Market Overview

The KSA Continuous Glucose Monitoring devices market current size stands at around USD ~ million, reflecting strong expansion from a recent base of USD ~ million driven by increasing adoption of digital diabetes care tools across clinical and home settings. Growing demand for real-time glucose insights has accelerated device uptake among patients requiring intensive monitoring, while healthcare providers continue to integrate connected monitoring into chronic disease pathways. Rising healthcare expenditure and expanding private care networks are further strengthening market depth and commercial viability.

Regional dominance within the KSA Continuous Glucose Monitoring devices market is led by Riyadh and the Western healthcare corridor, supported by dense hospital infrastructure, a high concentration of endocrinology specialists, and advanced digital health readiness. These regions benefit from mature payer ecosystems, stronger medical device distribution networks, and early adoption of remote patient monitoring models. Policy alignment toward preventive care and chronic disease management has further reinforced institutional demand, enabling faster integration of continuous glucose monitoring into routine diabetes management protocols.

Market Segmentation

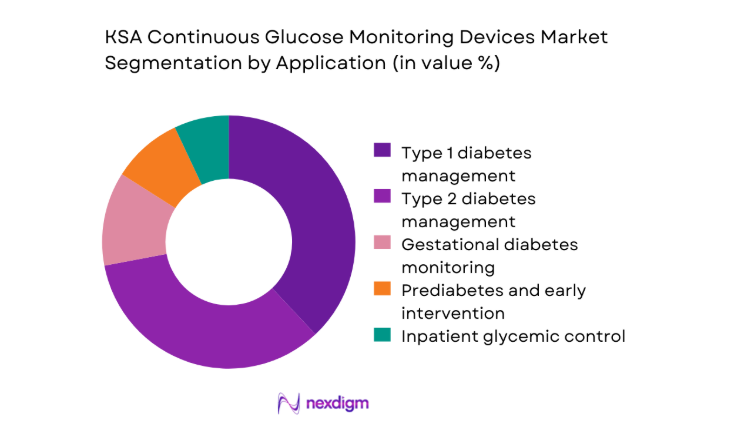

By Application

Continuous glucose monitoring adoption is strongest in intensive diabetes management applications, where real-time glucose visibility supports proactive therapy adjustments and reduces acute complications. Hospitals and specialty clinics are increasingly integrating these devices into treatment protocols for insulin-dependent patients, while homecare usage continues to expand among individuals seeking convenience and continuous insights. Growth is also visible in gestational and early-stage diabetes monitoring, supported by rising awareness of early intervention benefits. The application landscape reflects a clear shift toward long-term disease management models, where continuous data streams enhance clinical decision-making, improve patient adherence, and strengthen outcomes across the care continuum.

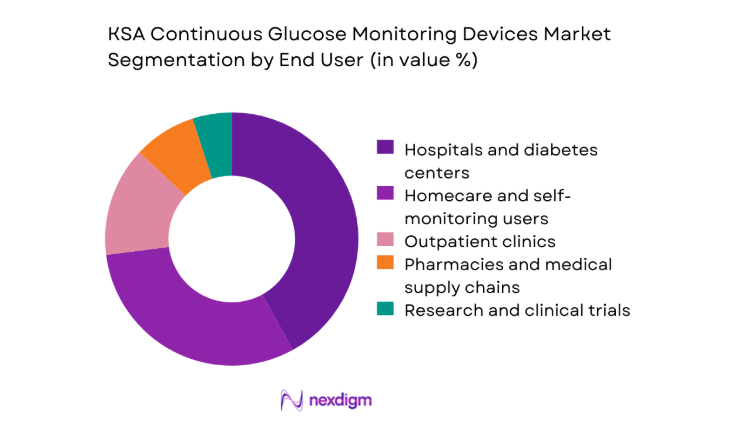

By End User

Hospitals and specialty diabetes centers dominate demand due to their role in advanced therapy initiation and complex case management. However, homecare users represent the fastest-expanding segment, driven by convenience, growing digital literacy, and the availability of app-connected monitoring platforms. Pharmacies and medical supply chains are playing a more strategic role by improving device accessibility and patient onboarding. The end-user mix highlights a transition from institution-centric usage toward a distributed care model, where continuous glucose monitoring supports decentralized, patient-led disease management supported by telehealth and remote clinical oversight.

Competitive Landscape

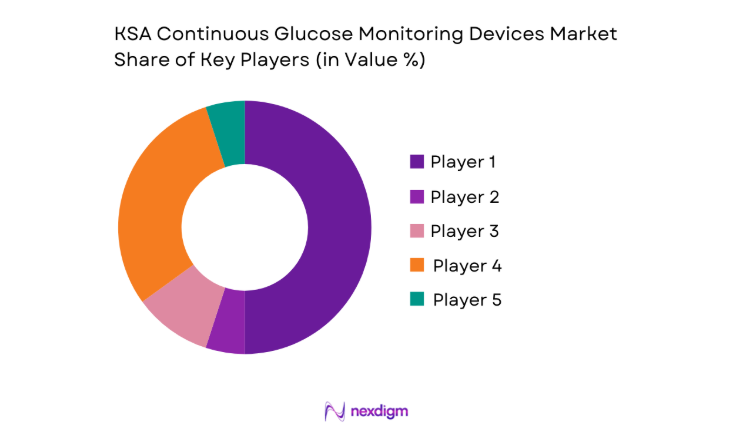

The KSA Continuous Glucose Monitoring devices market features a moderately concentrated competitive structure, characterized by a small group of global technology leaders and a growing presence of regional distributors. Market dynamics are shaped by technology differentiation, service capabilities, and regulatory readiness, with competition increasingly focused on ecosystem integration and long-term patient engagement models.

| Company Name | Establishment Year | Headquarters | Formulation Depth | Distribution Reach | Regulatory Readiness | Service Capability | Channel Strength | Pricing Flexibility |

| Abbott Diabetes Care | 1981 | United States | ~ | ~ | ~ | ~ | ~ | ~ |

| Dexcom | 1999 | United States | ~ | ~ | ~ | ~ | ~ | ~ |

| Medtronic | 1949 | Ireland | ~ | ~ | ~ | ~ | ~ | ~ |

| Roche Diabetes Care | 1896 | Switzerland | ~ | ~ | ~ | ~ | ~ | ~ |

| Senseonics | 1996 | United States | ~ | ~ | ~ | ~ | ~ | ~ |

KSA Continuous Glucose Monitoring Devices Market Analysis

Growth Drivers

Rising prevalence of diabetes and metabolic disorders in Saudi Arabia

The growing burden of diabetes is creating sustained demand for continuous glucose monitoring devices across clinical and homecare environments. In recent years, diagnosed patient pools expanded to ~ individuals, increasing the need for long-term glucose tracking solutions that reduce complications and hospital admissions. Healthcare facilities managing ~ chronic care visits annually are progressively shifting toward digital monitoring to improve treatment efficiency. The market has responded with a rise in device deployments of ~ systems across hospitals and specialty clinics, reinforcing continuous monitoring as a standard component of diabetes management pathways.

Government focus on preventive healthcare and digital health transformation

National healthcare strategies emphasizing preventive care have accelerated the integration of connected medical devices, including continuous glucose monitoring platforms. Public sector programs supporting chronic disease management have facilitated the onboarding of ~ patients into remote monitoring frameworks, supported by digital infrastructure investments valued at USD ~ million. The expansion of telehealth services across ~ care centers has created a favorable environment for CGM adoption, enabling clinicians to manage patient glucose data remotely and improve treatment adherence while reducing avoidable clinical visits.

Challenges

High upfront and recurring cost of sensors and consumables

The financial burden associated with continuous glucose monitoring remains a key barrier to broader adoption, particularly among self-paying patients. Annual out-of-pocket spending for device maintenance often exceeds USD ~ million in aggregate across private households, limiting penetration beyond premium care segments. Clinics serving ~ patients annually report slower uptake in cost-sensitive demographics, despite clear clinical benefits. This cost-related challenge constrains market expansion into mid-income groups and delays large-scale transition from traditional testing methods to continuous monitoring solutions.

Limited insurance coverage for continuous glucose monitoring in certain patient segments

Insurance reimbursement gaps continue to restrict access to CGM devices for a sizable portion of the diabetic population. Coverage eligibility often applies to only ~ individuals within high-risk categories, leaving many patients dependent on direct payment. Healthcare providers managing ~ insured cases annually report uneven adoption patterns linked to payer policies rather than clinical need. This structural limitation slows market scaling and reduces the overall addressable base, particularly in outpatient and preventive care settings where continuous monitoring could deliver long-term system-wide cost efficiencies.

Opportunities

Integration of CGM with insulin pumps and closed-loop systems

The convergence of continuous glucose monitoring with automated insulin delivery technologies presents a major growth opportunity. Integrated therapy platforms are being introduced across ~ specialty centers, improving glycemic control outcomes for patients requiring intensive management. Pilot deployments covering ~ users have demonstrated reduced intervention needs and improved therapy adherence, strengthening demand for fully connected ecosystems. As healthcare providers prioritize outcome-based care models, integrated CGM solutions are well positioned to capture expanding institutional investments in advanced diabetes management infrastructure.

Expansion of remote patient monitoring and tele-diabetology services

The rapid expansion of remote care services is opening new channels for continuous glucose monitoring adoption. Telehealth networks now support ~ virtual consultations annually, enabling CGM data to be embedded into routine clinical workflows. Healthcare systems managing ~ chronic patients remotely are increasingly standardizing CGM usage to enhance care continuity and reduce in-person visits. This shift toward decentralized care delivery is creating scalable demand across urban and semi-urban regions, positioning CGM devices as core tools in future-ready diabetes management models.

Future Outlook

The KSA Continuous Glucose Monitoring devices market is expected to experience sustained momentum through the end of the decade, supported by ongoing healthcare digitalization and a strong national focus on chronic disease management. Expanding telehealth adoption and deeper integration of monitoring technologies into standard care pathways will continue to reshape demand patterns. As policy alignment, infrastructure maturity, and patient awareness improve, continuous glucose monitoring is set to become a central pillar of long-term diabetes care across the Kingdom.

Major Players

- Abbott Diabetes Care

- Dexcom

- Medtronic

- Roche Diabetes Care

- Senseonics

- Ascensia Diabetes Care

- Medtrum

- Nemaura Medical

- Ypsomed

- Insulet

- Tandem Diabetes Care

- POCTech

- i-SENS

- Glunovo

- Bionime

Key Target Audience

- Hospitals and tertiary care centers

- Specialty diabetes clinics and endocrinology centers

- Home healthcare service providers

- Retail pharmacy chains and medical distributors

- Investments and venture capital firms

- Saudi Ministry of Health

- Saudi Food and Drug Authority

- Digital health platform providers

Research Methodology

Step 1: Identification of Key Variables

Core market variables including disease prevalence trends, device adoption patterns, and healthcare infrastructure readiness were identified. Demand-side factors such as patient behavior and care pathway evolution were mapped. Supply-side dynamics covering technology innovation and distribution structures were assessed. Regulatory and reimbursement environments were also evaluated to define market boundaries.

Step 2: Market Analysis and Construction

Quantitative and qualitative indicators were synthesized to build a structured market framework. Segmentation logic was developed around application, end-user, and care delivery models. Adoption scenarios were created based on healthcare digitization progress. Competitive positioning parameters were integrated to reflect real-world market dynamics.

Step 3: Hypothesis Validation and Expert Consultation

Preliminary findings were validated through structured expert interactions across clinical, operational, and regulatory domains. Feedback was incorporated to refine demand drivers, constraint factors, and opportunity areas. Market assumptions were stress-tested under multiple adoption scenarios to ensure analytical robustness.

Step 4: Research Synthesis and Final Output

All validated insights were consolidated into a cohesive market narrative. Data points were aligned with strategic themes such as preventive care and digital health transformation. The final output was structured to support decision-making across investment, policy, and commercial planning contexts.

- Executive Summary

- Research Methodology (Market definitions and scope boundaries, continuous glucose monitoring device taxonomy across real time and flash systems, market sizing logic by installed base and sensor consumption, revenue attribution across devices sensors transmitters and services, primary interview program with endocrinologists’ hospitals pharmacies and distributors, data triangulation validation assumptions and limitations)

- Definition and Scope

- Market evolution

- Care and usage pathways

- Ecosystem structure

- Supply chain and channel structure

- Regulatory environment

- Growth Drivers

Rising prevalence of diabetes and metabolic disorders in Saudi Arabia

Government focus on preventive healthcare and digital health transformation

Growing adoption of home-based chronic disease management solutions

Increasing awareness of continuous glucose monitoring benefits among clinicians and patients

Expansion of private healthcare and specialty diabetes clinics

Improving reimbursement landscape for advanced diabetes technologies - Challenges

High upfront and recurring cost of sensors and consumables

Limited insurance coverage for continuous glucose monitoring in certain patient segments

Low awareness in rural and semi-urban populations

Data privacy and cybersecurity concerns related to connected medical devices

Shortage of trained diabetes educators and device trainers

Resistance to technology adoption among elderly patients - Opportunities

Integration of CGM with insulin pumps and closed-loop systems

Expansion of remote patient monitoring and tele-diabetology services

Localization of distribution and service networks across Saudi regions

Development of non-invasive and long-wear sensor technologies

Public-private partnerships in chronic disease management programs

Growing pediatric and gestational diabetes monitoring needs - Trends

Shift from fingerstick testing to continuous and real-time monitoring

Rising adoption of smartphone-based CGM ecosystems

Increasing focus on predictive analytics and AI-driven glucose insights

Growth of subscription-based sensor supply models

Partnerships between CGM manufacturers and digital health platforms

Expansion of implantable CGM solutions for long-term monitoring - Government Regulations

- SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Value, 2019–2024

- By Shipment Volume, 2019–2024

- By Installed Base, 2019–2024

- By Average Selling Price, 2019–2024

- By Fleet Type (in Value %)

Individual end users

Hospitals

Specialty diabetes clinics

Retail pharmacies

Home healthcare providers - By Application (in Value %)

Type 1 diabetes management

Type 2 diabetes management

Gestational diabetes monitoring

Prediabetes and early intervention

Inpatient and ICU glycemic control - By Technology Architecture (in Value %)

Real-time continuous glucose monitoring systems

Flash glucose monitoring systems

Implantable continuous glucose monitoring systems

Non-invasive and optical glucose monitoring technologies - By End-Use Industry (in Value %)

Hospitals and tertiary care centers

Outpatient clinics and diabetes centers

Homecare and self-monitoring users

Pharmacies and medical supply chains

Research and clinical trials - By Connectivity Type (in Value %)

Bluetooth-enabled devices

Near-field communication based systems

Cellular-connected monitoring platforms

Cloud-integrated and app-based ecosystems - By Region (in Value %)

Central Region

Western Region

Eastern Region

Northern Region

Southern Region

- Market structure and competitive positioning

Market share snapshot of major players - Cross Comparison Parameters (sensor accuracy and MARD, wear duration, calibration requirements, integration with insulin delivery systems, mobile app and data analytics ecosystem, price per sensor and transmitter, reimbursement and payer coverage, local distribution and service network strength)

- SWOT Analysis of Key Players

- Pricing and Commercial Model Benchmarking

- Detailed Profiles of Major Companies

Abbott Diabetes Care

Dexcom

Medtronic

Roche Diabetes Care

Senseonics

Ascensia Diabetes Care

Medtrum

Nemaura Medical

Ypsomed

Insulet

Tandem Diabetes Care

POCTech

i-SENS

Glunovo

Bionime

- Demand and utilization drivers

- Procurement and tender dynamics

- Buying criteria and vendor selection

- Budget allocation and financing preferences

- Implementation barriers and risk factors

- Post-purchase service expectations

- By Value, 2025–2030

- By Shipment Volume, 2025–2030

- By Installed Base, 2025–2030

- By Average Selling Price, 2025–2030