Market Overview

The KSA Coronary Artery Imaging Equipment market current size stands at around USD ~ million, supported by sustained diagnostic demand and expanding interventional cardiology capacity across major healthcare networks. Recent performance shows consistent annual market activity at USD ~ million in one year and USD ~ million in the following year, reflecting steady procurement of advanced imaging platforms. Ongoing public healthcare modernization programs and private sector investments continue to strengthen equipment replacement cycles, technology upgrades, and service contracts across tertiary hospitals and specialty cardiac centers nationwide.

Market dominance is concentrated in Riyadh, Jeddah, and Dammam, driven by dense clusters of tertiary hospitals, cardiac institutes, and advanced diagnostic infrastructure. These cities benefit from higher patient inflow, stronger specialist availability, and early adoption of next-generation imaging modalities. Mature procurement ecosystems centralized tendering systems, and favorable regulatory support further reinforce their leadership. Regional hubs also attract private healthcare expansion and medical tourism, enabling faster diffusion of intravascular imaging, hybrid cath labs, and integrated digital imaging solutions.

Market Segmentation

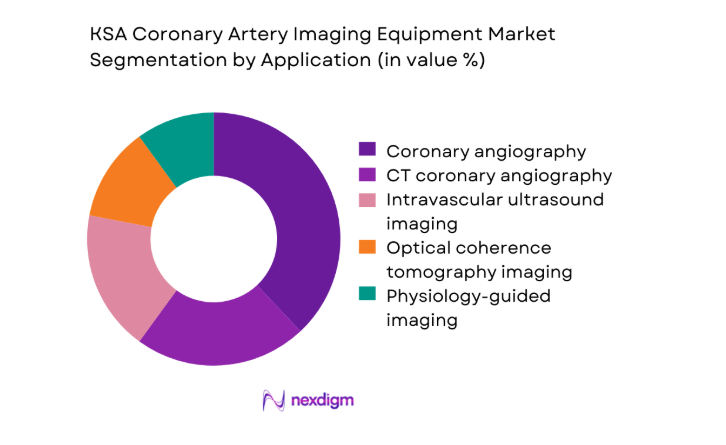

By Application

Coronary angiography and advanced intravascular imaging dominate application demand due to the high clinical reliance on precise visualization during interventional procedures. Large cardiac centers perform sustained diagnostic volumes exceeding ~ procedures annually, while specialty hospitals continue to expand CT coronary angiography to manage rising preventive screening needs. Intravascular ultrasound and optical coherence tomography are increasingly adopted in complex lesion assessment, supported by procedural growth of ~ cases per major cardiac hub each year. This dominance is reinforced by clinical guidelines emphasizing image-guided interventions, driving consistent equipment upgrades and recurring system utilization across leading hospitals.

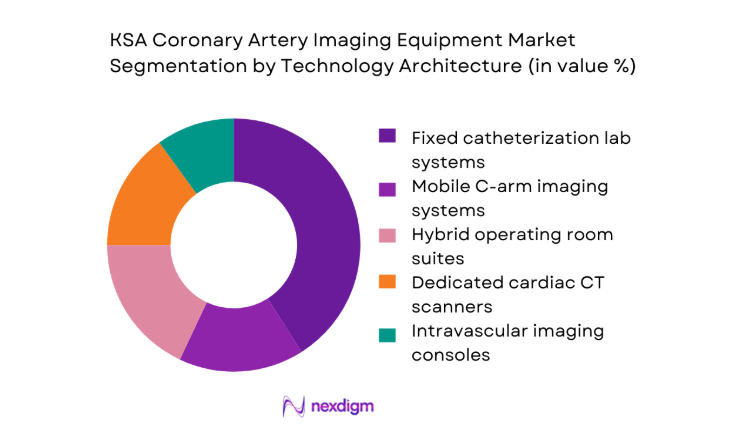

By Technology Architecture

Fixed catheterization lab systems lead the technology landscape, supported by large-scale hospital expansions and modernization projects. Major healthcare networks operate more than ~ active imaging suites, prioritizing hybrid operating rooms to support complex cardiovascular and structural heart procedures. Dedicated cardiac CT scanners continue to gain traction in preventive cardiology, with installations reaching ~ platforms across private diagnostic chains. Mobile C-arm systems are increasingly deployed in secondary care settings to expand procedural reach, while integrated intravascular imaging consoles enhance precision workflows in high-volume cardiac centers, reinforcing technology-driven dominance across care tiers.

Competitive Landscape

The market features a moderately concentrated structure, led by multinational imaging technology providers supported by strong service networks and long-term public sector relationships. Competitive positioning is shaped by technology depth, lifecycle service capability, and the ability to meet stringent regulatory and clinical performance standards.

| Company Name | Establishment Year | Headquarters | Formulation Depth | Distribution Reach | Regulatory Readiness | Service Capability | Channel Strength | Pricing Flexibility |

| Philips Healthcare | 1891 | Netherlands | ~ | ~ | ~ | ~ | ~ | ~ |

| Siemens Healthineers | 1847 | Germany | ~ | ~ | ~ | ~ | ~ | ~ |

| GE HealthCare | 1892 | United States | ~ | ~ | ~ | ~ | ~ | ~ |

| Canon Medical Systems | 1914 | Japan | ~ | ~ | ~ | ~ | ~ | ~ |

| Boston Scientific | 1979 | United States | ~ | ~ | ~ | ~ | ~ | ~ |

KSA Coronary Artery Imaging Equipment Market Analysis

Growth Drivers

Rising prevalence of coronary artery disease and lifestyle disorders

Cardiovascular disease incidence continues to rise, with annual diagnosed patient volumes exceeding ~ cases across major urban centers. Hospitals report procedure growth of ~ interventional cases per year, driving sustained utilization of coronary imaging systems. Screening programs and early detection initiatives have expanded diagnostic throughput to more than ~ scans annually in leading facilities. This clinical burden directly supports consistent demand for angiography platforms, intravascular imaging consoles, and advanced cardiac CT systems, reinforcing equipment replacement cycles and service contract renewals across tertiary and specialty care providers.

Expansion of tertiary care and cardiac centers under Vision 2030

National healthcare transformation programs have enabled the establishment of more than ~ new tertiary facilities and specialized cardiac units in recent planning cycles. These centers collectively added ~ advanced imaging suites, significantly expanding procedural capacity. Annual procurement volumes now exceed ~ systems across public and private networks combined. The strategic emphasis on centers of excellence has accelerated adoption of hybrid operating rooms and multi-modality imaging platforms, positioning advanced coronary imaging as a core infrastructure pillar within modernized cardiac care delivery.

Challenges

High capital cost of advanced imaging systems

State-of-the-art coronary imaging platforms require capital allocations exceeding USD ~ million per installation, creating procurement barriers for mid-tier hospitals. Annual equipment replacement needs across secondary care remain below ~ systems due to funding limitations. Even large networks face extended approval cycles as multi-year budgeting frameworks constrain rapid technology refresh. These cost pressures slow market penetration of next-generation imaging, particularly for intravascular modalities and hybrid cath labs that demand additional infrastructure investments.

Budget constraints in public healthcare facilities

Public sector hospitals manage annual capital expenditure ceilings of around USD ~ million per facility, limiting flexibility for high-value imaging upgrades. Average procurement cycles extend beyond ~ months, delaying technology adoption. While patient volumes surpass ~ visits annually in major government hospitals, imaging system capacity expansion often lags demand growth. This imbalance places operational strain on existing equipment fleets and constrains the pace of modernization across secondary and regional healthcare institutions.

Opportunities

Expansion of private healthcare and medical tourism

Private hospital chains continue to add more than ~ new cardiac beds annually, supported by rising medical tourism inflows estimated at ~ international patients each year. These facilities prioritize premium imaging capabilities to attract complex cardiovascular cases. Capital deployment of USD ~ million annually toward advanced diagnostic infrastructure enables faster adoption of intravascular imaging and cardiac CT platforms, creating strong growth headroom for high-end equipment suppliers and service partners.

Localization of service and maintenance capabilities

Healthcare operators increasingly allocate more than USD ~ million annually to local service contracts to reduce downtime and lifecycle costs. Establishment of regional service hubs has expanded certified engineering capacity to over ~ specialists nationwide. This localization trend improves system uptime, accelerates spare parts availability, and strengthens long-term customer retention, opening opportunities for value-added service models and multi-year maintenance agreements across large hospital networks.

Future Outlook

The market is set to advance steadily as healthcare modernization programs, private sector expansion, and rising cardiovascular disease prevalence converge to sustain long-term demand. Increasing integration of digital imaging, AI-enabled diagnostics, and hybrid procedural environments will reshape technology adoption patterns. Regulatory alignment with global standards and continued infrastructure investments are expected to strengthen clinical outcomes and operational efficiency. Over the coming years, advanced coronary imaging will remain central to the evolution of interventional cardiology in the Kingdom.

Major Players

- Philips Healthcare

- Siemens Healthineers

- GE HealthCare

- Canon Medical Systems

- Boston Scientific

- Abbott Laboratories

- Medtronic

- Terumo Corporation

- Shimadzu Corporation

- Fujifilm Healthcare

- Hitachi Healthcare

- Mindray Medical

- Ziehm Imaging

- Carestream Health

- Allengers Medical Systems

Key Target Audience

- Public hospital procurement authorities

- Private hospital network administrators

- Specialty cardiac center operators

- Diagnostic imaging chain executives

- Ambulatory surgical center owners

- Investments and venture capital firms

- Ministry of Health and Saudi Health Council

- Saudi Food and Drug Authority

Research Methodology

Step 1: Identification of Key Variables

Core demand indicators, equipment deployment patterns, and clinical utilization metrics were defined across major cardiac care settings. Infrastructure expansion plans and technology adoption pathways were mapped to establish baseline market structure. Regulatory frameworks and procurement norms were incorporated to reflect real-world decision environments.

Step 2: Market Analysis and Construction

Supply-side capacity, service ecosystems, and technology penetration levels were evaluated across public and private healthcare segments. Market sizing logic integrated equipment lifecycles, replacement cycles, and utilization intensity to build a robust analytical foundation.

Step 3: Hypothesis Validation and Expert Consultation

Clinical workflow assumptions and procurement dynamics were validated through structured interactions with healthcare administrators, biomedical engineers, and cardiology department heads. Scenario testing ensured alignment with operational realities and policy-driven investment trends.

Step 4: Research Synthesis and Final Output

All findings were consolidated into a unified analytical framework, ensuring consistency across market sizing, segmentation, and competitive assessment. Final insights were refined to support strategic decision-making and long-term planning.

- Executive Summary

- Research Methodology (Market definitions and scope boundaries, terminology and abbreviations, coronary artery imaging equipment taxonomy across CT angiography IVUS and OCT platforms, market sizing logic by installed base and procedure volume, revenue attribution across systems catheters software and service contracts, primary interview program with cardiologists hospitals imaging centers and distributors, data triangulation and validation approach, assumptions limitations and data gaps)

- Definition and Scope

- Market evolution

- Care and diagnostic pathways

- Ecosystem structure

- Supply chain and channel structure

- Regulatory environment

- Growth Drivers

Rising prevalence of coronary artery disease and lifestyle disorders

Expansion of tertiary care and cardiac centers under Vision 2030

Growing adoption of minimally invasive cardiology procedures

Government investment in advanced diagnostic infrastructure

Increasing demand for precision imaging in interventional cardiology

Technological advancements in IVUS, OCT, and cardiac CT - Challenges

High capital cost of advanced imaging systems

Budget constraints in public healthcare facilities

Shortage of trained interventional cardiologists and technologists

Complex procurement and tendering processes

Maintenance and lifecycle management challenges

Interoperability issues with legacy IT systems - Opportunities

Expansion of private healthcare and medical tourism

Localization of service and maintenance capabilities

Adoption of AI-driven image analysis and workflow optimization

Development of mobile and modular cath lab solutions

Public-private partnerships in diagnostic infrastructure

Growth of outpatient and ambulatory cardiac care - Trends

Shift toward hybrid OR and multi-modality imaging suites

Integration of imaging with hemodynamic and physiology platforms

Increased preference for cloud-based image storage and analytics

Rising demand for low-dose radiation imaging technologies

Vendor focus on bundled solutions and long-term service contracts

Growing role of remote diagnostics and tele-cardiology - Government Regulations

- SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Value, 2019–2024

- By Volume, 2019–2024

- By Installed Base, 2019–2024

- By Average Selling Price, 2019–2024

- By Fleet Type (in Value %)

Public hospital fleets

Private hospital networks

Specialty cardiac centers

Diagnostic imaging chains

Mobile cath lab operators - By Application (in Value %)

Coronary angiography

CT coronary angiography

Intravascular ultrasound imaging

Optical coherence tomography imaging

Physiology-guided imaging and assessment - By Technology Architecture (in Value %)

Fixed catheterization lab systems

Mobile C-arm imaging systems

Hybrid operating room imaging suites

Dedicated cardiac CT scanners

Intravascular imaging consoles - By End-Use Industry (in Value %)

Tertiary care hospitals

Specialty cardiac hospitals

Diagnostic imaging centers

Ambulatory surgical centers

Military and government healthcare facilities - By Connectivity Type (in Value %)

Standalone imaging systems

Networked PACS-integrated systems

Cloud-enabled imaging platforms

AI-enabled imaging and analytics systems - By Region (in Value %)

Central Region

Western Region

Eastern Region

Northern Region

Southern Region

- Market structure and competitive positioning

Market share snapshot of major players - Cross Comparison Parameters (installed base strength, technology portfolio depth, service network coverage, pricing competitiveness, financing options, local partnerships, regulatory compliance track record, innovation pipeline)

- SWOT Analysis of Key Players

- Pricing and Commercial Model Benchmarking

- Detailed Profiles of Major Companies

Philips Healthcare

Siemens Healthineers

GE HealthCare

Canon Medical Systems

Shimadzu Corporation

Fujifilm Healthcare

Hitachi Healthcare

Boston Scientific

Abbott Laboratories

Terumo Corporation

Medtronic

Ziehm Imaging

Mindray Medical

Allengers Medical Systems

Carestream Health

- Demand and utilization drivers

- Procurement and tender dynamics

- Buying criteria and vendor selection

- Budget allocation and financing preferences

- Implementation barriers and risk factors

- Post-purchase service expectations

- By Value, 2025–2030

- By Volume, 2025–2030

- By Installed Base, 2025–2030

- By Average Selling Price, 2025–2030