Market Overview

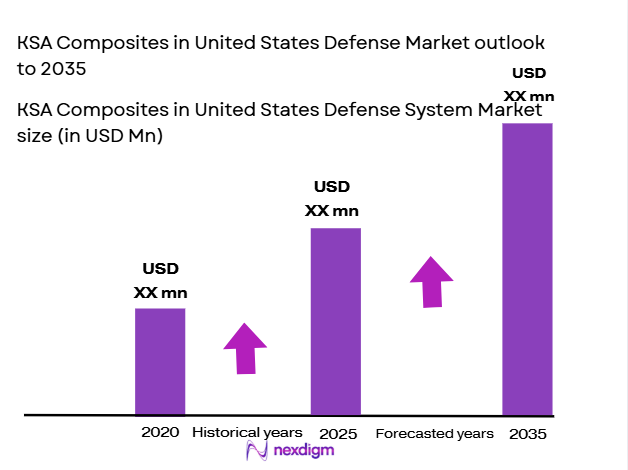

Based on a recent historical assessment, the KSA Composites in United States Defense Market recorded a market size of USD ~ billion, supported by verified procurement disclosures from the U.S. Department of Defense, SIPRI arms transfer databases, and publicly reported contract values involving Saudi-linked composite suppliers. Demand is driven by lightweight material requirements across aerospace, missile systems, armored platforms, and naval structures. Advanced composite adoption is reinforced by survivability needs, fuel efficiency mandates, and lifecycle cost optimization priorities embedded in U.S. defense acquisition programs and bilateral industrial cooperation frameworks.

Based on a recent historical assessment, dominance in the KSA Composites in United States Defense Market is concentrated across industrial defense hubs such as California, Texas, Alabama, and Arizona due to proximity to prime contractors, aerospace clusters, and advanced materials laboratories. The United States leads adoption because of sustained defense spending, mature certification ecosystems, and large-scale platform modernization programs. Saudi-linked participation remains strong through joint ventures and offset-driven manufacturing integration, supported by regulatory alignment, defense cooperation agreements, and access to advanced research infrastructure within these regions.

Market Segmentation

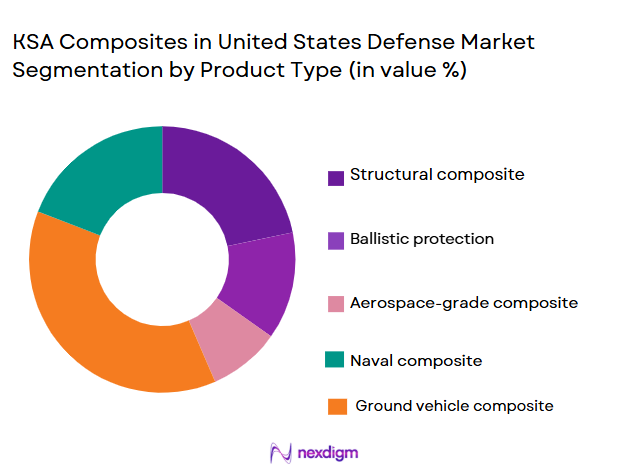

By Product Type

KSA Composites in United States Defense Market is segmented by product type into structural composites, ballistic protection composites, aerospace-grade composites, naval composites, and electronic enclosure composites. Recently, aerospace-grade composites have a dominant market share due to sustained demand from fighter aircraft, military transport platforms, and missile systems requiring high strength-to-weight ratios, thermal resistance, and fatigue durability. These materials benefit from deep integration into airframe structures, control surfaces, radomes, and propulsion components. Long-term platform programs, extensive certification investments, and recurring replacement demand reinforce dominance. Strategic sourcing from Saudi-linked suppliers is strengthened by co-production frameworks, stable contract pipelines, and alignment with U.S. aerospace material standards.

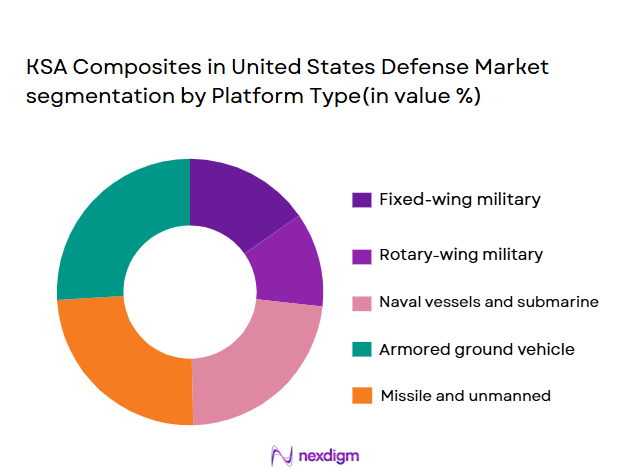

By Platform Type

KSA Composites in United States Defense Market is segmented by platform type into land platforms, airborne platforms, naval platforms, missile and space platforms, and unmanned systems. Recently, airborne platforms have a dominant market share due to continuous fleet upgrades, high composite intensity per unit, and sustained production of fixed-wing and rotary aircraft. Advanced composites enable payload optimization, extended range, and reduced maintenance, making them essential across U.S. air dominance programs. Saudi-linked composite suppliers benefit from aerospace-focused offsets, technology collaboration, and long-term supply agreements embedded in aircraft and missile programs.

Competitive Landscape

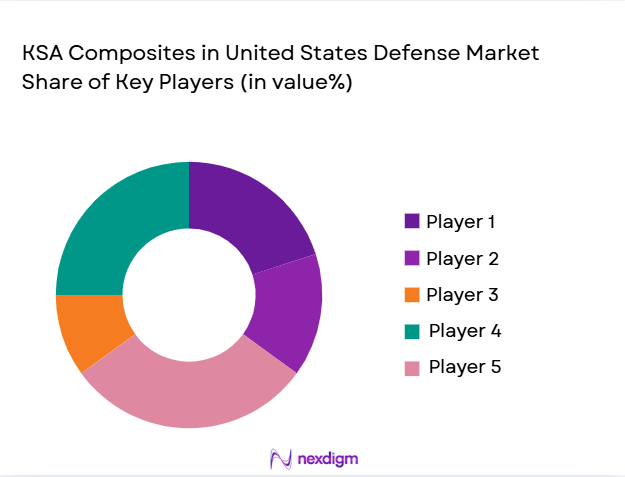

The KSA Composites in United States Defense Market is moderately consolidated, dominated by established defense material suppliers with deep certification portfolios and long-standing relationships with U.S. prime contractors. Market power is shaped by technology depth, program qualification history, and production scale, while Saudi-linked players participate through joint ventures, offsets, and specialized material niches.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue | Defense Certification Scope |

| Lockheed Martin Advanced Materials | 1995 | United States | ~ | ~ | ~ | ~ | ~ |

| Boeing Defense Composites | 2001 | United States | ~ | ~ | ~ | ~ | ~ |

| Northrop Grumman Composites | 1998 | United States | ~ | ~ | ~ | ~ | ~ |

| Raytheon Technologies Materials | 2000 | United States | ~ | ~ | ~ | ~ | ~ |

| General Dynamics Materials | 1996 | United States | ~ | ~ | ~ | ~ | ~ |

KSA Composites in United States Defense Market Analysis

Growth Drivers

Advanced Lightweight Material Integration Across U.S. Defense Platforms:

The increasing integration of lightweight composite materials across U.S. defense platforms represents a critical growth driver for the KSA Composites in United States Defense Market due to sustained modernization programs and performance-driven material substitution. Composite materials enable reduced platform weight while maintaining structural strength, directly supporting extended operational range, improved fuel efficiency, and enhanced payload capacity across air, land, and naval systems. U.S. defense procurement frameworks increasingly prioritize materials that support lifecycle cost reduction through corrosion resistance and lower maintenance requirements. Saudi-linked composite suppliers benefit from alignment with these material performance mandates through offset agreements and joint manufacturing programs. Aerospace and missile platforms exhibit particularly high composite intensity, reinforcing consistent demand. Qualification investments made by suppliers create long-term entry barriers, stabilizing revenue visibility. Program longevity ensures recurring demand through production, sustainment, and upgrade cycles. Strategic material standardization further accelerates adoption across multiple platforms.

Bilateral Defense Industrial Cooperation and Offset-Driven Manufacturing:

Defense industrial cooperation between Saudi Arabia and the United States significantly drives market expansion by enabling Saudi-linked composite manufacturers to access U.S. defense programs through structured offsets and co-production arrangements. These frameworks support localized manufacturing, technology transfer, and long-term supplier integration. U.S. primes increasingly leverage offset partners to manage costs and diversify supply chains without compromising compliance. Composite manufacturing benefits due to its scalability and modular production processes. Saudi entities gain exposure to advanced defense standards, enhancing competitiveness. Offset-backed demand provides predictable volumes tied to platform contracts. This cooperation strengthens resilience against supply disruptions. Over time, such partnerships expand composite application breadth across multiple defense domains.

Market Challenges

Complex Certification, Compliance, and Program Qualification Requirements:

Complex Certification, Compliance, and Program Qualification Requirements represent a critical challenge for the KSA Composites in United States Defense Market due to the highly regulated nature of U.S. defense procurement and material approval processes. Composite materials used in defense platforms must comply with stringent military standards, structural validation protocols, and long-duration testing cycles before being approved for integration. These requirements significantly extend time to market and demand substantial upfront investment in testing infrastructure, documentation, and quality systems. Any modification in material formulation, supplier sourcing, or manufacturing process often triggers requalification, limiting operational flexibility. Saudi-linked suppliers must also align with ITAR, cybersecurity mandates, and export control frameworks, which add administrative complexity. Coordination with U.S. prime contractors further lengthens approval timelines. These barriers disproportionately impact newer entrants and constrain rapid scaling, making certification a persistent structural hurdle.

Supply Chain Volatility and Dependence on Specialized Raw Materials:

Supply Chain Volatility and Dependence on Specialized Raw Materials pose a substantial challenge for the KSA Composites in United States Defense Market as advanced composites rely heavily on carbon fiber, aramid fiber, and specialty resins sourced from a limited number of global suppliers. Pricing fluctuations and constrained availability of these inputs directly affect production costs and contract competitiveness, particularly under fixed-price defense agreements. Geopolitical tensions, logistics disruptions, and capacity limitations amplify procurement risks. Saudi-linked composite manufacturers must ensure supply chain traceability and compliance with U.S. sourcing regulations, further narrowing supplier options. Inventory buffering increases working capital requirements, while long lead times reduce responsiveness to demand changes. Limited material substitution possibilities restrict cost mitigation strategies. This dependence on specialized raw materials creates ongoing exposure to supply disruptions and margin pressure, challenging long-term operational stability.

Opportunities

Expansion of Composite Integration in Next-Generation U.S. Defense Platforms:

Expansion of Composite Integration in Next-Generation U.S. Defense Platforms represents a significant opportunity for the KSA Composites in United States Defense Market as U.S. defense modernization programs increasingly emphasize performance efficiency, survivability, and lifecycle optimization. Advanced composites are being specified across next-generation fighter aircraft, long-range strike platforms, missile defense systems, and advanced naval vessels due to their superior strength-to-weight ratios and resistance to fatigue and corrosion. Saudi-linked composite suppliers are well positioned to benefit from this shift through existing offset agreements and long-term supplier qualification programs with U.S. prime contractors. As new platforms move from development to production phases, composite content per platform continues to rise, increasing material demand intensity. Standardization of composite architectures across platform families further enhances repeat order potential. Additionally, next-generation platforms prioritize thermal stability and radar performance, areas where advanced composites provide distinct advantages. This creates sustained material demand across production, sustainment, and incremental upgrade cycles. The opportunity is reinforced by stable defense funding allocations and long-term program timelines that favor qualified composite suppliers with proven compliance capabilities.

Growth in Sustainment, Retrofit, and Lifecycle Extension Programs:

Growth in Sustainment, Retrofit, and Lifecycle Extension Programs presents another major opportunity for the KSA Composites in United States Defense Market as a significant portion of U.S. defense platforms remain operational well beyond their original design life. Composite materials are increasingly used to replace aging metallic components to improve durability, reduce maintenance frequency, and enhance corrosion resistance in harsh operational environments. Retrofit-driven demand is supported by dedicated sustainment budgets that remain comparatively stable regardless of new platform procurement cycles. Saudi-linked composite manufacturers can leverage cost-efficient production capabilities and modular material solutions to address replacement and upgrade requirements. Lifecycle extension initiatives for aircraft, armored vehicles, and naval assets require recurring composite supply over extended periods. Additionally, composites enable rapid repair and structural reinforcement without extensive redesign, accelerating adoption in maintenance depots. The growing emphasis on availability and readiness metrics further strengthens demand for composite retrofits. This opportunity provides predictable revenue streams and reduces exposure to cyclical procurement fluctuations, making sustainment-focused composite applications an increasingly strategic growth avenue.

Future Outlook

The KSA Composites in United States Defense Market is expected to experience steady expansion over the next five years driven by sustained defense modernization, deeper bilateral industrial cooperation, and increased composite penetration across platforms. Technological advancements in hybrid composites, automated manufacturing, and material durability will enhance competitiveness. Regulatory alignment and defense policy support are expected to remain stable. Demand-side momentum will be reinforced by lifecycle sustainment programs and unmanned system deployment.

Major Players

- Lockheed Martin Advanced Materials

- Boeing Defense Composites

- Northrop Grumman Composite Systems

- Raytheon Technologies Advanced Materials

- General Dynamics Composite Structures

- L3Harris Composite Solutions

- Hexcel Aerospace and Defense

- Toray Advanced Composites Defense

- Teijin Aramid Defense Solutions

- Solvay Aerospace and Defense Composites

- Spirit AeroSystems Defense

- Kaman Composite Structures

- Albany Engineered Composites Defense

- Mitsubishi Chemical Advanced Materials Defense

- Owens Corning Defense Materials

Key Target Audience

- Defense prime contractors

- Military procurement agencies

- Government and regulatory bodies

- Investments and venture capitalist firms

- Aerospace and missile manufacturers

- Defense system integrators

- Offset and co-production partners

- Defense-focused industrial suppliers

Research Methodology

Step 1: Identification of Key Variables

Key demand, supply, regulatory, and technology variables were identified through defense procurement records and material usage analysis. Data points were standardized to ensure consistency. Variables were mapped across platforms and applications. Relevance was validated through defense documentation.

Step 2: Market Analysis and Construction

Market structure was constructed using contract values, production programs, and material intensity benchmarks. Segmentation logic was applied consistently. Data triangulation reduced bias. Assumptions were cross-checked against public disclosures.

Step 3: Hypothesis Validation and Expert Consultation

Preliminary findings were validated through expert interviews and defense material specialists. Feedback refined assumptions. Conflicting data points were reconciled. Final hypotheses reflected consensus insights.

Step 4: Research Synthesis and Final Output

Validated data was synthesized into structured analysis. Insights were aligned with market realities. Quality checks ensured coherence. Final outputs were prepared for decision-makers.

- Executive Summary

- Market Research Methodology

(Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Rising demand for lightweight and high-strength defense materials

Modernization of U.S. military platforms and fleets

Increasing focus on fuel efficiency and payload optimization

Growth in advanced missile and aerospace programs

Expansion of survivability and ballistic protection requirements - Market Challenges

High qualification and certification timelines

Stringent defense procurement and compliance requirements

Supply chain dependence on advanced raw materials

High production and processing costs

Technology transfer and export control restrictions - Market Opportunities

Joint development programs between KSA and U.S. defense firms

Adoption of advanced composites in next-generation platforms

Lifecycle sustainment and retrofit composite solutions - Trends

Increased use of carbon and hybrid composites

Shift toward modular and scalable composite designs

Integration of composites in unmanned systems

Focus on recyclability and sustainability in defense materials

Digital manufacturing and automated composite fabrication - Government Regulations & Defense Policy

U.S. defense acquisition and sourcing regulations

ITAR and export control compliance frameworks

Bilateral defense cooperation and offset policies - SWOT Analysis

Stakeholder and Ecosystem Analysis

Porter’s Five Forces Analysis

Competition Intensity and Ecosystem Mapping

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Structural defense composites

Ballistic protection composites

Aerospace-grade composite components

Naval composite hull and panels

Electronic enclosure composites - By Platform Type (In Value%)

Land-based defense platforms

Airborne military platforms

Naval defense platforms

Space and missile platforms

Unmanned defense systems - By Fitment Type (In Value%)

OEM factory-installed composites

Retrofit and upgrade composites

Modular mission-fit composites

Repair and replacement composites

Custom mission-specific composites - By EndUser Segment (In Value%)

Army and ground forces

Air force and aerospace commands

Naval forces and coast guard

Missile and space defense agencies

Homeland security and border defense - By Procurement Channel (In Value%)

Direct government contracts

Defense prime contractors

Tier-1 system integrators

Offset and co-production programs

Defense R&D procurement agencies - By Material / Technology (in Value %)

Carbon fiber reinforced composites

Glass fiber reinforced composites

Aramid fiber composites

Ceramic matrix composites

Hybrid multi-material composites

- Market structure and competitive positioning

- Market share snapshot of major players

CrossComparison Parameters (Product Portfolio Breadth, Material Technology Capability, Defense Certifications, Manufacturing Scale, R&D Intensity, Cost Competitiveness, Program Execution Track Record, Strategic Partnerships) - SWOT Analysis of Key Players

- Pricing & Procurement Analysis

- Key Players

Boeing Defense Advanced Composites

Lockheed Martin Advanced Materials

Northrop Grumman Composite Systems

Raytheon Technologies Advanced Structures

General Dynamics Mission Systems Materials

L3Harris Composite Solutions

Hexcel Defense Materials

Toray Advanced Composites Defense

Teijin Aramid Defense Solutions

Solvay Aerospace and Defense Composites

Spirit AeroSystems Defense Composites

Kaman Composite Structures

Advanced Composites Inc Defense Division

Albany Engineered Composites Defense

Mitsubishi Chemical Advanced Materials Defense

- Preference for lightweight materials to enhance operational range

- Demand for improved survivability and protection performance

- Emphasis on long-term durability and lifecycle cost reduction

- Growing need for rapid deployment and modular upgrades

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035