Market Overview

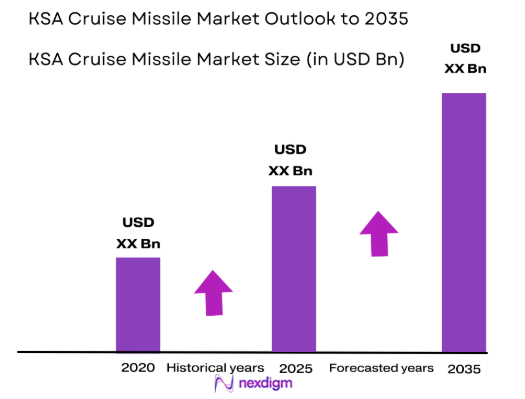

The KSA Cruise Missile Market is projected to grow significantly, driven by increasing defense budgets and the need for advanced military capabilities in the region. Based on a recent historical assessment, the market size in 2025 is estimated to be approximately USD ~ billion. This growth is primarily fueled by the expansion of military modernization programs, technological advancements in missile systems, and heightened geopolitical tensions in the Middle East. Moreover, the demand for advanced cruise missile systems is rising, as military forces seek enhanced precision and strike capabilities.

Dominant countries such as Saudi Arabia are leading the market due to substantial defense spending and strategic positioning in the region. Saudi Arabia’s government investments in defense systems have created a robust demand for advanced weaponry, including cruise missiles, to maintain regional security. The country is focusing on building a strong defense infrastructure and increasing its procurement of cutting-edge missile systems from leading international manufacturers. Furthermore, the growing military alliances with global powers has further cemented the dominance of Saudi Arabia in the KSA Cruise Missile Market.

Market Segmentation

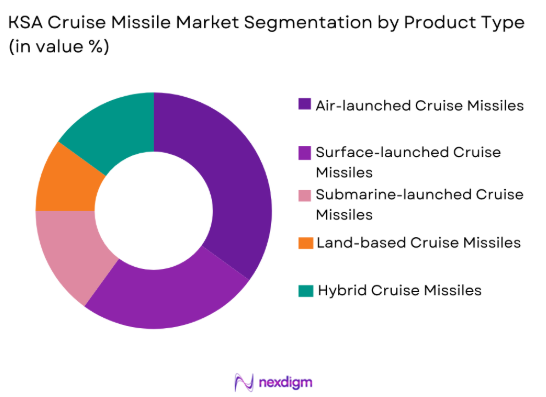

By Product Type

The KSA Cruise Missile Market is segmented by product type into air-launched, surface-launched, submarine-launched, land-based, and hybrid cruise missiles. Recently, air-launched cruise missiles have dominated the market share due to factors such as the increasing demand for strategic aerial attacks and the improved capabilities of airborne platforms. These systems offer versatility and range, making them ideal for modern military operations. The demand for air-launched systems has also been driven by advancements in aircraft integration, making them more efficient and lethal in combat scenarios.

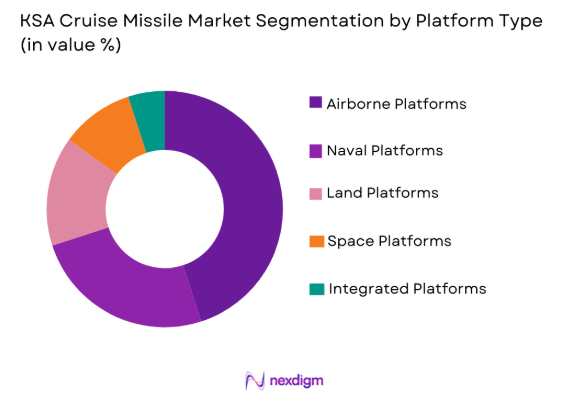

By Platform Type

The KSA Cruise Missile Market is segmented by platform type into airborne, naval, land, space, and integrated platforms. Airborne platforms have been leading the market share due to their increased efficiency in launching long-range precision strikes. The development of stealth capabilities, enhanced missile guidance systems, and the ability to operate from diverse aircraft have strengthened the market position of airborne platforms. These systems are highly favored due to their strategic advantage in terms of speed, mobility, and operational flexibility.

Competitive Landscape

The competitive landscape of the KSA Cruise Missile Market is characterized by the presence of both established defense contractors and newer entrants striving to expand their market share. Major players such as Lockheed Martin, Raytheon Technologies, and BAE Systems dominate the market, driving technological innovation and production of advanced missile systems. The market is seeing increasing consolidation as key players form partnerships with regional manufacturers to increase their market reach and comply with local regulations. The collaboration between international defense companies and local manufacturers has become a common strategy to navigate regulatory barriers and improve market penetration.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue | Additional Market-Specific Parameter |

| Lockheed Martin | 1912 | USA | ~ | ~ | ~ | ~ | ~ |

| Raytheon Technologies | 2020 | USA | ~ | ~ | ~ | ~ | ~ |

| BAE Systems | 1999 | UK | ~ | ~ | ~ | ~ | ~ |

| Northrop Grumman | 1939 | USA | ~ | ~ | ~ | ~ | ~ |

| General Dynamics | 1952 | USA | ~ | ~ | ~ | ~ | ~ |

KSA Cruise Missile Market Analysis

Growth Drivers

Increased Geopolitical Tensions

Increased geopolitical tensions in the Middle East, particularly between regional powers, are one of the key drivers of growth for the KSA Cruise Missile Market. The region has witnessed several conflicts that have accelerated military spending and defense modernization initiatives. Countries in the region, especially Saudi Arabia, are focused on building a robust defense infrastructure capable of safeguarding national security and countering regional threats. The rising need for advanced weapons systems, such as cruise missiles, to protect strategic interests has led to a surge in procurement by national governments and defense contractors. As a result, military forces are investing in cutting-edge missile technology to enhance deterrence capabilities and strike precision in warfare. The focus on long-range missile capabilities is particularly important in a region with complex security dynamics, and cruise missiles offer a strategic solution to counter threats effectively. Moreover, political instability in neighboring regions has further heightened the demand for cruise missiles, making them a central component of military modernization efforts. Saudi Arabia, as a key player in the Middle East, continues to invest heavily in advanced missile technology to maintain a strong defense posture and assert its regional dominance.

Technological Advancements in Missile Systems

Technological advancements in missile systems have also played a significant role in driving the growth of the KSA Cruise Missile Market. The integration of new technologies such as AI, advanced guidance systems, and GPS precision has enhanced the effectiveness and accuracy of cruise missiles. These technological improvements have made missiles more reliable and capable of performing in diverse operational environments. The rise in smart missile technology, with the ability to adapt to changing conditions and counter anti-missile defense systems, has made cruise missiles even more desirable for military forces. The continuous development of hypersonic missiles, which offer speeds exceeding five times the speed of sound, is another significant advancement. As the capabilities of cruise missiles improve, they are becoming increasingly integral to modern defense strategies. Saudi Arabia, along with other regional players, is focusing on acquiring these advanced systems to maintain military superiority and address growing defense challenges.

Market Challenges

High Capital Expenditure in Defense Projects

A major challenge facing the KSA Cruise Missile Market is the high capital expenditure required for defense projects. Developing, producing, and maintaining advanced missile systems involves substantial investment, which can put a strain on national defense budgets. Countries like Saudi Arabia are heavily investing in their defense capabilities, but this requires balancing military needs with broader economic goals. Large-scale procurement of advanced missile systems comes with significant financial obligations, including research and development costs, production expenses, and ongoing maintenance and upgrades. Additionally, the high cost of integration with existing defense infrastructure, coupled with the need for specialized training and support, adds further financial pressure. Despite the advantages that advanced missile systems bring, the cost of procurement and operational deployment can be a significant barrier for many nations, including Saudi Arabia, that are focused on maximizing military capabilities while managing financial constraints.

Technological Integration and Interoperability Issues

Another challenge in the KSA Cruise Missile Market is the complexity of technological integration and interoperability with existing defense systems. Modern cruise missiles require integration with a wide range of platforms, including air, sea, and land-based systems, which can create compatibility issues. The different technological standards and operational requirements of each platform can hinder smooth integration, leading to delays, cost overruns, and suboptimal performance. Furthermore, the ability of cruise missiles to operate seamlessly in conjunction with other defense systems is crucial for mission success, yet achieving this level of integration can be a difficult and time-consuming process. As regional defense forces like Saudi Arabia invest in multiple systems from various manufacturers, ensuring that all components work together efficiently becomes increasingly challenging. Overcoming these interoperability issues is essential for maximizing the effectiveness of cruise missile systems and ensuring they meet the demanding requirements of modern warfare.

Opportunities

Development of Hypersonic Cruise Missiles

The development of hypersonic cruise missiles presents a significant opportunity for growth in the KSA Cruise Missile Market. Hypersonic missiles, which can travel at speeds greater than Mach 5, offer a strategic advantage by allowing for rapid, long-range strikes that are difficult for adversaries to intercept. This next-generation missile technology is gaining traction due to its potential to bypass traditional missile defense systems, making it highly attractive to defense forces in the region. Saudi Arabia and other Middle Eastern countries are increasingly focused on acquiring hypersonic missile technology to bolster their defense capabilities. As hypersonic missile systems become more commercially available, they are expected to play a key role in transforming regional defense strategies, particularly in terms of deterrence and offensive capabilities. The growing emphasis on hypersonic technologies is driving investment in research and development, which will further fuel the expansion of the KSA Cruise Missile Market. The integration of hypersonic missiles into the Saudi defense portfolio is expected to enhance military deterrence and expand the country’s strategic options in addressing emerging security threats.

Partnerships with Private Tech Firms for Enhanced Missile Systems

Another opportunity lies in forming partnerships with private technology firms to enhance missile systems. Collaborations between defense contractors and tech companies can lead to the development of more advanced missile technologies, including improved propulsion systems, guidance mechanisms, and electronic warfare capabilities. By leveraging the expertise of private firms specializing in AI, cybersecurity, and advanced manufacturing, defense forces in Saudi Arabia can gain access to cutting-edge solutions that enhance the effectiveness and security of missile systems. These partnerships can also help reduce the cost of innovation by enabling shared research and development efforts. The increasing involvement of the private sector in defense technology development is expected to drive innovation in missile systems, providing enhanced capabilities for regional players like Saudi Arabia. Such collaborations will also foster greater technological self-sufficiency in the region, reducing reliance on foreign defense suppliers and strengthening the local defense industry.

Future Outlook

The KSA Cruise Missile Market is expected to witness significant growth over the next five years. The market will be driven by increased investments in advanced missile technologies, particularly in the areas of hypersonic missiles, AI-guided systems, and integrated defense solutions. Governments in the Middle East, particularly Saudi Arabia, are expected to continue their focus on modernizing military infrastructure, with an emphasis on precision strike capabilities. Technological advancements, coupled with the growing need for defense modernization, will position the market for robust growth in the coming years.

Major Players

- Lockheed Martin

- Raytheon Technologies

- BAE Systems

- Northrop Grumman

- General Dynamics

- Thales Group

- Leonardo

- Saab Group

- L3 Technologies

- Rheinmetall AG

- Elbit Systems

- Harris Corporation

- MBDA

- Rafael Advanced Defense Systems

- Kongsberg Gruppen

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Defense contractors

- Military forces

- Aerospace manufacturers

- Security service providers

- Private sector technology firms

- Research institutions

Research Methodology

Step 1: Identification of Key Variables

Key variables such as market trends, growth drivers, and technological advancements are identified for analysis to ensure a clear understanding of the market dynamics.

Step 2: Market Analysis and Construction

A comprehensive analysis is conducted to construct the market landscape and key data points, including segmentation, competitive environment, and forecasted trends.

Step 3: Hypothesis Validation and Expert Consultation

Expert consultation is used to validate hypotheses, ensuring the accuracy of market predictions and providing insights into evolving market conditions and future opportunities.

Step 4: Research Synthesis and Final Output

The research is synthesized into a detailed final output that includes all relevant market insights, data, and actionable recommendations, offering a comprehensive understanding of the market’s current and future state.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Rising Geopolitical Tensions

Increasing Military Budgets

Technological Advancements in Missile Systems - Market Challenges

High Capital Expenditure in Defense Projects

Complex Integration with Existing Systems

Technological Interoperability Issues - Market Opportunities

Development of Hypersonic Cruise Missiles

Increased Collaboration with Private Technology Firms

Emerging Demand in Middle Eastern Defense Markets - Trends

Integration of AI in Cruise Missile Systems

Shift Towards Autonomous Weapons

Growing Investments in Cybersecurity for Defense - Government Regulations

Arms Control and Missile Export Policies

International Compliance Regulations

National Defense Procurement Regulations

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Air-launched Cruise Missiles

Surface-launched Cruise Missiles

Submarine-launched Cruise Missiles

Land-based Cruise Missiles

Hybrid Cruise Missiles - By Platform Type (In Value%)

Airborne Platforms

Naval Platforms

Land Platforms

Space Platforms

Integrated Platforms - By Fitment Type (In Value%)

On-premise Systems

Cloud-based Systems

Modular Systems

Integrated Systems

Hybrid Systems - By End User Segment (In Value%)

Military Forces

Defense Contractors

Government Agencies

Security Services

Private Sector / Technology Firms - By Procurement Channel (In Value%)

Direct Procurement

Government Tenders

Private Sector Procurement

Online Bidding Platforms

Third-party Distributors

- Market Share Analysis

- Cross Comparison Parameters (System Type, Platform Type, Procurement Channel, End User Segment, Fitment Type, Technology Integration, Regulatory Compliance, System Complexity, Deployment Range, Cost-effectiveness)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Porter’s Five Forces

- Key Players

Lockheed Martin

Northrop Grumman

Raytheon Technologies

BAE Systems

Thales Group

General Dynamics

Leonardo

Saab Group

L3 Technologies

Rheinmetall AG

Elbit Systems

Harris Corporation

MBDA

Rafael Advanced Defense Systems

Kongsberg Gruppen

- Military Forces’ Demand for Advanced Systems

- Government Agencies’ Focus on National Security

- Defense Contractors’ Role in R&D

- Private Sector’s Interest in Security Solutions

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035