Market Overview

The KSA crumple zones market is valued at USD ~ billion in 2025, with consistent growth seen in 2026. This expansion is driven by the rising adoption of safety standards in the automotive industry, which includes stricter regulations and the increasing focus on passenger safety. The integration of advanced materials such as high-strength steel and aluminum alloys in automotive manufacturing has bolstered this market. Furthermore, the government’s Vision 2030 and increasing vehicle production capacity have created a conducive environment for the growth of crumple zone technology in Saudi Arabia. Automotive manufacturers are pushing for enhanced vehicle safety features to comply with global crash standards.

Saudi Arabia’s automotive industry is primarily concentrated in major cities like Riyadh, Jeddah, and Dammam. These cities dominate the market due to their proximity to key industrial hubs, production plants, and strong infrastructural setups. Riyadh, being the capital, is a central hub for automotive policies, while Jeddah is home to critical port operations and the country’s entry point for international automotive products. The dominance of these cities is further driven by government initiatives to boost local automotive production and safety standards, as well as growing consumer demand for high-quality, durable vehicles.

Market Segmentation

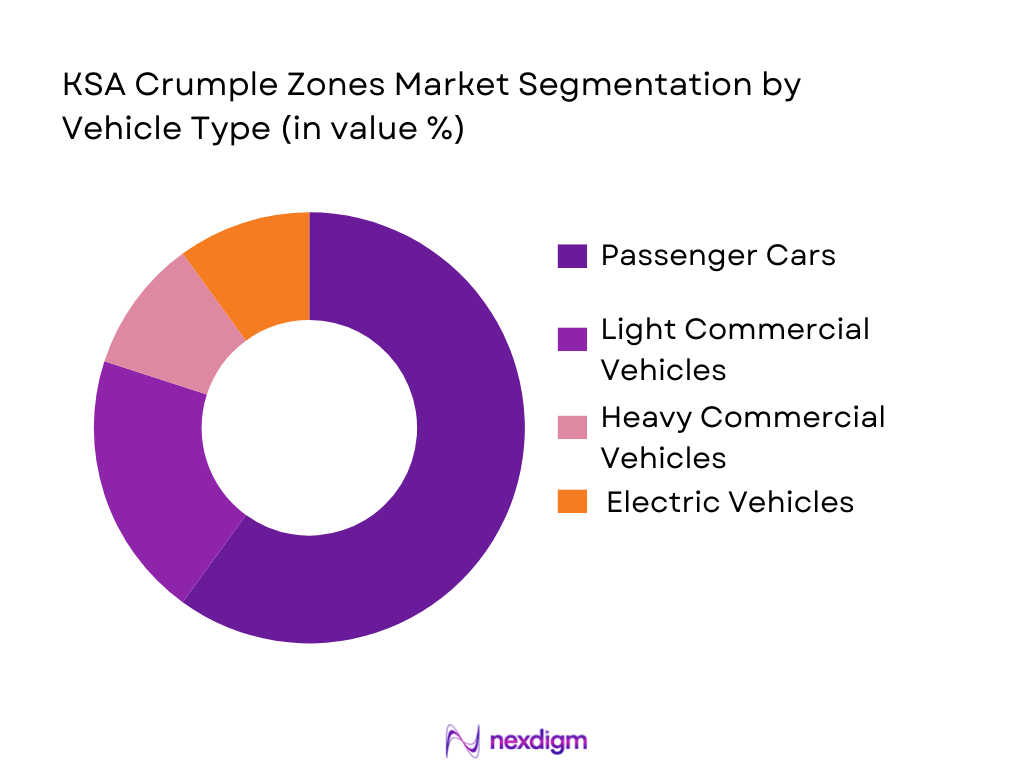

By Vehicle Type

The KSA crumple zones market is segmented by vehicle type into passenger cars, light commercial vehicles, heavy commercial vehicles, and electric vehicles. Among these, passenger cars dominate the market share due to their higher volume in production and stronger consumer demand for safety features. The shift towards safety-conscious consumer behavior and stringent safety regulations, particularly in urban centers like Riyadh, has led to a higher integration of crumple zones in passenger vehicles. Furthermore, with increasing urbanization and rising disposable income, consumers are prioritizing advanced safety systems in their vehicles, making passenger cars the highest contributor to the market.

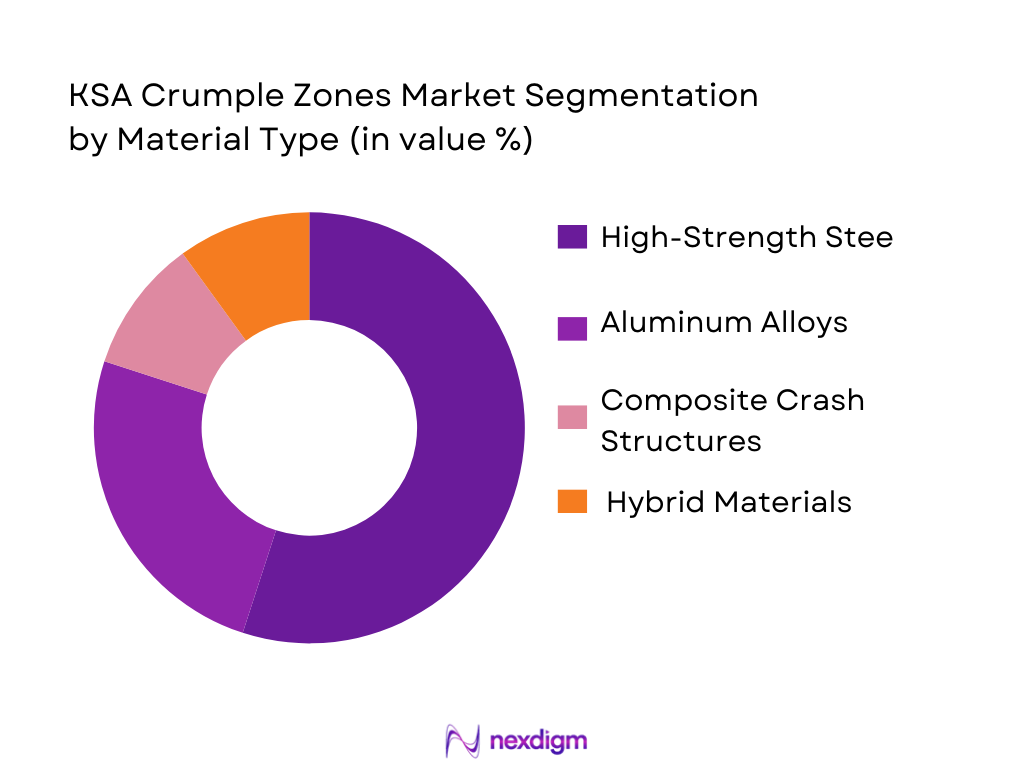

By Material Type

The market is divided into high-strength steel, aluminum alloys, composite crash structures, and hybrid materials. High-strength steel dominates the material segment due to its cost-effectiveness, structural rigidity, and ease of manufacturing. This material offers a balanced combination of affordability and performance in crumple zone structures, making it the most commonly used material across various vehicle types. Additionally, its recyclability and high availability further cement its dominance in KSA, where manufacturing capabilities and raw material supply chains are robust.

Competitive Landscape

The KSA crumple zones market is characterized by a handful of dominant players, including global automotive safety systems manufacturers such as Autoliv, Magna International, and Faurecia. These players have a significant market presence due to their advanced research and development capabilities, along with a strong foothold in the region’s automotive supply chain. These companies are continually innovating to meet the stringent safety standards required by KSA’s growing automotive market. Local players also contribute to the competitive landscape by providing cost-effective solutions tailored to the regional market.

| Company Name | Establishment Year | Headquarters | Product Range | R&D Investment | Market Presence | Key Clients |

| Autoliv | 1997 | Sweden | ~ | ~ | ~ | ~ |

| Magna International | 1957 | Canada | ~ | ~ | ~ | ~ |

| Faurecia | 1997 | France | ~ | ~ | ~ | ~ |

| Hyundai Mobis | 1977 | South Korea | ~ | ~ | ~ | ~ |

| ZF Friedrichshafen | 1915 | Germany | ~ | ~ | ~ | ~ |

KSA Crumple Zones Market Analysis

Growth Drivers

Urbanization

Urbanization is a key driver of the KSA crumple zones market, particularly as the population continues to concentrate in cities. In 2025, Saudi Arabia’s urban population stood at approximately ~% of the total population, a significant increase from previous years. This trend is expected to continue with the ongoing development of mega-projects such as NEOM and the Red Sea Project. The expansion of urban areas directly contributes to the rising demand for passenger vehicles, as urban residents prefer vehicles with enhanced safety features, including crumple zones. These urban developments not only boost demand for vehicles but also create a higher necessity for advanced vehicle safety systems to meet stringent traffic and crash safety regulations. The urbanization trend will inevitably increase the focus on vehicle safety technologies in Saudi Arabia’s fast-growing cities.

Industrialization

Industrialization plays a crucial role in the growth of the KSA crumple zones market. Saudi Arabia has been focusing heavily on industrial diversification as part of Vision 2030, targeting growth in the manufacturing and automotive sectors. The automotive sector is poised for continued expansion, with significant investments flowing into local vehicle manufacturing plants, such as the planned factory by Lucid Motors in the King Abdullah Economic City. Industrial output in Saudi Arabia reached SAR ~ billion in 2025, highlighting the growing strength of the industrial sector. As a result, the production of locally manufactured vehicles is rising, and with it, the demand for enhanced safety features such as crumple zones is increasing. This industrial push is anticipated to continue strengthening the local automotive industry’s safety standards and capabilities, contributing to the rise of crumple zones technology.

Restraints

High Initial Costs

One of the main challenges for the KSA crumple zones market is the high initial cost of advanced crumple zone technology. The adoption of such technology involves significant upfront investment in research, development, and manufacturing infrastructure, particularly for materials like high-strength steel and aluminum alloys. The cost of incorporating crumple zones into vehicle structures is particularly high for newer vehicle models that require more advanced systems. The average cost of upgrading materials in vehicles in Saudi Arabia has been steadily rising, with the automotive industry’s material costs increasing by ~%. This cost burden can limit the widespread adoption of crumple zones in certain vehicle segments. Despite these challenges, demand remains robust for vehicles featuring these technologies due to the increasing consumer emphasis on safety.

Technical Challenges

The integration of crumple zones into vehicle designs presents significant technical challenges. Vehicle manufacturers face hurdles in optimizing crumple zones to balance structural integrity with energy absorption in collisions. In Saudi Arabia, many vehicles still feature outdated structural designs that are not optimized for crumple zones, and retrofitting these vehicles to meet modern standards is often a complex and costly process. Furthermore, the availability of advanced materials required for crumple zones, such as composite materials, is limited, making it difficult for manufacturers to fully integrate cutting-edge safety technologies. As a result, the transition to improved crumple zone systems is slower, especially for older vehicle models, further delaying the market’s growth.

Opportunities

Technological Advancements

Technological advancements in materials science and vehicle safety systems present significant opportunities for the KSA crumple zones market. The automotive industry in Saudi Arabia is increasingly embracing new materials and design technologies to improve vehicle safety. Advanced materials like carbon-fiber composites and ultra-high-strength steel are being explored for their potential to enhance crumple zone performance. Currently, in Saudi Arabia, car manufacturers have begun adopting advanced welding and laser cutting technologies to improve the accuracy and efficiency of crumple zone integration. This trend is likely to continue, as automakers are investing more in R&D to improve safety features. In particular, companies are focusing on lightweight, stronger, and more energy-absorbing materials, which will likely reduce manufacturing costs over time and drive the proliferation of crumple zones in vehicles.

International Collaborations

International collaborations in the automotive sector present a unique opportunity for the KSA crumple zones market. Saudi Arabia’s growing partnerships with global automotive giants, such as the collaboration with Japan’s Toyota and South Korea’s Hyundai, are paving the way for the transfer of advanced safety technologies, including crumple zones. These collaborations allow Saudi manufacturers to access the latest innovations in vehicle safety, which are already in use in other markets. The establishment of joint ventures and the influx of foreign investments in Saudi Arabia’s automotive industry facilitate the introduction of state-of-the-art safety systems. Additionally, global players are setting up production facilities in the country, enabling the local market to benefit from advanced crumple zone technologies.

Future Outlook

Over the next 5 years, the KSA crumple zones market is expected to show significant growth driven by advancements in safety technology, increased vehicle production, and the ongoing push towards stricter crash safety regulations. The ongoing implementation of Saudi Arabia’s Vision 2030, with a focus on industrial expansion, will further bolster the automotive sector, leading to higher demand for crumple zone integration in both domestic and international markets. Additionally, the introduction of newer materials like composite crash structures is anticipated to create new opportunities for market players.

Major Players in the KSA Crumple Zones Market

- Autoliv

- Magna International

- Faurecia

- Hyundai Mobis

- ZF Friedrichshafen

- Gestamp

- Benteler Automotive

- Toyota Boshoku

- Lear Corporation

- Bosch (Safety Systems Division)

- ThyssenKrupp Automotive

- Samvardhana Motherson Group

- Dana Incorporated

- Nexteer Automotive

- Plastic Omnium

Key Target Audience

- Automotive Manufacturers (OEMs)

- Tier-1 Suppliers of Vehicle Safety Systems

- Automotive Parts Distributors and Retailers

- Automotive Crash Repair Networks

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies (e.g., Saudi Standards, Metrology, and Quality Organization – SASO)

- Automotive Safety Certification Agencies

- Fleet Operators and Commercial Vehicle Managers

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map for the KSA crumple zones market. This includes identifying the major stakeholders such as OEMs, Tier-1 suppliers, regulatory bodies, and automotive consumers. Secondary research utilizing industry reports, government publications, and databases will be conducted to gather the necessary data to map these key variables.

Step 2: Market Analysis and Construction

During this phase, we will compile and analyze historical market data pertaining to crumple zone adoption in Saudi Arabia. This will involve examining past trends in vehicle production, safety standards, and material use. Data from relevant industry sources will be integrated to project future market performance and establish a reliable market size estimate.

Step 3: Hypothesis Validation and Expert Consultation

The market hypothesis will be validated through interviews with industry experts, including representatives from major OEMs and safety parts suppliers. These consultations will provide critical insights into operational trends, technological advancements, and market dynamics.

Step 4: Research Synthesis and Final Output

In the final phase, direct engagement with manufacturers and local authorities will validate market data and hypotheses. This includes obtaining feedback from production facilities, understanding material preferences, and confirming the role of government policies in shaping the market. This will ensure that the data reflects the most accurate and up-to-date market scenario.

- Executive Summary

- Research Methodology (Market Definitions & Scope, Abbreviations, Data Sources, Secondary & Primary Research Framework, Data Triangulation, Forecasting Models, Limitations)

- Definition of Crumple Zone Systems

- Structural Safety Integration

- KSA Automotive Safety Policy Background

- Market Genesis & Adoption Drivers

- Historical Market Evolution

- KSA Automotive Value Chain & Safety Systems Supply Network

- KSA Crumple Zones System Ecosystem Architecture

- Market Drivers

Stricter Safety Standards

Urban Vehicle Adoption

Increase in Vehicle Parc

EV Safety Requirements - Market Challenges

Import Dependency

Limited Local Production Scale

Raw Material Cost Volatility - Opportunity Mapping

localization of Crash Safety Production

Tier‑2 Material Innovation

Integration with ADAS - Technology Trends

Smart Crumple Zones

Predictive Crash Load Management - Regulatory Framework

Saudi Traffic Safety Regulations

GCC Vehicle Safety Standards

Import Safety Mandates - SWOT Analysis – KSA Crumple Zones Ecosystem

- Porter’s Five Forces – Competitive Intensity

- Stakeholder Ecosystem

- By Value, 2019-2025

- By Volume, 2019-2025

- By Average Price of Platforms/Services, 2019-2025

- By Vehicle Type (In Value %)

Passenger Cars (City, Mid‑Size, SUV)

Light Commercial Vehicles

Heavy Commercial Vehicles

Electric Vehicles

Luxury Performance Vehicles - By Material Type (In Value %)

High‑Strength Steel

Aluminum Alloys

Composite Crash Structures

Hybrid Material Constructs - By Deployment Type (In Value %)

Front Crumple Zone

Rear Crumple Zone

Side Impact Zone

Sub‑Frame & Cross‑Member Zones - By Feature Enrichment (In Value %)

Adaptive Crumple Structures

Sensor Integrated Crumple Zones

Energy Absorbing Foams & Inserts

Smart Impact Response Configurations

- Competitive Scenario – Market Share by Value/Volume (Estimated)

- Cross‑Comparison Parameters (Company Overview, Product Portfolio, Material Innovation, Deployment Technology, Safety Certifications, Regional Footprint, Revenues, OEM Contracts, Aftermarket Distribution, Safety R&D Spend, Crash Testing Partnerships, Production Capacity, Supply Chain Integration, Strategic Alliances, IP/Patents)

- Pricing Benchmarking – SKU & System Level

- Detailed Profiles of Key Industry Players

Autoliv

Magna International

ZF Friedrichshafen

Gestamp

Benteler Automotive

Faurecia (Forvia)

Toyota Boshoku

Hyundai Mobis

Denso Corporation

Lear Corporation

ThyssenKrupp Automotive

Samvardhana Motherson Group

Bosch (Safety Systems Division)

Dana Incorporated

Nexteer Automotive

- Demand Patterns – OEM vs Aftermarket

- OEM Procurement & Safety Qualification Criteria

- Replacement & Crash Repair Market Metrics

- Safety Certification Penetration & Consumer Awareness

- Decision Drivers in Vehicle Safety Purchases

- Future Market Size by Value, 2026-2030

- Future Market Size by Volume, 2026-2030

- Average Frame Cost Outlook, 2026-2030