Market Overview

As of 2024, the KSA soft gelatin capsules market is valued at USD ~ billion, with a growing CAGR of 5.4% from 2024 to 2030, supported by the booming construction sector and ongoing government infrastructure investments. A review of historical data indicates robust growth, as the market is heavily influenced by rising urbanization and the need for durable construction materials across various applications, including residential and commercial projects.

Dominant cities such as Riyadh, Jeddah, and Dammam lead the KSA concrete block market. Riyadh’s role as the capital city drives significant infrastructure development and housing projects, positioning it as a focal point for concrete block demand. Jeddah and Dammam, being pivotal economic and commercial centers, also contribute substantially to the market due to their strategic locations and growing investments in commercial and industrial developments.

Market Segmentation

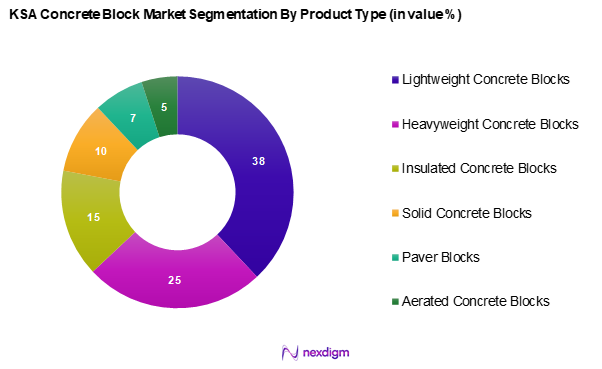

By Product Type

The KSA concrete block market is segmented into lightweight concrete blocks, heavyweight concrete blocks, insulated concrete blocks, solid concrete blocks, paver blocks, and aerated concrete blocks. Currently, lightweight concrete blocks dominate this segment, driven by their superior thermal insulation properties and reduced ship weight, which lowers transportation costs. This growing preference among builders for energy-efficient and cost-effective materials has increased the demand for lightweight blocks in both residential and commercial applications.

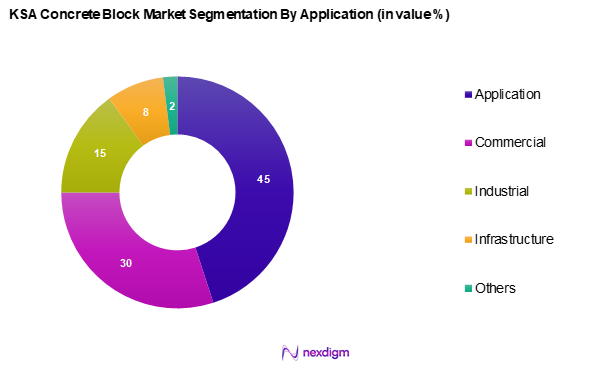

By Application

The KSA concrete block market is segmented into residential, commercial, industrial, infrastructure, and others. The residential segment constitutes the largest share, largely due to the ongoing housing projects driven by government initiatives and increasing urban migration. The demand for affordable housing has led to a surge in construction activity, making this application pivotal in the market landscape.

Competitive Landscape

The KSA concrete block market is dominated by major players like Al Jazeera Factory, Alfanar Building Materials, and Saudi Concrete Products. These companies have established themselves through strong distribution networks and a diverse range of high-quality products, highlighting their significant influence within the market.

| Company | Establishment Year | Headquarters | Major Products | Annual Revenue (USD) | Market Strategy | Manufacturing Capacity |

| Al Jazeera Factory | 1990 | Riyadh, KSA | – | – | – | – |

| Alfanar Building Materials | 1976 | Riyadh, KSA | – | – | – | – |

| Saudi Concrete Products | 1976 | Dammam, KSA | – | – | – | – |

| Qanbar Ready Mix | 1978 | Dammam, KSA | – | – | – | – |

| Cemex Saudi Arabia | 1906 | Jeddah, KSA | – | – | – | – |

KSA Concrete Block Market Analysis

Growth Drivers

Rising Construction Activities

Rising construction activities in Saudi Arabia have been a significant driver for the concrete block market. The total value of contracts awarded in the Saudi construction industry reached approximately USD 51.3 billion in 2022 and is projected to maintain strong momentum in 2023, reflecting a government focus on infrastructure projects. The World Bank highlights that the construction sector is pivotal in diversifying the economy, with the industry making up about 6.0% of GDP in 2021. This sustained growth in construction activity supports increased demand for concrete blocks as essential building materials across various projects.

Government Infrastructure Investments

Government infrastructure investments in Saudi Arabia have exceeded USD 35 billion in 2023, with major projects under Vision 2030 aimed at boosting economic diversification. Primary sectors benefiting from these investments include transportation, urban development, and public utilities, significantly impacting concrete block demand. Major initiatives like NEOM and the expansion of the transportation network are set to drive steel and cement demand, crucial components for concrete block production. Additionally, the Saudi government’s commitment to investing over USD 250 billion in infrastructure projects over the coming years indicates sustained demand for concrete blocks as construction initiatives unfold.

Market Challenges

Volatility in Raw Material Prices

Volatility in raw material prices poses a significant challenge to the KSA concrete block market. The price of cement, a key ingredient in concrete block production, rose by 8.0% from 2022 to 2023, partially due to global supply chain disruptions and increased demand. According to the International Monetary Fund (IMF), fluctuations in energy prices also influence the cost of materials vital for manufacturing processes, as energy costs account for nearly 30% of total production costs in the sector. Such volatility makes it difficult for manufacturers to maintain stable pricing and profit margins, subsequently affecting market expansion.

Regulatory Compliance Issues

Regulatory compliance issues present another challenge for the KSA concrete block market. The rapid pace of construction has led the government to implement stringent regulations, including building codes and safety standards, affecting production processes. The Saudi Standards, Metrology and Quality Organization (SASO) mandates that all construction materials meet specific quality standards before approval. Furthermore, non-compliance can result in penalties or project delays, adding significant costs to construction projects and hampering manufacturers’ operational efficiency. As of 2023, non-compliance leads to an average of 15% additional costs for projects, emphasizing the need for adherence to regulations in maintaining competitiveness.

Opportunities

Technological Advancements in Production

Technological advancements in production present substantial opportunities for growth in the KSA concrete block market. The adoption of automated manufacturing processes has increased production efficiency by approximately 25%, allowing manufacturers to produce higher quality concrete blocks with consistent properties. Advanced technologies such as 3D printing and robotics are set to further influence production dynamics, enabling reduced waste and improved cost efficiencies. Companies that leverage these technologies now position themselves favourably within the competitive landscape, capitalizing on the demand for innovative building materials that enhance construction quality and sustainability.

Expansion of Eco-Friendly Products

The expansion of eco-friendly products in the concrete block market aligns with growing sustainability trends and government initiatives supporting green building practices. The demand for sustainable construction materials increased by approximately 20% from 2022 to 2023, driven by consumer awareness and regulatory frameworks promoting environmental responsibility. The Saudi government has emphasized its commitment to sustainable urban development, which aligns with global standards and practices, creating a burgeoning market for eco-friendly concrete blocks made from recycled materials. This shift not only meets regulatory demands but also appeals to a growing segment of environmentally-conscious consumers.

Future Outlook

Over the next five years, the KSA concrete block market is anticipated to experience robust growth, driven by ongoing government investments in infrastructure and urban development, as well as increasing consumer demand for high-quality, sustainable building materials. The transition toward advanced construction technologies and eco-friendly products is expected to reshape the market dynamics, contributing to a favourable growth trajectory.

Major Players

- Al Jazeera Factory

- Alfanar Building Materials

- Saudi Concrete Products

- Qanbar Ready Mix

- Madar Building Materials

- Raknor LLC

- ACICO Group

- KSA Precast Concrete

- Eastern Precast Concrete

- Cemex Saudi Arabia

- Nesma Concrete Solutions

- Saudi Readymix Concrete Co. Ltd.

- Al Amam Factory for Concrete and Bricks

- Saleh Al-Juhani Sons Company

- ACBC Almansour Concrete Block Co.

Key Target Audience

- Construction Companies

- Real Estate Developers

- Building Material Suppliers

- Government and Regulatory Bodies (Ministry of Municipal and Rural Affairs, Ministry of Housing)

- Investors and Venture Capitalist Firms

- Project Management Firms

- Architects and Engineering Firms

- Commercial and Industrial Builders

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the KSA concrete block market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level insights. The primary goal is to identify and define the critical variables influencing market dynamics including demand drivers, regulatory frameworks, and competitive landscapes.

Step 2: Market Analysis and Construction

In this phase, we will compile and analyze historical data pertaining to the KSA concrete block market. This includes assessing market penetration, the ratio of manufacturers to end-users, and revenue generation outcomes. Additionally, an evaluation of service quality statistics will be included to ensure the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be developed and subsequently validated through computer-assisted telephone interviews (CATIs) with industry experts representing various sectors within the KSA concrete block market. These consultations will provide operational and financial insights directly from industry practitioners, which will play a pivotal role in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase entails engagement with multiple concrete block manufacturers to gain detailed insights concerning product segments, sales performance, consumer preferences, and other pertinent factors. This interaction will serve to verify and complement the statistics derived from the bottom-up approach, ensuring a comprehensive, accurate, and validated analysis of the KSA concrete block market.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Overview Genesis

- Timeline of Major Players

- Business Cycle

- Supply Chain & Value Chain Analysis

- Growth Drivers

Rising Construction Activities

Government Infrastructure Investments - Market Challenges

Volatility in Raw Material Prices

Regulatory Compliance Issues - Opportunities

Technological Advancements in Production

Expansion of Eco-Friendly Products - Trends

Increasing Demand for Prefabricated Materials

Shift Towards Modular Construction - Government Regulation

Building Codes

Safety Standards

Environmental Regulations - SWOT Analysis

- Stakeholder Ecosystem

- Porter’s Five Forces

- By Value, 2019-2024

- By Volume, 2019-2024

- By Average Price, 2019-2024

- By Product Type, (In Value %)

Lightweight Concrete Blocks

Heavyweight Concrete Blocks

Insulated Concrete Blocks

Solid Concrete Blocks

Paver Blocks

Aerated Concrete Blocks

Others - By Application, (In Value %)

Residential

Commercial

Industrial

Infrastructure

Others - By Distribution Channel, (In Value %)

Direct Sales

Retail

Online Sales

Wholesale - By Region, (In Value %)

Riyadh

Jeddah

Dammam

Khobar

Makkah

Others - By End-User Segment, (In Value %)

Construction Companies

Government Projects

DIY Consumers - By Material Composition, (In Value %)

Cement

Fly Ash

Sand

Aggregates

Recycled Materials - By Manufacturing Process, (In Value %)

Manual Molding

Semi-Automatic

Fully Automatic

- Market Share of Major Players on the Basis of Value/Volume, 2024

Market Share of Major Players by Product Type Segment, 2024 - Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strength, Weakness, Organizational Structure, Revenues, Number of Production Facilities, Distribution Channels, Product Variants, Unique Value Offering, Customer Support)

- SWOT Analysis of Major Players

- Pricing Analysis Basis SKUs for Major Players

- Detailed Profiles of Major Companies

Al Jazeera Factory

Alfanar Building Materials

Saudi Concrete Products

Qanbar Ready Mix

Madar Building Materials

Raknor LLC

ACICO Group

KSA Precast Concrete

Eastern Precast Concrete

Cemex Saudi Arabia

Nesma Concrete Solutions

Saudi Readymix Concrete Co. Ltd.

Al Amam Factory for Concrete and Bricks

Saleh Al-Juhani Sons Company

EAMAR Cement Products Factory

ACBC Almansour Concrete Block Co.

Al Kifah Ready-mix & Blocks (KRB)

Abu Haitham Group Trading Company

Lightweight Construction Company –SIPOREX

Others

- Market Demand and Utilization

- Purchasing Power and Budget Allocations

- Regulatory and Compliance Requirements

- Needs, Desires, and Pain Point Analysis

- Decision-Making Process

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average Price, 2025-2030