Market Overview

The KSA combat helmet market current size stands at around USD ~ million, reflecting ongoing procurement aligned with defense and internal security requirements. Recent operational cycles indicate equipment refresh programs supporting field deployments and training rotations, with certification approvals enabling standardized configurations across protection levels. Adoption rates improved following evaluations of modular rails and compatibility, while fielded systems emphasize ergonomics and weight reduction. Standardization protocols now govern approved variants, supporting interoperability across diverse operational environments and mission profiles.

Demand concentration remains strongest across major defense hubs and logistics corridors, where mature maintenance infrastructure supports rapid deployment readiness. Urban command centers and border regions exhibit sustained procurement intensity due to training density and operational requirements. Industrial clusters enable localized assembly, shortening lead times and improving lifecycle support availability. Policy frameworks encouraging domestic participation strengthen ecosystem maturity, while certification pathways accelerate integration with communications and night-vision systems. Regional testing facilities and centralized depots reinforce resilience across supply chains and sustainment networks.

Market Segmentation

By Application

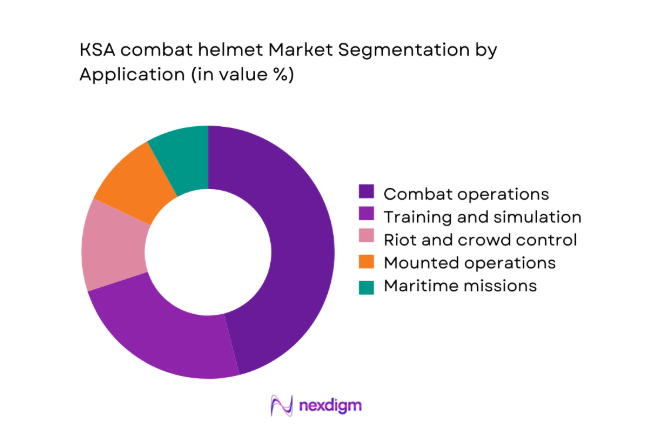

Operational deployment dominates procurement as mission-ready configurations prioritize ballistic protection, modular accessory integration, and compatibility with communications. Training allocations follow, driven by rotational cycles, simulation readiness, and wear-rate management across field exercises. Specialized riot-control and maritime missions adopt tailored variants emphasizing impact protection, moisture resistance, and accessory interoperability. Lifecycle replacement schedules concentrate demand within operational units, while training pools absorb standardized variants for cost-efficient rotation. Procurement frameworks favor scalable configurations supporting multiple mission profiles, reducing inventory complexity and improving sustainment efficiency across diverse operational theaters and readiness levels. Field trials and certification pathways accelerate adoption for application-specific requirements without fragmenting procurement channels.

By Technology Architecture

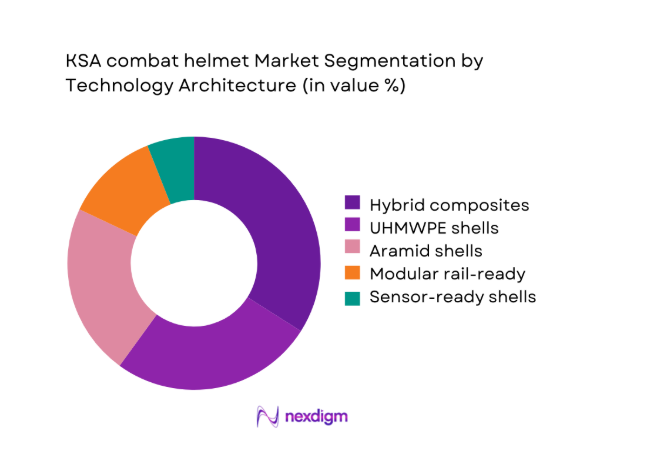

Hybrid composite architectures lead adoption due to balanced protection-to-weight performance and modularity readiness for accessories. UHMWPE variants expand where mobility and endurance are prioritized, while aramid remains prevalent within standardized training inventories. Modular rail systems drive platform convergence, enabling rapid configuration across missions without increasing inventory diversity. Sensor-ready shells gain traction for integrated communications and power routing, improving situational awareness. Certification pipelines favor architectures supporting incremental upgrades, reducing replacement cycles. Procurement teams prioritize architectures enabling common spares and maintenance processes, strengthening fleet-level sustainment while aligning with domestic manufacturing capabilities and quality compliance frameworks.

Competitive Landscape

The competitive environment features a mix of established manufacturers and localized production partners supporting qualification, assembly, and lifecycle services. Differentiation centers on certification readiness, modular integration capability, delivery reliability, and sustainment support within defense procurement frameworks.

| Company Name | Establishment Year | Headquarters | Formulation Depth | Distribution Reach | Regulatory Readiness | Service Capability | Channel Strength | Pricing Flexibility |

| 3M Ceradyne | 1967 | United States | ~ | ~ | ~ | ~ | ~ | ~ |

| Galvion | 2002 | Canada | ~ | ~ | ~ | ~ | ~ | ~ |

| Gentex Corporation | 1894 | United States | ~ | ~ | ~ | ~ | ~ | ~ |

| Revision Military | 2001 | United States | ~ | ~ | ~ | ~ | ~ | ~ |

| ArmorSource | 2005 | United States | ~ | ~ | ~ | ~ | ~ | ~ |

KSA combat helmet Market Analysis

Growth Drivers

Rising defense and internal security budgets

Budget expansions increased equipment refresh rates across formations, improving readiness and modernization coverage during 2024 operational cycles. Procurement authorizations supported ~ units across rotational training pools, enhancing standardized protection across deployments during 2025 exercises. Multi-year planning improved scheduling certainty for suppliers, enabling predictable production capacity utilization across programs. Program governance emphasized interoperability across units, streamlining configuration approvals and certification pathways. Incremental funding supported modular accessories adoption, expanding mission adaptability without fragmenting inventory holdings. Procurement calendars aligned with training schedules, reducing downtime and improving readiness across operational brigades. Logistics planners improved spare provisioning, reducing turnaround times for damaged helmets during exercises. Contract frameworks incentivized local assembly participation, strengthening resilience within sustainment networks. Quality audits reinforced compliance with protection standards, improving acceptance rates across issued equipment. Program oversight improved lifecycle tracking, enabling data-driven replacement planning across operational inventories.

Modernization of soldier systems and night-fighting capability

Integration initiatives accelerated compatibility between helmets and optics during 2024 field validations across operational units. Night-vision interoperability requirements standardized mounting interfaces, reducing configuration variability during deployment preparation cycles. Power routing readiness improved sensor integration without compromising protection performance during extended operations. Training curricula incorporated helmet-mounted systems proficiency, increasing utilization across ~ deployments during 2025 rotations. Standard kits reduced setup times, improving mission readiness during rapid mobilization scenarios. Modular rails enabled rapid reconfiguration for urban and desert environments across operational theaters. Certification pathways shortened approval timelines for integrated accessories, improving adoption momentum. Sustainment teams optimized maintenance protocols for mounted components, reducing failure rates during exercises. Interoperability testing improved cross-unit compatibility, minimizing configuration conflicts during joint operations. Feedback loops from trials refined ergonomic requirements, improving comfort during prolonged night operations.

Challenges

Stringent qualification and certification requirements

Qualification processes require extensive ballistic testing, extending approval timelines for new variants across procurement cycles. Certification documentation increases administrative overhead, slowing onboarding of modular upgrades during deployments. Compliance audits require repeated validation after design adjustments, delaying fielding schedules. Environmental testing mandates add complexity for maritime and desert operational readiness assessments. Documentation harmonization across agencies introduces delays during multi-unit adoption efforts. Testing throughput constraints limit rapid scaling during urgent operational requirements. Requalification cycles following accessory integration increase timelines before operational issuance approvals. Quality assurance staffing constraints affect batch acceptance during peak procurement periods. Audit remediation extends timelines when minor deviations emerge during inspections. Approval dependencies complicate synchronized rollouts across geographically dispersed units.

Price sensitivity in large-volume tenders

Tender frameworks emphasize cost efficiency, constraining adoption of premium materials despite performance advantages. Budget ceilings influence configuration choices, limiting optional integrations during procurement cycles. Volume-driven pricing negotiations pressure suppliers to streamline features without compromising certification requirements. Cost optimization requirements favor standardized variants over specialized mission configurations. Procurement committees prioritize total lifecycle considerations, restricting incremental upgrades across deployments. Cost scrutiny lengthens tender evaluations, delaying award timelines during operational urgency periods. Suppliers balance compliance investments with pricing expectations, constraining innovation velocity. Contractual penalties for overruns discourage rapid customization during urgent field requests. Financial controls prioritize predictable unit configurations, limiting experimentation during trials. Pricing rigidity complicates phased upgrades aligned with modernization objectives.

Opportunities

Local assembly and technology transfer partnerships

Localization programs incentivize assembly partnerships, strengthening domestic capabilities across manufacturing and quality assurance functions. Technology transfer agreements improve process maturity for composite fabrication during 2024 pilot lines. Workforce training programs enhance certification readiness, accelerating compliance for locally assembled variants. Local sourcing reduces lead times, improving responsiveness during operational surges across 2025 rotations. Partnerships enable co-development pathways for modular accessories aligned with operational requirements. Industrial participation supports sustainment hubs near deployment corridors, reducing logistics friction. Quality systems adoption elevates acceptance rates for locally assembled helmets. Localized testing facilities shorten certification cycles for configuration updates. Collaborative R&D refines ergonomic designs tailored to operational climates. Policy alignment strengthens supplier commitment to long-term ecosystem development.

Upgrade cycles toward modular and integrated helmets

Lifecycle planning emphasizes retrofit pathways, enabling incremental upgrades without full replacement across inventories. Modular interfaces support phased integration of communications components during training cycles. Upgrade kits standardize mounting solutions, reducing compatibility risks across operational units. Retrofit programs align with maintenance windows, minimizing downtime during readiness preparation. Configuration libraries enable standardized upgrade packages for different mission profiles. Accessory integration improves situational awareness while preserving protection performance. Training modules expand proficiency with upgraded configurations across operational rotations. Data from trials informs upgrade prioritization for high-utilization units. Inventory management systems track upgrade readiness across distributed depots. Phased upgrades balance operational continuity with modernization objectives.

Future Outlook

The market trajectory reflects sustained modernization priorities aligned with localization policies and operational readiness goals. Integration with soldier systems will deepen as certification pathways mature and modular standards converge. Procurement practices will favor scalable configurations supporting rapid mission adaptation. Domestic assembly capabilities are expected to strengthen ecosystem resilience, while sustainment infrastructure expands near deployment corridors. Interoperability standards will continue shaping configuration choices across services through the outlook period.

Major Players

- 3M Ceradyne

- Galvion

- Gentex Corporation

- Revision Military

- ArmorSource

- BAE Systems

- Rheinmetall

- Thales Group

- Elbit Systems

- Saudi Military Industries

- MSA Safety

- Avon Protection

- Point Blank Enterprises

- DuPont

- Honeywell

Key Target Audience

- Defense procurement authorities within Ministry of Defense

- Saudi Arabian National Guard procurement divisions

- Ministry of Interior procurement agencies

- Border Guard procurement departments

- Military logistics and sustainment commands

- Prime system integrators and local manufacturing partners

- Program management offices for soldier modernization

- Investments and venture capital firms

Research Methodology

Step 1: Identification of Key Variables

Core variables were defined around protection standards, configuration architectures, interoperability requirements, and lifecycle replacement patterns. Operational usage contexts, certification constraints, and sustainment pathways were mapped. Procurement cycles and localization mandates were incorporated to frame scope boundaries.

Step 2: Market Analysis and Construction

Segment structures were constructed by application and technology architecture aligned with operational use cases. Demand drivers and constraints were mapped to procurement workflows and certification timelines. Scenario logic reflected localization participation and sustainment infrastructure maturity.

Step 3: Hypothesis Validation and Expert Consultation

Assumptions were validated through domain expert consultations across operations, logistics, and quality assurance functions. Field feedback informed ergonomic priorities and integration readiness. Validation cycles refined adoption pathways and configuration feasibility.

- Executive Summary

- Research Methodology (Market Definitions and ballistic helmet taxonomy for KSA forces, Threat-level based segmentation and use-case mapping across services, Bottom-up shipment and installed base modeling from MoD and procurement disclosures, Value attribution using bill-of-materials and ASP ladders by protection level, Primary interviews with KSA defense procurement officials and integrator OEMs, Trade data and tender-tracking triangulation with local assembly output, Assumptions on localization mandates and lifecycle replacement cycles)

- Definition and Scope

- Market evolution

- Operational usage and care pathways

- Ecosystem structure

- Supply chain and channel structure

- Regulatory and standards environment

- Growth Drivers

Rising defense and internal security budgets

Modernization of soldier systems and night-fighting capability

Border security and counterterrorism requirements

Localization and in-Kingdom manufacturing programs

Increased operational tempo and training intensity

Higher threat levels requiring improved ballistic protection - Challenges

Stringent qualification and certification requirements

Price sensitivity in large-volume tenders

Supply chain dependence on advanced fibers and resins

Weight-comfort-performance trade-offs

Lengthy procurement cycles and tender delays

Integration complexity with communications and NVG systems - Opportunities

Local assembly and technology transfer partnerships

Upgrade cycles toward modular and integrated helmets

Special forces and elite unit customization programs

Lifecycle replacement and retrofit programs

Exports to neighboring markets from KSA-based production

Add-on accessories and digital soldier ecosystem integration - Trends

Shift toward lighter UHMWPE and hybrid constructions

Growing adoption of modular rails and accessory mounts

Integration with communications and power management

Emphasis on comfort, ergonomics, and heat management

Standardization with NATO and allied protection levels

Increased use of data-driven procurement and trials - Government Regulations

SWOT Analysis

Stakeholder and Ecosystem Analysis

Porter’s Five Forces Analysis

Competition Intensity and Ecosystem Mapping

- By Value, 2020–2025

- By Volume, 2020–2025

- By Installed Base, 2020–2025

- By Average Selling Price, 2020–2025

- By Fleet Type (in Value %)

Infantry and mechanized infantry

Armored vehicle crews

Special operations forces

Border guard and internal security

Law enforcement and riot control - By Application (in Value %)

Ballistic combat operations

Training and simulation

Riot and crowd control

Mounted and vehicular operations

Maritime and amphibious missions - By Technology Architecture (in Value %)

Aramid composite shells

UHMWPE shells

Hybrid aramid-UHMWPE shells

Modular rail and accessory-ready shells

Integrated sensor and power-ready shells - By End-Use Industry (in Value %)

Defense forces

Internal security forces

Civil defense

Private security services

Critical infrastructure protection - By Connectivity Type (in Value %)

Standalone ballistic helmets

NVG and optics-compatible helmets

Communications-integrated helmets

Sensor-enabled helmets

Networked soldier-system helmets - By Region (in Value %)

Central Region

Eastern Region

Western Region

Northern Region

Southern Region

- Market structure and competitive positioning

- Market share snapshot of major players

Cross Comparison Parameters (Protection level, Weight and ergonomics, Modularity and accessory support, Integration readiness, Local content and offset compliance, Pricing and lifecycle cost, Delivery and lead time, After-sales support) - SWOT Analysis of Key Players

- Pricing and Commercial Model Benchmarking

- Detailed Profiles of Major Companies

3M Ceradyne

Galvion

Gentex Corporation

Revision Military

ArmorSource

BAE Systems

Rheinmetall

Thales Group

Elbit Systems

Saudi Military Industries (SAMI)

MSA Safety

Avon Protection

Point Blank Enterprises

DuPont

Honeywell

- Demand and utilization drivers

- Procurement and tender dynamics

- Buying criteria and vendor selection

- Budget allocation and financing preferences

- Implementation barriers and risk factors

- Post-purchase service and upgrade expectations

- By Value, 2026–2035

- By Volume, 2026–2035

- By Installed Base, 2026–2035

- By Average Selling Price, 2026–2035