Market Overview

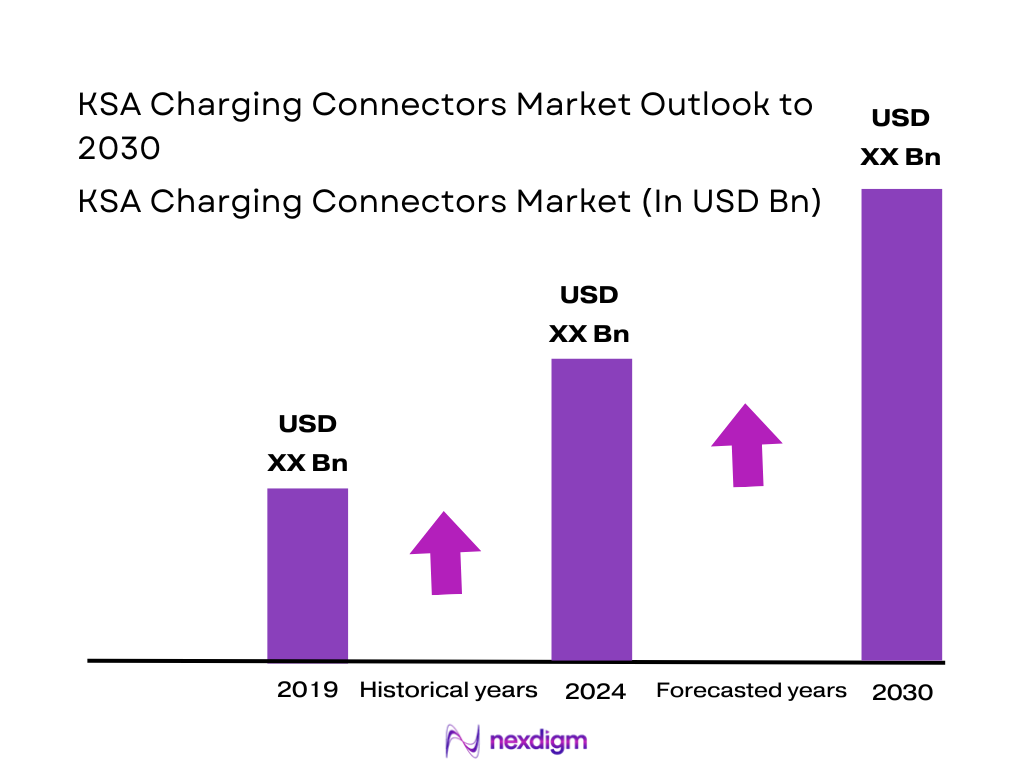

The KSA Charging Connectors Market, proxied against the country’s EV charging infrastructure value, stands at about USD ~ million for the latest reported base year, driven by Vision 2030 decarbonization goals and rapid infrastructure build-out. This infrastructure pool is projected to rise toward USD ~ million over the current decade, supported by a national roll-out of 5,000 fast chargers at 1,000 locations under EVIQ. The network has already expanded from roughly 285 public charging points in the preceding year, underscoring accelerating connector deployment.

Northern and Central regions, anchored by Riyadh, lead the KSA Charging Connectors Market because they concentrate population, corporate HQs and Vision 2030 flagship projects such as NEOM-linked corridors and smart city districts. These regions as the largest for charging infrastructure, reflecting early pilot sites, government offices, premium residential communities and the first public fast-charging hubs, including ROSHN Front. Secondary hubs such as Jeddah and Dammam follow, supported by dense road networks, airports, tourism, retail destinations and early CPO activity.

Market Segmentation

By Connector Type

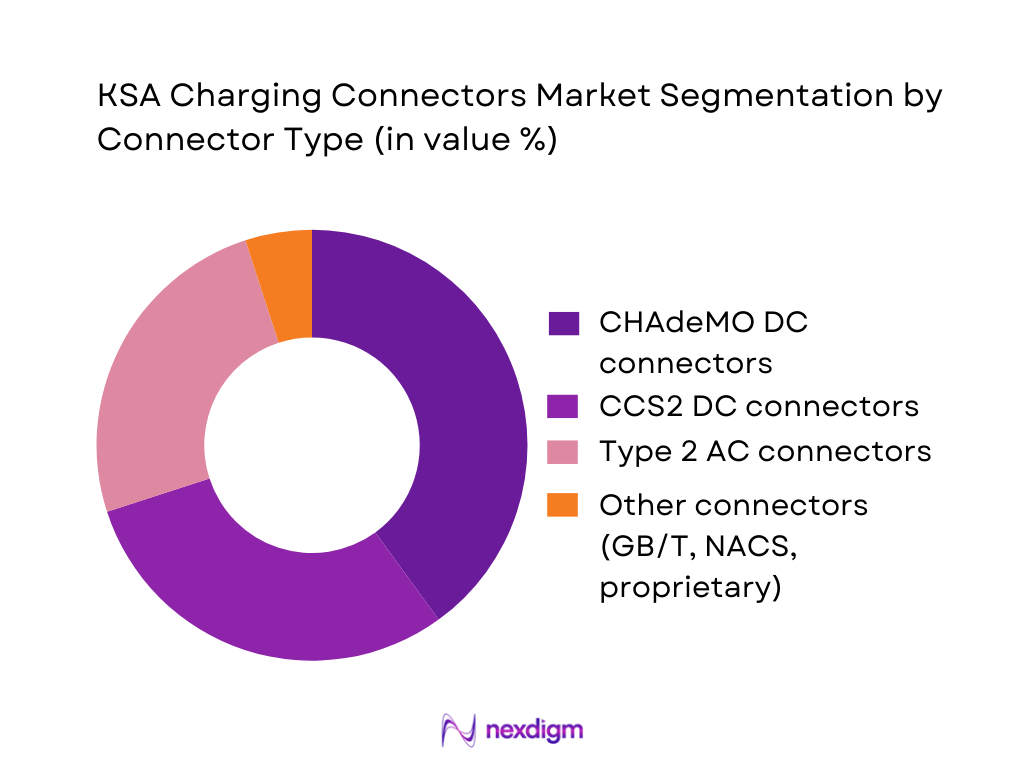

The KSA Charging Connectors Market is segmented by connector type into Type 2 AC connectors, CCS2 DC fast connectors, CHAdeMO DC fast connectors, and other formats (including GB/T and proprietary systems such as Tesla/NACS used via adapters). Currently, CHAdeMO connectors hold the dominant share under this segmentation, reflecting their early adoption by Japanese OEMs and widespread use in existing fast-charging sites. CHAdeMO dominates KSA charging stations by connector type, with CCS2 and Type 2 AC rapidly catching up as European and Chinese OEMs ramp up launches and CPOs migrate toward globally harmonized standards.

CHAdeMO’s leading position in the KSA Charging Connectors Market is linked to early Japanese OEM activity, including Nissan-based fleets and imported models that anchored the first fast-charging corridors. CPOs and utilities initially standardized on CHAdeMO to ensure rapid roll-out, supported by proven hardware and robust DC architectures. As a result, many legacy fast-charging locations in urban Riyadh and on key inter-city routes feature dual-gun CHAdeMO-centric pedestals.

By Installation Environment

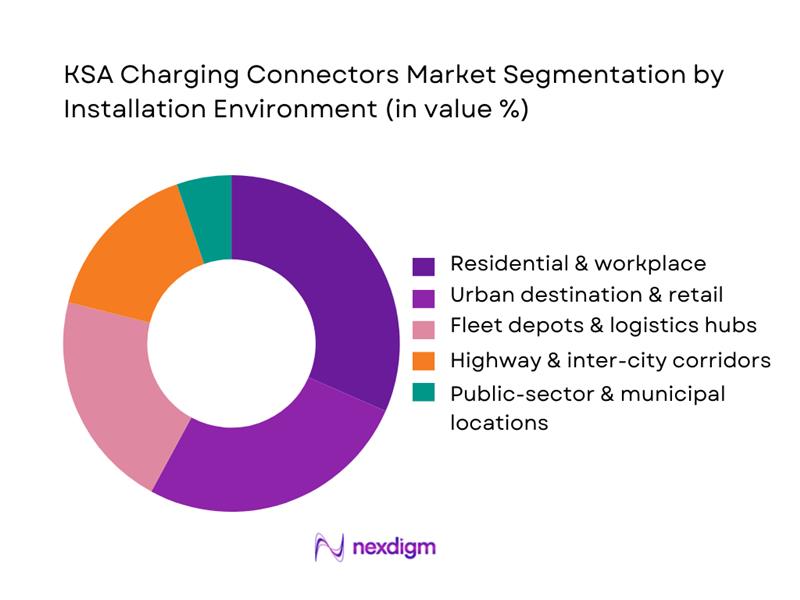

Residential & workplace connectors dominate the KSA Charging Connectors Market because early EV adoption is heavily skewed toward affluent urban households and corporate fleets seeking predictable, overnight and office-hours charging. As EV ownership spreads in Riyadh, Jeddah and Dammam, villa compounds, premium apartments and Class-A offices are integrating multi-socket Type 2 and CCS2 pedestals into basements and shaded parking. Residential charging minimizes range anxiety where public network density is still limited—Just over a hundred formal charging stations nationwide, with long desert stretches still underserved—making home and office connectors the backbone of daily charging patterns while public fast-charging acts as a range-extension layer.

Competitive Landscape

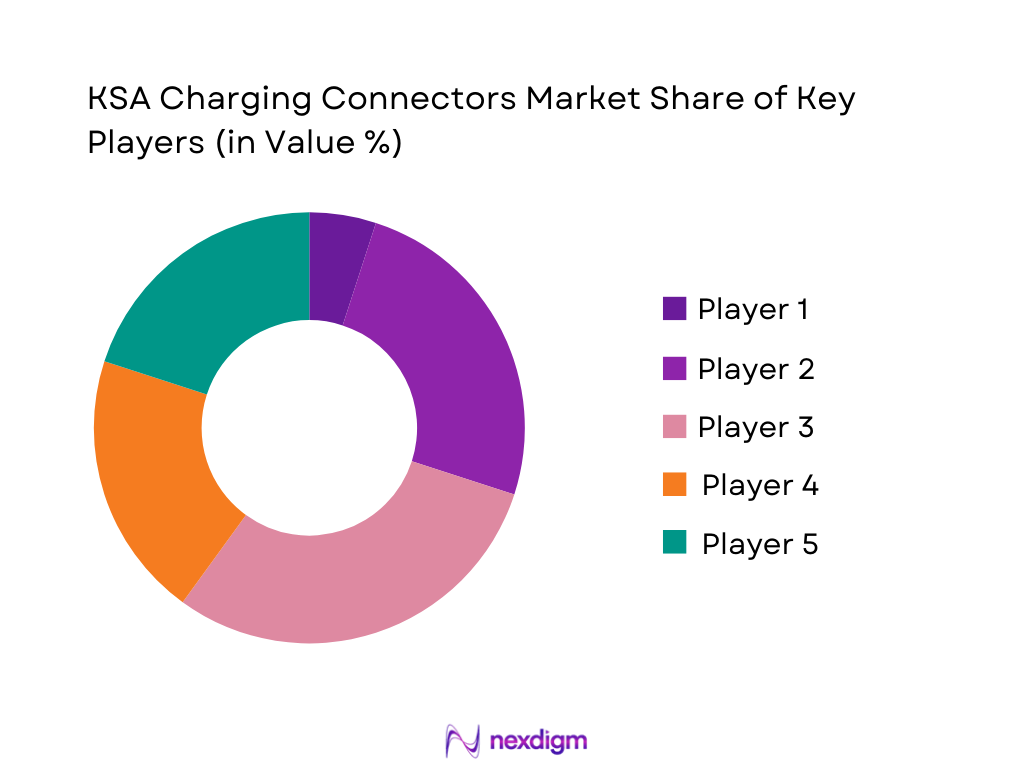

The KSA Charging Connectors Market is shaped by a blend of local champions and global e-mobility majors. Electromin operates one of the largest charging networks, with over 200 locations, while EVIQ, the PIF–Saudi Electricity Company JV, is building the first Kingdom-wide rapid-charging network targeting 5,000 fast chargers by 2030. These domestic platforms are complemented by hardware and connector portfolios from ABB E-mobility, alfanar’s alfaCharge range, and Siemens Smart Infrastructure, which supply multi-standard AC/DC hardware optimized for harsh climate operation. Competition centers on connector standard breadth, maximum power ratings, grid-integration software, and local service capability.

| Company | Establishment Year | Headquarters | Connector Portfolio Focus (AC/DC) | Dominant Connector Standards in KSA | Max Power Offering (Typical) | KSA Network / Role | Smart Features & Protocols | Localization / Manufacturing Footprint |

| Electromin | 2011 | Jeddah, Saudi Arabia | ~ | ~ | ~ | ~ | ~ | ~ |

| Electric Vehicle Infrastructure Company (EVIQ) | 2023 | Riyadh, Saudi Arabia | ~ | ~ | ~ | ~ | ~ | ~ |

| alfanar (alfaCharge) | 1976 | Riyadh, Saudi Arabia | ~ | ~ | ~ | ~ | ~ | ~ |

| ABB E-mobility | 2010 | Zurich, Switzerland | ~ | ~ | ~ | ~ | ~ | ~ |

| Siemens Smart Infrastructure (eMobility) | Division since 2019 (Siemens legacy 1847) | Zug, Switzerland | ~ | ~ | ~ | ~ | ~ | ~ |

KSA Charging Connectors Market Analysis

Growth Drivers

Vision-Linked EV Adoption Targets and Public Infrastructure Plans

Saudi Arabia’s Vision-led mobility agenda underpins long-term demand for charging connectors. The Kingdom’s GDP reached about USD ~ trillion in current prices, providing fiscal space for large infrastructure programs that include EV charging networks. Population has climbed to roughly ~ million residents, with over four-fifths living in urban areas, concentrating demand for urban charging hubs. Saudi Arabia has set a target to raise EV adoption from about 1 in 100 vehicles to 30 in 100 within a few years, while expanding the public charging network from just 101 stations in operation in 2024 to 5,000 nationwide, as highlighted in recent government-linked disclosures and media briefings. This combination of national EV targets, fiscal capacity and explicit charger roll-out goals creates a clear, policy-anchored runway for high-reliability AC and DC connector demand across highways, cities and new giga-projects.

OEM Launch Pipelines and EV Model Mix in KSA

The KSA charging connectors market is increasingly shaped by OEM launch activity and vehicle mix. As of 2024, only 101 public charging stations served a light-vehicle fleet of more than ~ million registered and roadworthy vehicles in the Kingdom, underscoring how early EV penetration still is relative to the overall parc. In the twelve months before Tesla’s official launch, the entire Saudi market sold only about 2,000 EVs, according to media reports quoting official and industry data, compared with hundreds of thousands of internal-combustion vehicles registered in the same year. At the same time, Saudi-backed Lucid is building a plant with planned annual capacity of up to 150,000 vehicles, while global OEMs such as BYD, Zeekr and Tesla have all established sales footprints in the Kingdom (AsiaE, Reuters). A more diversified EV line-up—ranging from premium sedans to pickups and Chinese mass-market models—drives demand for multi-standard connectors (CCS, CHAdeMO, GB/T, NACS) at public, residential and depot sites, increasing complexity and volume requirements across connector form factors.

Challenges

Grid Capacity, Feeder Constraints and Peak Load Clustering

Saudi Arabia’s rapidly growing power demand is a structural constraint for dense fast-charging roll-outs. The Saudi Electricity Company (SEC) reports that peak load on its grid reached about 72.9 GW in the first half of 2024, up roughly 9.5% year-on-year, with electricity consumption hitting 146 TWh over the same period. Total grid-connected generation capacity increased to around 92.2 GW in 2024, of which 56.4 GW is directly owned by SEC. High-power charging hubs in dense urban districts or along already stressed feeders can create localized peaks that are difficult to accommodate without costly upgrades to substations and medium-voltage lines. SEC is planning capital expenditures of roughly SAR ~ billion over six years to reinforce generation, transmission and distribution infrastructure, but prioritizing where and when to allocate capacity among industrial, residential and transport loads remains a major planning challenge for connector OEMs and charge-point operators targeting fast-growth nodes.

Standard Fragmentation and Interoperability

Standard fragmentation is emerging as a significant friction point for Saudi charging-connector deployment. As of 2024, the Kingdom had only 101 public EV charging stations, compared with 261 in the UAE despite the latter’s population being roughly one-third of Saudi Arabia’s, highlighting how sparse and city-concentrated the network remains. At the same time, the registered vehicle fleet exceeded ~ million units in 2024, with more than one million new registrations that year alone. Newly launched brands span American (Tesla), Chinese (BYD, Zeekr) and Saudi-backed Lucid models, each historically aligned to different connector standards—CCS, GB/T variants, proprietary fast-charging systems and, potentially, NACS in future. For connector manufacturers and CPOs, this multiplicity raises hardware and software costs, requires multi-standard dispensers and roaming-compatible back ends, and complicates long-distance travel where even a 559-mile highway between Riyadh and Mecca currently lacks a single charger, according to recent media reporting based on official data.

Opportunities

High-Power Corridors and Logistics Depot Connectors

Saudi Arabia’s ambition to become a global logistics hub creates a strong opportunity for high-power corridor and depot charging connectors. Under the National Transport and Logistics Strategy, targets include handling ~ million air passengers and about ~ million tons of air cargo annually by the end of the decade, while rolling out 59 logistics zones. Recent summaries of logistics performance show road networks moving around ~ million tons of goods annually and about ~ million rail freight tons, with ~ million tons of metals and chemicals alone moving through the system. At the same time, parcel-delivery volumes surpassed ~ million items in a single quarter in 2025, demonstrating the rapid scaling of last-mile logistics. Building megawatt-scale charging hubs along key freight corridors—linking ports, airports, industrial cities and land ports—will require connector systems capable of supporting future Megawatt Charging System (MCS) standards and high-throughput CCS for medium-duty trucks, positioning specialized connector suppliers and integrators to capture long-duration, utility-linked contracts.

Bus, Truck and Depot Charging Connectors

Public-transport and fleet modernization programs open a dedicated opportunity layer around depot charging connectors. GASTAT data indicate that total public-bus ridership in 2023 exceeded ~ million passengers, with ~ million within cities and about ~ million on intercity routes, supported by roughly ~ million bus journeys in that year. One major operator alone, SAPTCO, has prepared a fleet of 129 modern buses supported by four dedicated accommodation and maintenance centers to serve approximately ~ million passengers annually on long-distance routes. In parallel, Riyadh’s new metro system, spanning 176 km with 85 stations and a daily capacity of ~ million passengers, is integrated with more than 80 bus routes and 842 buses to provide first- and last-mile connectivity (Le Monde – Riyadh Metro). As municipal authorities pilot electric bus lines and logistics operators explore battery-electric trucks for dense urban and pilgrimage flows—such as the more than one million worshipers that can gather in the Two Holy Mosques area during peak Ramadan and Hajj periods, supported by fleets that already include around 2,000 electric vehicles in some operations —there is clear scope for high-duty connectors optimized for depot charging, smart load management and harsh-climate uptime, anchoring long-term recurring demand beyond private-car charging alone.

Future Outlook

Over the next six years, the KSA Charging Connectors Market is expected to expand rapidly, underpinned by Vision 2030 transport decarbonization, OEM model launches and large-scale infrastructure roll-outs across highways and smart cities. The market will increasingly shift from pilot deployments to dense, commercially viable networks in Northern & Central corridors and tourism hubs such as the Red Sea coast. Investments by PIF, utilities, oil-marketing companies and global OEMs will push the ecosystem toward multi-standard, high-power connectors with strong digital and grid-integration capabilities, while local manufacturing deepens for cables, guns and pedestals.

Major Players

- Electromin

- Electric Vehicle Infrastructure Company

- alfanar

- ABB E-mobility

- Siemens Smart Infrastructure

- Schneider Electric Saudi Arabia

- CITA EV Charger

- Tesla, Inc.

- BYD

- Lucid Group

- EVBox

- Wallbox Chargers

- Delta Electronics EV Charging Solutions

- CATEC Mobility

Key Target Audience

- Charging point operators (CPOs) and e-mobility service providers

- Utilities and grid operators

- Oil & gas forecourt and retail fuel operators

- Real-estate developers, mall owners and hospitality groups

- Fleet and logistics operators

- Vehicle OEMs and authorized dealer networks

- Investments and venture capitalist firms

- Government and regulatory bodies

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map for the KSA Charging Connectors Market, covering CPOs, utilities, OEMs, hardware vendors, EPCs and regulators. Extensive desk research across syndicated reports, regulatory portals and OEM collateral is used to define critical variables such as installed chargers, connector counts per site, standard mix, power bands and site archetypes. This creates the baseline taxonomy for connectors, differentiating AC vs DC, CCS2 vs CHAdeMO vs Type 2, and public vs depot vs residential environments.

Step 2: Market Analysis and Construction

In this phase, historical data for EV sales, charging-infrastructure investments and public charging points is compiled from the sources. Top-down models estimate connector demand per vehicle and per kWh delivered, while bottom-up models reconstruct connector counts from site maps, tender announcements and OEM partnerships. Both approaches generate revenue estimates by multiplying connector volumes by typical hardware price bands and factoring in multi-gun configurations on high-power chargers.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses on dominant connector standards, leading installation environments and future power-band shifts are stress-tested through interviews with CPOs, hardware vendors, utilities, fleet operators and real-estate developers. These consultations, typically conducted via structured calls or online discussions, validate assumptions on connector replacement cycles, uptime, derating in high temperature conditions and evolving procurement preferences. Insights on policy implementation, financing structures and localization plans are integrated into the model to refine growth forecasts and segment shares.

Step 4: Research Synthesis and Final Output

The final phase triangulates quantitative models and expert inputs to produce a coherent view of the KSA Charging Connectors Market. Connector volumes, revenues and segmentation splits are cross-checked against EV adoption trajectories, planned highway corridors and public announcements (such as EVIQ’s 5,000 fast-charger target) to ensure internal consistency. The output is synthesized into an investor-ready narrative, with clear articulation of market size, CAGR, connector-type and environment segmentation, competitive landscape, and actionable white-space opportunities for hardware vendors, CPOs and infrastructure investors.

- Executive Summary

- Research Methodology (Market Definition and Scope for Charging Connectors, Connector Taxonomy and Technical Classifications, Data Sources, Assumptions and Normalization Rules, Top-Down Sizing: EV Parc, Kilometer Driven, kWh Demand and Connector Need, Bottom-Up Sizing: Site Audits, Charger Count, Outlet Count and Power Bands)

- Definition and Scope of Charging Connectors within EV Infrastructure

- Evolution of KSA EV and Charging Ecosystem

- Timeline of Connector Standards and OEM Adoption

- Business Cycle and Investment Horizon for Connector Assets

- Supply Chain and Value Chain Mapping for Connectors

- Regulatory and Standards Landscape (SASO, IEC, OCPP, ISO 15118 Snapshot)

- Growth Drivers

Vision-Linked EV Adoption Targets and Public Infrastructure Plans

OEM Launch Pipelines and EV Model Mix in KSA

Fleet and Public Transport Electrification Programs

Real-Estate, Hospitality and Retail Destination Charging Initiatives - Challenges

Grid Capacity, Feeder Constraints and Peak Load Clustering

Standard Fragmentation and Interoperability

Harsh Climate, Dust Ingress and Connector Durability Issues

Financing, Payback and Asset Utilization Risks - Opportunity

High-Power Corridors and Logistics Depots

Bus, Truck and Depot Charging Connectors

Real-Estate, Commercial and Industrial Campus Connectors

Software-Defined, Smart and V2G-Ready Connector Opportunities - Product and Technology Trends

- Government Regulations and Standards

- Grid Impact, Load Management and V2G Readiness

- SWOT Analysis of KSA Charging Connectors Market

- Stakeholder and Ecosystem Mapping

- Porter’s Five Forces Analysis for Charging Connectors

- By Revenue, 2019-2024

- By Connector Outlets and Ports, 2019-2024

- By Number of Charging Points, 2019-2024

- Throughput and Utilization Metrics, 2019-2024

- Average Connector Power Rating and Mix by Power Class, 2019-2024

- By Connector Standard (in Value %)

Type 1

Type 2

CCS2

CHAdeMO

GB/T

- By Charging Mode and Power Band (in Value %)

≤7 kW

7–22 kW

22–50 kW

50–150 kW

>150 kW

- By Installation Environment (in Value %)

Residential

Workplaces

Retail & Destination

Highway Corridors

Fleet Depots

- By Ownership / Ecosystem Node (in Value %)

Utilities

CPOs

Oil & Gas Forecourts

Real-Estate Developers

OEM Networks

- By Source of Manufacturing and Supply (in Value %)

Fully Imported

Semi-Knocked Down

Local Assembly

Fully Localized Connectors

- By Region (in Value %)

Riyadh & Central

Makkah & Western Corridor

Eastern Province

Southern Corridor

Northern Corridor

- Market Share of Major Players by Connector Revenue

Market Share by Connector Standard and Power Band - Cross Comparison Parameters (Company Overview, Connector Standard Portfolio & AC/DC Mix, Maximum Power Rating per Outlet and High-Power Connector Count, Installed Base of Connectors and Sites in KSA, Compliance with SASO/IEC/OCPP/ISO 15118, Thermal Management and Uptime in High-Temperature Conditions, Smart Charging & V2G/Load Management Capabilities, Localization Level, Service Hubs and Spare Parts, Commercial Model Flexibility – CAPEX, Lease, Revenue-Share, Subscription

- SWOT Analysis of Major Players in KSA Charging Connectors

- Pricing and Commercial Model Analysis

- Detailed Profiles of Major Companies

Electromin

Electric Vehicle Infrastructure Company

Alfanar / alfaCharge

ABB E-mobility

Siemens Smart Infrastructure

Schneider Electric

CITA EV Charger

Tesla Supercharger

BYD Charging and Connector Solutions

XCharge

Wallbox Chargers

EVBox

Delta Electronics EV Charging Solutions

Saudi Electricity Company

- Connector Demand and Utilization by End-User Archetype

- Procurement Criteria and Technical Specifications by Segment

- Budgeting, TCO and Payback Expectations for Connector Investments

- Service-Level, Uptime and Warranty Expectations

- Digital Journey: Discovery, Roaming, Billing and Customer Experience at the Connector

- By Revenue, 2025-2030

- By Connector Outlets and Ports, 2025-2030

- By Number of Charging Points, 2025-2030

- Throughput and Utilization Metrics, 2025-2030

- Average Connector Power Rating and Mix by Power Class, 2025-2030