Market Overview

The KSA Connected Glucose Meters market is valued at USD ~ million in the prior year and USD ~ million in the latest year, reflecting a rapidly expanding national revenue pool for glucose monitoring devices where smartphone-linked SMBG meters and cloud-enabled data sharing are increasingly embedded in patient workflows. Growth is supported by a high diabetes burden, technology upgrades (wireless connectivity, app-led insights), and scaled care delivery through hospitals and homecare pathways, alongside tighter device governance under SFDA-led medical device oversight.

Commercial demand concentrates around Riyadh (largest specialist provider density and payer ecosystems), the Jeddah–Makkah corridor (high patient volumes and large multi-site provider networks), and the Eastern Province (large urban clusters and strong private healthcare footprint). On the supply side, device ecosystems are largely led by multinational principals (notably U.S./European-origin diabetes technology and Swiss/German SMBG heritage brands), while national digitization programs connecting payers and providers increase the value of “connected” data capture and interoperability in these metro-led care pathways.

Market Segmentation

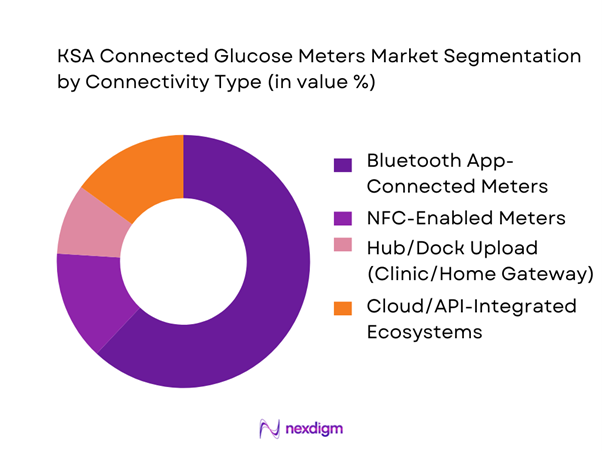

By Connectivity Type

KSA Connected Glucose Meters market is segmented by connectivity type into Bluetooth app-connected meters, NFC-enabled meters, hub/dock upload meters (clinic or home gateway), and cloud/API-integrated ecosystems. Recently, Bluetooth app-connected meters have a dominant market share because they deliver the simplest “phone-first” experience: automatic logbooks, reminders, caregiver sharing, and clinician-ready summaries without additional hardware. Their dominance is reinforced by high smartphone penetration behavior in urban KSA, pharmacy-led recommendation at point-of-sale, and rapid onboarding for newly diagnosed Type ~ and insulin users seeking daily visibility with minimal friction.

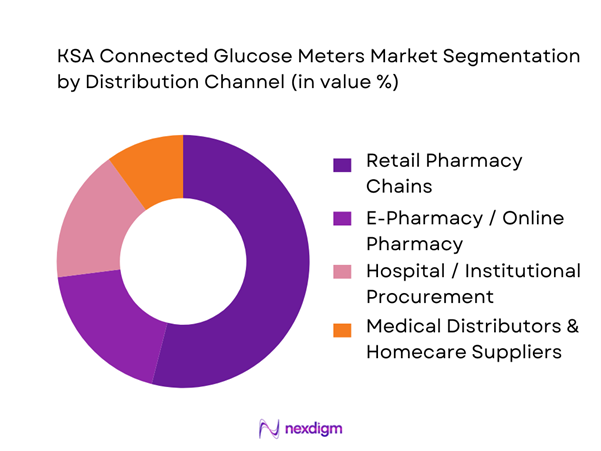

By Distribution Channel

KSA Connected Glucose Meters market is segmented by distribution channel into retail pharmacy chains, e-pharmacy/online pharmacy, hospital/institutional procurement, and medical distributors & homecare suppliers. Recently, retail pharmacy chains hold the dominant market share because SMBG purchasing decisions are often immediate and convenience-led—patients buy meters and strips together, frequently after physician advice or during routine refills. Chain pharmacies also influence brand choice through shelf visibility, loyalty programs, bundled strip promotions, and in-store education. E-pharmacy is growing fast, but pharmacies remain the primary channel for first-time device onboarding and urgent strip replenishment.

Competitive Landscape

The KSA Connected Glucose Meters market is led by a concentrated set of global diabetes technology companies and established SMBG manufacturers, supported by local distributors and pharmacy chains. Competitive advantage is increasingly defined by app ecosystem quality, strip availability and refill convenience, Arabic UX, and data-sharing capability for provider follow-up and payer programs. SFDA oversight and post-market requirements raise the bar for compliant market access, favoring scaled brands with strong regulatory and quality systems.

| Company | Established | HQ | Key Connected Meter Ecosystem | App / Data Features | Strip System Strength | Primary Route-to-Market in KSA | Clinical/Provider Reporting | Regulatory Readiness (SFDA pathway alignment) |

| Roche Diabetes Care | 1896 | Switzerland | ~ | ~ | ~ | ~ | ~ | ~ |

| LifeScan | 1981 | USA | ~ | ~ | ~ | ~ | ~ | ~ |

| Ascensia Diabetes Care | 2016 | Switzerland | ~ | ~ | ~ | ~ | ~ | ~ |

| Abbott | 1888 | USA | ~ | ~ | ~ | ~ | ~ | ~ |

| i-SENS | 2000 | South Korea | ~ | ~ | ~ | ~ | ~ | ~ |

KSA Connected Glucose Meters Market Analysis

Growth Drivers

Diabetes prevalence and screening intensity

Saudi Arabia’s diabetes burden is structurally large, sustaining high-frequency self-monitoring demand and making “connected” meters (auto-logbooks, sharing, adherence nudges) more valuable in routine care. IDF reports ~ adults living with diabetes in Saudi Arabia and an adult population of ~. This base load of daily monitoring demand is amplified by a large national population of ~ people, supporting broad retail scale for meters and strips.

From a macro capacity standpoint, Saudi Arabia’s economy is sizeable—GDP (current US$) of ~ trillion and GDP per capita (current US$) of ~—supporting sustained healthcare consumption and private-sector outpatient expansion where connected readings are increasingly used for follow-ups and therapy adjustments. Cost-of-living stability also matters for refill behavior: the World Bank reports inflation (consumer prices) of ~ (annual) and unemployment of ~ (modeled ILO estimate), which together support steadier household purchasing and refill cadence for testing supplies across major urban centers.

Connected care adoption

Connected glucose meters benefit directly from Saudi Arabia’s accelerating digitization of care journeys—especially where payer-provider workflows increasingly require structured data and faster documentation. At the system level, macro stability supports ongoing infrastructure investment: Saudi Arabia records GDP (current US$) of ~ trillion and GDP growth of ~ (annual), enabling continued modernization across healthcare delivery and claims processing that increases the utility of digitally shareable glucose readings.

Digitization on the payments side is also a strong proxy for consumer readiness to transact digitally for health products and services: SAMA reports ~ billion electronic (non-cash) payment transactions versus ~ billion in the prior year, showing rapid scaling of digital transactions that also supports subscription refills for strips and app-led device ecosystems. From a patient-demand standpoint, IDF’s estimate of ~ adults with diabetes underlines the scale of chronic-condition management that benefits from device-to-app capture, trend reporting, and caregiver sharing—especially in insulin-using cohorts where structured logs are repeatedly required.

Challenges

Accuracy perception and trust

Accuracy perception is a high-friction barrier because glucose readings directly influence therapy decisions, and any doubt increases brand switching, returns, and reluctance to adopt “connected” premium features. In KSA, this challenge plays out at scale because the diabetes user base is large—IDF reports ~ adults living with diabetes—so even a small trust deficit becomes a major commercial risk across pharmacy and institutional channels.

Macro conditions increase scrutiny rather than reducing it: with GDP per capita of ~ and GDP (current US$) of ~ trillion, consumers and providers have access to multiple brands and are more willing to reject devices perceived as unreliable, especially in private-sector care where patient expectations are high. A national population of ~ also means wide heterogeneity in user capability; weak onboarding (incorrect strip handling, improper sampling) can be misattributed to device inaccuracy—amplifying distrust.

Strip affordability

Strip affordability is a persistent constraint because test strips drive recurring out-of-pocket spend, and connected ecosystems often rely on higher refill consistency to justify adoption. The challenge is particularly impactful in Saudi Arabia because the diabetes population is large—~ adults with diabetes (IDF)—which translates into massive recurring strip consumption demand and high sensitivity to refill disruption when budgets tighten.

While macro indicators show capacity—GDP per capita ~ and GDP ~ trillion—purchasing power varies by household type, and refill cadence is affected by competing expense priorities, particularly among families managing multiple chronic conditions. The national population of ~ also implies a wide income distribution; affordability constraints appear most sharply outside premium private-care cohorts, where patients may down-test or delay refills, undermining app-based adherence programs.

Opportunities

RPM enablement

Remote patient monitoring (RPM) is a strong opportunity for connected glucose meters because it converts episodic care into continuous oversight, enabling early intervention for high-risk patients and better therapy adherence. The scale is compelling: IDF reports ~ adults living with diabetes in Saudi Arabia, creating a large base where RPM programs can prioritize insulin users, gestational diabetes pathways, and patients with poor control who benefit from structured follow-ups.

Macro fundamentals support program deployment: the World Bank reports GDP (current US$) of ~ trillion and GDP per capita (current US$) of ~, which supports payer/provider investment in digital platforms, care coordinators, and device-supported pathways across private and government-linked healthcare delivery. RPM also aligns with Saudi Arabia’s broader digital maturity: SAMA reports ~ billion electronic payment transactions compared with ~ billion previously, indicating strong nationwide adoption of app-enabled transactions that can support device replenishment, subscription refills, and digital engagement loops essential for RPM continuity.

Payer-led programs

Payer-led programs are a high-potential growth pathway because they can standardize device access, incentivize adherence, and reduce downstream complications by targeting high-risk cohorts with structured monitoring. Saudi Arabia’s diabetes scale makes payer programs economically meaningful: IDF reports ~ adults living with diabetes, enabling segmentation-based interventions (insulin users, pregnant women, newly diagnosed) that rely on connected logs and shareable reports.

Macro capacity supports program financing and analytics investments: the World Bank reports GDP of ~ trillion, GDP per capita ~, and GDP growth ~, which supports continued modernization of insurance operations, provider contracting, and data infrastructure required to run adherence-linked benefits. Payer readiness is also reinforced by broader national digitization behaviors: SAMA reports ~ billion electronic payment transactions (vs ~ billion previously), demonstrating large-scale digitized consumer interactions that can support digital reimbursements, automated co-pay workflows, and app-based benefit redemption for strips refills.

Future Outlook

Over the next five years, the KSA Connected Glucose Meters market is expected to expand steadily as diabetes monitoring shifts further into homecare and digitally enabled chronic care. National digitization efforts that standardize payer–provider exchange will keep increasing the utility of connected readings for continuity of care and approvals.

From a sizing standpoint, the broader Saudi blood glucose monitoring devices revenue pool is expected to grow at a CAGR of ~% reaching USD ~ million at the end of the period—creating a larger addressable base for connected SMBG solutions, app ecosystems, and subscription-led strip replenishment models.

Major Players

- Abbott

- Dexcom

- Medtronic

- Roche Diabetes Care

- Ascensia Diabetes Care

- LifeScan

- i-SENS

- ARKRAY

- Terumo

- Nova Biomedical

- ACON Laboratories

- AgaMatrix

- ForaCare Suisse

- Sinocare

Key Target Audience

- Medical device manufacturers and brand owners

- Retail pharmacy chains and e-pharmacy operators

- Hospital groups and multi-site provider networks

- Diabetes specialty centers and outpatient clinics

- Health insurers and TPAs

- Medical distributors and authorized representatives

- Investments and venture capitalist firms

- Government and regulatory bodies

Research Methodology

Step 1: Identification of Key Variables

We construct an ecosystem map covering manufacturers, authorized representatives, distributors, pharmacy chains, providers, payers, and regulators shaping connected SMBG adoption. Desk research is supported by secondary sources and structured extraction of device, channel, and policy variables influencing demand and access.

Step 2: Market Analysis and Construction

We compile historical revenue signals across the glucose monitoring pool and build a market model around device shipments, installed base dynamics, and strip consumption economics. Channel checks are used to validate where connected features (apps, sharing, cloud logs) materially impact purchase and repurchase behavior.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses on segment dominance, route-to-market economics, and adoption barriers are validated through CATI discussions with distributors, pharmacy category teams, diabetes educators, and provider procurement stakeholders, capturing operational realities and commercial terms.

Step 4: Research Synthesis and Final Output

We triangulate bottom-up findings with top-down reference benchmarks, then finalize segmentation shares, competitor positioning, and strategic recommendations. The output is stress-tested for regulatory logic (SFDA) and health-data handling expectations (PDPL) relevant to connected devices.

- Executive Summary

- Research Methodology (Market Definitions and Assumptions, Abbreviations, Scope Validation Framework, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Data Triangulation and Validation, Limitations and Future Conclusions)

- Definition and Scope

- Overview Genesis

- Timeline of Major Ecosystem Developments

- Business Cycle

- Supply Chain and Value Chain Analysis

- Growth Drivers

Diabetes prevalence and screening intensity

Connected care adoption

E-pharmacy growth

Patient engagement via apps

Employer wellness demand - Challenges

Accuracy perception and trust

Strip affordability

Counterfeit/parallel imports

Interoperability gaps

App localization and usability

Data/privacy compliance readiness - Opportunities

RPM enablement

Payer-led programs

Pregnancy pathways

Smart kits bundling

Chronic care analytics for providers - Trends

AI-based insights in apps

Arabic-first UX

Integration with national digital health initiatives

Omnichannel pharmacy playbooks

Value-based care adjacency - Regulatory & Policy Landscape

- SWOT Analysis

- Porter’s Five Forces Analysis

- Competitive Intensity & Ecosystem Mapping

- By Value, 2019–2024

- By Volume, 2019–2024

- By Average Selling Price, 2019–2024

- By Strip Consumption Value, 2019–2024

- By Product Category (In Value %)

Bluetooth-Connected Blood Glucose Meters

NFC-Enabled / Scan-Assist Ecosystem Meters

Multi-Patient / Clinic-Grade Connected Meters

Meter + Strip Starter Kits

Premium Coaching-Enabled Offerings - By Connectivity Type (in Value %)

Bluetooth to Smartphone App

NFC to Smartphone App

Hub-Based Upload

Cloud-Connected Platforms - By Patient Cohort / Indication (In Value %)

Type 1 Diabetes

Type 2 Diabetes – Insulin Users

Type 2 Diabetes – Non-Insulin Users

Gestational Diabetes

Prediabetes / Weight-Management Monitoring - By Care Setting (In Value %)

Home Self-Monitoring

Hospitals & Specialty Centers

Primary Healthcare Centers

Corporate/Occupational Health Programs

Pilgrimage-Season Health Monitoring Pathways - By Distribution Channel (In Value %)

Retail Pharmacy Chains

E-Pharmacy / Online Pharmacy Apps & Marketplaces

Hospital Procurement & Institutional Supply

Distributors / Medical Equipment Suppliers

Direct-to-Consumer - By Payer Type (In Value %)

Out-of-Pocket

Private Insurance

Government/Quasi-Government Coverage Pathways - By Region (in Value %)

Central

Western

Eastern

Northern Region

Southern Region

- Market Share of Major Players

- Cross Comparison Parameters (SFDA Registration & Post-Market Track Record, Meter–App Ecosystem Strength & Feature Depth, Strip Availability & Refill Convenience, Accuracy/Performance Credentials & Trust Signals, Arabic Localization & Patient UX, Channel Footprint Across Retail/E-Pharmacy/Institutional, Data Privacy Readiness & Security Controls, Partnerships/Integration Potential with Providers/Payers/Digital Health Platforms)

- SWOT Analysis of Major Players

- Pricing Analysis Basis SKUs

- Detailed Profiles of Major Companies

Abbott

Dexcom

Medtronic

Roche Diabetes Care

Ascensia Diabetes Care

LifeScan

i-SENS

ARKRAY

Terumo

Nova Biomedical

ACON Laboratories

AgaMatrix

ForaCare Suisse

Sinocare

- Purchasing Power and Budget Allocation

- Needs, Desires, and Pain Point Analysis

- Decision-Making Process

- Patient Support & Education Landscape

- By Value, 2025–2030

- By Volume, 2025–2030

- By Average Selling Price, 2025–2030

- By Strip Consumption Value, 2025–2030