and evacuation planning. Sensor placement strategies prioritized chokepoints and high density transit areas for improved coverage. Mobile response units enhanced perimeter security for episodic risk scenarios and planned events. Command centers centralized alerts enabling faster cross agency coordination during simulated incidents. Asset hardening programs aligned technology upgrades with facility risk assessments and resilience targets. Policy alignment strengthened adoption pathways through standardized requirements for critical asset protection programs.

Challenges

High acquisition and lifecycle costs

Procurement budgets face pressure from platform complexity and sustainment requirements across diverse operating environments. Long term support obligations strain planning cycles for maintenance and calibration across distributed assets. Integration expenses compound as legacy interfaces require customization for interoperability compliance. Training overhead increases operational expenditures across agencies adopting advanced systems concurrently. Spare parts logistics create downtime risks across remote deployments and high utilization sites. Service level expectations elevate vendor commitments and contract management complexity. Technology refresh cycles compress planning horizons for budgeting and asset depreciation schedules. Workforce specialization demands continuous certification programs and skills retention strategies. Lifecycle planning complexity complicates total ownership forecasting for multi platform deployments. Budget approvals require coordination across agencies with differing procurement cadences and priorities.

Complex integration with legacy systems

Legacy command platforms require interface adaptation to support modern sensor data streams reliably. Data standards fragmentation complicates interoperability across agencies operating heterogeneous systems concurrently. Network security policies restrict integration pathways and delay deployment approvals across secured environments. Middleware dependencies introduce latency risks affecting real time situational awareness outcomes. Validation cycles extend timelines due to compliance testing across multiple operational theaters. Customization requirements elevate deployment complexity and prolong commissioning activities across facilities. System hardening requirements necessitate iterative testing to ensure operational resilience. Integration documentation gaps slow onboarding of new capabilities into established workflows. Change management burdens increase training requirements for operators transitioning between interfaces. Governance alignment challenges coordination across agencies with differing technology roadmaps and priorities.

Opportunities

Localization and technology transfer programs

Localization initiatives encourage assembly, testing, and sustainment capabilities within national industrial ecosystems. Technology transfer frameworks enable knowledge diffusion across engineering teams supporting long term capability sovereignty. Joint development programs align platform customization with local operational requirements and environmental conditions. Supplier localization improves responsiveness for maintenance and spares across distributed deployments. Workforce development pathways expand technical competencies supporting advanced system sustainment locally. Local testing facilities shorten validation cycles for platform upgrades and interoperability assessments. Industrial participation programs attract ancillary suppliers supporting components and sub systems domestically. Co development accelerates adaptation of platforms for desert and maritime operating environments. Local integration partners enhance deployment speed and coordination with agency workflows. Localization commitments strengthen procurement confidence through improved lifecycle support assurances.

Smart city and critical infrastructure security projects

Urban modernization initiatives embed detection networks into smart infrastructure management frameworks citywide. Sensor fusion enhances situational awareness across traffic management and public safety operations. Data integration enables predictive risk modeling supporting proactive security planning across districts. Interoperable platforms connect municipal operations centers with national command networks seamlessly. Public venue modernization incorporates portable systems for event security and crowd management readiness. Infrastructure digitization supports continuous monitoring across utilities and transport corridors. Cross domain analytics improve response prioritization during complex incident scenarios. Smart city architectures facilitate scalable deployment of networked detection nodes across neighborhoods. Policy alignment accelerates procurement approvals for integrated safety technology deployments. Collaborative pilots validate performance across urban environments with high operational complexity.

Future Outlook

The market outlook reflects continued alignment between national resilience priorities and integrated security modernization through 2035. Technology convergence around networked detection, analytics, and command integration will shape procurement decisions. Localization initiatives are expected to deepen industrial participation and sustainment readiness. Interagency interoperability will remain a central design principle for future deployments. Policy frameworks supporting critical infrastructure protection will guide adoption pathways.

Major Players

- Thales Group

- Saab AB

- Rheinmetall AG

- RTX

- Northrop Grumman

- Lockheed Martin

- L3Harris Technologies

- Teledyne FLIR

- Smiths Detection

- Bruker Corporation

- Chemring Group

- Environics Oy

- Kromek Group

- Bertin Instruments

- Rapiscan Systems

Key Target Audience

- Ministry of Defense procurement directorates

- General Directorate of Civil Defense

- Saudi Border Guard command units

- National Guard security procurement offices

- Critical infrastructure operators in energy and utilities

- Transportation authority security divisions

- Investments and venture capital firms

- Government and regulatory bodies with agency names

Research Methodology

Step 1: Identification of Key Variables

Operational capability domains, deployment environments, and threat scenarios were mapped across defense, civil protection, and critical infrastructure contexts. System classes, integration requirements, and sustainment dependencies were structured to define scope boundaries. Regulatory and compliance considerations shaped variable selection across multi-agency deployments.

Step 2: Market Analysis and Construction

Capability categories were organized into application and end use lenses reflecting operational workflows. Deployment density, readiness cycles, and integration pathways informed analytical constructs. Value attribution logic aligned with lifecycle phases across procurement, deployment, and sustainment activities.

Step 3: Hypothesis Validation and Expert Consultation

Assumptions on adoption drivers, integration barriers, and localization impacts were tested through structured consultations with domain specialists and operational planners. Scenario workshops refined threat response pathways and interoperability constraints. Iterative validation improved alignment with operational realities.

Step 4: Research Synthesis and Final Output

Findings were reconciled across capability domains, deployment contexts, and policy frameworks to ensure internal consistency. Analytical insights were synthesized into actionable narratives aligned with procurement and deployment planning needs. Outputs were structured for executive and operational decision making.

- Executive Summary

- Research Methodology (Market Definitions and Scope Delimitation for CBRNE Assets, Threat Taxonomy and Capability Mapping for Saudi Arabia, Bottom-Up Platform and System-Level Market Sizing, Contract Value Attribution and Lifecycle Cost Modeling, Primary Interviews with MOD and Civil Defense Stakeholders, Triangulation Across Import Data and Program Budgets, Assumptions on Readiness Cycles and Localization)

- Definition and Scope

- Market evolution

- Operational deployment pathways

- Ecosystem structure

- Supply chain and channel structure

- Regulatory and standards environment

- Growth Drivers

Modernization of Saudi defense capabilities

Rising focus on critical infrastructure protection

Expansion of civil defense and emergency preparedness programs

Localization and domestic manufacturing initiatives

Major events security requirements

Integration of C4ISR and sensor networks - Challenges

High acquisition and lifecycle costs

Complex integration with legacy systems

Dependence on foreign technology suppliers

Stringent certification and compliance requirements

Skills and training gaps for advanced systems

Procurement cycle delays - Opportunities

Localization and technology transfer programs

Smart city and critical infrastructure security projects

Growth of unmanned and remote sensing platforms

Upgrades of border and maritime security

Public-private partnerships for emergency response

Regional export potential - Trends

Shift toward networked and interoperable systems

Adoption of AI-assisted detection and analytics

Miniaturization of sensors and portable platforms

Increased use of unmanned systems in hazardous environments

Lifecycle service and support contracts growth

Emphasis on multi-threat detection platforms - Government Regulations

- SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Value, 2020–2025

- By Volume, 2020–2025

- By Installed Base, 2020–2025

- By Average Selling Price, 2020–2025

- By Fleet Type (in Value %)

Fixed installations

Mobile platforms

Portable units

Unmanned systems - By Application (in Value %)

Detection

Identification

Decontamination

Protection

Continuous monitoring

Training and simulation - By Technology Architecture (in Value %)

Sensor-based systems

Spectroscopy-based systems

PCR and immunoassay platforms

Robotics-integrated solutions

Networked command and control

AI-enabled analytics - By End-Use Industry (in Value %)

Military and armed forces

Civil defense and emergency services

Homeland security and border protection

Oil and gas and critical infrastructure

Healthcare emergency preparedness

Transportation hubs and public venues - By Connectivity Type (in Value %)

Standalone systems

Wired networked systems

Wireless networked systems

SATCOM-enabled systems

Secure tactical networks - By Region (in Value %)

Central Region

Eastern Region

Western Region

Northern Region

Southern Region

- Market structure and competitive positioning

Market share snapshot of major players - Cross Comparison Parameters (Product portfolio breadth, Detection accuracy and response time, System interoperability, Localization and offset commitments, Lifecycle support capabilities, Pricing and contract models, Compliance and certifications, Delivery and integration track record)

- SWOT Analysis of Key Players

- Pricing and Commercial Model Benchmarking

- Detailed Profiles of Major Companies

Thales Group

Saab AB

Rheinmetall AG

RTX (Raytheon)

Northrop Grumman

Lockheed Martin

L3Harris Technologies

Teledyne FLIR

Smiths Detection

Bruker Corporation

Chemring Group

Environics Oy

Kromek Group

Bertin Instruments

Rapiscan Systems

- Demand and utilization drivers

- Procurement and tender dynamics

- Buying criteria and vendor selection

- Budget allocation and financing preferences

- Implementation barriers and risk factors

- Post-purchase service expectations

- By Value, 2026–2035

- By Volume, 2026–2035

- By Installed Base, 2026–2035

- By Average Selling Price, 2026–2035