Market Overview

The KSA crash boxes market, valued in the early years of the 2020s, is driven by increasing government regulation on automotive safety, along with the adoption of more advanced technologies by automotive manufacturers. These regulations are spurred by the Kingdom’s Vision 2030, which emphasizes the enhancement of vehicle safety and environmental standards. This market sees strong growth due to heightened awareness of crashworthiness and safety system upgrades, contributing to its consistent expansion over the past few years.

The cities and regions dominating the KSA crash boxes market are Riyadh, Jeddah, and Dammam. Riyadh, being the capital, is at the forefront of adopting new technologies and safety regulations, especially with its active push for technological innovation. Jeddah, with its proximity to the Red Sea and port, plays a significant role in facilitating international trade and automotive parts imports. Dammam, as an industrial hub, drives local production and assembly of automotive parts, contributing to the dominance of these regions in the market.

Market Segmentation

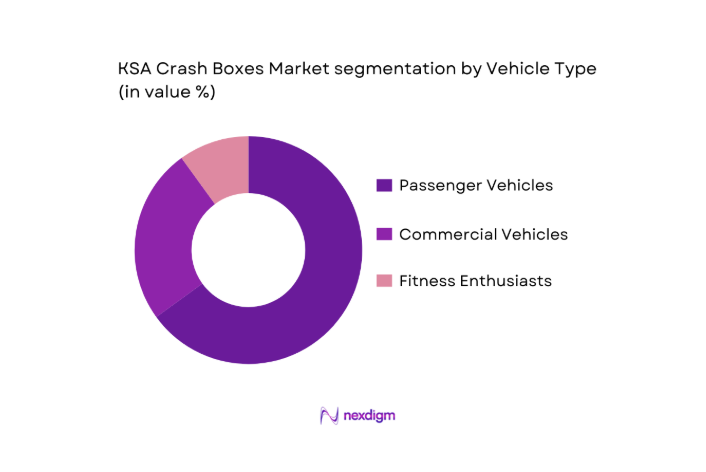

By Vehicle Type

The KSA crash boxes market is primarily segmented by vehicle type into passenger vehicles, commercial vehicles, and electric vehicles (EVs). Passenger vehicles dominate the market, primarily driven by the increasing urbanization of cities and rising demand for advanced safety features in consumer cars. Passenger cars are at the forefront of integrating crash box technologies due to the growing preference for enhanced crash safety features among consumers. This is further supported by regulatory standards and manufacturers’ push for better crash performance in their vehicles.

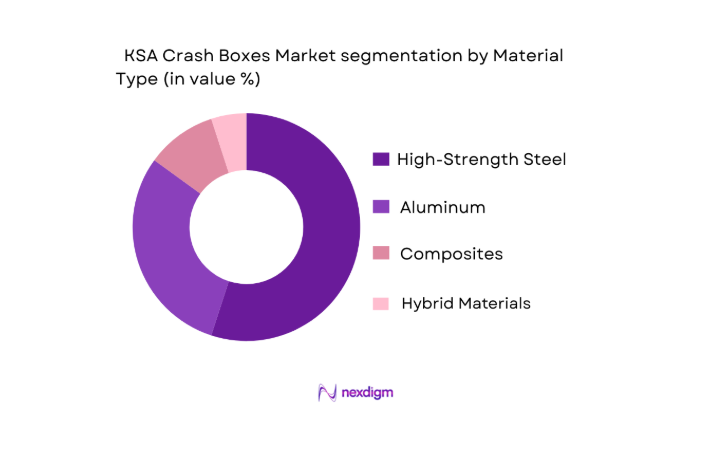

By Material Type:

Crash boxes in the KSA market are manufactured from a variety of materials, including high-strength steel, aluminum, composites, and hybrid materials. High-strength steel is the dominant material, accounting for the largest market share, primarily due to its cost-effectiveness and durability. Steel crash boxes offer excellent crash energy absorption and are commonly used in mass-market vehicles. Aluminum is growing in popularity due to its lightweight properties, which are particularly beneficial for electric and hybrid vehicles.

High-strength steel remains the most widely used material in crash box manufacturing due to its excellent balance of strength, cost, and energy absorption capabilities. Furthermore, the increasing demand for cost-effective yet durable materials from automakers has contributed significantly to the dominance of high-strength steel in the market. However, with the rise in the popularity of electric vehicles, aluminum and composites are expected to grow over the next few years.

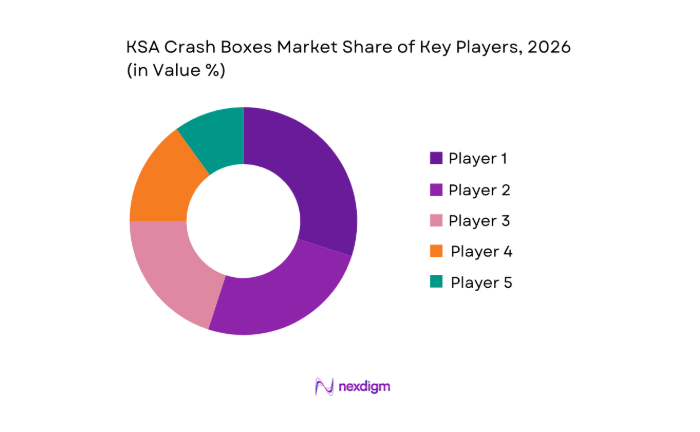

Competitive Landscape

The KSA crash boxes market is highly competitive, with a mix of local manufacturers and global players. Key players in the market include local manufacturers such as Zahid Group and Al-Jomaih Automotive, as well as global automotive parts suppliers like Magna International, Autoliv, and ZF Friedrichshafen. These companies are at the forefront of adopting new safety technologies and are working to meet both local and international automotive safety standards.

The market is characterized by a few dominant global players who possess advanced R&D capabilities, strong distribution networks, and robust relationships with OEMs. These companies continuously innovate and improve the performance of crash boxes to meet the evolving safety standards.

| Company Name | Establishment Year | Headquarters | Market-Specific Parameters |

| Magna International | 1957 | Canada | ~ |

| Autoliv | 1953 | Sweden | ~ |

| ZF Friedrichshafen AG | 1915 | Germany | ~ |

| Zahid Group | 1967 | Saudi Arabia | ~ |

| Al-Jomaih Automotive | 1946 | Saudi Arabia | ~ |

KSA Crash Boxes Market Analysis

Growth Drivers

Crash Safety Regulations & NCAP Testing Mandates

Crash safety regulations in Saudi Arabia have become a significant driving force for the adoption of crash boxes in the automotive market. The Saudi Standards, Metrology, and Quality Organization (SASO) introduced stringent crash safety standards that align with international NCAP (New Car Assessment Program) testing protocols. These regulations are driving the demand for better crash protection solutions, including crash boxes. In 2023, the Saudi government initiated new safety testing criteria for vehicles, which have directly increased the adoption of advanced safety features in vehicles. Additionally, the global shift toward stricter safety norms, like those adopted by the UNECE (United Nations Economic Commission for Europe), is influencing the KSA automotive sector. In 2022, global vehicle safety standards became more stringent with a push for enhanced crashworthiness and vehicle structural integrity.

Localization Policies

Localization policies in Saudi Arabia, particularly under Vision 2030, are accelerating the adoption of local manufacturing and automotive production, including crash box components. These policies aim to reduce dependence on imports and increase local production in the automotive industry. In 2023, the Saudi government introduced new incentives to localize the manufacturing of automotive parts, including crash boxes, under its national automotive development plan. These initiatives are supported by subsidies and favorable regulatory frameworks. Moreover, Saudi Arabia’s goal of producing 300,000 vehicles annually by 2030 further underscores the importance of local manufacturing in the region’s automotive market. In 2022, the country’s automotive sector accounted for 2.1% of its GDP, with local vehicle production contributing to this economic activity.

Market Restraints

High Material & Manufacturing Costs

The high material and manufacturing costs of crash boxes remain a significant restraint on the market’s growth. Crash boxes are typically manufactured from high-strength steel, aluminum, and composite materials. In 2022, global prices for aluminum rose by 25% compared to the previous year, affecting the cost of production for automotive parts, including crash boxes. Similarly, the rising costs of high-strength steel, driven by global supply chain disruptions and inflationary pressures, have made it difficult for manufacturers to keep production costs competitive. This is particularly challenging for local manufacturers in Saudi Arabia who rely on raw material imports. Moreover, the production of crash boxes involves complex manufacturing processes, which further adds to the overall cost structure.

Supply Chain Fragmentation

Supply chain fragmentation is another critical restraint affecting the KSA crash boxes market. While the country’s automotive industry continues to grow, the supply chain for raw materials and parts is highly fragmented. Saudi Arabia’s reliance on imported raw materials and components has led to significant vulnerabilities. In 2023, Saudi Arabia’s automotive sector faced delays in production and shipment of essential materials due to global supply chain disruptions. Moreover, regional manufacturing hubs for automotive components are underdeveloped, limiting the availability of certain critical parts. The lack of integration between local suppliers and global manufacturers results in inefficiencies, increasing lead times and costs, which affects the overall competitiveness of the KSA crash boxes market.

Market Opportunities

Local Manufacturing & Value-Add Content Incentives

Local manufacturing incentives under Saudi Arabia’s Vision 2030 represent a significant opportunity for the crash boxes market. The government has introduced several initiatives to encourage the development of the domestic automotive parts industry, including tax exemptions and subsidies for local manufacturers. These incentives are not only aimed at reducing dependency on imports but also at increasing the added value of locally produced components. In 2023, the Ministry of Industry and Mineral Resources announced plans to establish new automotive manufacturing hubs in the Eastern and Western regions of Saudi Arabia, which will help to meet the rising demand for crash boxes and other vehicle parts. These initiatives are expected to enhance the competitiveness of the Saudi automotive sector by supporting local manufacturing of high-value components like crash boxes.

Crash Boxes for Autonomous & Advanced Safety Platforms

The growing focus on autonomous and advanced driver assistance systems (ADAS) in Saudi Arabia represents a major opportunity for the crash boxes market. As the automotive industry embraces new technologies, the need for specialized crash boxes that can withstand higher impact forces and contribute to enhanced vehicle safety systems is increasing. Saudi Arabia’s automotive sector is gradually adopting ADAS and autonomous vehicle technologies, creating a demand for next-generation crash boxes. These systems require highly engineered crash boxes made from advanced materials that can absorb energy efficiently while maintaining vehicle structural integrity. In 2023, the Saudi government launched a national smart mobility initiative, which focuses on improving road safety through advanced vehicle technologies. This initiative is expected to boost demand for innovative crash box solutions tailored for autonomous vehicles.

Future Outlook

Over the next five years, the KSA crash boxes market is expected to experience significant growth driven by advancements in automotive safety regulations, increasing government support for the local manufacturing of automotive parts, and the growing adoption of electric and hybrid vehicles. Additionally, the push for improving vehicle crashworthiness standards under the Saudi Vision 2030 will play a pivotal role in shaping the market’s trajectory. The material innovation trend, including the use of lightweight and composite materials, is also expected to influence the demand for crash boxes in the coming years.

Major Players

- Magna International

- Autoliv

- ZF Friedrichshafen AG

- Zahid Group

- Al-Jomaih Automotive

- Benteler International AG

- Gestamp

- Dana Incorporated

- Toyota Boshoku Corporation

- Faurecia

- Continental AG

- Hitachi Astemo Ltd.

- Thyssenkrupp Automotive

- Japan Steel Works

- Hyundai Mobis

Key Target Audience

- Automotive Manufacturers

- Tier-1 Automotive Suppliers

- Government & Regulatory Bodies

- Investment and Venture Capitalist Firms

- Aftermarket Parts Distributors

- Automotive Component Manufacturers

- Automotive Repair and Maintenance Services

- Commercial Vehicle Fleets

Research Methodology

Step 1: Identification of Key Variables

The research begins with identifying and mapping key stakeholders in the KSA crash boxes market. This involves defining critical variables such as safety standards, automotive material types, and vehicle segment adoption rates. This step also includes an extensive review of market reports, company financials, and regulatory changes.

Step 2: Market Analysis and Construction

We collect and analyze historical data regarding market size, product types, material utilization, and customer preferences within the KSA crash boxes market. The analysis also includes the growth rate and competitive positioning of key players, ensuring reliable data for forecasting purposes.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses regarding trends such as the rise of lightweight materials and the growing demand for safety systems are validated through expert consultations with industry practitioners. These include product managers and engineers in automotive companies, who provide real-time insights on market drivers and constraints.

Step 4: Research Synthesis and Final Output

The final phase combines findings from secondary research and expert consultations to create a detailed, actionable market report. This step ensures the accuracy of data and its alignment with the actual market scenario, offering insights into market growth, key players, and emerging trends.

- Executive Summary

- Research Methodology (Market Taxonomy & Crash Box Definitions, Primary & Secondary Research Coverage, Top‑Down & Bottom‑Up Estimation Framework, Data Sources, Forecast Models, Limitations & Assumptions)

- Crash Boxes Definition & Automotive Context

- Automotive Safety Regulation Landscape in KSA

- Crash Box Engineering & Functional Role

- Role of Crash Boxes in Vehicle Crashworthiness & Insurance Outcomes

- Growth Drivers

Crash Safety Regulations & NCAP Testing Mandates

Localization Policies

Increase in Vehicle Parc & Aftermarket Demand

Adoption in EV Platforms - Market Restraints

High Material & Manufacturing Costs

Supply Chain Fragmentation - Market Opportunities

Local Manufacturing & Value‑Add Content Incentives

Crash Boxes for Autonomous & Advanced Safety Platforms - Trends

Lightweight Composite Crash Box Adoption

Digital Crash Simulation & Test Validation Standards

PESTEL & Regulatory Analysis - SWOT Analysis

- Porters Five Forces

- By Revenue, 2019-2025

- By Unit Shipments, 2019-2025

- By Average Selling Price, 2019-2025

- By Vehicle Type (in value %)

Passenger

Commercial

Electric & Hybrid

Fleet/Institutional - By Material Type (in value %)

High‑Strength Steel

Aluminum

Composite/Hybrid Materials

Carbon Fiber Reinforced Polymers - By Integration Type (in value %)

OEM Fitment

Aftermarket Replacement

Crash Repair Retrofit - By Sales Channel (in value %)

OEM Tier‑1 Contracts

Aftermarket Distribution

E‑commerce Parts Platforms - By Application Zone (in value %)

Front Crash Box

Rear Crash Box

Side Impact Modules

Cross‑Car Beams

- Market Share

- Cross‑Comparison Parameters (Company Overview, Global Footprint, Product Portfolio (Crash Box Variants), Safety Certification Levels, Material Technology, Pricing Strategy, Tier‑1/OEM Contracts, Localization Footprint, R&D Intensity, Production Capacity, Aftermarket Channel Reach, Warranty Terms, Delivery Lead Time, Quality Scores)

- SWOT Profiles of Key Players

- Crash Box Pricing Matrix

- Detailed Company Profiles

Autoliv Inc.

Magna International

ZF Friedrichshafen AG

Gestamp

Benteler International AG

Dana Incorporated

Toyota Boshoku Corporation

Continental AG

Thyssenkrupp Automotive

Faurecia

Japan Steel Works (JSW)

Hitachi Astemo Ltd.

Al Jomaih Automotive Components

Zahid Group – Auto Parts Division

Bosch Automotive Aftermarket

- Fleet Operators & Safety Specification Preferences

- Crash Repair Shops & Replacement Patterns

- OEM Purchasing Strategy & Qualification Standards

- Aftermarket Consumer Price Sensitivity

- By Revenue, 2026-2030

- By Unit Shipments, 2026-2030

- By Average Selling Price, 2026-2030